It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Sunday, September 12, 2021

Fri, September 10, 2021,

By Jonnelle Marte, Howard Schneider and Ann Saphir

Sept 10 (Reuters) - Media reports this week that two of the Federal Reserve's 12 regional bank presidents were active traders has some of the central bank's most vocal critics questioning the rules that allowed them to engage in the transactions in the first place.

Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren made frequent or substantial trades in 2020, the Wall Street Journal and Bloomberg reported earlier this week. The trades occurred during a year in which the central bank took major actions to shore up the economy and swooning financial markets after they were broadsided by the coronavirus pandemic.

While the trades were permitted under the Fed system's ethics guidelines, their disclosure prompted some observers and a top lawmaker to flag possible conflicts of interest.

"Forget about the individual trades," said Benjamin Dulchin, director of the Fed Up Campaign at the Center for Popular Democracy, a group that advocates for the Fed to focus more on the needs of American workers. "The issue is that a president of a Fed bank - one of the handful of people who ... set our country's monetary policy - so clearly has his personal interests aligned with the success of our biggest corporations."

On Thursday, Kaplan and Rosengren said in separate statements that their trades complied with the Fed's ethics rules. They also said they would change their investment practices to address "even the appearance of any conflict of interest" and sell all individual stock holdings by Sept. 30, moving the proceeds into cash or passively invested index funds. Both Kaplan and Rosengren said they would not trade on those accounts as long as they are serving as Fed presidents.

The changes came after they both faced criticism for transactions made last year, dealings that were first reported by the Wall Street Journal https://www.wsj.com/articles/dallas-feds-robert-kaplan-was-active-buyer-and-seller-of-stocks-last-year-11631044094 this week. Each has since made his annual financial disclosures public.

The documents showed that Kaplan, for instance, bought and sold at least $18 million in individual stocks in 2020, mostly tech stocks like Apple Inc and Amazon.com Inc and energy stocks such as Marathon Petroleum Corp. All of those transactions were reviewed by the Dallas Fed general counsel, said Dallas Fed spokesman James Hoard.

Rosengren, who has publicly shared concerns about potential over-valuation risks in the commercial real estate sector, held stakes in four real estate investment trusts and made other investment trades, as highlighted by a Bloomberg https://www.bloomberg.com/news/articles/2021-09-08/fed-official-who-warned-on-real-estate-was-active-reit-trader?sref=HFh69AJb report.

"Regrettably, the appearance of such permissible personal investment decisions has generated some questions, so I have made the decision to divest these assets to underscore my commitment to Fed ethics guidelines," Rosengren said in a statement on Thursday.

CALLS FOR GREATER OVERSIGHT

Fed officials are subject to specific restrictions, such as not trading during the “blackout period” around each Fed meeting when policy-sensitive information is distributed, not holding stocks in banks or mutual funds concentrated in the financial sector, and not reselling securities within 30 days of purchase.

But the Code of Conduct has broader language as well.

“An employee should avoid any situation that might give rise to an actual conflict of interest or even the appearance of a conflict of interest,” the code states. Those with access to market-moving information “should avoid engaging in any financial transaction the timing of which could create the appearance of acting on inside information concerning Federal Reserve deliberations and actions.”

The financial disclosures did not look strikingly different from prior years. But 2020 was a signature year for the Fed in which, by its own account, it crossed "red lines" to ensure financial markets continued to function. In a rapid-fire response to the then-unfolding pandemic, Fed policymakers in March 2020 slashed interest rates to near zero and rolled out programs meant to keep the markets for Treasury bonds, mortgage-backed securities and corporate bonds working smoothly.

The Fed's fast action was praised for helping to stave off a larger financial market collapse, an achievement Fed officials say helped to minimize the hit to the economy. But some criticized the Fed's moves for helping to boost asset prices while not doing enough to support small businesses and households on Main Street.

Some Fed-watchers say it may be time for the rules to be reviewed.

"This is more evidence that the oversight of the Federal Reserve regional bank presidents is broken," said Aaron Klein, a senior fellow at the Brookings Institution. "I don’t know if this is a failure to enforce the rules, or a failure of the rules."

