NFTs are gathering hype and controversy, so we break down what the latest in crypto exactly is and how it's shaking up the art and gaming worlds.

By Alessandro Barbosa on March 12, 2021

The landscape of digital art is being upended by NFTs, or non-fungible tokens, to the point where it's difficult not to have heard the term in passing. But what is an NFT? Why are people spending millions of dollars on JPEGs? And could it change how microtransactions in games work?

Just what is a Non-Fungible Token?

First and foremost, NFTs are intrinsically tied to the blockchain--an online ledger that is maintained by thousands of users globally through the process called mining. Transactions on the blockchain aren't centralized, so it's difficult (but not impossible) to edit the ledger to make fraudulent transactions. This is the same technology that powers cryptocurrencies like Bitcoin ($BTC), Dogecoin ($DOGE), and Ethereum ($ETH) around the world. NFTs exist on various blockchains, but most being sold are found on the Ethereum blockchain. Unlike the currency, however, they're non-fungible. That means that one NFT is entirely unique from the rest, unlike the fungible Ethereum, where one coin is identical to all others, thus allowing it to be used as a currency. NFTs, then, are one-of-a-kind in a way, which can explain why they're being used to verify purchases of digital goods. The goods themselves are specifically unique to the token (an image sold as an NFT can still find its way online for anyone to see) but the token itself is an indicator of the purchase.

So what does an NFT actually give me?

This is where things get a little strange. For example, an artist can choose to mint a piece of digital artwork with an NFT and then sell the token through multiple auction houses. The token itself does not determine who can view the artwork, but rather who holds the rights to it. There's some grey area here, where the artist can still govern overall ownership and distribution rights, but for the most part, the owner of the NFT is technically the owner of the artwork, even if the image is hosted on Google and available for anyone to right-click and save.

Although not a perfect analogy, you can think of it as someone owning the real Mona Lisa, or a cheap copy made at a novelty gift store. Both feature the same underlying work, but only one is the "real" Mona Lisa. With physical art, there's more to an original than just being the first of its kind, but with digital art, the difference is almost negligible. A copy of an image, a song, a gif, or anything of that kind can be shared in an unaltered state, diluting the relevance of owning a token to the original.

Wait, why are NFTs valuable then?

Those who see value in NFTs might see the potential to make a profit in the future, as the exclusivity of the token takes on a collector's status. Others might just want the bragging rights that come with owning the only minted NFT associated with a digital asset, whether it's accessible to everyone else or not. Although it is technically possible to mint multiple unique NFTs for the same digital asset, it seems most artists aren't doing this to help preserve the value of the single token that is generated.

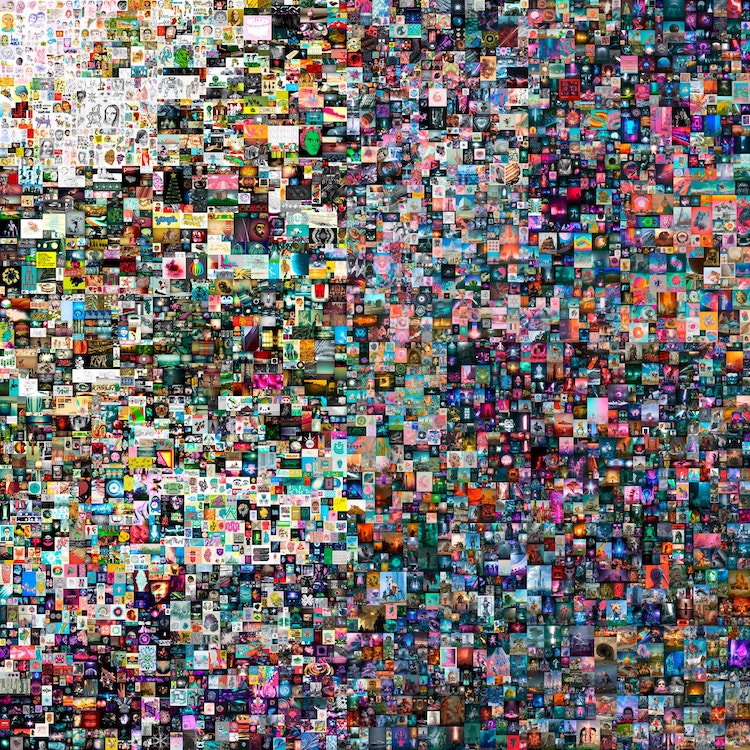

Mike Winklemann, an artist known as Beeple, started minting NFTs for his artwork last year, making several sales for thousands of dollars before reaching into the millions. His latest piece, Everydays: The First 5000 Days, was the first NFT sold by Christie's, a major art auction house. It sold for $69 million, but if you want to save Everdays to your desktop, you can just copy the image tweeted out by Christie's and do so. Hopefully, that gives you an idea of the difference between purchasing an NFT for an asset, and the asset itself.

