During the World War II period, shipbuilding rose into one of the most critical sectors for most countries in continental Europe and the U.S. In these regions, shipyards represented the backbone of waterfront businesses, providing a lifeline for many coastal communities. But despite that demand for construction of new vessels is still high, shipbuilding in the West has hit an inflection point. Overall, shipbuilding production has fallen to historic lows, a case in point being the U.S where shipyards capable of building large vessels have declined by more than 80 percent since the 1970s.

The same cannot be said of the Asian region, where massive shipbuilding complexes are the world leaders in supplying modern ships. China, South Korea and Japan continue to maintain the top three position in the global shipbuilding market. But to understand this Asian monopoly in shipbuilding, we must break it down at the country level.

In this case, South Korea has the most intriguing case of how it developed its shipbuilding and could offer valuable insights for the developing and middle power countries vying for a similar position. In a new research paper published in the Marine Policy journal, Dongkeun Lee, a Korean Navy(ROKN) reservist officer and a researcher based at the College of Asia and the Pacific, in the Australian National University, Canberra(ACT), explores the unique case of the Korean shipbuilding rapid development between 1960s to the 2000s.

Lee characterizes the history of the South Korean shipbuilding as relatively shorter compared to other major shipbuilding countries. For this reason, it defied several critical factors historically believed to be requisites for any country vying for a dominant position in global shipbuilding.

First, South Korea is a late industrialized middle power country with limited resources and population. This is a contrast to most major shipbuilding countries including China, the U.S, Russia and Japan, which have a long history of shipbuilding due to early industrialization during the 18th and 19th centuries. In addition, these countries have substantial resources such as manpower and a strong economy to allocate to the shipbuilding industry.

Another notable exception is that some countries that fall into the same economic category as South Korea, such as Saudi Arabia and Australia, lack sufficient shipbuilding capabilities to fully meet the demands of their navies. Partly, for such late industrialized countries without sufficient man power, it is not economically rational to build indigenous shipbuilding industries because of the high initial costs.

It then begs the question how South Korea managed to break these barriers to have shipbuilding as one of its major economic mainstays. Indeed, this topic has been covered widely in the past. The question has been answered by pointing to government subsidies that protected South Korean shipbuilding from foreign competitors. South Korea’s military dictator Park Chung-hee, who served as the country’s president from 1963 to 1979, heavily subsidized the industry, under the so-called chaebol companies to boost the national economy.

In Lee’s recent analysis, he was for the first time able to utilize documents from South Korea’s presidential archive, which was established back in 2007. The documents offer valuable insights on the intentions behind Park’s decision to subsidize Korean shipbuilding.

Notably, in 1970s sea-based North Korean military provocations compelled South Korea to develop sea power. This would see South Korea start the implementation of the Patrol Boat Acquisition and Domestic Building Policy. It would herald South Korean indigenous warship-building industry, which is still supported by the current defense strategy. During the same period, the government also invested in expanding existing shipbuilding infrastructure for commercial vessels. Some of these shipyards are still in use today including the Okpo shipyard by Hanwha and Ulsan shipyard by Hyundai Heavy Industries(HHI).

In fact, this represents one of the unique characteristics of South Korean shipbuilding, where the government concurrently supported commercial and warship building capabilities. Chaebol companies that had received government subsidies during the 1960s became important players in warship construction during the 1970s- 1980s.

Meanwhile, as many western countries discontinued their shipbuilding during the end of the Cold War, South Korea shipbuilding persevered. Increased demand for commercial ships throughout 1990s-2000s also created a robust ecosystem for the Korean shipbuilding to thrive.

While Lee acknowledges that the South Korean model may not be sufficient for other developed countries, he singles out government subsidies as a critical starting point for developing the shipbuilding capabilities. In the case of economies such as Australia and Canada, where labor costs are high, one viable option for government subsidies could involve building high-value commercial ships alongside warships. A good example is Italy’s Fincantieri, which not only builds cruise ships but also warships.

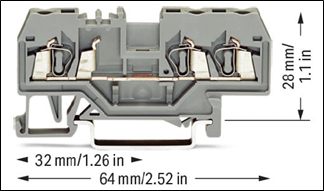

The team pulled a terminal block - a female connector socket for plug-in components - out of the control circuit for the breaker undervoltage release (illustration at left, courtesy WAGO). Two sections of the control wiring associated with this terminal block were also removed from the switchboard, and these components were taken back to NTSB's laboratory for further testing.

The team pulled a terminal block - a female connector socket for plug-in components - out of the control circuit for the breaker undervoltage release (illustration at left, courtesy WAGO). Two sections of the control wiring associated with this terminal block were also removed from the switchboard, and these components were taken back to NTSB's laboratory for further testing.