Kazakhstan's Nuclear Referendum Faces Growing Opposition

- Kazakhstan is holding public hearings on a proposed nuclear power plant, but critics say the events are staged and pro-nuclear.

- The government claims nuclear power is needed to address energy shortages, but opponents cite safety concerns and Russia's potential involvement.

- Anti-nuclear activists have been detained and silenced, and a referendum on the issue is expected to be held soon.

The world's largest uranium producer is another step closer to building a nuclear power plant.

Last week, the Kazakh capital, Astana, hosted the last of 20 public hearings staged around the country ahead of a national referendum in the fall on whether to start producing nuclear power.

The format differed little from the discussions held in other cities.

Official presentations focused only on the perceived advantages of nuclear power, while those wishing to ask questions were allocated just two minutes to speak.

After that time had elapsed, the microphone was turned off and those who continued speaking were ushered away.

Some critics never even made it to the venue.

Antinuclear activist Meiirkhan Abdimanapov was fined 129,000 tenges ($270) after being detained in Almaty on August 19 ahead of his trip to Astana.

The official reason for the detention was his participation in an unsanctioned rally six months before.

But he argued that the real reason was to prevent him from repeating his performance at the public hearing in Kazakhstan's largest city on August 16, when he decried the exercise as "an advert for a nuclear power plant."

Then there was the struggle witnessed by journalists from RFE/RL's Kazakh Service inside the Radisson Hotel in Astana, where the August 20 hearing was held.

"What is it that you were saying about speaking freely while at the same time not letting people in?" complained activist Nagizhan Toleubaev as minders at the event tried to bar him from entering the event's main room.

"Didn't the president himself want the issue to be put to public discussion? How do you explain your actions?"

Despite these apparent attempts to manage attendance, the hearings that began last year on the shores of Lake Balkhash -- near the prospective nuclear facility's likely location -- have still witnessed plenty of emotional speeches.

Toleubaev, who was eventually admitted into the question-and-answer session, warned authorities that "future generations will damn you" if the nuclear power plant goes ahead. He was subsequently dragged from the mic by well-built men standing nearby.

And opposition will surely only grow louder as the referendum, which pro-nuclear President Qasym-Zhomart Toqaev has not yet set a date for, gets closer.

But why is his administration heading down this contentious path?

An apparently widening energy deficit is certainly one reason. But another might be nudging from its overbearing ally Russia, which many view as a shoo-in to build the plant.

Rosatom: First Among Equals?