Winklemann isn't alone in the gold rush surrounding NFTs. Musician Steve Aoki sold an NFT to John Legere, the former CEO of T-Mobile, for $888,888.88. The asset was a 36-second music snippet accompanied by a gif, part of which has been shared online. For nearly a million dollars the ownership of the gif will remain on the blockchain as Legere's, even if the full gif eventually finds its way online and is experienced by millions of other people.

This is definitely finding its way into games, isn't it?

NFTs aren't exactly new, and their first big use case was actually in a game. Cryptokitties, which launched in 2017, allows players to purchase NFTs for specific digital cats, which they solely own. These cats can then breed with other digital cat purchases and produce entirely new cats that can then be sold as unique NFTs of their own. This market has generated millions since its inception, with some single cats costing well over a million dollars alone. A curious glance at the website shows that many cheaper cats are simply reskins of the same designs, but the ability to own one for yourself is part of the allure

If that makes you think about the possibility of NFTs to merge with cosmetic microtransactions in games like Fortnite, Overwatch, or Dota 2, I think it's safe to bet that there is at least conversation being had over the potential around a system like that. There are already games using NFTs in novel ways, too. The Sandbox is a community-driven creative space that lets users create voxel-based assets or gaming experiences. You could say it's similar to Roblox, outside of the fact that these gaming experiences all exist on finite virtual land that users can buy using NFTs. The tokens correlate to a piece of land where you can host game creations for other users to visit, with the value of the size and position of the land determined by simple supply and demand.

Mythical Games is planning to use both NFTs and the blockchain in its upcoming PC and console title, Blankos. The studio is designing another game driven by user-generated content, but where items such as cosmetics can be sold in finite numbers. In-game items are transferred to players using NFTs, which can then be resold on a marketplace where the value is determined by the buyers. Think of it as Steam Trading Cards and Valve's Marketplace, except powered by blockchain transactions for items that come in finite waves.

Can an NFT be minted against anything then? That sounds dangerous

Given that an NFT can be minted for almost anything digital (Twitter's Jack Dorsey is selling an NFT of the first tweet ever sent, for example) the ease of creating the token has helped give artists the ability to make money via a new platform. But it's also led to a lot of abuse, which has already started dominating the conversations around NFTs. Artists are finding tokens minted against their art without their consent, letting someone else reap the benefits of a sale without any of the work. It's also difficult to prevent this right now, given the way in which social media allows digital art of any kind to be shared. NFTs aren't solving the root problem of copyright online, but they are giving those who would abuse it a lot of freedom to do so.

An official merchandise creator for Among Us recently stumbled upon thousands of NFT sales based on artwork from the game, none of which had been authorized by the studio. This is just a glimpse at the issue thousands of artists are facing, leading to a divide on whether NFTs are the future of digital art collection or a new problem for creators to fight against.

There's also the environmental impact to consider, which isn't so much tied to NFTs but rather blockchain technology. Since the blockchain is essentially a ledger maintained by users around the world, requiring computer processing power to authenticate transactions, each one takes up some unit of energy. Combined, studies are showing that the consumption of the overall system is incredibly high, with the Bitcoin blockchain consuming more electricity in a year than the whole of Argentina.

Maintaining the blockchain and facilitating all of the transactions that take place requires incredible amounts of processing power, which incurs large electricity costs. Given that electricity and its generation is still one of the biggest environmental impactors, this has brought the cost of cryptocurrencies to the environment into focus. Microsoft founder Bill Gates has said he's appalled by the harm that cryptocurrencies present to the environment, but also notes that the push towards greener electricity could mitigate it. "If it's green electricity and it's not crowding out other uses, eventually, you know, maybe that's ok," Gates told the New York Times.

Ethereum is far more efficient than Bitcoin (one of Ethereum's founders similarly spoke out against the energy consumption of Bitcoin), which means that it's using less electricity overall on its blockchain than the most popular cryptocurrency on the market. That still does not make it emission-free, however, and it is no secret that popular tokens like NFTs lead to more transactions, which lead to more energy consumption. This also ties into the scarcity of hardware powerful enough for processing the blockchain, which is a big reason why you might have trouble buying a GPU or power supply for your next PC right now.

So where do NFTs go next?

That is the state of NFTs currently, and it's bound to grow even more now that it's reached a point of public consciousness that helped propel Bitcoin a few years ago. It's difficult to say what the future might hold for NFTs as a tangible collector's item, but for now it's a bit of a minefield, where you can either sell art to an entirely new, wealthy audience or have even more work illegally stolen from you. And there is no indication of how those problems might be solved just yet.

Got a news tip or want to contact us directly? Email news@gamespot.com