Renewables Accounted for 14.6% of Global Energy Consumption in 2023

- Renewable energy's share of global energy consumption reached 14.6% in 2023, driven by record growth in solar and wind power.

- China led the world in renewable energy production and capacity additions, particularly in wind and solar.

Despite the rapid growth of renewables, overall energy demand continues to outpace supply, leading to increased fossil fuel consumption.

In June, the Energy Institute released the 2024 Statistical Review of World Energy. The Review provides a comprehensive picture of supply and demand for major energy sources on a country-level basis. Each year, I write a series of articles covering the Review’s findings.

In previous articles, I discussed:

- Overall highlights

- Trends in global carbon dioxide emissions

- Global production and consumption of petroleum

- Global production and consumption of natural gas

- Global production and consumption of coal

- Trends in nuclear power

Today I will discuss renewable energy, with a focus on the growth of wind and solar power.

Overview

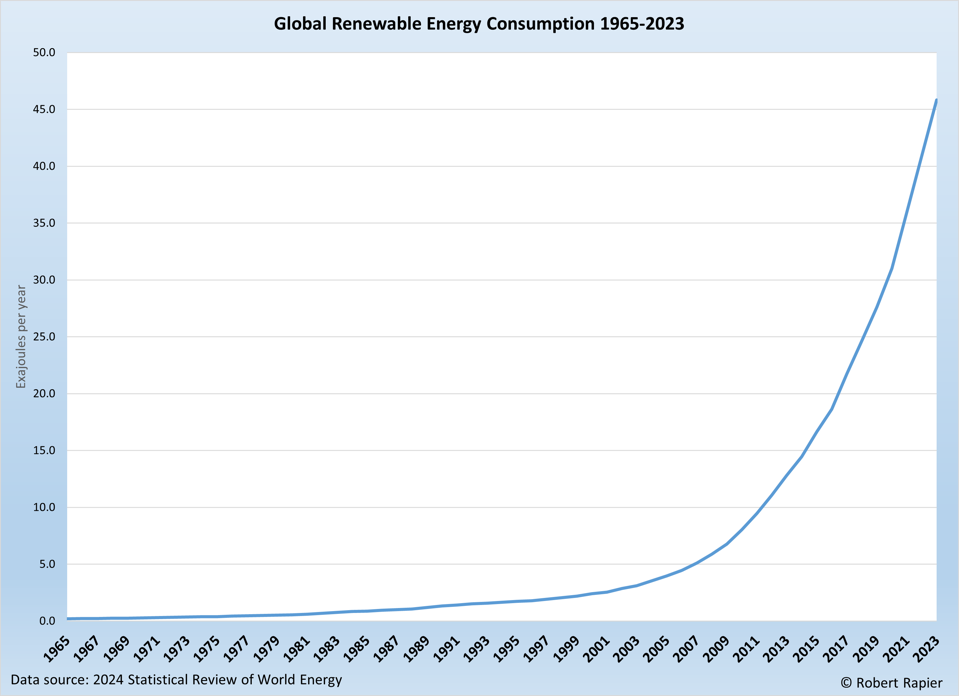

In 2023, renewable energy sources surged to new heights. Renewables’ share of total primary energy consumption reached 14.6%, 0.4% above the previous year.

Solar and wind power drove global renewable electricity generation to a record-breaking 4,748 TWh, marking a 13% increase from the previous year. This growth accounted for 74% of all net additional electricity generated worldwide.

Solar power led the charge, with 346 GW of new capacity, smashing the 2022 record by 67%. China contributed a quarter of this growth. Europe, too, made significant strides, adding over 56 GW of solar capacity, making up 16% of the global total capacity increase.

Global Renewable Consumption (excluding hydropower). Robert Rapier

Wind power also soared to new heights, with over 115 GW of new capacity installed—another record. China again was at the forefront, responsible for nearly 66% of these additions. China’s total installed wind capacity now rivals that of North America and Europe combined. Offshore wind, a growing frontier in renewable energy, saw Europe holding the highest share at 12%, but China wasn’t far behind, boasting 37 GW compared to Europe’s 32 GW.