U.S. Senator Elizabeth Warren, long one of Washington's most vocal critics of the central bank's approach to financial regulation, said Fed officials should not be allowed to trade.

"I've said it before and will say it again: Members of Congress and senior government officials should not be allowed to trade or own stocks," Warren posted on Twitter https://twitter.com/SenWarren/status/1436370981669462019 on Friday. "Period." (Reporting by Jonnelle Marte in New York, Howard Schneider in Washington and Ann Saphir in Berkeley, Calif. Editing by Dan Burns and Matthew Lewis)

Cayman Fund Ensnared in Fraud Case Files for Bankruptcy in U.S.

Robert Burnson

Fri, September 10, 2021,

(Bloomberg) -- A Cayman Island mutual fund whose manager was charged in a $100 million bait-and-switch scheme filed for Chapter 15 bankruptcy protection in the U.S. to protect its assets from lawsuits by disgruntled investors.Representatives of the so-called Income Collecting 1-3 Months T-Bills Mutual Fund asked a federal bankruptcy judge in New York on Friday to recognize their efforts to liquidate the company, which they said would include an attempt to pay back investors. Recognition of the foreign liquidation would put a hold on any lawsuits against the fund.The fund’s manager, Ofer Abarbanel, was arrested June 24 in Los Angeles and charged with securities and wire fraud. U.S. prosecutors said the California man told an investor group that its money would be primarily placed in short-term U.S. Treasury securities but instead put it in funds he controlled or was closely associated with.Two days before Abarbanel’s arrest, the fund was placed in liquidation in the Cayman Islands on the vote of its sole shareholder, NY Alaska ETF Management LP, according to court records.

The fund’s representatives said in court papers that the fund has “a particular need” for recognition of its liquidation efforts, given the Securities and Exchange Commission’s findings of “potential significant fraud against the fund and its creditors.”According to the SEC, the fund “had $106 million in liabilities against possibly only approximately $88 million in assets,” the lawyers said. “Based upon these serious allegations of fraud, it is likely that other parties may assert litigation against the fund. A stay of any pending and potential future proceedings will be important to the (representatives’) investigation and efforts to collect assets and wind down the fund.”

Brooke DiPalma

·Reporter, Booking Producer

Fri, September 10, 2021,

The competition among purveyors of plant-based protein is heating up the fast food industry with a frenzy that resembles the increasingly hot chicken sandwich wars.

On Thursday, McDonald's (MCD) announced its plan to test its first ever plant-based burger, the McPlant, it created with Beyond Meat (BYND) in a strategic three-year partnership. For now, however, the Sept. 29 launch is limited to 10 restaurants in the United Kingdom and Ireland. On October 13th, it will expand to 250 locations before rolling out more broadly both the United Kingdom and Ireland by 2022.

After three years of research and development, the Golden Arches cooked up plant-based patty served on a vegan sesame bun with vegan cheese that's based on pea protein and a new vegan sauce. It is served with traditional toppers like onions, pickles, lettuce, tomato, ketchup and mustard.

McDonald's also made it clear that it will be cooked separately from other burgers and sandwiches using dedicated utensils — perhaps taking note of the trouble that embroiled Burger King (QSR), which introduced its plant-based Impossible Whopper in 2019.

The chain was sued by a vegan customer who claimed the restaurant chain was taking part in “false and misleading business practices" when advertising its plant-based entree. Burger King later won the lawsuit in 2020 after a federal judge dismissed the lawsuit.

Plant-based market: a $14B opportunity

(Courtesy: McDonald’s)

McDonald's pilot, and the mushrooming fake meat options in the notoriously meat-friendly fast food industry, are the latest sign of how the sector is adopting itself to a more health-conscious demographic. According to a new report from food intelligence firm Tastewise, menu mentions of plant-based meat spiked by a staggering 1,320% in the U.S. compared to pre-pandemic levels in early 2020.

Fake meat's march into fast food chains shows no signs of slowing down. Burger King's Impossible Burger was followed by Starbucks' June 2020 launch of the Impossible breakfast sandwich — which was then followed by Dunkin's Beyond Meat breakfast sandwich.

And 2021 has become the dawn of other plant-based entrees, like Morningstar Farms (K) to introduce the Southwest Veggie Power Breakfast Sandwich and Wendy's Spicy Black Bean Burger.

