Russia’s War Has Sparked A Coal Renaissance

- It appears that the decline of coal, the dirtiest of all the fossil fuels, has been somewhat exaggerated in recent years, with the current energy shortage causing demand to soar.

- Despite being significantly dirtier than both oil and natural gas, there is a huge demand for coal as a reliable and relatively cheap source of energy in an incredibly expensive market.

- Sanctions on Russia due to its invasion of Ukraine have only added to the supply shortage, although some countries like India are taking advantage of discounts to buy up Russian coal.

Despite lots of talk about renewable energy acceleration, coal continues to dominate some markets. China is steadily increasing its coal output, while Indonesia looks to export to new European buyers. And while lots of countries are imposing sanctions on Russian coal, India is now backing up its cheap Russian oil imports with low-cost coal.

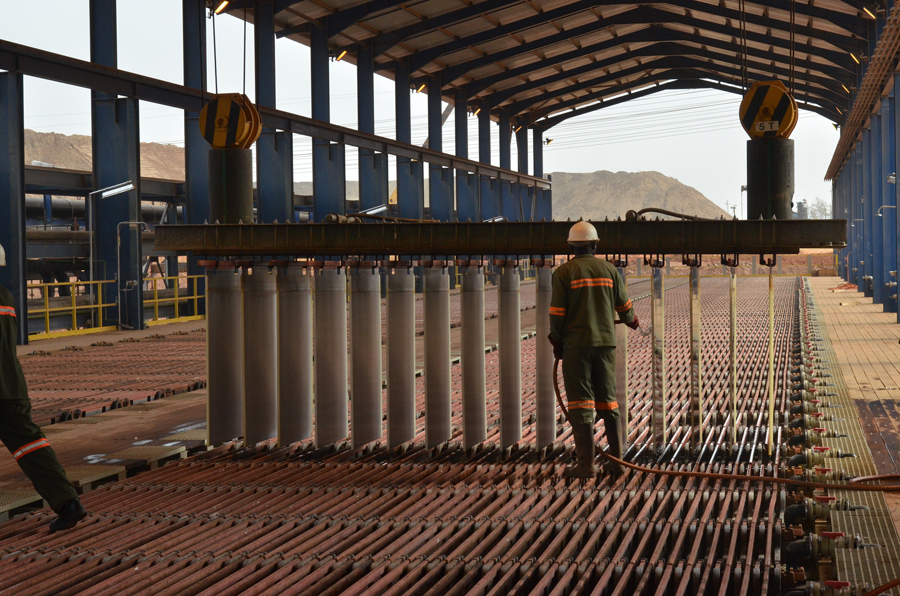

China’s daily output of coal continues to rise, seeing a 15 percent increase in production in March from the same period last year. This equated to approximately 395.79 million tonnes, or 12.77 million tonnes every day. This goes beyond China’s target of 12.6 million tonnes a day throughout 2022. China is eager to keep production levels high due to the uncertainties created in the supply chain in response to the Russian invasion of Ukraine.

This rise comes despite several new lockdowns implemented across China in the wake of another Covid outbreak. The use of coal across utilities has dropped due to new Covid restrictions, allowing China to stockpile some of this increased coal output. Coal inventories rose from around 22 million tonnes at several major utilities in April 2021 to 28 million tonnes this year.

And as China ramps up production to ensure its energy security, Indonesia is looking to fill the gap left by sanctions on Russia by exporting its coal to Europe. The country’s second-largest coal miner PT Adaro Energy Indonesia has exported around 300,000 tonnes of coal to European buyers in response to sanctions on Russian coal. While Adaro says it will maintain its current coal trade links, European buyers could well be looking to Indonesia to fill the gap.

Chief finance officer at Adaro, Lie Luckman, stated: “Indeed there has been some demand from Europe, but our market is mainly Asia. We will focus on fulfilling our commitments to our customers who already have long-term contracts with us.”. The list of customers includes Japan, China, South Korea, and India.

As part of its sanctions on Russian energy, the EU is banning coal imports from Russia starting in mid-August. Governments across the region are now racing to secure their energy sources by looking for more import options as well as ramping up national production of both fossil fuels and renewables. Indonesia’s coal exports reached record highs in March, a trend that is likely to continue because of the sanctions.

The EU delayed its sanctions on Russian coal by around two months due to pressure from Germany, a major importer of Russian energy, to extend the period. In 2020, Germany imported around 21.5 percent of its coal from Russia, as well as 35.2 percent of its oil and 58.9 percent of its natural gas, showing its heavy reliance on the energy producer. While the EU is eager to impose sanctions in response to the conflict, this has not been an easy task and it acknowledges the importance of ensuring the region’s energy security before cutting Russia off completely.

However, other countries are less steadfast in their condemnation of Russia and are using the situation as an opportunity to purchase low-cost energy. Having acquired cheap Russian oil, India is now eyeing affordable coal, as other countries turn their backs on Russia.

India’s coal imports from Russia increased to a two-year high this March. And analysts believe that both India and China may continue to increase their coal imports from Russia as it offers lower prices in response to the loss of other export partners. Russia is selling its coal at around a $60-$65 per metric tonne discount, compared to Newcastle 5,500 kcal/kg NAR coal, making it increasingly attractive at a time when energy prices are continuing to rise to record levels.

Head of trade at government relations consulting firm Vogel Group Samir N. Kapadia explained, “Despite warnings from the West, India continues to lean into their supply chain relationship with Russia for natural resources like oil and coal.” He believes a rupee-rouble currency swap could help India bypass the sanctions imposed on Russia, allowing them to continue importing low-cost coal. The White House is putting significant pressure on India to curb its imports, warning of potential consequences if it continues to support Russia.

India has had low stockpiles of coal since last year, with several states across the country likely to experience power shortages. Although the government announced an aim to all stop coal imports by 2030, by boosting production from state-owned coal plants, it still relies heavily on foreign coal at present. It currently buys much of its coal from Australia, as its seventh-largest trading partner. But if Russia continues to offer cheaper energy alternatives, it may be hard to say no.

Despite bold pledges to transition away from fossil fuels to renewable alternatives, new sanctions on Russia are exposing the world’s persistent reliance on coal. As European buyers look to Asian producers to meet their coal demands, others quickly turn to Russia – putting low-cost energy above geopolitics.

By Felicity Bradstock for Oilprice.com