WORKERS CAPITALUS Pensions Vie With Gulf Funds for First Shot at PE Deals

![]()

![]()

Marion Halftermeyer

Fri, Jun 14, 2024

(Bloomberg) -- It took Scott Chan two years to convince his bosses at the California State Teachers’ Retirement System to free up more cash for lucrative investments alongside the world’s biggest private equity firms.

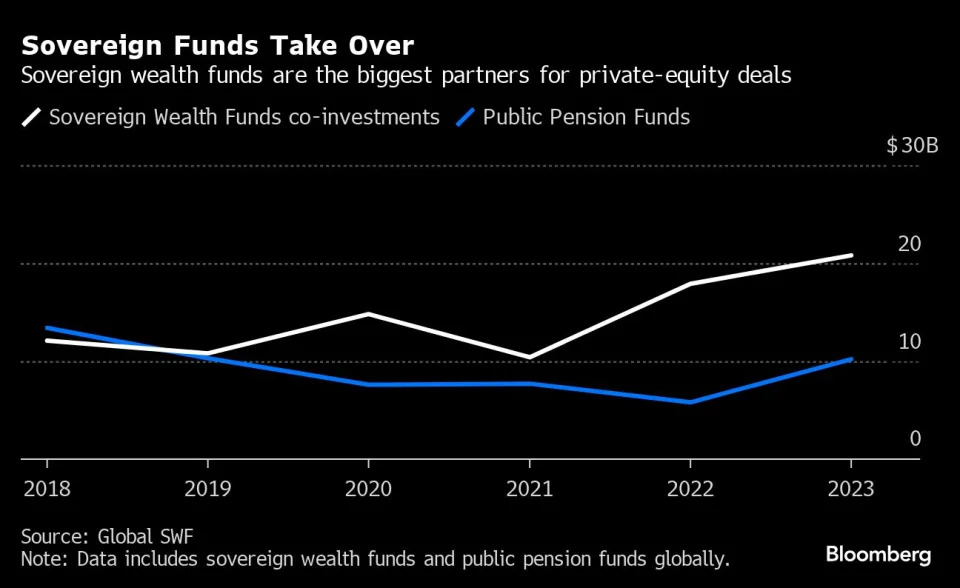

In the time it took the Calstrs deputy chief investment officer to build his case, faster and nimbler investors — mostly Middle Eastern sovereign wealth funds — snapped up more than $38 billion of such deals.

US pension funds, long among the most coveted clients for buyout firms, are rapidly losing ground to deep-pocketed Middle Eastern sovereign wealth funds. That’s especially true in deals known as co-investments, where private equity managers tap favored investors to put more money into individual purchases — without the hefty fees. Sovereign wealth funds such as the Abu Dhabi Investment Authority and Mubadala Investment Co. have been seizing on such opportunities, deploying billions to help get private equity deals over the line in recent years.

The increased competition for such deals comes just as they’re becoming a more important tool for US pensions to save on management fees and bet on higher returns. That’s changing the dynamics of how US pensions invest, public fund executives say. The largest US pensions are cranking into gear, revamping decision-making processes that made them slow to evaluate new investments and increasing allocations to capture more of these deals.

The board of the largest US pension fund, the California Public Employees’ Retirement System, or Calpers, has given its investment team permission to make decisions in 48 hours if they need to. At Calstrs, which manages approximately $338 billion, Chan persuaded the fund’s board this year to tweak an existing co-investment program to be more flexible and put more money to work.

“Pensions are trying to move a lot faster now that the big sovereign wealth funds are in the picture,” said Marcus Frampton, the chief investment officer for the $78 billion Alaska Permanent Fund. The fund made 50 co-investments in the past decade and last year decided to expand its private equity team to do more of such deals.

US public pensions, managed on behalf of teachers, firefighters and other public-sector workers, have for years invested in private equity funds as a means of generating strong returns with less volatility than in the public equity markets. The aim is to close a funding gap that has left many of them tens of billions short of covering expected retirement benefits.

But the asset class is expensive. Some US pensions spend roughly a half-billion dollars on private equity management fees per year.

In recent years, US pensions have ramped up co-investments to gain exposure to attractive companies in a fund’s underlying portfolio, with zero fees to pay. Calpers, which manages about $490 billion, increased its private equity target allocation to 17%, in part to shift more money into such co-investments. The pension made its biggest yet just last year, investing $750 million in an undisclosed US buyout deal.

Access to these deals often goes hand in hand with commitments to a private equity firm’s next fundraise. Meanwhile, private equity firms benefit from having a partner who can shoulder some of the risk at the outset, rather than fronting it all themselves.

The entry of giant sovereign wealth funds from the Middle East has introduced a complication. US pensions have historically taken weeks or even months to make an investment decision, hamstrung by a cumbersome process involving investment committees, consultant reviews and political battles over the stewardship of retirees’ money. By contrast, the likes of ADIA and Saudi Arabia’s Public Investment Fund can commit large sums quickly — sometimes in hours.

