CRIMINAL CAPITALI$M

Chris Kay

Wed, March 8, 2023

(Bloomberg) -- The tiny island of Mauritius spent years trying to clean up its image as a base for murky money launderers and shell firms. The short-seller allegations against billionaire Gautam Adani are once again reviving questions about the country’s role as a tax haven for India’s tycoons.

In a report late January that sent Adani stocks on a $153 billion downward spiral, Hindenburg Research said that entities controlled by the tycoon’s brother, Vinod, or his associates used Mauritius as a conduit for money laundering and share-price manipulation. Though the report mentioned a “vast labyrinth” of shell companies from the Caribbean to the United Arab Emirates, it pinpointed offshore firms in Mauritius as having played a pivotal part.

The US-based short seller said 38 firms connected to Vinod were domiciled in the tropical island, located in the Indian Ocean off the eastern coast of Madagascar. Hindenburg claims some were used to reroute money from India that was then used to buy shares in the group, and inflate their stock prices back home. In the five years prior to the bombshell report, Adani equities saw some of their wildest rallies, with flagship Adani Enterprises Ltd. surging almost 2,600%, about 41 times the gain in the benchmark Nifty 50 index.

Staffers at Vinod’s Dubai offices recently directed requests for comment to the ports-to-energy conglomerate’s headquarters in India. A representative for Adani Group didn’t respond to a request for comment. In its 413-page rebuttal issued on Jan. 29, the group said Vinod has no role in Adani Group’s day-to-day affairs. The offshore entities are public shareholders in Adani portfolio companies and “innuendoes that they are in any manner related parties of the promoters are incorrect,” it said.

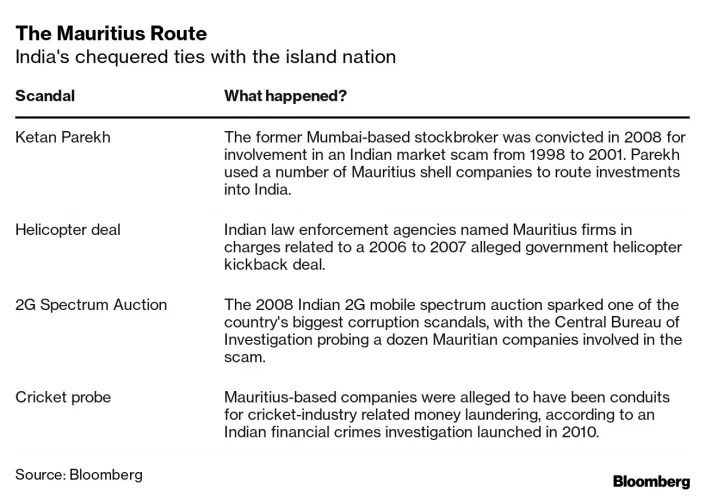

While it isn’t illegal to register businesses in low-tax jurisdictions like Mauritius, the allegations around the offshore shell firms appear to be a throwback to a time when the tourist paradise featured in a slew of other Indian corporate controversies since the late 1990s. The biggest of them was a stock market scandal that saw a broker drive up prices of select shares between 1998 and 2001.

The accusations against Adani — some reported by local media years before Hindenburg dropped its report — come at an uncomfortable time for Mauritius, which has been attempting to detoxify its financial industry and getting noticed for its efforts: the European Union just last year took it off a blacklist of countries it deems deficient in their anti money laundering and terrorism financing regimes.

“Adani’s alleged use of Mauritius as a center for shell companies is not unusual in the Indian context,” said Bhaskar Chakravorti, the dean of global business at The Fletcher School at Tufts University. What would be unusual is if this happened despite the cleanup efforts, he said. The “sheer scale” of what’s being alleged by Hindenburg is “staggering,” according to Chakravorti.

Hindenburg’s allegations landed right before a visit to India by Mahen Kumar Seeruttun, Mauritius’s minister of financial services and good governance, to drum up investment. In a February interview with Bloomberg News, Seeruttun said that the Adani Group has complied with all regulations in his country’s jurisdiction and his government will cooperate with Indian authorities on the matter.

“We want to uphold our reputation as a jurisdiction of repute and substance,” Seeruttun said.

In earlier comments to Bloomberg, Dhanesswurnath Thakoor, chief executive of the nation’s Financial Services Commission, denied that Mauritius is a tax haven. He said the country complies with the Organisation for Economic Co-operation and Development’s minimum taxation standards with a 15% corporate rate. In comparison, the British Virgin Islands levies no tax.