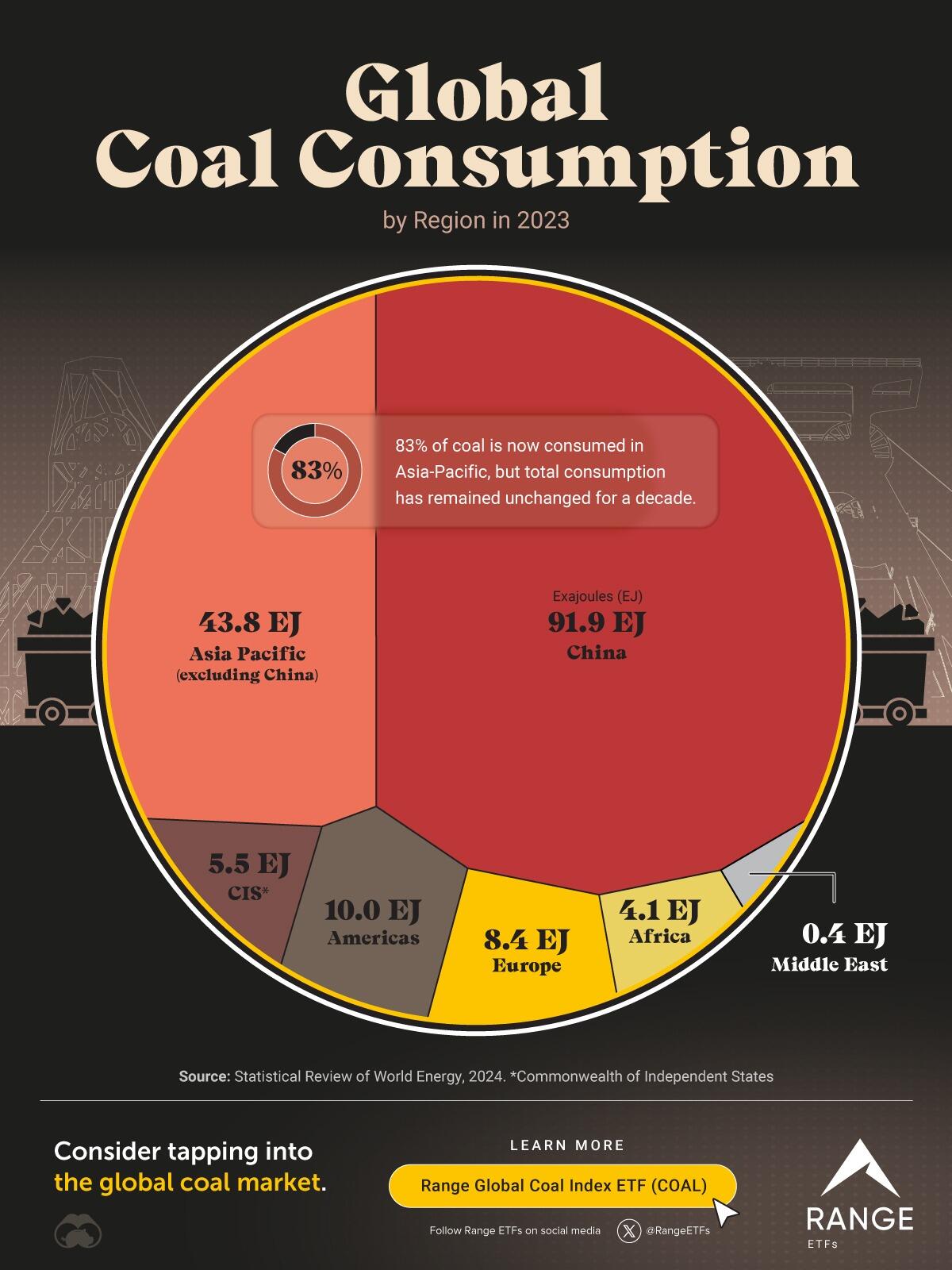

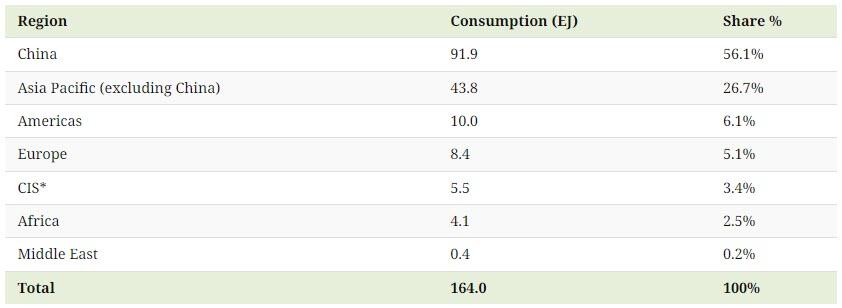

As government-affiliated experts at the public hearings argued, nuclear power is a cleaner form of power generation than the coal-heated and often aging thermal power plants that most Kazakh cities still rely on.

Yet it is also more controversial, and not just because of renewed anxieties around nuclear power in general, after the accident at the Fukushima Daiichi nuclear power plant in Japan in 2011.

For four decades during the Soviet Union, the northeastern part of Kazakhstan hosted regular, Moscow-directed nuclear tests.

The human and environmental consequences of those tests can still be seen today.

Another source of anxiety, referenced by at least one speaker at the Astana event, is the danger posed by a nuclear power plant in a potential conflict scenario.

Russia’s full-scale invasion of Ukraine saw Russian forces surround and occupy the Zaporizhzhya nuclear power plant -- Europe's largest -- in eastern Ukraine early in the war.