"This is one of those rare moments in history where the business opportunity and the betterment of the world align," Alon Chen, Co-Founder and CEO of Tastewise told Yahoo Finance in an email. "Plant-based is both the right thing to do for the world, and for exponential growth over the next decade."

However, it's not just vegans being lured to meatless foods — evidence suggests there are many others who are making the shift for different reasons.

"Consumers from all lifestyles are expecting brands to address concerns about climate change, sustainability, and personal health," Chen said.

"This shift has created a $14B opportunity over the next decade, where the question is not 'if' every foodservice business must offer plant-based alternatives, but 'when' and which technology will prevail," he added.

Tastewise data shows the playing field is still tilted in favor of traditional meat, with plant-based options — at least for now — comprising a slim portion of menu options. However, many think there's a major opportunity for food producers: Right now, the total plant-based market is worth nearly $7 billion dollars in the U.S., with plant-based meat in particular lending just $1.4 billion dollars of that total.

(Courtesy: Yahoo Finance, sourced from Tastewise Report)

While opportunity exists within this market, 54% of Americans have already tried the meatless options at popular fast-food chains, according to a recent survey by Piplsay. Of that number, 70 percent said that they enjoyed it.

With Burger King being an early entrant in the competition, most have tried plant-based meat there. According to Piplsay, 41% of consumers have tried BK's meatless entrees, followed by 10% at Starbucks, 10% at Wendy's (WEN), 10% at Subway's, and 8% at Dunkin'. Elsewhere, less then 7% have tried it at other places including Del Taco, Qdoba, Carl's Jr. and others.

And plant-based chicken options are also on the rise. Recently Panda Express collaborated with Beyond Meat to bring Beyond the Original Orange Chicken to its menus, and Shake Shack (SHAK) offered a limited-edition vegan menu item.

Lastly, fake seafood is also making its way onto menus and bubbling up on the Internet — up 90.7% in social interest according to Tastewise. Recently, Long John Silver’s and Whole Foods have leaned in on the fish-less category.

Brooke DiPalma is a reporter for Yahoo Finance. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Biden's vaccine mandate:

Even Trump-friendly companies

seem comfortable with COVID

restrictions

On Thursday afternoon, President Joe Biden announced that U.S. businesses with over 100 employees will soon need to ensure that their employees are either fully vaccinated or tested weekly.

Within hours, the reaction in the political class was intense. The hashtag #wewillnotcomply was trending on Twitter, Biden was called an authoritarian and a fascist, and Republican governors and the RNC threatened legal action.

Brooke Rollins, the CEO of Trump-aligned America First Policy Institute, was one of many to try to bring in the business community. “Businesses across the country should refuse to endorse this egregious violation of our most fundamental rights,” he said in a statement. JD Vance, a Republican candidate for Senate in Ohio and the author of "Hillbilly Elegy," told the business community, "DO NOT COMPLY."

By Friday morning, President Biden still expressed confidence about his new mandate. When asked about the threats of lawsuits, the president replied, “Have at it.”

For their part, real-life businesses — including those aligned with Trump — have had a muted reaction so far to the new guidelines.

We ‘will comply’

During his speech on Thursday, Biden noted that United Airlines (UAL), Disney (DIS), and Tyson Foods (TSN) were already complying with the forthcoming rules.

Then he pointedly added “even Fox News” to that group already playing by the new rules.

Indeed, memos from the company from July and another in August lay out how the company has had detailed systems in place for weeks that likely ensure virtually all their employees will be either vaccinated or regularly tested

In contrast to the tone of much of their coverage late Thursday and Friday, Fox’s actual policy remains and shows no signs of changing. Virtually all of Fox News employees need to either provide proof of a vaccination or be tested regularly. Employees must report their vaccination status and there is testing on-site for employees in the New York office. The company even has a mask mandate in confined spaces like control rooms.

Another conservative-leaning channel, Newsmax, also offered up critical coverage of the new rule but appears to be willing to comply with it.

The station is run by Chris Ruddy, who is a longtime friend of Trump's and a member of his Mar-a-Lago Club. His channel has long offered a platform for vaccine criticism including one notorious example of a host saying vaccines were “against nature.”

