Alex Tanzi

Mon, 26 Aug 2024,

(Bloomberg) -- Mortgages locked in at low costs provided US consumers with an extra $600 billion in spending cash since 2022, blunting the impact of the Federal Reserve’s interest-rate hikes, according to analysis by the Swiss Re Institute.

The boost received by homeowners with fixed-rate mortgages amounted to almost 2% of all personal consumption spending, wrote economists Mahir Rasheed and James Finucane at the insurance firm’s research arm.

The effect has been to mute the impact of monetary policy transmission, as consumer demand proved resilient to Fed hikes. The same mechanism will likely counteract the effectiveness of rate cuts that the Fed is now planning, and make it harder to stimulate consumer demand if the economy slows.

That limited boost from looser monetary policy could lead to “a sharper easing cycle over the next year than our baseline currently assumes,” the Swiss Re analysts wrote.

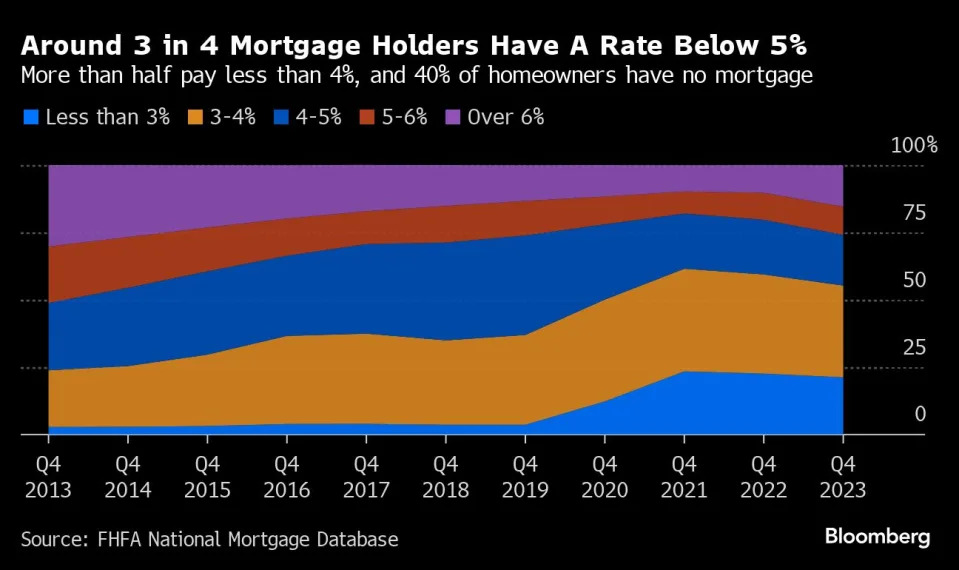

During the recent Fed tightening cycle, market rates for US mortgages exceeded the average rate that borrowers paid on existing mortgages by as much as 3.2 percentage points, according to Swiss Re.

Because the impact of monetary policy moves was dispersed, with a large chunk of household debt shielded from any impact, the Fed may have raised rates higher than it would have otherwise — in effect penalizing renters.

The coming year may see the same effect in reverse, pushing the Fed to cut rates more aggressively, according to Swiss Re. The median home price has risen some 60% since early 2020 and credit card delinquencies are above pre-pandemic levels, pointing to larger household debt burdens that will only see limited relief from lower borrowing costs.

Most Read from Bloomberg Businessweek

No comments:

Post a Comment