Portland protesters demonstrate at police union building, mayor's condo

Demonstrators set an object on fire near the boarded-up Portland Police Association building early Saturday, following a demonstration earlier in the evening in the lobby of Mayor Ted Wheeler's condominium building. Photo courtesy Portland Police Bureau

Aug. 29 (UPI) -- Protesters took to the streets for the 93rd night in a row in Portland, Ore., demonstrating at Mayor Ted Wheeler's condominium building and at a separate location near the Portland Police Association building.

The Oregonian reported that the first demonstration, in the Pearl neighborhood near downtown, ended with a dance party Friday. At the second, multiple people were arrested early Saturday after someone set a large burning object near the police union building.

Portlanders have protested against racism and police brutality every night since May 28, with demonstrations drawing the ire of President Donald Trump and criticism over handling of crowds by both local police and federal law enforcement officials.

On Friday afternoon, Wheeler posted an image of a letter he wrote to Trump on Twitter declining the president's repeated offer to send federal law enforcement to Portland.

"We don't need your politics of division and demagoguery," Wheeler wrote. "We have already seen your reckless disregard for human life in your bumbling response to the COVID pandemic. And we know you've reached the conclusion that images of violence or vandalism are your only ticket to reelection."

"If the incompetent Mayor of Portland, Ted Wheeler, doesn't get control of his city and stop the Anarchists, Agitators, Rioters and Looters, causing great danger to innocent people, we will go in and take care of matters the way they should have been taken care of 100 days ago!" Trump wrote later that night.

The North Portland demonstration began at a neighborhood park as a vigil for Emmett Till on the 65th anniversary of his lynching in Mississippi.

Later that night demonstrators lit fires in two dumpsters placed in the street and set an object that appeared to be a mattress or box spring against the boarded-up police union building.

According to media and police reports, someone appeared to add accelerant to the object, causing the plywood on the building to catch fire.

Officers then demanded that protesters scatter and began making arrests. As of Saturday afternoon the Portland Police Bureau had not announced the number of people arrested or the names of arrestees.

Early Saturday morning, witnesses said a car drove by the demonstration and fired shots, according to a video of the scene posted to Twitter by an Oregon Public Broadcasting reporter. An observer found shell casings at the scene, but no one was hurt.

The demonstration in Wheeler's building was punctuated by an encounter between activists and former Minnesota Timberwolves executive David Kahn, who lives in the same building and said he was a friend of Wheeler's.

He offered to set up a meeting with Wheeler to discuss the situation, but activists declined, saying they wanted to talk to the mayor -- who did not emerge Friday -- directly.

Thousands of Mauritians protest government's handling of oil spill

People during a protest over the governments handling of the Wakashio oill spill in Port Louis, the capital of Mauritius, Saturday. Citizens and various political parties denounced the government's handling of the Wakashio case. Photo by Lura Morosoli/EPA-EFE

Aug. 29 (UPI) -- Thousands of people marched through the Mauritian capital Saturday to protest the government's handling of a massive oil spill that has leaked an estimated 1,000 oil into the waters around the island nation since the end of July.

Some wore black and waved the national flag, where others wore T-shirts bearing the inscription, "I love my country. I'm ashamed of my government."

On July 25 a Japanese oil tanker, the MV Wakashio, was en route to Brazil when it hit a coral reef off the Indian Ocean, spilling oil near the small island nation.

In mid-August the ship broke in half, causing more oil to leak into the waters around Mauritius.

The affected area includes a sanctuary for rare wildlife, and the Mauritian government reported Friday that 39 dead dolphins have washed ashore on the island -- up from a reported 18 earlier this week.

Activists say the government could have done more to prevent the spill, and have criticized the decision to deliberately sink the ship after it split in half.

"They didn't do anything when the ship approached our coastline - 12 days they didn't do anything until the oil spill and now thousands of people and marine people are affected," a demonstrator told the BBC.

RELATED Japanese government under fire for Mauritius oil spill

Environmental activists have also criticized the Japanese government for failing to take responsibility for the damage caused by the spill.

The Mauritian government has promised to investigate the spill, and the captain of the ship has been arrested and charged with endangering safe navigation.

Demonstrators in other countries -- including Canada, New Zealand and Australia -- also took to the streets Saturday to show solidarity with protesters in Mauritius.

