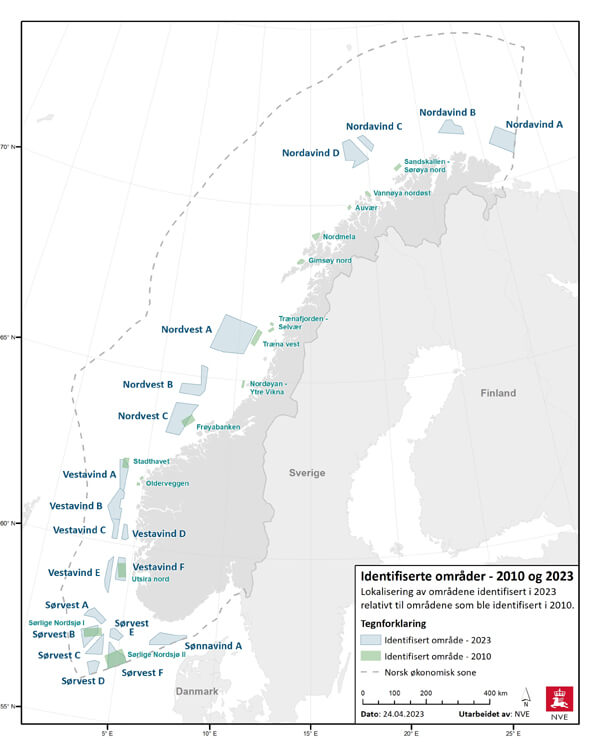

Norway Identifies Up To 20 New Areas for Offshore Wind Development

Norwegian authorities today identified broad new areas offshore that they believe can be used to dramatically expand the country’s renewable energy generation. The initiative which involved a wide selection of government agencies outlined the areas and is calling for further study to designate the most suitable areas that could be developed in support of the country’s goal for the development of 30 GW of offshore wind energy generation.

“Together with several directorates and specialist communities, we have identified 20 sea areas with good wind resources, where the conflicts of interest between the environment, fisheries, and other industries are relatively low. These are areas along the entire coast, from Skagerak in the south to the Barents Sea in the north,” said Kjetil Lund, watercourses and energy director for Norway's Directorate of Water Resources and Energy (NVE). “These sea areas should now be investigated in more detail to find the areas that are best suited for offshore wind.”

The areas outlined today hold the potential for Norway to nearly double its power production. Depending on the portion of the sites that would move forward for development, they said that these sites could be equivalent to nearly three-quarters of the country’s current energy generation.

Today’s announcement comes just a month after Norway outlined two new offshore wind locations and set a goal to launch the tender for those sites later this year and in 2024. Two of the sites announced today are adjacent to the lease areas outlined in March and as such the energy authority believes they could be developed as extensions to those projects. Saying that opportunities had been identified for capacity expansion at those locations the energy authority believes that these two sites could be allocated in 2025.

The other 18 sites will require more in-depth impact assessments to confirm the belief that the conflicts between the environment, fisheries, and other industries are low. Lund said that the 18 new areas should be investigated in more detail considering aquaculture, fisheries, environmental interests, petroleum, and shipping.

“We don't have a final decision today on how much offshore wind will be built and where,” said Lund during his briefing. “We will need further studies on environmental and business interests, but also on economics, effects on the power system, and the need for grids. In that process, it is conceivable that some areas will be reduced or eliminated.”

The energy authority worked with the Norwegian Directorate of Fisheries, the Norwegian Environment Agency, the Norwegian Coastal Administration, the Norwegian Petroleum Directorate, and Defense Construction in identifying the target sites. In addition, the Petroleum Safety Authority, the Institute of Marine Research, the Norwegian Institute for Natural Research, Statnett, the Aviation Safety Authority, the Meteorological Institute, the National Communications Authority, and Avinor were also consulted.

