Carnival Corp Highlights Strategies for Cruise Ship GHG Emission Reductions

Carnival Corporation is highlighting that its cruise ship operations are “on pace” to achieve its ambitious reductions in greenhouse gas emissions as it also reaffirms progress toward achieving its goals. The world’s largest cruise company, with a fleet of nearly 100 cruise ships, highlights that it is following a strategy to both reduce fuel consumption across the fleet and to adopt new technologies and lower emissions with the existing fuel alternatives.

Last year, the company reported it was accelerating its stated 2023 GHG intensity reduction goal by four years, committing to at least a 20 percent cut (measures on lower berth capacity) to be achieved by 2026 instead of 2030 when compared to 2019 levels. Now, Carnival Corp. reports it expects to reach an 18 percent reduction in 2024 (compared to 2019).

Measured against its first benchmark in 2008, Carnival Corp. says it expects to have reduced its GHG emissions by 42 percent (on a lower berth capacity basis). Carnival Corporation asserts today it has reduced GHG emissions by more than 10 percent versus its peak historical year (2011), despite increasing capacity by roughly 30 percent since that time.

One of the key steps is reducing the fuel used by its cruise ships. Onboard they have taken steps such as upgrading the ships with modern and efficient HVAC systems, using LED and smart lighting technology, and remote monitoring which they report has reduced power and in turn fuel by five to 10 percent per ship. Also, 60 percent of the corporation’s ships are now equipped to use shore power in port.

Fleet modernization is contributing with 26 older, less-efficient ships removed from the fleet since 2020 and a quarter of the fleet capacity is on newer, more efficient ships. The new ships include optimizing the hull design. They are also employing special coatings on the hulls to reduce drag and installing air lubrication systems which they report can reduce fuel consumption by up to five percent.

Carnival was also the first cruise company to introduce vessels able to operate on liquified natural gas, which the industry promotes as the cleanest fuel currently available. Today the company has nine LNG-capable ships in service and two more on order. They also report that more than 90 percent of the fleet is outfitted with advanced air quality systems, i.e. scrubbers, to reduce particulate matter.

Other operational changes include developing more energy-efficient itineraries, slowing the ships when possible, using hydrodynamics and ocean currents, and other techniques such as weather routing.

To achieve the next phase of their targeted reductions the corporation continues to explore new technologies. They have already tested new fuels, including biofuel mixes, on several ships including both AIDA and Holland America Line. They are testing other technologies including a first-of-its-kind lithium-ion battery storage system, and for the future look to fuel cells powered by hydrogen derived from methanol.

As one of the most visible segments of the shipping industry, cruising is highly scrutinized and comes in for frequent criticism for its operations. Carnival Corporation like others in the industry continues significant investments they highlight as part of their sustainability programs. The company like the shipping industry overall says its strategy is to pursue net-zero emissions from ship operations by 2050.