In this sense, the territorial threats issued regularly against Kazakhstan by Russian politicians and pundits after Astana failed to support Moscow's invasion have done little to make the idea of a Russian-built nuclear facility appealing.

"A country whose military illegally occupies the nuclear facilities of another sovereign state and creates unprecedented nuclear risks cannot be seen as a reliable partner in the nuclear field," nuclear politics expert Togzhan Kassenova told RFE/RL.

That along with the complications that Western sanctions against Russia could pose to a Russian-led nuclear project in Kazakhstan mean that its nuclear energy giant, Rosatom, "should be a nonstarter for political and practical reasons," argued Kassenova, who is the author of the book Atomic Steppe: How Kazakhstan Gave Up The Bomb.

Tet the government has suggested otherwise.

In 2023 -- before Toqaev said a referendum on the construction of a nuclear plant would be held – the Kazakh Energy Ministry said Rosatom was one of four contractors whose reactors were under consideration for the plant, with EDF of France, the China National Nuclear Corporation, and South Korea's Korea Hydro & Nuclear Power the other three.

In the past, Kazakh authorities have floated the rather hopeful idea of an international consortium to build the potential plant.

But skeptics of the idea that Russian leadership of the project is not inevitable don't have to look far.

In next-door Uzbekistan, then-Energy Minister Zhurabek Mirzamahmudov stated in November that Uzbek authorities were examining the "experience and technology" of other countries and not just Russia, with whom Uzbekistan had already held talks on building a nuclear power plant.

But Tashkent and Moscow subsequently reached an agreement for a Russian-built, small nuclear power plant (SMR) when Russian leader Vladimir Putin visited the Central Asian country for talks in May.

In Kazakhstan, Moscow and Astana are already cooperating in the nuclear realm in higher education.

Among the young supporters of nuclear power in Astana last week was a collective of students and graduates of the Almaty branch of the National Research Nuclear University (NRNU).

The NRNU opened an affiliate on the grounds of the Al-Farabi Kazakh National University in 2022 -- more than a year before Toqaev said the nuclear power plant plan would be put to a national vote.

'A Test Of Patriotism’

Few doubt that the Kazakh referendum will deliver a "yes," despite visible opposition.

The campaign in favor of nuclear power enjoys the resources of the state.

Naysayers, meanwhile, complain they have been repeatedly refused permission from city councils to hold protests against the proposed plant.

Yet for many citizens, there are some compelling arguments in favor of nuclear power.

In Ulken, where the first public hearing on the project was held in August 2023, some residents expressed enthusiasm for the plant's capacity to generate local jobs for a depressed region, even as Balkhash fishermen raised alarm over the future of their industry.

Nationally, and especially in the provinces, power shortages are a growing problem with high consumption in the densely populated south taking a heavy toll on the national grid.

Last year, Kazakhstan's state-run Samruk Energy company projected the national power deficit could double to reach 3 gigawatts by 2029.

Kazakhstan's future nuclear power plant is projected to be significantly larger in terms of capacity than Uzbekistan's in-progress 330-megawatt version -- a downsize on the plant that Tashkent had originally intended to build.

At an event held by antinuclear activists in Almaty in September, speakers acknowledged that villagers who suffer regular outages might be easily convinced of the benefits of nuclear power.

What the government has not done, they said, is present the population with viable and clean alternatives to the plant, such as ramping up of wind and solar production.

The referendum moved a step closer on August 27, when Energy Minister Almasadam Satkaliev issued a proposal for a presidential decree on holding a nationwide vote at a government meeting, which was backed unanimously.

Toqaev, who earlier promised that the referendum would be held in the fall, is expected to name a date imminently.

Blaming "independent bloggers" and media for stirring up criticism of the nuclear plans, Satkaliev said a Kazakh citizen's position on nuclear power was a "test" of "intellect…patriotism…decency," with opponents apparently failing on all three counts.

Nuclear power was needed for "the next frontier, for the development of the economy and science, so that the country reaches a new civilizational level of development," Satkaliev added.

By RFE/RL