Meanwhile, the share of biofuels increased in the global energy mix. Production grew by over 17% from 2022, with the United States and Brazil leading the way. In 2024, bio-gasoline (predominantly ethanol) and biodiesel production reached a near-even split, with the U.S., Brazil, and Europe consuming the lion’s share of these renewable fuels.

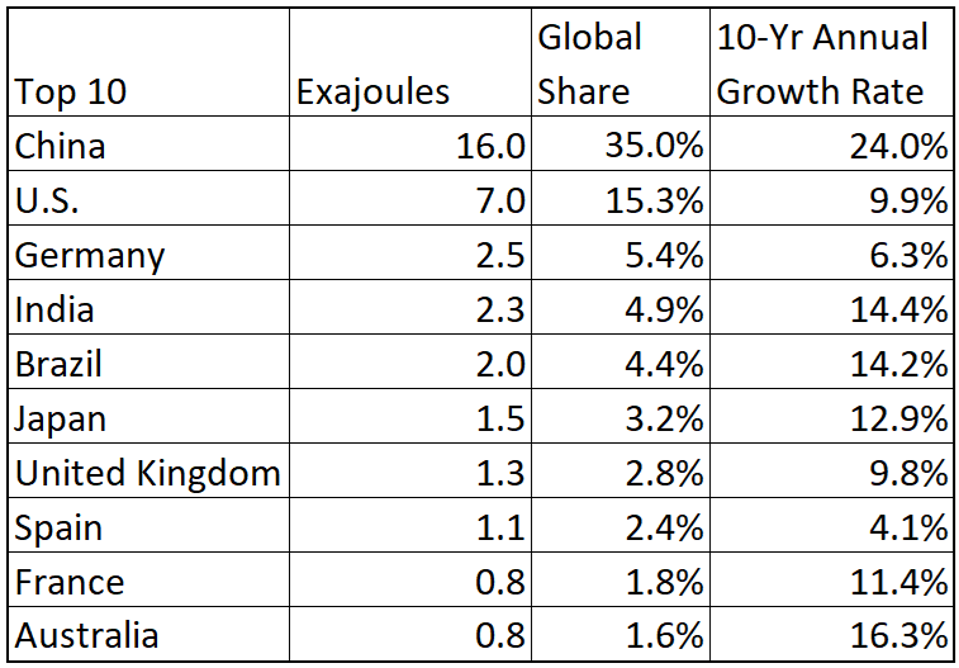

The Top Producers

China dominates the world’s renewable energy production. Notably, both China and India — which have seen dramatic fossil fuel consumption growth in recent years — have increased renewable consumption at double-digit rates over the past decade.

Top 10 Renewable Energy Producers in 2023. Robert Rapier

There are a couple of caveats to note about this table. First, it excludes hydropower. The reason is even though hydropower generation contributes around as much as wind and solar, hydropower growth has been relatively stable for years. This table basically shows the growth trajectory of modern renewables like wind and solar power.

Second, the numbers are reported as “Input-equivalent energy”, which is the amount of fuel that would be required by thermal power. This accounts for the lower efficiencies of converting coal, for example, into electricity. In other words, for a given amount of solar power, the table is calculating how much coal or natural gas would be required to produce that much power.

Conclusions

Renewable energy, particularly wind and solar, continue to grow at rapid rates. With record-breaking growth in capacity and generation, these modern renewables continue to supplement traditional energy sources.

China continues to dominate the renewable sector, driving much of the global expansion, while the U.S., Europe, and Brazil also make significant contributions, particularly in biofuels.

As the world strives to reduce carbon emissions and transition to cleaner energy, renewables will play a critical role in shaping a sustainable and resilient energy future. However, to date overall energy demand continues to outpace the growth in renewables, which has meant that fossil fuel consumption has also continued to grow.