PUBLISHED TUE, JUL 20 2021

Sam Meredith@SMEREDITH19

KEY POINTS

The world is confronting a climate emergency, and policymakers and chief executives are under intensifying pressure to deliver on promises made as part of the landmark Paris Agreement.

Proponents of carbon capture technologies believe they can play an important and diverse role in meeting global energy and climate goals.

The topic is divisive, however, with climate researchers, campaigners and environmental advocacy groups arguing that carbon capture technology is not a solution.

A detail of the pilot carbon dioxide (CO2) capture plant is pictured at Amager Bakke waste incinerator in Copenhagen on June 24, 2021.

IDA GULDBAEK ARENTSEN | AFP | Getty Images

LONDON — Carbon capture technology is often held up as a source of hope in reducing global greenhouse gas emissions, featuring prominently in countries’ climate plans as well as the net-zero strategies of some of the world’s largest oil and gas companies.

The topic is divisive, however, with climate researchers, campaigners and environmental advocacy groups arguing that carbon capture technology is not a solution.

The world is confronting a climate emergency, and policymakers and chief executives are under intensifying pressure to deliver on promises made as part of the landmark Paris Agreement. The accord, ratified by nearly 200 countries in 2015, is seen as critically important in averting the worst effects of climate change.

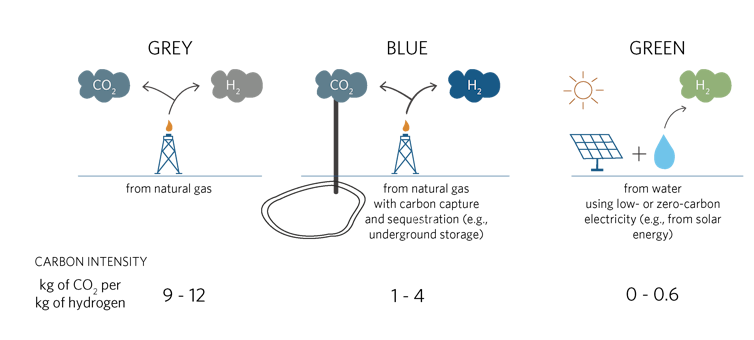

Carbon capture, utilization and storage — often shortened to carbon capture technology or CCUS — refers to a suite of technologies designed to capture carbon dioxide from high-emitting activities such as power generation or industrial facilities, that use either fossil fuels or biomass for fuel.

The captured carbon dioxide, which can also be captured directly from the atmosphere, is then compressed and transported via pipeline, ship, rail or truck to be used in a range of applications or permanently stored underground.

There are a number of reasons why carbon capture is a false climate solution.

The first and most fundamental of those reasons is that it is not necessary.

Carroll Muffett

CHIEF EXECUTIVE AT THE CENTER FOR INTERNATIONAL ENVIRONMENTAL LAW

Proponents of these technologies believe they can play an important and diverse role in meeting global energy and climate goals.

Carroll Muffett, chief executive at the non-profit Center for International Environmental Law (CIEL), is not one of them. “There are a number of reasons why carbon capture is a false climate solution. The first and most fundamental of those reasons is that it is not necessary,” he told CNBC via telephone.“If you look at the history of carbon capture and storage, what you see is nearly two decades of a solution in search of a cure.”

Some CCS and CCUS facilities have been operating since the 1970s and 1980s when natural gas processing plants in south Texas began capturing carbon dioxide and supplying the emissions to local oil producers for enhanced oil recovery operations. The first one was set up in 1972.

It wasn’t until several years later that carbon capture technology would be studied for climate mitigation purposes. Now, there are 21 large-scale CCUS commercial projects in operation worldwide and plans for at least 40 new commercial facilities have been announced in recent years.

A report published by CIEL earlier this month concluded that these technologies are not only “ineffective, uneconomic and unsafe,” but they also prolong reliance on the fossil fuel industry and distract from a much-needed pivot to renewable alternatives.

Employees near the CO2 compressor site at the Hawiyah Natural Gas Liquids Recovery Plant, operated by Saudi Aramco, in Hawiyah, Saudi Arabia, on Monday, June 28, 2021. The Hawiyah Natural Gas Liquids Recovery Plant is designed to process 4.0 billion standard cubic feet per day of sweet gas as pilot project for Carbon Capture Technology (CCUS) to prove the possibility of capturing C02 and lowering emissions from such facilities.