A statement to Yahoo Finance Friday said that “Newsmax has encouraged its readers, viewers and employees to get the COVID vaccine.” The statement added: “Newsmax has and will comply with all employee health requirements as set forth by the government.”

There has been at least one example of a pro-Trump outlet stating it won't comply with the Biden mandate. Daily Wire, a conservative website, announced that it will resist the vaccine requirement. "We'll use every tool at our disposal including legal action to resist," the site's CEO said in a video.

Other large companies in the Trump immediate orbit have likewise more often chosen to comply with health restrictions instead of defying public health guidelines.

Trump’s own hotels offer their guests extensive assurances online about their compliance with COVID regulations. Hotels like the Washington, DC location currently have an indoor mask mandate.

Ben Werschkul is a writer and producer for Yahoo Finance in Washington, DC.

President Biden's COVID-19 vaccine mandate: What top CEOs are saying about it

Editor OilPrice.com

Sat, September 11, 2021

After recent announcements of new developments in Iraq by several oil majors, the country appears to be rebounding strongly from the coronavirus pandemic, looking to maintain its reputation for oil as well as establish itself as a renewable energy innovator.

Last week, French supermajor Total announced it would be constructing four large energy projects in the south of Iraq in a $27 million deal, expected to commence before the end of 2021.

The deal includes investments in improved crude oil recovery, a gas processing plant, enhancing the Iraqi gas market through greater production more competitive prices, and a solar power plant project. The funding will allow Iraq to boost crude output in its Artawi oilfield from 85,000 bpd now to 210,000 bpd as well as achieving gas production levels of 300 million cubic feet of gas per day.

But this is just the latest in several optimistic achievements in Iraq’s oil and gas industry in 2021, following months of developments after the worldwide oil slump in 2020. In August, Iraq announced that its oil exports had risen to 3.054 million bpd from 2.9 million bpd in July. This reflects the increase in global demand for oil experienced throughout the summer months, with Iraq’s August oil revenue reaching $6.5 billion and an average barrel price of $69.

This comes after the country finally returned to production levels not seen since April 2020 in July. Iraq produced 4.18 million bpd of crude in July, demonstrating an increase of around 150,000 bpd compared to June, above the agreed-upon OPEC production cut-off point. Overall, Iraq produces the highest quantity of oil of any OPEC country apart from Saudi Arabia.

This is an important turnaround for Iraq’s oil-dependent economy, which was hit particularly hard during the coronavirus pandemic, as oil demand dropped, and prices plummeted leaving Iraq’s economy in tatters. After several months of OPEC+ production cuts, Iraq is finally able to return to its pre-pandemic output, helping to support both jobs and the national economy.

Also in August, BP and PetroChina announced a joint venture to operate Iraq’s giant Rumaila oilfield. The oilfield will be run by state-owned Basra Energy Co. Ltd., with access to funding from BP. While the oilfield will continue to emit greenhouse gasses, BP hopes that the joint venture will provide the capital needed to invest more heavily in other low-carbon projects.

British supermajor BP has worked hard in recent months to shift public opinion of its practices, investing heavily in the development of renewable energy projects, with the aim of achieving 50 gigawatts of renewable energy in its portfolio by 2030, as well as maintaining its strong oil and gas portfolio. However, its operations in Rumaila have repeatedly caused the company to come under fire as Iraq is one of the biggest methane emitters globally.

BP has been developing the major oilfield since 2010, with new operations under the joint venture planned to run until at least 2034. Rumaila is one of the world’s biggest oilfields, producing over 1.4 million bpd.

This was positive news for Iraq, following the previous withdrawal of other international supermajors from the country due to political instability and the difficulties in foreign company terms within the country’s oil industry. Until recently, BP was expected to withdraw from Rumaila as it sought more carbon-friendly oil projects. However, the government has recently improved operating conditions for foreign oil companies in a bid to keep them in the market.

Changing regulations on foreign investment in the country’s oil sector comes as part of the oil ministry’s bid to raise oil production to an 8 million bpd of oil average by 2027, almost doubling its current output.