Ancient megadrought may explain civilization’s ‘missing millennia’ in Southeast Asia

Laos is now wet and verdant, but new findings suggest it experienced a 1000-year megadrought starting about 5000 years ago. FBXX/ISTOCK.COM

By Charles ChoiAug. 24, 2020 , 2:05 PM

A megadrought that lasted more than 1000 years may have plagued Southeast Asia 5000 years ago, setting up dramatic shifts in regional civilizations, suggests a new study of cave rocks in northern Laos. The researchers believe the drought began when the drying of the distant Sahara Desert disrupted monsoon rains and triggered droughts throughout the rest of Asia and Africa.

For years, archaeologists studying mainland Southeast Asia—an area encompassing modern-day Cambodia, Laos, Myanmar, Malaysia, Thailand, and Vietnam—have been puzzled by what they call “the missing millennia,” a period from roughly 6000 to 4000 years ago with little evidence of human settlements. University of Pennsylvania archaeologist Joyce White, a co-author on the new paper, says she and others long thought this was because researchers hadn’t yet pinpointed where people of the era lived. Now, she believes the settlements could be missing because a megadrought devastated their populations and drove them to find water elsewhere.

To re-create the climate of that time, White and her colleagues investigated stalagmites in Tham Doun Mai, a cave in northern Laos. Stalagmites are tapering pillars of rock that rise from the floors of caves; they slowly grow taller as mineral-rich water drips from cave ceilings—often after rainfall. By analyzing the content of the slowly deposited rock, researchers can gauge not only the age of the rock, but also how wet it was at the time.

Scientists first radioisotope dated sections of three stalagmites from 9500 to 700 years ago. They next examined oxygen isotopes in the rocks to see how rainfall might have varied over those times. When rain falls, drops bearing heavy oxygen-18 isotopes land before those holding lighter oxygen-16 isotopes. Frequent downpours let loose both isotopes, but arid places that see only spotty showers tend to be depleted in light oxygen. By looking for stalagmite layers that were enriched in oxygen-18, the researchers could identify times when the climate was dry.

Paleoclimatologist Michael Griffiths collects a sample of calcite growth that precipitated onto a glass plate left in Tham Doun Mai Cave in Laos for 2 years. KATHLEEN JOHNSON

The researchers found that rainfall in the cave was relatively steady for more than 4000 years before abruptly decreasing between roughly 5100 to 3500 years ago. That suggests the region may have experienced a prolonged, heretofore unrecognized drought that lasted more than 1 millennium, the researchers report this month in Nature Communications.

If so, it may have been part of a larger series of megadroughts that hit Africa and Asia between 5000 and 4000 years ago, says study co-author Kathleen Johnson, a paleoclimatologist at the University of California, Irvine. During this time, civilizations across western Asia and the Middle East went through major upheavals, such as the collapse of the Akkadian Empire of Mesopotamia and the abandonment of cities in the Indus Valley. The climate shift, which some have dubbed the “4.2-kiloyear event,” is the basis for the Meghalayan, a controversial new geological age. It coincided with—and may have resulted from—the end of the Green Sahara, when once-verdant north Africa became a desert.

To determine whether African desertification could be linked to the Southeast Asian megadrought, the researchers simulated the ancient climate, incorporating interactions among the oceans, the atmosphere, dust, and vegetation. They found that the drying of the Sahara might have increased airborne dust, pushing the Pacific Ocean into a prolonged El Niño–like cycle that disrupted mainland Southeast Asia’s summer monsoon rains. This in turn could have triggered a megadrought over large swaths of Southeast Asia and flooding across East Asia. This was, in essence, “a redistribution of moisture across Asia,” says Michael Griffiths, a paleoclimatologist at William Paterson University and lead author on the study.

Raymond Bradley, a paleoclimatologist at the University of Massachusetts, Amherst, says the new study suggests the 4.2-kiloyear event—which many consider an abrupt climate shift—may have been part of a larger trend that began roughly 800 years earlier. He hopes the new study will spur researchers to review well-dated records from other regions across Asia to see where and when similar climatic shifts occurred. “Only then can we try to figure out why such changes occurred and how they might or might not be related to societal changes.”

