NEWSFILE - NEWSFILE - MON JUN 24, 2024

Calgary, Alberta--(Newsfile Corp. - June 24, 2024)

"LithiumBank spent the past five-years consolidating Park Place brine hosted mineral licenses. This work has now culminated in 100% ownership of the largest LCE inferred mineral resource in North America and with the highest recorded lithium grade in Alberta. This is a remarkable achievement for the Company. The Park Place resource puts LithiumBank's collective lithium brine resources inventory for the Company's Alberta projects at 27.78 million tonnes LCE. This presents district scale potential opportunity for Canada to become a major supplier of lithium in North America," commented LithiumBank CEO, Rob Shewchuk. "The Company will now focus on additional brine sample assaying, completing lithium extraction test work, and initiate a Preliminary Economic Assessment ("PEA") for Park Place. We believe this can be expeditiously achieved as we can make use of our knowledge gained from our Boardwalk PEA, effectively dated February 22, 2024, located approximately 50 km to the north, in which the Leduc Formation brine is similar in chemistry, depth of resource, porosity and permeability. Park Place brine will be chemically and metallurgically evaluated at the Company's, exclusively licensed, 10,000 L/day Direct Lithium Extraction ("DLE") pilot plant in Calgary following a bulk brine sampling program in H2 2024."

Highlights:Park Place is the largest known NI 43-101 inferred lithium brine resource estimate in North America.

Highest known reported lithium-in-brine grades used in a NI 43-101 inferred lithium resource estimate in Alberta.

10,078,000 tonnes inferred LCE within the Leduc Fm aquifer at an average of 79.4 mg/L lithium.

11,603,000 tonnes inferred LCE within the Swan Hills Fm aquifer, which underlies the Leduc Formation, at an average of 80.9 mg/L lithium.

Multiple high porosity areas occur that have a combined Leduc & Swan Hills Fm thickness of over 350 metres, and as high as 510 m, to be studied for potential selection of future PEA.

Subsurface reservoir modelling conducted by SLB included data from 420 wells, 104 km2 of 3D seismic data and 262 km of two-dimensional ("2D") seismic data.

Technical work pertaining to mineral resources to be documented in the technical report was performed by SLB, and overseen by Qualified Persons from Matrix Solutions Inc.

The subsurface reservoir model constructed by SLB will assist in planning well networks and locations in future economic and engineering studies such as a PEA; and

Park Place bulk brine sample collection to occur in H2 2024 to be included in the 10,000 L/day continuous direct lithium extraction ("cDLE") pilot plant test work located in the Company's DLE facility in Calgary, Alberta.

Figure 1: Map of the Park Place project showing Area of Interest ("AOI") and lithium brine samples used in the Park Place NI 43-101 resource estimate along with surface infrastructure.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10140/214147_ce6f8256f4b9fbb1_001full.jpg

The consolidated Park Place project consists of 1,404,558 acres of contiguous Brine Hosted Mineral Licenses ("BHML"). The project is situated between Edson, Fox Creek, and Hinton, approximately 180 km west of Edmonton, and is approximately 50 km to the south of the Company's Boardwalk lithium brine project ("Boardwalk"). This area has seen over 70 years of hydrocarbon extraction resulting in a well-established and well-trained labour force, networks of all-weather gravel roads, drill sites that can be easily accessed from Provincial highways, and electrical transmission lines that run through and adjacent to the project (see Figure 1).

Reservoir Evaluation

The reservoir evaluation was completed by SLB and overseen be Alex Haluszka, M.Sc., P.Geo. of Matrix Solutions Inc., a qualified person ("QP") under NI 43-101.

The Park Place NI 43-101 mineral resource estimate includes inferred mineral resources from both the Leduc and Swan Hills Formations of 21,681,000 tonnes LCE at a weighted average grade of 80.2 mg/L lithium (Table 1). Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The mineral resource estimate work was prepared within a portion of the Park Place Property (81%) that is defined as the area of interest ("AOI") and totals 1,140,115 acres (Figure 1). The Swan Hills Fm directly underlies the Leduc Fm and appear to be in hydraulic communication based on regionally available pressure data. While they may represent a regionally connected aquifer system, the two formations are evaluated separately due to an identifiable difference in lithology and porosity. The Swan Hills Fm is mapped to from 24 to 264 m in thickness within the claims area and the Leduc Fm immediately overlies the Swan Hills Fm, where present, with a maximum thickness of 366 m within the claims area. The maximum observed combined thickness where the two units overlap within the property is 511 m of highly porous reservoir rock occur that would potentially present ideal locations for consideration within a PEA (Figure 2).

