Stock image.

Wealthy Australians, in search of attractive investment returns, are emerging as an important pool of capital for financing coal projects shunned by banks due to environmental, social and governance concerns.

Income Asset Management Group Ltd. is one fund manager targeting the well-off in Australia to provide private loans to coal and other mining companies, offering investment returns of about of 12% to 13% per year.

“We can go into non-ESG deals as well like mining if a return on the credit works because our investors have appetite for good returns,” Varuna Gunatillake, director, debt capital markets at IAM said in an interview in Melbourne.

The firm has placed over A$500 million ($335 million) of loans in the last three years in coal and commodity-related infrastructure projects. Those included a piece of Whitehaven Coal Ltd.’s recent $1.1 billion private credit loan, and A$170 million in junior debt to Newcastle Coal Infrastructure Group Pty’s coal terminal in New South Wales. It earns a placement fee for each transaction.

For IAM, the rising demand for private credit globally dovetails with a growing interest among some individual investors in Australia for coal and other resource bets that offer strong returns.

Strident opposition to coal developments in the country has been tempered by a slowdown in renewable energy project investments. Developers have had to wrestle with rising costs, lengthy approval processes and capacity constraints in the transmission grid.

A recent decision by Origin Energy Ltd. to push back the closure of Australia’s largest coal-fired power station by two years amid fears of power shortfalls underscores the dilemma posed by the slower-than-expected transition.

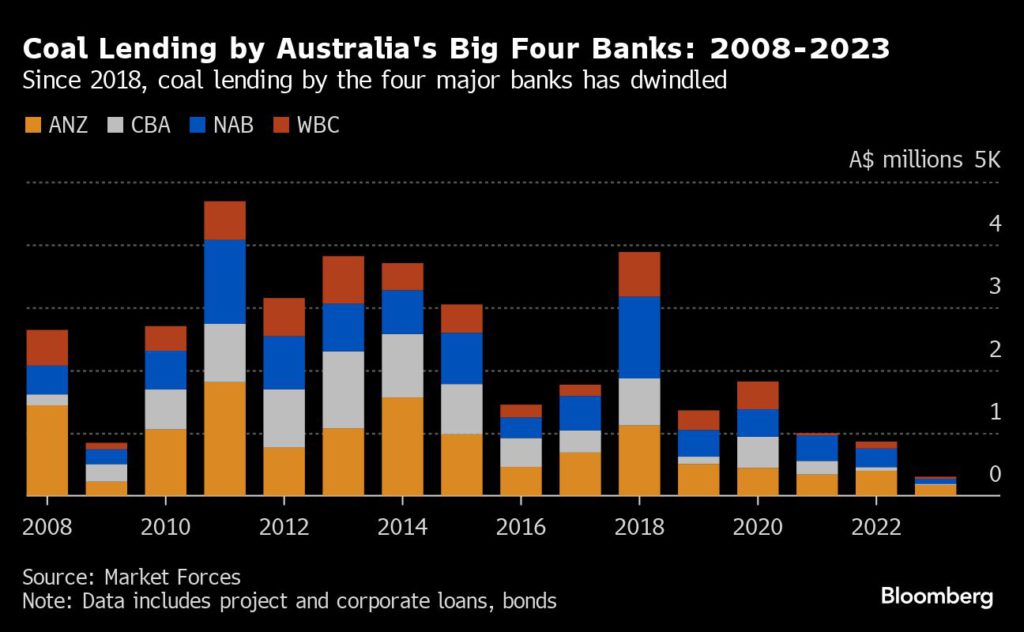

As a result, the financing pipeline for coal-related projects in Australia is healthy, notwithstanding opposition from ESG proponents and a pull back by traditional lenders. Some of Australia’s major banks, including Commonwealth Bank of Australia and Westpac Banking Corp., have committed to limit or refrain from lending to thermal coal miners.

A unit of India’s Adani Group recently got a A$500 million private credit loan from non-bank lenders Farallon Capital Management and King Street Capital Management, people familiar with the matter told Bloomberg News. Meanwhile, a consortium led by Indonesia’s Widjaja family sounded out private credit funds to finance its acquisition of a coal mine in Australia from South32 Ltd.

IAM recognized the growing opportunity to earn strong returns from businesses — particularly in mining and mining services — that have been shunned by commercial lenders and institutional investors. IAM has more than A$3 billion in assets under administration including cash deposits, bonds and treasury management, according to information on its website.

“We can be the conduit between these two opportunities and connect the high net worth customers to these institutional deals that are not accessible easily” for the wealthy, Gunatillake said.

The potential pool of liquidity from high-net worth individuals in Australia is enormous. Capgemini, in a June report, estimated wealthy Australians had investable assets of more than $1 trillion in 2023. Overall, high-net worth individuals globally had assets worth $86.8 trillion.

Untested market

The $1.7 trillion private credit market is relatively new, and largely untested in a credit crunch. It remains to be seen if individual investors have enough understanding of the risks of lending to complex projects.

“These family offices and high-net worth clients are highly sophisticated investors,” said Gunatillake. “They have their own financial advisers, investment managers, legal experts and in-house analysts.”

However, Axel Dalman, head of research at Market Forces, an environmental activist group, warned retail investors against investing in a sector shut out of public debt markets.

“Investors need to see the writing on the wall and recognize that coal is a dying market,” he said. “The big banks understand that ESG risk is financial risk, and private creditors may learn that the hard way.”

(By Sharon Klyne)