To that end, Griffiths and his team are planning to explore caves in Vietnam and Thailand to get a better look at the period. And their answers may also inform modern-day climate projections, he says. “Perhaps studying the past can help illuminate our current situation in new ways.”

doi:10.1126/science.abe4757

Utah State University researchers have grown cannabis plants since 2018, when hemp cultivation was legalized. ELI LUCERO/THE HERALD JOURNAL VIA AP

Cannabis research database shows how U.S. funding focuses on harms of the drug

By Cathleen O’GradyAug. 27, 2020 , 4:05 PM

A new analysis of cannabis research funding in the United States, Canada, and the United Kingdom has found that $1.56 billion was directed to the topic between 2000 and 2018—with about half of the money spent on understanding the potential harms of the recreational drug. Just over $1 billion came from the biggest funder, the U.S. National Institute on Drug Abuse (NIDA), which doled out far more money to research cannabis misuse and its negative effects than on using cannabis and cannabis-derived chemicals as a therapeutic drug.

“The government’s budget is a political statement about what we value as a society,” says Daniel Mallinson, a cannabis policy researcher at Pennsylvania State University, Harrisburg, who reviewed the funding analysis provided to Science by the consultant who conducted it. “The fact that most of the cannabis money is going to drug abuse and probably to cannabis use disorder versus medical purposes—that says something.” The data confirm “word on the street” that government grants go to research that focuses on harms, says Daniela Vergara, who researches cannabis genomics at the University of Colorado, Boulder.

However, overall cannabis research funding in the United States is rising steadily, from less than $30.2 million in 2000 to more than $143 million in 2018, and money to explore cannabis medical treatments is growing—although not as fast as funding for research on harms

The analysis is based on a database assembled by Jim Hudson, a consultant for medical research charities and government agencies, who collected publicly available grant data from 50 funders, including public agencies such as the U.S. National Institutes of Health and charities such as Canada’s Arthritis Society. Based on his own reading of the 3269 grants that included cannabis-related keywords, Hudson classified each into categories that captured the focus of the research.

Compared with the $1.49 billion spent by the United States over the 19-year period, Canada spent $32.2 million and the United Kingdom $40 million. Whereas U.K. spending was similarly dominated by research on the harmful effects of cannabis, Canada’s funding focused on the endocannabinoid system—the body’s own system of cannabinoid receptors and naturally produced endocannabinoids that bind to them.

In 2018, research on the potential harms of cannabis received more than 20 times more funding than research on cannabis therapeutics, according to an analysis of cannabis research grants from 50 public agency and charity funders.

The tools Hudson developed to access and sort the public grant data are ultimately destined for his consulting work on cancer research funding, but he says the much smaller field of cannabis offered a bite-size test drive. Hudson made the broad findings public on his website today, although the raw data behind the analysis are not. It’s the first attempt to consolidate cannabis grant data from a wide range of sources and classify it, says Lee Hannah, a cannabis policy researcher at Wright State University, and it’s useful to see “how the lion’s share in the U.S. remains focused on negative consequences and prevention.”

The analysis also hints at the legal hurdles to studying cannabis. In 2018, the $34 million spent by the three countries on cannabis medical treatments was dominated by research on cannabinoids—chemicals found in cannabis—rather than the cannabis plant itself.

This is probably in part because of practicality, Vergara says: It’s often easier for researchers to work with isolated compounds and create regulated doses than to use the whole marijuana plant with its psychoactive properties. But in the United States, it’s also difficult to get governmental permission to use the whole plant for research, she adds. Right now, the only legal producer of cannabis for research in the United States is the University of Mississippi, which grows cannabis that is less potent than recreational pot.

Although NIDA still dominates cannabis research funding, both nationally and internationally, new sources have appeared in recent years. The U.S. Department of Defense has spent a few million dollars on cannabinoid research over the past few years, and, in 2014, the Colorado Department of Public Health & Environment created a medical marijuana research program. That’s part of a wider pattern of U.S. states legalizing cannabis and setting money aside for research despite ongoing federal restrictions, Hannah says.

The analysis isn’t an exhaustive picture of worldwide cannabis research, because it only captures public data from a short list of countries. Despite a reputation as a major center of cannabis research, Israel doesn’t feature, although Hudson hopes to expand the list of included countries and funders. The analysis of NIDA funding does not distinguish between money for outside scientists versus the institute’s own researchers. And Mallinson points out that there’s no record of the private research funding that has increased recently, like Harvard Medical School’s International Phytomedicines and Medical Cannabis Institute, which has received funding from Canadian cannabis producer Atlas Biotechnologies and other companies.