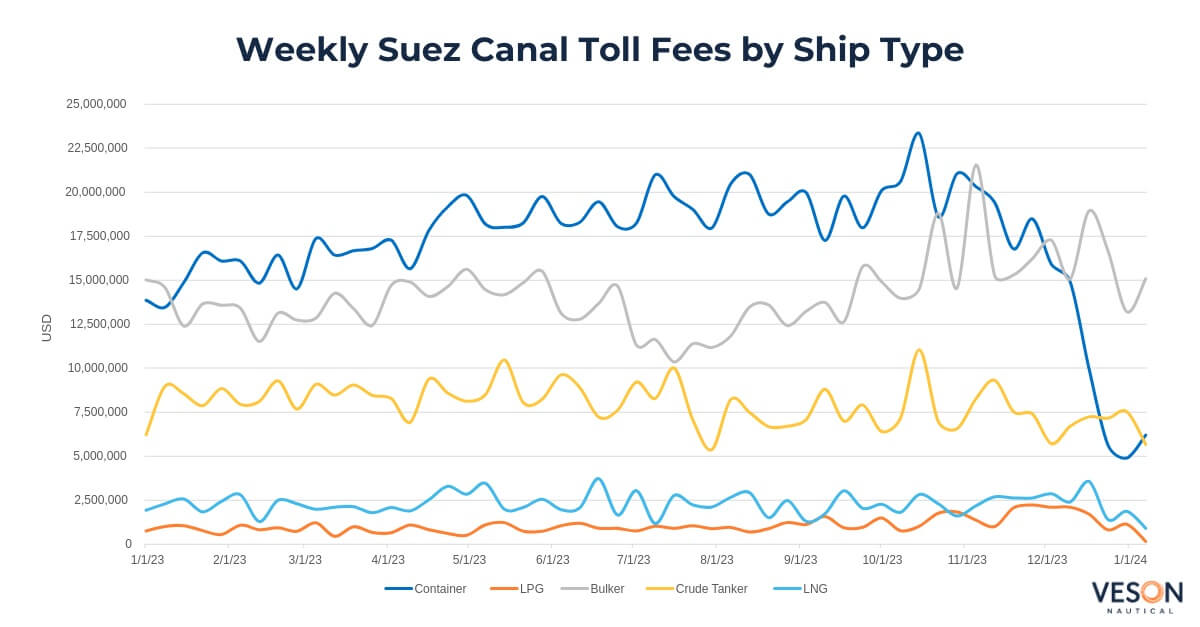

Graph 1: Weekly estimated Suez Canal toll fees for crude tankers, bulkers, LNG, LPG and container ships

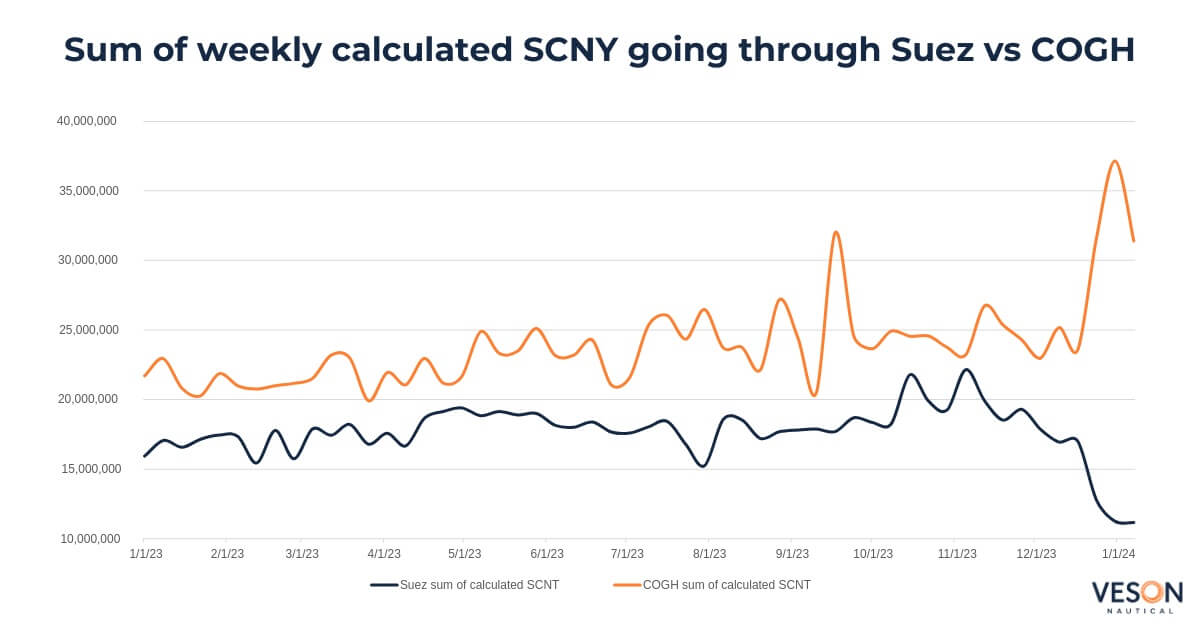

Graph 1: Weekly estimated Suez Canal toll fees for crude tankers, bulkers, LNG, LPG and container ships  Graph 2: Sum of weekly calculated Suez Canal Net Tonnage (SCNT) for cargo vessels transiting through the Suez Canal vs Cape of Good Hope.

Graph 2: Sum of weekly calculated Suez Canal Net Tonnage (SCNT) for cargo vessels transiting through the Suez Canal vs Cape of Good Hope.