Published by admin on 05/08/2024

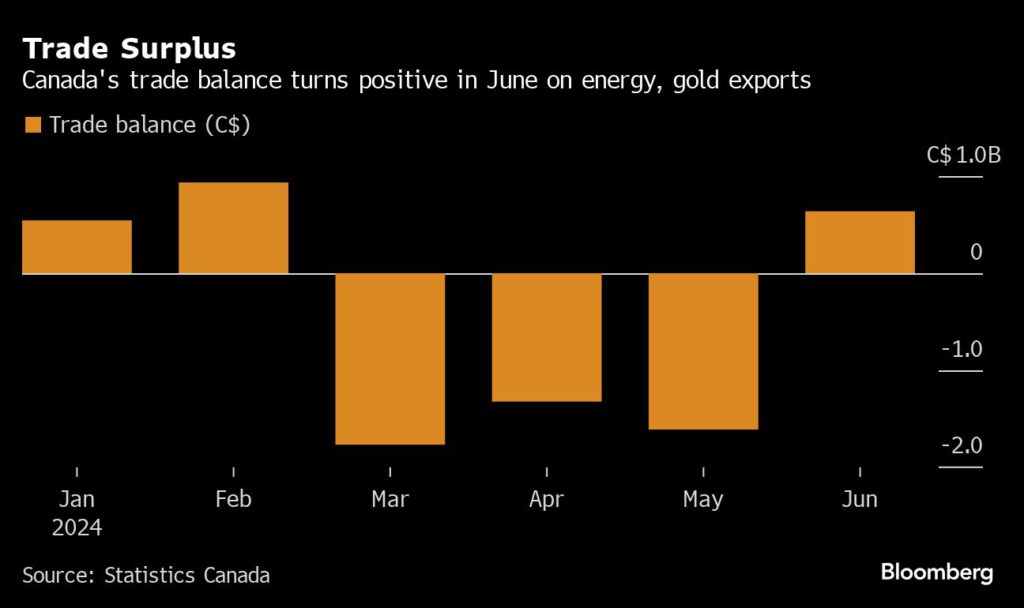

Gold surpassed $2,500 per ounce for the first time in history on Friday in the wake of rising geopolitical tensions and new data indicating a weakening US economy.

Gold contracts for December delivery reached an all-time high of $2,522.50 in the early trading hours, before shedding its gains to trade at $2,475.90 an ounce by 11:00 a.m. ET.

Sign Up for the Precious Metals Digest

Spot gold posted a marginal loss of 0.5% at $2,432.86 per ounce, having hit as high as $2,477.10 — just within grasp of its all-time peak of $2,483.73 set earlier this month.

Current AUD dollar prices for pure bullionGold AUD $ 3749.21

Platinum AUD $ 1498.65

Silver AUD $ 43.83

Incidentally, Agnico Eagle operates the country’s biggest gold mines in terms of output- Detour Lake and Canadian Malartic.

SEATTLE (Scrap Monster): Agnico Eagle topped the list of Canada-based miners by market cap. The market cap of the company stood at C$51.4 billion as of late-July this year. Incidentally, Agnico Eagle operates the country’s biggest gold mines in terms of output- Detour Lake and Canadian Malartic.

The company was second in the ranked list of Canadian miners by net income in 2023. With a net income of $1.9 billion, it stood second to Barrick Gold Corporation, whose annual net income totalled $1.95 billion during the previous year.

Ammar Al-Joundi, President and CEO, Agnico Eagle commented that the company continues to remain focused on capital discipline. The company is currently advancing the former Hope Bay gold mine project in Nunavut. Also, it plans to undertake a $1 billion underground expansion at Detour Lake, which is expected to boost its annual output to 1 million ounces, he added.

In second and third place were Barrick Gold and Wheaton Precious Metals, with market cap of C$44.7 billion and C$37.9 billion respectively. The other miners in the top ten list along with their market cap in billion Canadian dollars are as follows: Nutrien (34.5), Franco-Nevada Corp. (33.3), Teck Resources (32.6), Cameco (27.7), Ivanhoe Mines Ltd. (24.8), Fist Quantum Minerals (13.7) and Kinross Gold (15).

Reuters | August 6, 2024

Image: Pixabay

India’s gold industry, with the support of the World Gold Council (WGC), has established a self-regulatory organization in a bid to increase consumer confidence and restore trust, the WGC said on Tuesday.

The newly-formed Indian Association for Gold Excellence and Standards (IAGES) aims to promote fair, transparent and sustainable practices in the bullion industry, along with regulatory compliance, a code of conduct, and an audit framework, said Sachin Jain, CEO of WGC’s Indian operations.