The limited funding for therapeutic research is part of a vicious circle, Mallinson says: Research is restricted because the U.S. Drug Enforcement Administration lists marijuana as a Schedule I drug, meaning it is considered to have high potential for abuse and no evidence for medical benefits—but the threshold needed to demonstrate evidence of medical benefits is hard to reach because the research is restricted. “It’s difficult to break that,” Mallinson says.

Putting marijuana on the less-restricted Schedule II list, alongside such drugs as oxycodone, felt “inevitable” more than 10 years ago, Hannah says, but no change has yet materialized.

doi:10.1126/science.abe5328

New “Nano-Diamond” Battery Can Last Up to 28,000 Years

Beebom Staff -August 30, 2020

Beebom Staff -August 30, 2020

With several researchers and scientists working on various kinds of battery tech, we have seen some pretty long-lasting batteries for EVs and even smartphones. However, no matter how long these batteries last, they would lose their power, maybe in days or even months, after a charge. So now, a company has some bold claims which state that their new radioactive-waste-consuming batteries can last for thousands of years and too on a single charge!

According to a recent report, California-based battery-makers, NDB has developed a new type of battery that can use radioactive waste to generate electric power. Moreover, the company claims that these batteries can last up to 28,000 years.

NDB’s new “nano-diamond batteries” are a new type of battery that uses nuclear material as a source to create electrical energy. According to the company, these new batteries serve as little generators that can take radioactive waste materials from nuclear powerplants to convert it into electrical energy to power cars and electronic devices.

A Nuclear Waste-Consuming Battery

As per the report, the company used leftover radioactive graphite to create different kinds of diamonds with varying carbon levels. These residue radioactive graphite are pretty harmful if left untreated. So, the company takes the waste material and purifies it.

Then they develop a layered structure to make the batteries that can produce electricity. And according to NDB, they can manipulate the structure of the battery and make it in any size, like AA or AAA.

Now, if you are thinking about the radiation levels around you when you use this new battery, then do not worry. The company says that these batteries give off radiation which is less than the natural radiation of the human body. So, it should be safe to use the nano-diamond batteries.

The company also states that this technology can be scaled up to create these special batteries for future EVs. Generally, companies like Tesla take responsibility for their car batteries for up to eight years or for 100,000 miles.

However, NDB claims that with the technology scaled up, it can produce car batteries that will power an EV for around 90 years. Apart from cars, these batteries can also be hugely useful for medical devices like pacemakers.

Now, we are not sure when these batteries will actually make their way to the consumer market. Nonetheless, these kinds of new developments show that we are certainly not letting out environment down and are willing to protect it.

The company has released an explanatory video about these new batteries and the technology behind them. You can check it out right below.

SOURCE The Next Web

Minas Gerais asks court to block Vale assets worth $4.7 bn

Bruno Venditti | August 26, 2020

The aftermath of the disaster in Brumardinho after Vale’s tailings dam collapsed. Photo by Vinícius Mendonça/Ibama, Wikimedia Commons.

Brazil’s Minas Gerais state authorities and federal prosecutors have asked a judge to order Vale (NYSE: VALE) to pay for economic losses and other damages stemming from last year’s deadly Brumadinho tailings dam disaster, which killed 270 people.

The authorities have sent a joint petition seeking a judge’s order for the miner to freeze 26.7 billion reais ($4.78 billion) in assets for eventual restitution to the state.

They are also seeking 28 billion reais ($5.01 billion) in collective “moral and social” damages.

AUTHORITIES HAVE SENT A JOINT PETITION SEEKING A JUDGE’S ORDER FOR THE MINER TO FREEZE ASSETS FOR EVENTUAL RESTITUTION TO THE STATE

“This amount corresponds to the net profit distributed to shareholders in 2018, an amount that could have been applied to guarantee the safety of the dams,” prosecutors said.

According to Vale, $1.9 billion have already been presented in guarantees and judicial deposits.

“Vale reinforces that this is not a new public civil action but claims in the lawsuit, which has been in progress since January 2019,” the company said in a press release.

Vale said that it is not formally aware of the requests made and will comment on them in the records of the proceedings, within the period stipulated by the judge.

In July, a court decision suspended $1.5 billion in legal deposits that had been previously required in a case related to the deadly dam collapse.

In May, the city of Brumadinho suspended Vale’s operating license after health agents said that the company’s onsite activities had “not respected the rules of social isolation.”

A Minas Gerais state court in Brazil later revoked the decree after the company argued that the suspension was issued with the main purpose of serving as retaliation for non-payment of emergency aid to the entire population of the city.