In line with this target, the Iraqi government has already provided several foreign oil firms with operating licenses to drill new wells as well as recovering existing ones in the areas of Kirkuk, Baghdad, Basra, Maysan and Nasiriyah; BP and Eni being two of the major international firms to pick up contracts. Iraq is also in talks with China’s CNOOC over the potential recovery of 150 wells in the Bazarkan field at an estimated cost of $160 million dollars. Several of these wells were abandoned during the pandemic due to the lack of demand. However, many are still viable and could go a long way to supporting Iraq’s 2027 oil production target.

As well as investing in the future of its oil and gas industry, Iraq is also showing its openness to new renewable energy developments. This September, Iraq’s finance minister made a call for OPEC to greatly consider the movement away from fossil fuels to more sustainable renewable energy projects.

Reiterating this message, deputy prime minister of Iraq, Ali Allawi, wrote to media outlet The Guardian urging oil producers to pursue “an economic renewal focused on environmentally sound policies and technologies”, including solar and nuclear power.

In recent months, Iraq has announced several agreements with international oil and gas players for the development of renewable projects in the coming years. As well as with Total, Iraq has also signed an agreement with PowerChina ink for the development of solar energy plants expected to produce as much as 2 GW of power. This would help the country to decrease its dependence on Iranian electricity.

While Iraq looks far from prepared to back away from its oil and gas engagements, with plans to develop the sector further over the next decade, it is also looking to lead OPEC member states on renewable energy as it works with foreign supermajors on the development of solar and other alternative energy projects.

By Felicity Bradstock for Oilprice.com

Vlad Savov and Josh Eidelson

Fri, September 10, 2021

(Bloomberg) -- Apple informed Gjovik that it’s terminating her employment for violating policies including the disclosure of confidential product-related information, according to documents that she supplied to Bloomberg News.

“I’m really disappointed because I love Apple,” she said in an interview Friday. “It’s incredibly frustrating that I knew this was coming since March when I started raising concerns about work conditions.”

Gjovik, a senior engineering program manager at the company, filed an Aug. 26 NLRB complaint, which alleged harassment by a manager, a retaliatory investigation and forced paid administrative leave. Her situation began when she voiced fears about whether pollution had made her office a dangerous place to work.

Apple said Thursday that it wouldn’t discuss any individual employee matters, out of respect for the privacy of the people involved.

“We are and have always been deeply committed to creating and maintaining a positive and inclusive workplace,” the company said. “We take all concerns seriously and we thoroughly investigate whenever a concern is raised.”

Gjovik also has filed complaints with the U.S. Occupational Safety and Health Administration, the U.S. Equal Employment Opportunity Commission and California’s Department of Fair Employment and Housing, according to documents she provided. The California and U.S. civil rights agencies each issued a right-to-sue notice, giving Gjovik the option to file a discrimination lawsuit in state or federal court.

In her fair employment complaint, Gjovik alleged that she was humiliated, harassed, and discriminated and retaliated against by management, and that Apple employee relations “asked I not share my concerns with other employees” rather than addressing them.

“I have to think they know that I’m not going to let it go,” she said in the interview. “I still am very much devoted to holding them accountable for this and trying to make things better for my colleagues and other people in workplaces like this.”

(Updates with Gjovik’s right-to-sue notice in final two paragraphs.)

Olga Kharif

Fri, September 10, 2021,

(Bloomberg) -- A couple of Virginia public pension funds that first dipped their toes into the world of digital assets by investing in venture capital two years ago are at it again, and this time they are making a more direct bet on cryptocurrencies.

The Fairfax County Police Officers Retirement System and Fairfax County Employees’ Retirement System are planning to invest, pending board approvals, a total of $50 million in Parataxis Capital Management LLC’s main fund, which buys various digital tokens and cryptocurrency derivatives.

The outlays come on the heels of the Fairfax funds -- which together manage about $7.15 billion -- investing several times in Morgan Creek Asset Management funds, and, earlier this year, in crypto venture firm Blockchain Capital. While some of these investments ended up going into coins like Bitcoin, the majority was invested into technology startups, so Fairfax considered them venture-capital investments. Parataxis, with its focus on actual coins, is different.

“We think that there’s going to continue to be volatility in crypto, and this is going to be good for value traders,” Katherine Molnar, chief investment officer for the police officers retirement fund, said in an interview with Bloomberg News. “It’s an area that’s going to grow in adoption and interest. We think that it’s inefficient enough, so we think there are some alpha opportunities to take advantage of.”

