Austal Names Ex-US SECNAV as Chairman Replacing Founder

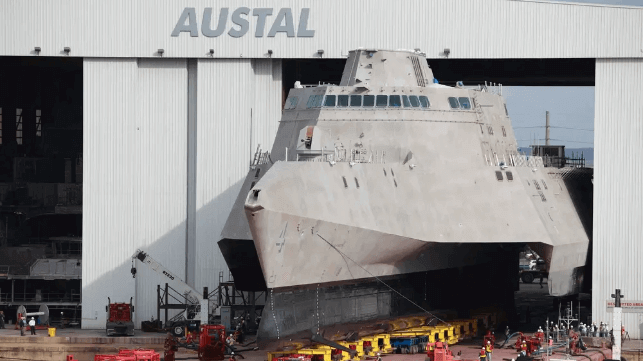

Austal, a leading defense contractor for the Australian and U.S. navies, has selected former U.S. Secretary of Navy Richard Spencer to replace its retiring chairman and founder John Rothwell. The move comes as the shipbuilder is considered to be “in play” after South Korea’s Hanwha Group proposed an acquisition and several private equity firms are reported considering a bid.

In announcing Rothwell’s retirement as Chairman, the company called it “a significant milestone in the history of Austal,” noting Rothwell has served in the position for 37 years since he founded the company in 1987. He remains the second largest private shareholder in the company owning approximately nine percent behind Australian businessman Andrew Forrest, the non-executive chairman of Fortescue, who owns nearly 20 percent of Austal’s stock.

Under Rothwell’s leadership, Austal grew from a small, privately-owned, West Australian, commercial shipbuilder to a publicly traded, international defense contractor with a multibillion-dollar orderbook. The company reports it has over 4,000 employees and substantial shipbuilding operations in Australia, the United States, and South East Asia.

Rothwell, who is 80 years old, said he believes the timing is right for the transition. He said Austal set out four criteria to select its new chair, including excellent character, strong business acumen, in-depth knowledge of the U.S. defense industrial base, and relationships with the Australian and/or US defense sector.

Richard Spencer was named the 76th Secretary of the U.S. Navy taking office in August 2017 under President Donald Trump. He continued to serve until November 2019 when he was entangled in a dispute with Secretary of Defense Mark Esper, who fired him. Spencer served five years with the U.S. Marine Corps as a Naval Aviator from 1976 to 1981 before going into private industry.

Spencer worked at several investment banks including Goldman Sachs, Donaldson, Lufkin and Jenrette, and Bear Stearns. He also served on the Pentagon Defense Business Board advisory panel and the Chief of Naval Operations Executive Panel. Today, he serves as Global Chairman of Bondi Partners, a U.S./Australia advisory and investment firm, which according to the Australian Financial Review was rumored to be one of the potential suitors for Austal.

Austal has reportedly received attention from investment firms including Cerberus Capital Management and JF Lehman & Company according to the Australian Financial Review. Speaking with the outlet today, Rothwell however said the company continues to think the possible suitors remain very limited due to Austal’s position as Australia’s primary naval builder and its extensive work with the U.S. Navy, including with the nuclear submarine program. Rothwell said that the approach from Hanwha remains stalled due to the company’s view that a deal would not win approval from Australian and U.S. authorities. Austal is demanding an agreement for a breakup fee from Hanwha before letting the Koreans commence a due diligence to ensure that it is a serious bid and not fishing.

A possible takeover of Austal has not been ruled out, but management says its focus is on continuing to grow its role as the leading naval contractor.