The Fire Brigade of Minas Gerais will resume the search for still missing bodies of 11 victims of the disaster.

Earlier this year, state prosecutors charged Fabio Schvartsman, the chief executive at the time of the burst, and 15 other people with homicide. Schvartsman left his position at the company in March 2019.

Wage talks with Kumba Iron Ore hit deadlock, union says

Reuters | August 26, 2020

Sishen Mine, a Kumba Iron Ore mine in South Africa’s the Northern Cape Province. (Image by Graeme Williams, Media Club, Wikimedia Commons)

South Africa’s National Union of Mineworkers (NUM) on Wednesday said that wage negotiations with Kumba Iron Ore, owned by Anglo American, were deadlocked and the union had declared a dispute, a move that is one step short of a strike.

NUM, the majority union at Kumba, said the company had agreed a wage increase of 8% for the lowest-paid workers and 6.5% for the highest-paid, but the two parties had disagreed over sick leave.

“The company policy on sick leave provides workers with 120 days. To our dismay, in a round of negotiations, the company wants to do away with the benefit,” the NUM said in a statement.

The union’s declaration of a dispute means that a protected strike could go ahead if conciliation talks between the parties mediated by the Commission for Conciliation, Mediation and Arbitration fail to break the impasse.

Kumba, which has mining operations in the Northern Cape province and a port operation in Saldanha Bay, said it was continuing negotiations with NUM.

“We trust that we will be able to reach an amicable solution soon, which will be in the best interest of both the employees and the company,” Kumba Iron Ore said in an emailed statement.

Negotiations with the two other unions, the Association of Mineworkers and Construction Union (AMCU) and Solidarity, which are representated at Kumba’s operations, have been concluded.

(By Tanisha Heiberg; Editing by David Goodman and Barbara Lewis)

Rio Tinto’s weak response to cave blasts will trigger stronger reaction

Reuters | August 25, 2020

Rio Tinto was given permission to blast Juukan Gorge 1 and 2 under Section 18 of the Aboriginal Heritage Act. (Credit: Puutu Kunti Kurrama And Pinikura Aboriginal Corporation)

(The opinions expressed here are those of the author, Clyde Russell, a columnist for Reuters)

Rio Tinto may have inadvertently triggered the law of unintended consequences with its blasting of an Aboriginal heritage site at one of its Australian iron ore mines, and the subsequent slap on the wrists for some senior executives.

The board of Rio cut the bonuses of three senior executives including Chief Executive Jean-Sébastien Jacques as part of the company’s review into the destruction of two historically significant caves in Western Australia state, against the wishes of the Aboriginal traditional owners.

Rio, which overtook Brazil’s Vale as the world’s biggest iron ore miner last year, destroyed the Juukan Gorge caves in May as part of an expansion of its Brockman 4 mine.

REVIEW FOUND THERE WAS NO SINGLE “ROOT CAUSE OR ERROR” THAT RESULTED IN THE DESTRUCTION OF THE CAVES, RATHER IT WAS A “SERIES OF DECISIONS, ACTIONS AND OMISSIONS OVER AN EXTENDED PERIOD OF TIME

While the blasting met legal requirements, Rio has faced a public and investor backlash for allegedly putting profits ahead of heritage, a view amplified by the revelation that the company had alternatives to destroying the caves but chose not to pursue them.

The Rio board review said there was no single “root cause or error” that resulted in the destruction of the caves, rather it was a “series of decisions, actions and omissions over an extended period of time.”

The board recommended improving procedures and setting up new processes to ensure this type of incident doesn’t happen again.

The board’s review likely fails what Australians refer to as the “pub test,” which means whether the average patrons of a typical bar believe the actions are reasonable and appropriate.

The loss of about $3.7 million in bonuses for the three executives is a very mild punishment, given their level of remuneration and the fact that Jacques, along with head of iron ore Chris Salisbury and Simone Niven, the executive responsible for corporate relations, bear responsibility for what has become a public relations disaster for the company.

The board’s soft-pedalling of the cave destruction was condemned by shareholder advocacy group the Australasian Corporate Centre for Responsibility, and several institutional investors.

While Rio will no doubt hope the issue blows over with the passage of time, it’s more likely that it leads to a renewed focus on environment, social and governance (ESG) issues.

Shareholders are becoming increasingly aware of the financial risks of companies that are viewed as not having leading ESG programmes and a culture of doing the right thing.