Figure 2: A-A' Cross-section through Park Place (as shown in Figure 3) of the effective porosity model for Leduc Fm and Swan Hills Fm.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10140/214147_ce6f8256f4b9fbb1_002full.jpg

Table 1: Park Place Lithium global in-situ Inferred Mineral Resource Estimations

Reporting parameters Leduc Fm Domain Swan Hills Fm Domain Combined Total

Total Volume (km3)1 501.2 660.5 1,161.7

Pore Volume (km3)2 25.1 28.4 53.5

Average Li Concentration (mg/L) 79.4 80.9 80.23

Average Effective Porosity (%) 5.0 4.3 4.64

Average brine pore space (%) 95 95 95

Total elemental Li resource (tonnes) 1,893,000 2,180,000 4,073,000

Total LCE (tonnes) 10,078,000 11,603,000 21,681,000

1. Total volume of rock and pore space

2. Total volume of effective porosity

3. Calculated using a weighted average (by pore volume) from the average grade of the Leduc and Swan Hills formations

4. Calculated using a weighted average porosity by total formation volume for both Leduc and Swan Hills formations

Note 1: Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the mineral resource will ever be upgraded to a higher category. The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Note 2: The weights are reported in metric tonnes (1,000 kg or 2,204.6 lbs).

Note 3: Tonnage numbers are rounded to the nearest 1,000 unit.

Note 4: In a 'confined' aquifer (as reported herein), effective porosity is an appropriate parameter to use for the resource estimate.

Note 5: The resource estimation was completed and reported using a cut-off of 50 mg/L Li.

Note 6: To describe the resource in terms of industry standard, a conversion factor of 5.323 is used to convert elemental Li to Li2CO3, or Lithium Carbonate Equivalent (LCE).

The NI 43-101 mineral resource three-dimensional model utilized over 1,171 wells that have been drilled into the Devonian aged strata being evaluated. Of the 1,171 wells, 420 have good quality data to make stratigraphic picks within the AOI as shown in Figure 3. The dataset consisted of 196 wells intersecting the top of the Leduc Fm, 300 wells intersecting the top of the Swan Hills Fm, and 236 wells intersecting the bottom of the Swan Hills Fm.

SLB constructed 3D geological and porosity models in Petrel™ subsurface software by using existing well logs and a combination of 3D and 2D seismic data acquired throughout the AOI at Park Place. SLB conducted petrophysical analysis of 118 wells, processed and interpreted 3D and 2D seismic data to correlate between acoustic impedance and porosity. Porosity data was parameterized in a 3D grid by distributing the porosity evaluated from well logs using a variogram derived from 3D and 2D seismic impedance data. Log porosity was verified via direct petrophysical correlations to core porosity measurements. This demonstrated that the petrophysical log-based porosity correlates well with effective core porosity.

Figure 3: Tonnage map of the Park Place indicating A-A' cross-section from figure 2 and wells used for stratigraphic picks.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10140/214147_ce6f8256f4b9fbb1_003full.jpg

Total in-place formation brine volume was obtained by multiplying the total rock volume of the Leduc and Swan Hills Fm within the AOI using the estimated porosity volume of the 3D grid.

An analysis of available oil and gas reserves information indicates an original hydrocarbon saturation of these reservoirs of approximately 5%. SLB models provided estimated volumes of each formation within the claims area by summing the effective porosity grid blocks overlapping the claims and assuming 95% of the pore space being brine saturated:The Leduc Fm, within the AOI, hosts 23.8 km3 of lithium-rich brine.

The Swan Hills Fm, within the AOI, hosts 26.9 km3 of lithium-rich brine.

Combined total of 50.8 km3 of brine within the AOI at Park Place.

North American Brine Resources

Figure 4: Comparison of LCE brine resources by select companies. With the addition of the Park Place inferred lithium resource, LithiumBank is now the largest known holder of inferred LCE brine resources by a company in North America.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10140/214147_ce6f8256f4b9fbb1_004full.jpg

Inferred Mineral Resource Calculation Process

During 2022 and 2024, LithiumBank obtained permission from two oil and gas companies to collect Leduc and Swan Hills formations brine samples from 2 separate oil and gas wells for the purpose of analytical testing.Three brine samples were collected from a 72-metre-thick vertical interval at the top of the Leduc Fm from well 100/12-03-059-23W5/00 and returned grades ranging between 71.2 – 82.0 mg/L lithium with an overall average of 77.2 mg/L lithium (Figure 1).

Three brine samples were collected from a 2-metre-thick vertical interval at the top of the Swan Hills Fm in well 100/01-23-062-20W5/00 returning grades between 75.5 – 84.9 mg/L lithium with an overall average of 80.1 mg/L lithium.