While many pension funds and endowments are exploring cryptocurrencies, few besides Fairfax have publicly announced they are jumping in. Regulatory uncertainty and high volatility of the coins have been partly responsible for the hesitancy.

But that same volatility can lead to outsized returns, which have been one reason for Fairfax’s expanded investment. Molnar’s $1.95 billion police retirement fund was planning for 2% exposure to crypto via Morgan Creek and Blockchain Capital, but at the end of June crypto accounted for 7% of assets, due to appreciation, she said. Although Molnar couldn’t discuss exact appreciation, crypto “was not an insignificant contributor to performance” in the second quarter, she said.

While in recent months some companies such as MicroStrategy Inc. have begun investing their corporate treasuries into Bitcoin, Fairfax doesn’t want to invest into coins directly, Molnar said -- partly because there are still too few data points to draw conclusions from on whether Bitcoin can be likened to gold, for example, she said.

“Three years ago we weren’t comfortable making a bet on which cryptocurrency will rise to the top,” she said. “And I am not sure we are comfortable yet doing that today.”

Parataxis was started in 2019 by Edward Chin, previously an investment banker at Michael Novogratz’s Galaxy Digital Holdings, and by Thejas Nalval, a former portfolio manager with digital-asset hedge fund LedgerPrime and head of asset management at the Element Group. Parataxis has about $55 million in assets under management, Chin said. The two Parataxis funds invest in everything from Bitcoin to derivatives to DeFi coins such as MakerDAO. It plans to launch another fund.

“This is our first pension fund,” Chin said in an interview. “We are in conversations with a couple more, and a couple of endowments as well. It’s clear that people are trying to get exposure.”

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

Updated 19:44, 12-Sep-2021

CGTN

Director General of the IAEA Rafael Grossi (C) speaks with Deputy Head of the Atomic Energy Organization of Iran Behrouz Kamalvandi (L) upon his arrival at Tehran Imam Khomeini International Airport, Iran, September 11, 2021. /CFP

Iran is to allow the United Nations (UN) nuclear watchdog to service monitoring cameras at Iranian nuclear sites after talks on Sunday with International Atomic Energy Agency (IAEA) head Rafael Grossi, according to the head of Iran's atomic energy body and a joint statement.

"We agreed over the replacement of the memory cards of the agency's cameras," Mohammad Eslami, who heads the Atomic Energy Organization of Iran (AEOI), was quoted as saying by state media.

Grossi traveled to Iran Saturday for talks and met Eslami on Sunday.

"We had constructive negotiations. There are essentially technical issues between the two sides," said Eslami, according to the Iranian Mehr News Agency.

"IAEA's inspectors are permitted to service the identified equipment and replace their storage media which will be kept under the joint IAEA and AEOI seals in the Islamic Republic of Iran," the nuclear bodies said in a joint statement. "The way and the timing are agreed by the two sides."

"The two sides decided to maintain their mutual interactions and meetings at relevant levels," the statement said, adding Grossi planned another visit to Tehran "in the near future."

Grossi's visit comes after talks between major world powers to save Iran's nuclear deal have become deadlocked.

The 2015 deal promised Tehran sanctions relief in return for curbs on its nuclear program. But the landmark agreement was torpedoed in 2018 by then U.S. President Donald Trump's unilateral decision to withdraw Washington from it and impose a punishing sanctions regime.

A law passed by Iran's parliament in December 2020 mandated the Iranian government to stop implementing the IAEA's Additional Protocol if U.S. sanctions were not lifted by February 23.

Iran and the IAEA reached a three-month temporary agreement on February 23 for the former to store video records of cameras monitoring its nuclear sites, and deliver those records to the IAEA only if and after U.S. sanctions on Iran would be lifted. Iran extended the agreement for one more month on May 23.