Social licence to operate, along with climate change, comes up often as the top concerns for miners, with a survey last year by consultants EY showing 44% of mining executives viewed keeping a social licence as their top concern.

Miners to change

Unfortunately, the Rio incident with the Juukan caves shows that miners may still have some way to go in order to be seen to be placing ESG issues at the heart of their operations.

Rio isn’t alone in this, with other leading mining companies seeming to fall short in this area, despite public commitments that it is their top priority.

Like Rio’s corporate affairs boss Niven, other miners have executives listed as having responsibility for ESG issues, such as outgoing BHP external affairs chief Geoff Healy, Tim Langmead at Fortescue Metals Group, Anik Michaud at Anglo American and Luiz Osorio at Vale.

Glencore is unusual among major miners in not having an executive with ESG responsibilities listed on its website.

But merely having an executive named doesn’t mean these people are among the most important decision makers in the companies they work for.

All the executives’ names above have additional responsibilities and none of them have a public profile worth speaking about.

In effect, they are largely invisible and take little or no public part in the debate over ESG issues.

This hardly speaks to mining companies that appear to view ESG issues as front and centre of their existence.

For companies to be taken seriously, it would likely take the appointment of senior executives, with real power over the decision-making process, to become involved in placing ESG at the heart of each company’s mission.

If Rio had somebody like this, somebody could have stopped the blasting even if the CEO wanted it to proceed, somebody who understood that the negative optics of blowing up the caves considerably outweighed the potential profits, then it may have avoided the current mess.

However, it’s likely that ongoing shareholder demands for increased ESG accountability, coupled with activism by interest groups, will force miners down the path of making ESG more than just the current statements of principle.

Codelco presses ahead with automation plans to bolster production

Reuters | August 28, 2020

Haul trucks at Codelco’s Gabriela Mistral mine are 100% autonomous. Credit: Codelco

Chile’s state-owned Codelco, the world’s largest copper producer, will press ahead with plans to roll out automation of its mining operations as it seeks to maintain production levels into the future amid declining ore grades and the disruption of the coronavirus pandemic, its chief executive said on Friday.

The progress of Codelco’s digitalization agenda has strained relations with the unions because of the potential for technological advances reducing the need for manual labour.

Technological development is however critical to ensuring the longer-term viability of mining, Codelco CEO Octavio Araneda said in a seminar hosted in the capital Santiago.

COPPER MINERS IN CHILE ARE FACING A COMBINATION OF DECLINING ORE GRADES AND COSTLY OVERHAULS OF AGEING MINES

Copper miners are struggling globally with the ongoing disruption of the coronavirus pandemic, while in Chile they are also facing a combination of declining ore grades and costly overhauls of ageing mines.

“We are committed to a programme of introducing autonomous trucks in the pits. That’s a potent and challenging goal in terms of automation,” he said.

“That’s the big step still remaining to take, our are plants are already pretty automated.”

Codelco, which delivers all its profits to the state, increased production by 4.7% in the first half of the year even as it reduced staffing and adjusted shift systems to slow the spread of the virus in its operations.

But as Chile reached its peak of infections in July and the virus spread to its northern desert cities, Codelco’s unions reported around 3,000 cases and a handful of deaths, it was forced to stall development projects and smelters.

Araneda celebrated Codelco’s managing to reduce levels of the coronavirus among workers to an average of seven daily cases per day in a mass of 70,000 people, more than half of whom are asymptomatic.

Araneda said the company was prepared for a second wave.

“It is very likely that increases in the number of infections will happen in the country and the regions where we operate,” he said.

Chile this week surpassed 400,000 infections and more than 11,000 deaths from covid-19 though with a drop in daily infection and positivity rates, it has begun a cautious lifting of lockdowns and resumption of business activity in the capital and around the country.

(By Fabian Cambero and Aislinn Laing; Editing by Marguerita Choy)

Canadian mine wages steady increase over five years

August 28, 2020

Canadian Malartic mine is the country’s largest operating gold operation. (Image courtesy of Canadian Malartic.)