Samples were analysed at AGAT Laboratories, an ISO 17025:2017 certified lab, in Calgary Alberta. LithiumBank implemented Quality Control and Quality Assurance (QA/QC) protocols for the analysis. Testing of brine samples from the 2 wells included duplicate samples, sample blanks, and laboratory-prepared sample standards. Samples were collected from the well head by BV Labs technicians (Leduc samples) and AGAT Lab technicians (Swan Hills samples) and couriered to AGAT Laboratories for analysis in Calgary.

The LithiumBank brine sampling and analytical programs showed the Leduc and Swan Hills Formation aquifers underlying the Park Place Property contain elevated concentrations of lithium and the sampling program validated the post-2010s minerals industry exploration Li-brine results, with the exception of the historical Li-brine data compiled by the Government of Alberta ("GoA"). Hence, a total of 40 LithiumBank-derived and historical brine samples were used to determine the grade for the inferred mineral resource estimations (7 brine analyses from the Leduc Fm and 33 brine analyses from the Swan Hills Fm). Furthermore, Roy Eccles, a QP under NI 43-101 was involved in the historical minerals industry Li-brine sample collection campaigns and can therefore validate the collection, chain-of-custody, and analytical procedures that were used to determine select historical lithium-brine values. The QP was not able to validate the GoA data for use in the resource modelling and estimation process.

The QP assessed both within-property and adjacent property Li-brine data using historical mineral industry- and LithiumBank-derived Li-brine values. In the QPs opinion average Li-brine concentrations of 79.4 mg/L Li and 80.9 mg/L Li should be used to estimate the Li-brine mineral resources for the Leduc and Swan Hills aquifers, respectively, underlying the Park Place property. Additional brine sampling and assay testing is required at Park Place to provide additional confidence to the distribution of lithium within the Leduc Fm and Swan Hills Fm aquifers.

Resource Estimate Calculation

The NI 43-101 mineral resource estimates were calculated as a global in-situ resource within the Leduc and underlying Swan Hills formations. The Park Place Li-brine resource estimate is classified as an inferred mineral resource in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum definition standards and best practice guidelines (2014, 2019) and the disclosure rule NI 43-101 as adopted by the Canadian Securities Administrators.

Combined, the Leduc and Swan Hills Fm aquifers consist of a total of 1,161.7 cubic kilometres (Leduc Fm = 501.2 km3 and Swan Hills 660.5 km3). Within the aquifers, the Leduc Fm hosts 23.8 km3 of brine with a lithium concentration of 79.4 mg/L and the Swan Hills Fm hosts 26.9 km3 of brine with a lithium concentration of 80.9 mg/L. Total elemental lithium in the Leduc Fm is 1,893,000 tonnes and 2,180,000 million tonnes in the Swan Hills Fm. To determine the amount of elemental lithium the following formula was used:

RLi = A x T x P x C

With RLi = lithium resources of selected reservoir(kg), A = surface area (km2), T = thickness (m), P = effective porosity (expressed between 0 and 1), C = average concentration (mg/l).

Multiplying the elemental lithium by a factor of 5.323 determines the LCE quantities that are stated to be 9,643,000 tonnes inferred LCE in the Leduc Fm and 11,372,000 tonnes inferred LCE in the Swan Hills Fm. The combined inferred lithium-brine resource estimate of both the Leduc and Swan Hills Formations is 21,681,000 tonnes LCE with a weighted average lithium grade of 80.2 mg/L. Figure 3 illustrates the combined (Leduc and Swan Hills Fm) tonnage map of the AOI with hotter colours indicating areas of higher combined tonnage.

An evaluation of permeability of the reservoir was completed in addition to the reservoir pore volume. The QP for reservoir evaluation believes there is sufficient permeability and pressure within the reservoir that brine production wells can be completed to deliver brine to surface for consideration in future economic assessment scoping studies

Lithium Extraction Evaluation

The evaluation of the suitability of applying DLE as a mineral processing technology for Park Place has been overseen by Maurice Shevalier, P.Chem, of Matrix Solutions Inc., QP as defined in NI 43-101.