Corrosive Role

Mauritius-based shell companies have been at the center of at least four major probes by Indian agencies in the past two decades for allegedly being conduits of illegal money. The country has also been accused by the UK’s Tax Justice Network group of playing a “corrosive role in Africa,” inflicting a $2.4 billion tax loss annually.

Commenting this week, Seeruttun said that reports like the one from Hindenburg do create doubts in the minds of some people about Mauritius, but the business community overseas has confidence in its jurisdiction. “Predictability, certainty, stability are the key words that they look for, and this is what Mauritius offers,” he said.

The origins of Mauritius’s status, which the Tax Justice Network says is a tax haven, can be traced to a treaty it signed with India in the early 1980s to promote trade and investment, where it eliminated double taxation and capital gains levies. At that time, Indian officials didn’t foresee that their country would soon abandon its Soviet-style socialist economy and embrace foreign capital.

As the South Asian nation was opening up, Mauritius signed into law an offshore business act in 1992, along with dozens of other bilateral tax treaties, allowing foreigners to set up companies with little disclosure or tax. Despite a headline corporate rate of 15%, for some entities, it effectively meant just 3%.

Combined with India’s cultural ties — two thirds of the island’s 1.3 million-strong population are of Indian origin — the treaties allowed Mauritius to become the South Asian nation’s largest source of foreign investment for some time until the year through March 2018.

The country, which gained independence from the British in 1968, is now one of the wealthiest in Africa. Services make up close to 70% of its $12 billion economy. According to the Tax Justice Network, about 2.3% of global tax haven flows make their way through the island known for its luxury holiday resorts and pristine beaches. That compares with the 6.4% for top-ranked BVI.

“Historically the treaty with Mauritius was the standard way to invest into India,” said Reuven Avi-Yonah, a corporate and international taxation professor at the University of Michigan Law School. “It contained no limits on who the ultimate recipient of the income could be as long as the funds flowed through Mauritius.”

‘Layering’ of Ownership

As those flows gained momentum, so did suspicions that Indian entities were routing their money via Mauritius, a maneuver called round tripping, which could be used by companies and individuals to evade tax and launder criminal proceedings, according to Arun Kumar, a retired professor who taught at New Delhi’s Jawaharlal Nehru University. Money trails and ownership from India were obscured by a process of “layering” through multiple overseas shell companies, he said.

“They were using this web to basically prevent investigative agencies from figuring out who’s moving what money and make it look as if these were genuine foreign funds and not round-trip funds,” said Kumar, who’s authored a book on India’s illicit economy.

Eventually, Mauritius came under global pressure after the Paradise Papers, a trove of documents leaked to the International Consortium of Investigative Journalists in 2017, alleged the country was a secretive financial hub that allowed businesses and wealthy individuals to shield their assets and profits from taxation.

For India, a succession of financial scandals and frustration at attempts to make foreign corporates pay more tax led to the two countries in 2016 reworking their treaty. It closed a popular loophole so India could tax short-term capital gains, though zero levies remain on investments held for over a year.

Little Impact

India also tightened rules on so-called participatory notes, which were used to anonymously invest in Indian stocks and derivatives, forcing issuers to verify client identity.

Mauritius reworked some of its tax laws and treaties, supporting in October 2021 a global agreement that introduced a minimum corporate tax rate as well as greater disclosure for businesses with annual revenue above 750 million euros ($791 million).

Those measures did see the Financial Action Task Force — a global watchdog — remove Mauritius in 2021 from its gray monitoring list. Within months, the EU moved to take it off its blacklist.

The steps also meant the waning of Mauritius’s position as India’s biggest source of foreign direct investment. After peaking at $15.9 billion in the year through March 2018, the flows have dropped sharply to $9.4 billion, according to Reserve Bank of India data, relegating the country below Singapore and the US.

“The Mauritius route is less appealing now because of both the changes in the law and in the tax treaty,” said Avi-Yonah.

Even so, Mauritius remains a popular offshore base for many investors seeking opportunities in some of the biggest markets.

The furor over Adani isn’t forcing a reckoning on the island’s sandy shores. Lovania Pertab, the chairperson of the local chapter of Transparency International, the anti-corruption group, said nobody wants to wreck its lucrative offshore financial industry. But setting up 38 companies in Mauritius, as Hindenburg alleges Adani did in their report, “looks very abnormal,” she said.

“In Mauritius, nobody is talking about it,” she said. “They don’t want to appear to be India bashing.”

--With assistance from Kamlesh Bhuckory, Sudhi Ranjan Sen, Debjit Chakraborty, Ashutosh Joshi and Ishika Mookerjee.