England’s biggest onshore windfarm plan is early test of anti-Nimby policy

The government must weigh up the need for huge amounts of green energy against strong opposition from locals for Calderdale Wind Farm proposal

The site that has been proposed for Calderdale Wind Farm

(photo: Ali West)

By Tom Bawden

Science & Environment Correspondent

July 14, 2024

Labour could be heading for a showdown with locals in the South Pennine Moors over plans to build England’s biggest onshore windfarm near Hebden Bridge.

The Calderdale Wind Farm’s 65 Blackpool Tower-height wind turbines would provide green electricity to more than a quarter of a million households, bring jobs to the area and give locals £75m over 30 years to help with energy bills.

But opponents say it would transform a beautiful, unspoilt area of peatland into an “industrial landscape”.

With its turbine tips reaching 200 metres into the sky, the proposed 23.5 square kilometre site on Walshaw Moor is just a few hundred metres from the farmhouse that is said to have inspired Emily Bronte’s novel, Wuthering Heights.

It is also near to where the tv drama Happy Valley was filmed.

The developers of Calderdale Wind Farm say they are ready to move “at pace” and will submit a planning application as soon possible after Labour’s planned changes to the way consent is granted for large onshore wind farms are finalised.

These would see planning decisions taken by central, rather than local, government, with this project thought likely to provide the first test case of Labour’s determination to drive through major wind farm – and other infrastructure – developments in the face of strong local opposition.

“Because of its size, location and timing Calderdale Wind Farm could be an important test case, showing whether we are likely to see a flurry of similar developments in the coming years,” Ed Griffiths, Head of Business & Client Analytics at Barbour ABI, a key provider of construction data to the Office for National Statistics and the government, told i.

“Large projects such as Calderdale, with 65 turbines proposed, will give an indication of the government’s determination to unblock onshore windfarms in England once planning has been submitted.”

Professor Rob Gross, director of Imperial College London’s UK Energy Research Centre, added: “The government will be keen that some well advanced large windfarms get going quickly. I’m sure that particular developments will come to be seen as a test case of controversial wind developments. This one might indeed be seen as that test case.”

Since taking power, Labour has ended the effective ban on all but the smallest onshore wind farms that was brought in by the Conservative party in 2015 – and vowed to take on the Nimbys.

This is a key part of the government’s plan to ensure the UK hits several ambitious, legally binding targets on reducing carbon emissions – which it is currently no-where near meeting – and to improve energy security.

But the wind farm is fiercely opposed by many people in the area, given its huge size and picturesque location

.

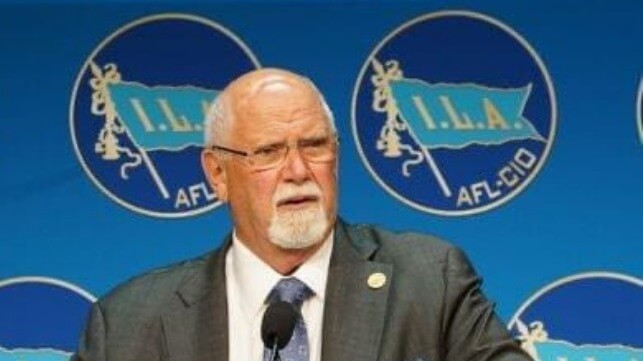

Steven Oldroyd of the Stop Calderdale Windfarm campaign (Steven Oldroyd)

“This will look absolutely horrendous. It just turns a wild area into an industrial landscape,” Steven Oldroyd, of the Stop Calderdale Windfarm campaign, told i.

“There are unspoilt views around there for miles and miles. You can walk for hours and not see another person, or building, or even a pylon. You can hear curlews, you can hear snipes – all wildlife,” added Oldroyd, who lives in nearby Sowerbury Bridge and runs a removal and courier delivery service.

“Areas that could pass as untouched are few and far between in this country. But the South Pennines is one of the last places like that.

“You have signs up in Japanese because they get that many tourists going to look at the area. What are they going to think when they see that?”

He is referring to the many tourists who throng to the area to see where the Bronte sisters grew up (in Haworth) and the ruined farmhouse of Top Withens, situated a few hundreds metres from the proposed wind farm site, which is said to be the origin of Cathy’s home Wuthering Heights in the novel and is particularly popular with Japanese tourists.

Jenny Shepherd, a retired creative writing lecturer living in Hebden Bridge is also strongly opposed to the development.

“I’m pretty angry, upset and pissed off about it to be honest,” she told i.

“We’re in favour of onshore wind but we’re absolutely clear it cannot be on peatland, particularly protected peatland like Walshaw Moor. Peatland is good for water quality, protects against flooding, helps against climate change by storing CO2 and provides habitat for birds, plants and animals,” she added.

Despite the opposition, Christopher Wilson, Executive Chairman at Worldwide Renewable Energy (WWRE), which is developing the project, insisted that it “is an incredible opportunity for Calderdale to play a nationally significant role in the UK’s Net Zero transition”.

“Our initial plans would also see the planting of thousands of trees and other planting across Walshaw Moor to enhance flood mitigation for the benefit of villages along the Calder Valley. It will also mean the end of grouse shooting on the moor,” he said.

“Together with a £75million community benefit fund over the lifetime of the project and an extra £26 million boost to the regional economy annually once operational, we firmly believe Calderdale Wind Farm to be a once in a generation opportunity for the local community.”

Newly elected Labour MP for Calder Valley, Josh Fenton-Glynn, said: “It’s hard to say whether I’m for or against a proposal that hasn’t been made yet.

“I have been clear that any decision on support or otherwise will consider the climate impact of potentially damaging deep peat and I would need assurances there would be no flooding impact on local communities.”

A Department for Energy Security and Net Zero (DESNZ) spokesperson declined to comment on the Calderdale proposal, however, they indicated a determination to drive through big windfarm projects more generally.

“By overturning the decade long ban on onshore wind, we have sent a signal to investors the UK is back in business, an immediate step in our mission to make Britain a clean energy superpower.

“Our bold action will help us take back control of our energy; boosting our energy independence and cutting bills for families as we tackle the climate crisis.”

A spokesperson for Calderdale Council said: “Calderdale Council has not received a planning application for the proposed wind farm development in Calderdale, so due to the pre-application stage, the Council isn’t in a position to comment further at the moment”

Cllr Scott Patient, Deputy Leader and Climate Action and Housing Cabinet Member, Calderdale Council, meanwhile, said: “We wholeheartedly welcome the new Labour Government’s decision to lift the effective ban on onshore wind.

“It will allow councils like ours to work more effectively with our local communities, harnessing the amazing resources we have in Calderdale to reduce energy bills, create good jobs and tackle the climate crisis.”

Kieran Turner, who stood for election as a Green MP for Calder Valley in this month’s election, said: “The Green Party believes in sustainable solutions. In the case of energy generation, this means projects need details of the total carbon footprint and environmental impact, of the site itself and all its connectivity infrastructure. In this example, we need more detail than has yet been made available in the scoping report from the proposers which uses uninformative vagueness such as ‘negotiations are ongoing’.”