Quantum of solace: even physicists are still scratching their heads

Readers respond to an editorial about understanding quantum theory and defining the laws of physics

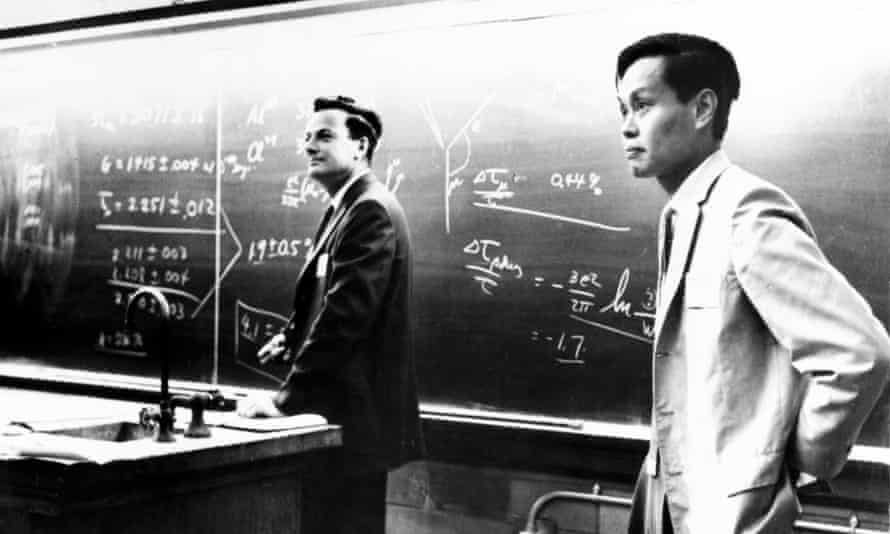

Your editorial on quantum physics (30 August) starts with a quote from Richard Feynman – “nobody understands quantum mechanics” – and then says “that is no longer true”. One of us (Norman Dombey) was taught quantum theory by Feynman at Caltech; the other (John Charap) was taught by Paul Dirac at Cambridge. Quantum theory was devised by several physicists including Dirac, Erwin Schrödinger and Werner Heisenberg in the 1920s and 1930s, and Dirac made their work relativistic.

It is absurd to say that quantum mechanics is now understood whereas it was not 50 years ago. There have of course been advances in our understanding of quantum phenomena, but the conceptual framework of quantum physics remains as it was. The examples you give of nuclear plants, medical scans and lasers involve straightforward applications of quantum mechanics that were understood 50 years ago.

The major advance in the understanding of quantum physics in this period is a theorem of John Bell from Cern, which states that quantum physics cannot be local – that is to say that it permits phenomena to be correlated at arbitrarily large distances from each other. This has now been demonstrated experimentally and leads to what is known as quantum entanglement, which is important in the development of quantum computers. But even these ideas were discussed by Albert Einstein and coworkers in 1935.

The editorial goes on to say that “subatomic particles do not travel a path that can be plotted”. If that were so, how can protons travel at the Large Hadron Collider at Cern and hit their target so that experiments can be performed?

We agree with Phillip Ball, who wrote in Physics World that “quantum mechanics is still, a century after it was conceived, making us scratch our heads”. There are many speculative proposals in contention but none have consensus support.

John Charap Emeritus professor of theoretical physics, Queen Mary University of London; Norman Dombey Emeritus professor of theoretical physics, University of Sussex

Whoever wrote this editorial does not understand what Richard Feynman meant when he said that nobody really understands quantum mechanics. Being able to make a smartphone, a nuclear weapon or an MRI machine does not require understanding quantum mechanics in the sense he meant – it requires the physical chops to set up the equations and the mathematical chops to find or approximate solutions to them. Any competent physicist has been able to do those calculations for at least 50 years. What Feynman meant was that, for quantum mechanics, nobody has the kind of intuitive understanding of what is actually happening in the world that physicists seek to gain. All we can do is shut up and calculate, or get lost in a never-never land of competing but empirically equivalent interpretations.

Perhaps Carlo Rovelli’s relational interpretation of quantum mechanics provides the intuitive understanding we’d like to have, although I rather doubt it, and I don’t believe Rovelli claims it does. Perhaps it even makes testable predictions that could distinguish it from other interpretations and thus is science rather than philosophy (I have no objection to philosophy).

It is just as true today as it was when Feynman said it in 1964 that nobody (or almost nobody) really understands quantum mechanics. And now, as then, a competent physicist does not need the kind of understanding Feynman meant to use the theory. Indeed, there’s no strong reason to believe that the human mind should be equipped to understand it at all. To quote another famous physicist: this editorial is not even wrong.

Tim Bradshaw

North Tawton, Devon

While it’s highly probable that the position of my copy of Helgoland is where I shelved it, I won’t know whether its pages are printed or blank until I get round to reading it. However, from Prof Rovelli’s previous work, I agree “the fundamental truth is that it’s impossible to know everything about the world”, including whether this letter will be published and in what world.

Harold Mozley

York

Given your editorial on quantum physics, is the strapline now “facts are relatively sacred” or “facts are sacred but relative”?

Simon Taylor

Warwick, Warwickshire