Reuters | August 26, 2021 |

The Jadar project has an estimated production capacity of 55,000 tonnes per year.(Image courtesy of Rio Tinto.)

Four years from now, fields in the Jadar river valley in western Serbia where Djorjde Kapetanovic grows corn and soy to feed his cattle will be turned into a waste dump for Europe’s biggest lithium mine.

Rio Tinto in July committed $2.4 billion to its Jadar project as global miners push into metals needed for the green energy transition, including lithium, which is used to make electric vehicle batteries. The Jadar project, once completed, would help make Rio a top 10 lithium producer, just as demand for EVs booms.

Opposition to the project is growing, however, because of concerns about possible environmental damage and protest rallies have become more frequent. In April, thousands gathered in Belgrade to protest against widespread pollution in the Balkan country and against the lithium mine near Loznica, 142 km (88 miles) southwest of the capital.

Once it reaches full capacity, the mine is expected to produce 58,000 tonnes of refined battery-grade lithium carbonate per year. That would make it Europe’s biggest lithium mine in terms of production, Rio said.

In the village of Korenita, dairy farmer Kapetanovic said the mine, if opened, could leave him without income. Part of his land where he grows crop to feed his animals will be turned into a dump for mining waste, known as tailings, with compensation from the company.

LITHIUM IS CENTRAL TO THE EUROPEAN UNION’S PLANS TO SECURE AN ENTIRE SUPPLY CHAIN OF BATTERY MINERALS AND MATERIALS AS THE USE OF ELECTRIC VEHICLES INCREASES

Other areas of his land, his house and a cattle shed will be outside the mine, leaving Kapetanovic worried about exposure to possible pollution.

“Who would want to buy products made on the outskirts of the mine?” said Kapetanovic, who produces 10 tonnes (22,000 lb) of meat and 90,000 litres (23,775 gallons) of milk per year, making him one of the bigger producers in the Loznica area.

Rio Tinto Serbia CEO Vesna Prodanovic said the Anglo-Australian miner would meet all European Union and Serbian environmental regulations, including on the treatment of wastewater.

“There’s simply no way for the construction to start without securing licences (and) if all those (EU standards) are not adhered to,” she said in an interview.

“We take into account precipitation levels, prescribed dust levels. We take into consideration everything there is in the field. We are making all studies and tests to get clear data about what is the current situation in the area.”

One study, commissioned by Rio on the mine’s environmental impact, concluded the mine should not be built as it will cause “irredeemable damage to the biosphere”, an abstract obtained by Reuters found.

“The implementation of the planned activities, especially the disposal of industrial waste, will significantly impair biodiversity in the entire area of the planned works,” the study by Belgrade University’s Faculty of Biology said.

“In … primary zones of (the mine’s) influence, there will be complete and direct destruction of habitats with the disappearance of all organisms that inhabit them.”

Rio said the biodiversity study was part of a wider feasibility study and it would conduct further research to “support the most advanced and most expensive solutions in nature protection, which would minimise the impact”.

Economic boost

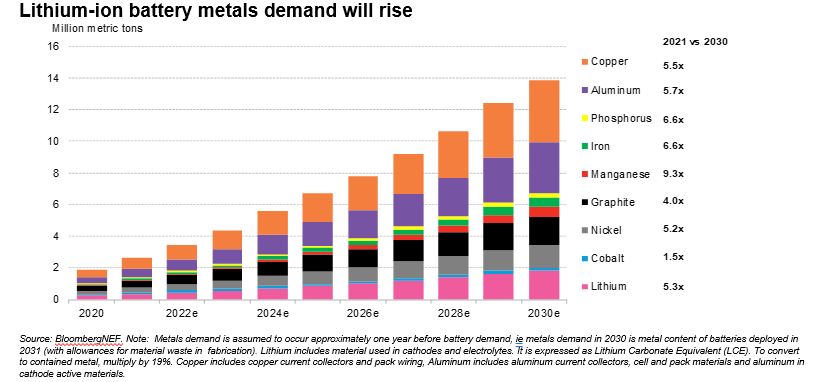

Lithium is central to the European Union’s plans to secure an entire supply chain of battery minerals and materials as the use of electric vehicles increases.

Serbia, which sits on the world’s 11th largest lithium reserves, is working its way through the accession process to join the EU.

For its own economy, the Jadar project is one of Serbia’s biggest foreign investments to date and could help to tackle rising unemployment in the Balkan country.

Rio said the project would create about 2,100 construction jobs and inject approximately 200 million euros ($235.32 million) per year into the domestic supply chain.

Energy minister Zorana Mihajlovic told Reuters that Serbia aimed, like the EU, to secure the entire production chain, including a potential battery plant and an electric vehicle plant.

Rio’s Serbia CEO said the company’s studies estimated the project would add 1 percentage point to Serbia’s $51.4 billion annual GDP. It would also boost Loznica’s municipal budget by 60-70% annually, she said.

In June, Serbian President Aleksandar Vucic, who is under fire for supporting the project, said a referendum would be held to allow people to decide whether it should go ahead.

The absence of further details on the referendum has worried opponents. In July, Loznica municipal assembly, which is dominated by Vucic’s Serbian Progressive Party and its allies, formally gave a green light for mine construction by approving a new municipal plan for land allocation.

Contacted by Reuters, the president’s office had no immediate comment.

Rio has bought nearly half of the land required for the mine, which will be spread over roughly 387 hectares.

Some $100 million of Rio’s investment has been earmarked for environmental protection, but activists say that is insufficient to compensate for potential damage.

One major concern for environmentalists is Rio’s plan to put

waste dumps in the Korenita and Jadar rivers valley, an area prone to flash flooding.

In 2014, Korenita river flooding caused a closed mine’s tailings dam to overflow, spilling toxic waste onto agricultural land.

Rio Tinto said it planned to convert the liquid waste into “dry cakes” to make it easier and safer to store and is planning for once-in-a-millennium floods in its construction.

($1 = 0.8499 euros)

(By Ivana Sekularac and Aleksandar Vasovic; Editing by Amran Abocar and Barbara Lewis)

SQM told to resubmit compliance plan as lithium scrutiny grows

Bloomberg News | August 26, 2021 |

Dried up brine pool on the Atacama salt flats, northern Chile, property of SQM the world’s second largest lithium producer. (Image courtesy of Ferrando | Flickr.)

SQM has been asked to resubmit a compliance plan for extracting brine from a salt flat in northern Chile, a process on which its lithium expansion plans depend.

The world’s no. 2 producer of the battery metal has 15 business days to address technical observations related to the impact of removing the solution from the Atacama salt pan and its system for monitoring pumping levels, environmental agency SMA said in a document dated August 19.

The process relates to charges that SQM had overdrawn brine, which led to a $25 million compliance plan that was approved by the SMA in 2019 but then blocked by a court in a win for indigenous and environmental activists. The SMA’s resolution last week includes observations from the Toconao community and grants a request by the Socaire community to also be party to the sanctioning process, said Cristobal De La Maza, who heads the agency.

While probably just a minor setback in a years-long process, the SMA’s requests underscore heightening scrutiny of the environmental and social impact of producing materials needed for the clean-energy transition.

SQM has laid out plans to reduce its use of fresh water and brine pumping rates even as it expands output to cater to an expected tripling of demand in a rechargeable battery boom.

“We received comments from the authority on the presentation we made last October, so now it’s up to us to deliver the proposal with the requested improvements,” said the Santiago-based company formally known as Soc. Quimica & Minera de Chile SA.

(By James Attwood, with assistance from Eduardo Thomson