“We needed to streamline the entire organization’s operations to become nimble so that we could compete in the marketplace at anyone’s speed and scale,” Chan said in an interview with Markets Group in March about the fund’s efforts to improve its co-investment strategy. “If we’re going to do a co-investment, we have to make sure we respond the same day.”

Calstrs saved $185.5 million in fees in 2022, helping to bolster Chan’s case. It now aims to do a co-investment for every fund investment it makes.

Calstrs can provide “quick turnarounds in making co-investment decisions and the ability to take down sizable amounts,” said Mindy Tirapelle, a spokesperson for Calstrs in an emailed response to Bloomberg’s questions about the pension fund’s co-investments.

Calpers declined to comment.

While US pensions aren’t new to co-investing, they’ve typically committed capital at a slower pace and in much smaller amounts than their sovereign wealth peers, which have grown at breakneck speed in recent years.

The 10 largest Middle Eastern sovereign wealth funds manage a collective $4.5 trillion in assets, edging closer to the amount the 10 biggest public investors in the US, Australia and Canada manage combined. That means they have large investment targets to fulfill, which in turn is pushing some deals into the multibillion-dollar range.

KKR, EQT, and Brookfield all turned to Middle East sovereign wealth funds last year to help fund big-ticket deals. And Apollo Global Management Inc. Chief Executive Officer Marc Rowan said in February that the best investors are now in places such as Singapore and the United Arab Emirates.

“The first people that get phone calls for some of these deals, especially the bigger deals, are the people that can write a billion-dollar check into one deal,” said Michael Lazorik, the director for private equity principal investments at the roughly $200 million Teacher Retirement System of Texas. “That’s a small number of people.”

That means over the past eight years, Lazorik said, investors — also known as limited partners — who could commit to backstopping a deal with 10-figure sums carved out a new tier for themselves. In that time, Gulf countries have pushed through reforms on business policies and made other efforts to diversify their economies away from oil.

Saudi Arabia’s Vision 2030 program, launched in 2016, has fueled the kingdom’s aggressive investment strategy in companies abroad. Crown Prince Mohammed bin Salman has said he wants to make investments the source of the government’s revenue, not oil. Instead of stashing a large share of their oil wealth in safe assets like cash, bank deposits and US debt, the sovereign funds are increasingly funneling money into investments in stocks, real estate, infrastructure and private equity.

The largest now underwrite deals alongside private equity firms and are involved much earlier in the investment process than historically was the case. Canadian and Australian public pension funds, as well as Singapore’s sovereign wealth funds GIC and Temasek, have been at the forefront of this type of investing and can keep up with the Middle Eastern players — and in some cases, when a deal gets too big, partner with them.

This has pushed some US pension funds into a so-called second tier. They get phone calls later, after a deal is signed, so that they buy sell-downs, portions of the investments that the larger limited-partners don’t want to keep.

Not every buyout firm has relegated US pensions to second place. Some have responded by creating an alternating system for who they offer deal access to first. More often than not, however, it’s about finding the money fast and avoiding having too many investors to negotiate deal terms with.

One large pension investor said that some money managers prefer a limited partner that has strict governance, as it forces more questions about a transaction and thereby adds a level of comfort to the viability of the deal itself. Many of the Middle East players are organized to write large tickets, but the speed of such deals leaves less time for due diligence compared to the approach of established limited partners, this person said, citing conversations with investment firms and experiences partnering with those players.

Still, US public pensions, which collectively manage several trillion, have started to tout that they, too, can be nimble and move quickly, and that they’re reliable long-term partners. Some of the more sizable ones still compete neck-in-neck with sovereigns on some deals.

“It’s very hard to attain a position in a private equity industry as an LP, and it’s even more important to maintain that position,” Lazorik said. To keep access to co-investments, limited partners often need to make promises of fat commitments in a private equity firm’s next fund raise. As both sovereign wealth funds and investment firm fund sizes grow larger, few US players can keep up.

Calstrs says its new policy makes them more competitive against rivals, letting the fund commit to very large deals that other US investors wouldn’t be able to do because of allocation constraints. Their eventual goal is to co-lead deals, taking as much as 49% ownership in companies and snagging observer board seats.

The largest US pension funds acknowledge privately that they’ve been eyeing the growth of sovereign wealth funds for the past decade, and watching how that has influenced their access to investment managers, according to people familiar with their thinking, who asked to remain anonymous discussing strategy that isn’t public.

Some of them even see trying to compete with the Middle East funds as a futile exercise.

Calpers invests $7.5 billion to $8 billion per year in co-investments, up from just $3 billion in 2022. This year it decided that it’s no longer planning to invest that money with the big-name private equity shops that run the blockbuster deals and garner steep competition with sovereign wealth funds.

Instead, Calpers is shifting its money to smaller managers and deals that can be less competitive. While the pension made that decision primarily to diversify its portfolio, getting meaningful traction with those funds is another benefit. As one person familiar said, Calpers wants to put its money where its tickets mean something.

Bloomberg Businessweek

.gif)