NVE has developed a plan for the investigation of the sites. Based on the time required to finalize the plan with other authorities and implement the research, Norway does not expect it will be possible to allocate any of these 18 sites in 2025. Timing for these additional locations will be developed based on the results of the study program.

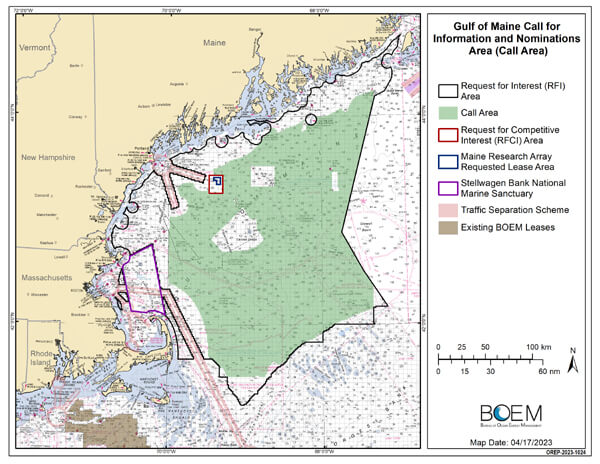

BOEM Advances Offshore Wind Leasing Process in the Gulf of Maine

Efforts are proceeding in the process to open the Gulf of Maine as the next region in the United States for the offshore wind industry. The Bureau of Ocean Energy Management (BOEM) will publish a call for public input tomorrow, April 26, beginning a 45-day comment period as it continues to develop the plan for the region.

The Gulf of Maine spanning areas offshore of Massachusetts, New Hampshire, and Maine, is the final zone in the 2021 Offshore Wind Leasing Path Forward plan released by the bureau in 2021 as part of the government’s goal of deploying 30 gigawatts of offshore wind energy capacity by 2030. After opening the Gulf of Mexico for the first leases, BOEM’s plan proceeds to the Central Atlantic region followed by opening the Oregon coast for the first offshore wind projects. The plan anticipates that the Gulf of Maine would be designated as a Wind Energy Area in the middle of this year and the first lease sales could proceed in mid-2024.

The Gulf of Maine is considered to be one of the more challenging areas. It is exposed to stronger weather conditions and also has deeper conditions than the projects elsewhere on the U.S. East Coast. So far, the only development in the Gulf of Maine is a small, non-commercial site that is proceeding forward as a research location in efforts led by the University of Maine to develop floating wind turbine approaches. State officials have moved to block near-shore development due to concerns from the fishing and tourism industries, encouraging developers to focus on floating wind technology.

The Call Area is shown in green on the map (BOEM)

BOEM’s publication of its Gulf of Maine Call for Information and Nominations is the next step in the efforts to assess interest in possible commercial wind energy development in areas offshore Massachusetts, New Hampshire, and Maine. BOEM calls it an early step in the commercial planning and leasing process, and the first required by BOEM regulations.

“BOEM is committed to transparent, inclusive, and data-driven processes, and public input is essential to helping us determine areas that may be suitable for offshore wind development in the Gulf of Maine,” said BOEM Director Elizabeth Klein. “We are still early in the planning and leasing process, and we look forward to the multiple future opportunities for engagement.”

After the public comment period closes, BOEM will review and analyze commercial nominations and public comments submitted in response to the call. BOEM will also consider information from government and tribal consultations and the Gulf of Maine Intergovernmental Renewable Energy Task Force to further evaluate the appropriateness of the Call Area for offshore wind energy development.

The call follows the Department of the Interior’s August 2022 Request for Interest to gauge whether commercial interest existed in obtaining wind energy leases within an area in the Gulf of Maine comprising about 13.7 million acres. BOEM worked collaboratively with National Oceanic and Atmospheric Administration’s National Centers for Coastal Ocean Science (NCCOS) to conduct a spatial analysis of the area and considering feedback they note the final Call Area reduces the area to 9.8 million acres, a nearly 30 percent reduction. BOEM removed approximately 160,000 acres from future consideration to avoid Georges Bank.