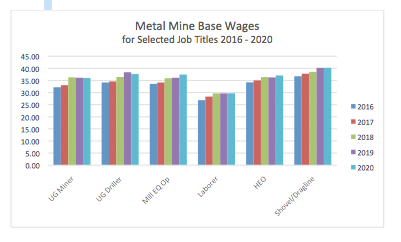

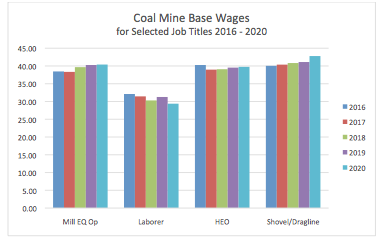

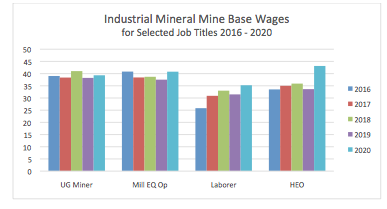

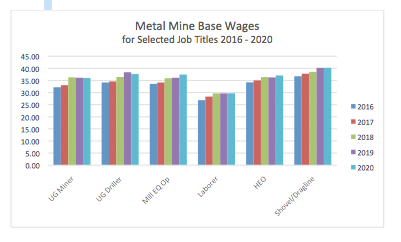

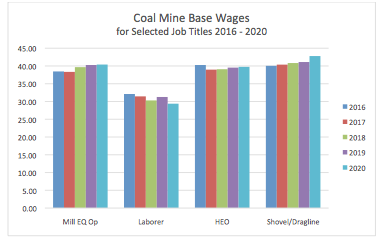

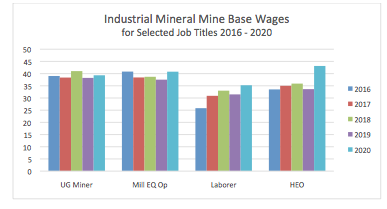

Canada’s mining industry has seen steady increases in wages over the past 5 years for energy fuel mines, metal mines, and industrial mineral mines.

These statistics are derived from five surveys conducted between 2016 and 2020 by MINING.COM’s sister company Costmine, a division of InfoMine USA, Inc, publisher of Mining Cost Service.

SIGN UP FOR THE MINING NEWS DIGEST

Sign Up

They found that, of Canada’s mining industry wage statistics, metal mining showed the highest average increase in wages, though metal mines lagged slightly behind on the pay scale. Industrial mineral mines showed the next highest increase in wages and coal mines pulled in third for the smallest increase.

Source: Costmine

The energy mines’ lead in wages resulted, in part, from generous compensation packages offered by northern Alberta’s oil sands industry. For example, base pay for a heavy equipment operator was reported as high as C$52.06 per hour in 2020.

Average benchmark hourly base wages for select job titles over the 5 year period are shown in the following tables for comparison purposes. Wages are reported in Canadian dollars.

Source: Costmine

Benefit packages at Canadian mines are often generous. In addition to the Canada Pension Plan or Quebec Pension Plan in Canada, Universal health care plans are also mandated.

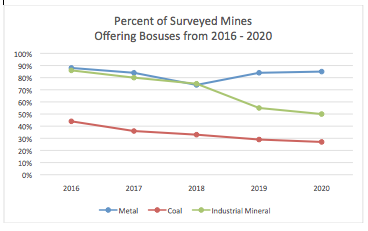

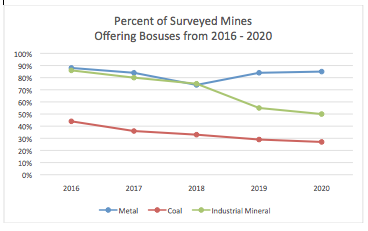

Many mines turn to bonus plans to make up for lower wages. Most plans today offer bonuses based on formulas that include safety, productivity, environmental protection, and achieving individual or team goals. Some also include commodity prices in the factoring. These plans can easily increase a miners pay 10 to 15% or more.

Source: Costmine

Metal mines are prime examples for supporting lower wages with bonus plans. In the 5 year period between 2016 and 2020, the number of bonus plans for surveyed metal mines ranged from 74% to 88% of metal mines.

Source: Costmine.

In comparison, only 27% of surveyed coal mines reported providing bonus plans in 2020; a number that has decreased from 44% in 2016 continues to fall far short of the reported number of metal mines providing bonuses. Industrial mineral mines fair a bit better than coal mines with 50% of mines reporting bonuses, but fewer of those mines are offering bonuses than in 2016.

The full report, titled Canadian Mine Salaries, Wages and Benefits, is available at Costmine.

Costmine would like to thank Brunel, co-sponsor on the 2020 Survey Results.