Maya Siddiqui | Bloomberg | Getty Images

“The unproven scalability of CCS technologies and their prohibitive costs mean they cannot play any significant role in the rapid reduction of global emissions necessary to limit warming to 1.5°C,” the CIEL said, referring to a key aim of the Paris Agreement to limit a rise in the earth’s temperature to 1.5 degrees Celsius above pre-industrial levels.

“Despite the existence of the technology for decades and billions of dollars in government subsidies to date, deployment of CCS at scale still faces insurmountable challenges of feasibility, effectiveness, and expense,” the CIEL added.

Earlier this year, campaigners at Global Witness and Friends of the Earth Scotland commissioned climate scientists at the Tyndall Centre in Manchester, U.K. to assess the role fossil fuel-related CCS plays in the energy system.

The peer-reviewed study found that carbon capture and storage technologies still face numerous barriers to short-term deployment and, even if these could be overcome, the technology “would only start to deliver too late.” Researchers also found that it was incapable of operating with zero emissions, constituted a distraction from the rapid growth of renewable energy “and has a history of over-promising and under-delivering.”

In short, the study said reliance on CCS is “not a solution” to confronting the world’s climate challenge.

Carbon capture is ‘a rarity’ in Washington

Not everyone is convinced by these arguments, however. The International Energy Agency, an influential intergovernmental group, says that while carbon capture technology has not yet lived up to its promise, it can still offer “significant strategic value” in the transition to net zero.

“CCUS is a really important part of this portfolio of technologies that we consider,” Samantha McCulloch, head of CCUS technology at the IEA, told CNBC via video call.

WATCH NOWVIDEO 17:35The big problem with capturing carbon is that it simply doesn’t pay

The IEA has identified four key strategic roles for the technologies: Addressing emissions from energy infrastructure, tackling hard-to-abate emissions from heavy industry (cement, steel and chemicals, among others), natural gas-based hydrogen production and carbon removal.

For these four reasons, McCulloch said it would be fair to describe CCUS as a climate solution.

At present, CCUS facilities around the world have the capacity to capture more than 40 million metric tons of carbon dioxide each year. The IEA believes plans to build many more facilities could double the level of CO2 captured globally.

“It is contributing but not to a scale that we envisage will be needed in terms of a net-zero pathway,” McCulloch said. “The encouraging news, I think, is that there has been very significant momentum behind the technology in recent years and this is really reflecting that without CCUS it will be very difficult — if not impossible — to meet net-zero goals.”

Electricity pylons are seen in front of the cooling towers of the coal-fired power station of German energy giant RWE in Weisweiler, western Germany, on January 26, 2021.

INA FASSBENDER | AFP | Getty Images

Meanwhile, the American Petroleum Institute, the largest U.S. oil and gas trade lobby group, believes the future looks bright for carbon capture and utilization storage.

The group noted in a blog post on July 2 that CCUS was a rare example of something that is liked by “just about everyone” in Washington – Democrats, Republicans and Independents alike.

Where do we go from here?

“Frankly, tackling climate change is not the same as trying to bring the fossil fuel industry to its knees,” Bob Ward, policy and communications director at the Grantham Research Institute on Climate Change at the London School of Economics, told CNBC via telephone.

“If the fossil fuel companies can help us get to net zero then why wouldn’t we want them to do that? I think too many environmental groups have conflated their dislike of oil and gas companies with the challenge of tackling climate change.”

VIDEO01:27Swiss RE CEO: Carbon capture ‘could be as big’ as oil and gas industry

When asked why carbon capture and storage schemes should be in countries’ climate plans given the criticism they receive, Ward replied: “Because if we are going to get to net zero by 2050, we have to throw every technology at this problem … People who argue that you can start ruling out technologies because you don’t like them are those who, I think, haven’t understood the scale of the challenge we face.”

The CIEL’s Muffett rejected this suggestion, saying proponents of carbon capture technologies are increasingly reliant on this kind of “all of the above” argument. “The answer to it is surprisingly easy: It is that we have a decade to cut global emissions in half and we have just a few decades to eliminate them entirely,” Muffett said.

“If on any reasonable examination of CCS, it costs massive amounts of money but doesn’t actually reduce emissions in any meaningful way, and further entrenches fossil fuel infrastructure, the question is: In what way is that contributing to the solution as opposed to diverting time and energy and resources away from the solutions that will work?”