BOEM has identified four areas that it is seeking public input on during this next phase of the review, including Lobster Management Area I, Platts Bank, Atlantic Large Whale Take Reduction Plan Restricted Areas, and Georges Bank (the immediately adjacent area along the southern boundary of the Call Area). They note that this is not an exhaustive list, but represents the areas that were most commented on in the most recent public engagement.

As part of the process, BOEM is also conducting task force meetings in Maine. The next one is scheduled for May 10-11, 2023, in Bangor, to update Task Force members and the public on BOEM’s commercial and research offshore wind energy planning activities and to discuss the next steps for the Gulf of Maine.

Eneti and Transocean Look to JV to Meet Offshore Wind Install Demands

Eneti, which was launched in 2021 to focus on the offshore energy sector, and Transocean, a large provider of offshore contract drilling services for oil and gas wells, believe they can offer a unique solution to the lack of installation capacity for the emerging offshore wind energy sector. The companies reported that they are in negotiations to form a joint venture company that would repurpose existing offshore drilling vessels to engage in offshore wind foundation installation activities.

Under the plan that is currently being negotiated, the two companies are exploring the formation of a new joint venture for the offshore wind sector. They announced the execution of a memorandum of understanding indicating their intention to form a joint venture company.

They look to create new capacity for the industry while tapping the expertise of both organizations. According to the announcement, the joint venture would initially convert at least two fit for purpose floating vessels into offshore wind foundation installation vessels. Upgrades to the vessels would include a 5,200-ton crane and are expected to provide them with the capability to carry up to six 3,500-ton monopile foundations with a 12-meter diameter. They would also incorporate “certain other environmentally responsible and efficiency-enhancing operating features.”

Eneti has been looking to add capacity while confronted with the high cost and timing of new construction. While they have two new wind turbine installation vessels ordered from Daewoo Shipbuilding and Marine Engineering, the company backed away from a plan to build a Jones Act-compliant vessel. In February 2022, Eneti said that talks with a U.S. shipyard were discontinued due to the high cost and design complications. The former Scorpio Bulker, however, also acquired Seajacks in 2021 to provide initial capacity in the sector. As of the beginning of February 2023, Eneti reported it has over $100 million in firm backlog with an additional $10 million of optional backlog. Demand continues to be strong with the restraints being capacity.

In an investor presentation, Eneti called the wind turbine installation sector a high-growth industry with a bottleneck. In addition to the vessel for turbine installations, foundation install capabilities are in strong demand. Eneti reports Seajacks International has installed more than 500 wind turbine foundation components at wind farms including in Japan, Germany, and Scotland. They currently have five vessels with the other two new constructions expected to be delivered in the fourth quarter of 2024 and the second quarter of 2025.

Transocean told investors in February that it believes the drilling industry was finally beginning a multi-year upcycle after a prolonged eight challenging years. Despite the largest annual backlog addition since before the industry downturn in 2014, the company however still reported a net loss attributable to controlling interest totaling $621 million for 2022. The backlog however nearly doubled standing currently at approximately $8.6 billion.

Transocean owns or has partial ownership interests in and operates a fleet of 37 mobile offshore drilling units consisting of 27 ultra-deepwater floaters and 10 harsh environment floaters. In addition, Transocean is constructing one ultra-deepwater drillship and holds a noncontrolling ownership interest in a company that is constructing one ultra-deepwater drillship.

The proposed joint venture looks to combine Transocean’s experience operating a global fleet of dynamically positioned offshore drilling rigs on long-term contracts with Eneti’s experience, through Seajacks International, in the installation market. According to Eneti, Transocean has three hundred-plus rig-years of experience.

Both companies would contribute operating expertise to the new company. They would also have rights to invest in the joint venture with additional partners.

No comments:

Post a Comment