LithiumBank has yet to conduct mineral processing test work on brine from Park Place; however, brine characteristics of the Leduc Fm and the Swan Hills Fm at Park Place are similar enough to the brine at Boardwalk to safely assume the DLE technology used to extract lithium from the brine will be successful at Park Place. The Company is expected to conduct a bulk brine sampling program from both the Leduc and Swan Hills formations in H2 2024. Park Place will benefit from an existing, exclusive licensing agreement with G2L Greenview Resources Ltd. ("G2L") and piloting with their cDLE® Ion Exchange ("IX") technology. The G2L IX technology is unique in that it is designed to work at high flow rates while maintaining a very high recovery of lithium (98%) and achieving a high purity (70%) lithium eluate, as reported in the Boardwalk PEA dated effective February 22, 2024. The Boardwalk PEA demonstrates that lower cost and readily available reagents such as quick lime (CaO) and sulphuric acid (H2SO4) can produce a high purity lithium sulphate eluate and lowering the cost of downstream processing of an LHM.

The scientific and technical information relating to the Park Place mineral resources presented in this news release has been reviewed and approved by Mr. Alex Haluszka P. Geol. of Matrix Solutions Inc. Mr. Alex Haluszka is independent of LithiumBank and the Park Place property, and a Qualified Person as defined by NI 43-101.

The scientific and technical information relating to the Park Place mineral resources, related to the potential of lithium extraction, presented in this news release has been reviewed and approved by Mr. Maurice Shevalier, P.Chem, of Matrix Solutions Inc. Mr. Maurice Shevalier, P.Chem, is independent of LithiumBank and the Park Place property, and a Qualified Person as defined by NI 43-101.

The scientific and technical information relating to the brine sampling and lithium grade validation for the Park Place mineral resources presented in this news release has been reviewed and approved by Mr. Roy Eccles P. Geol. of APEX Geoscience Ltd. Mr. Eccles is independent of LithiumBank and the Park Place Property, and a Qualified Person as defined by NI 43-101.

Risks and Uncertainties

There is no guarantee that a company can successfully extract lithium from Alberta's Devonian petroleum system in a commercial capacity. Initial mineral processing bench-scale and/or demonstration pilot test work may not translate to a full-scale commercial operation.

LithiumBank has been dependent on petro-companies to access brine for chemical analysis. In the absence of not owning their own wells, LithiumBank must work with petro-companies to obtain small and bulk brine samples to build on its current data set. The Company is currently negotiating to selectively acquire existing wells within the AOI, similar to what the Company has done at Boardwalk (news release, May 16, 2024) to allow for additional brine sampling.

The information used to quantify the reservoir effective porosity was historical information collected through petroleum exploration in the study area. Therefore, there is an implicit bias in this dataset towards portions of the reservoir that are hydrocarbon saturated. Although the QP believes the reservoir properties are sufficiently representative of the bulk formation, this will need to be confirmed through continued exploration and data collection. The existing measurements come from a combination of secondary physical properties (geophysics) and core analysis that were upscaled to the bulk reservoir volume. The bulk reservoir properties have not yet been confirmed through targeted exploration drilling and pumping tests from the brine resource interval. Furthermore, DLE technologies have not been tested directly as an extraction technique for the Park Place brines. At the current time, DLE applicability has been inferred from testing activities completed at LithiumBank's other properties.

About LithiumBank Resources Corp.

LithiumBank Resources Corp. (TSXV: LBNK) (OTCQX: LBNKF), is a publicly traded lithium company that is focused on developing its two flagship projects, Boardwalk and Park Place, in Western Canada. The Company holds 2,130,470 acres of brown-field lithium brine licenses, across three (3) districts in Alberta and Saskatchewan. The Company has licensed a DLE technology from Go2Lithium.

About G2L Greenview Resources Inc. (Go2Lithium)

G2L Greenview Resources Inc is a 100% owned subsidiary of Go2Lithium Inc. Go2Lithium Inc. was formed in early 2023 as a 50/50 joint venture between Computational Geosciences Inc (CGI), a subsidiary of the Robert Friedland-chaired Ivanhoe Electric Inc. (NYSE: IE) and Clean TeQ Water (ASX: CNQ). Please see Clean TeQ's website (www.cleanteqwater.com) for additional information on their suite of water treatment and metal extraction technologies.

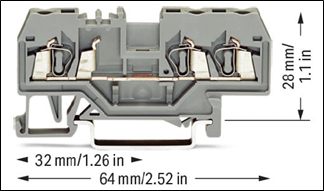

The team pulled a terminal block - a female connector socket for plug-in components - out of the control circuit for the breaker undervoltage release (illustration at left, courtesy WAGO). Two sections of the control wiring associated with this terminal block were also removed from the switchboard, and these components were taken back to NTSB's laboratory for further testing.

The team pulled a terminal block - a female connector socket for plug-in components - out of the control circuit for the breaker undervoltage release (illustration at left, courtesy WAGO). Two sections of the control wiring associated with this terminal block were also removed from the switchboard, and these components were taken back to NTSB's laboratory for further testing.