India is the world’s second-biggest gold consumer after China, but the industry has a trust deficit with consumers and even the government due to poor practices by a small section of the business, he said.

“The purpose of this association is to provide accreditation based on a very strict audit. After the audit, the member will earn the IAGES logo, which they can display,” Jain told Reuters, without specifying details of the audit framework.

Industry bodies such as Indian Bullion and Jewellers Association (IBJA), All India Gems and Jewellery Council of India (GJC) and Gem and Jewellery Export Promotion Council (GJEPC) would be part of the IAGES, Jain said.

The WGC would take the initiative to popularize IAGES among retail consumers and would also finance the campaign, he added.

India’s gold demand in the June quarter fell 5% from a year ago, but consumption in the second half of 2024 is set to improve due to a correction in local prices following a steep reduction in import taxes, the WGC said last month.

(By Rajendra Jadhav; Editing by Varun H K)

IAMGOLD reaches commercial production at Ontario gold mine

Published by Jane Bentham, Editorial Assistant

Global Mining Review,

IAMGOLD Corporation has announced that the Côté Gold Mine has reached commercial production.

Côté Gold is located in Ontario, Canada and is operated as a joint venture between IAMGOLD, as the operator, and Sumitomo Metal Mining Co., Ltd. Commercial production is defined as the achievement of reaching a minimum of 30 consecutive days of operations during which the mill operated at an average of 60% of nameplate throughput of 36 000 tpd.

“I would like to commend our teams at Côté Gold who have come together to achieve another great milestone as we progress and ramp up what we believe will be one of Canada's largest gold mines and a model for modern mining in Canada,” said Renaud Adams, President and Chief Executive Officer of IAMGOLD. “Since achieving the first pour of gold on 31 March 2024, our teams have spent the last four months methodically and iteratively testing and ramping up all facets of the mine. This process has required remarkable commitment, ingenuity and teamwork to bring all the systems online together to achieve this milestone.”

“With commercial production behind us we continue to focus on improving plant availability towards our goal of Côté exiting the year at 90% of nameplate throughput. Further, in May we completed our equity financing which has positioned us well to repurchase the 9.7% interest in Côté this November and return to 70% ownership thereby gaining more exposure to this foundational and keystone asset for the benefit of all our stakeholders.”

The ramp up of the plant continues to progress, with all major equipment demonstrating the capability to operate at or above design levels. After the initial pour, focus early in the second quarter was on testing the processing circuits to handle nameplate loads. The primary components of the overall plant responded well achieving at or above nameplate throughput, though availability of the dry-side of the processing facilities was limited, in particular in the crushing and screening circuits. The Company is planning a multi-day shutdown in September to address and mitigate the impact of traditional wear and tear on availability of the circuits, in support of the goal to ramp up throughput to 90% by the end of the year.

VANCOUVER, British Columbia,

Darren Hall, President and Chief Executive Officer of Calibre, stated: “I am pleased to announce that we have obtained Federal Environmental approval for the development of the Berry Pit at Valentine. With this approval and the recent issuance of Provincial mining and surface leases for Berry and associated infrastructure, we now have the major approvals required for the three-pit mine plan included in the 2022 Feasibility Study."

“Since acquiring Valentine in January, we have progressed engineering to 98%, advanced construction from 50% to 77%, and employed an experienced operations team, positioning us to deliver first gold in Q2, 2025.”

To view the Amended Decision Statement and IAAC’s Analysis of the Berry Pit Expansion, please click the links below:

Link 1 – Amended Decision Statement

Link 2 – Analysis of Marathon Gold Corporation Proposed Changes to the Valentine Gold Project

About CalibreCalibre is a Canadian-listed, Americas focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland & Labrador in Canada, Nevada and Washington in the USA, and Nicaragua. Calibre is focused on delivering sustainable value for shareholders, local communities and all stakeholders through responsible operations and a disciplined approach to growth. With a strong balance sheet, a proven management team, strong operating cash flow, accretive development projects and district-scale exploration opportunities Calibre will unlock significant value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President & Chief Executive Officer

For further information, please contact:

Ryan KingSVP Corporate Development & IRT: 604.628.1012E: calibre@calibremining.comW: www.calibremining.com

Calibre’s head office is located at Suite 1560, 200 Burrard St., Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed nor accepts responsibility for the adequacy or accuracy of this news release.

NEWS RELEASE TRANSMITTED BY Globe Newswire