(With input from agencies)

Updated 17:34, 12-Sep-2021

CGTN

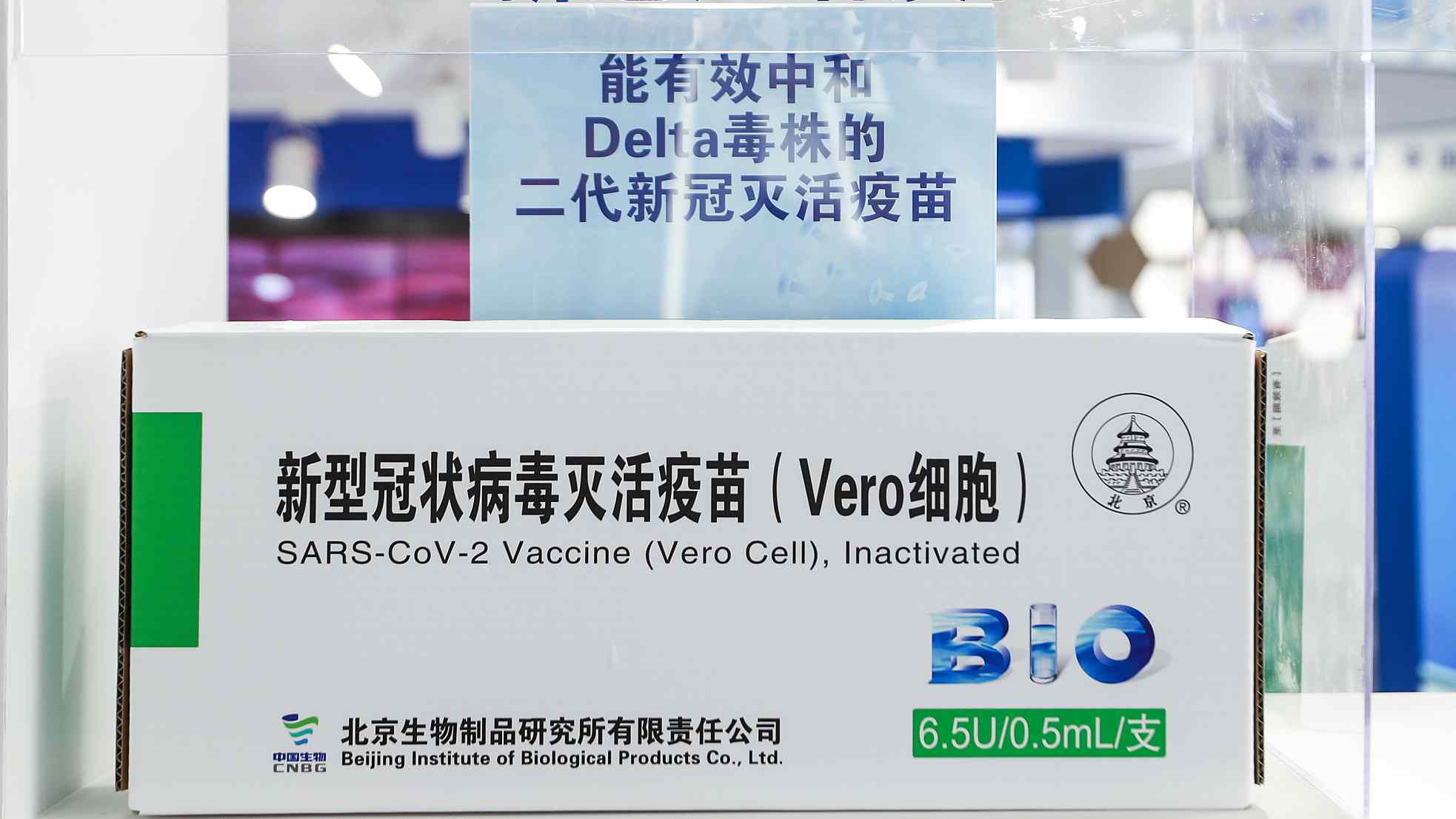

A box of upgraded inactivated COVID-19 vaccine targeting the Delta variant is displayed at the 2021 China International Fair for Trade in Services in Beijing, September 6, 2021. /CFP

Chinese drugmaker Sinopharm said on Friday that its newly developed vaccines targeting the Delta and Beta variants of the novel coronavirus are very effective.

Zhang Yuntao, chief scientist of China National Biotec Group (CNBG), a subsidiary of Sinopharm, made the remarks during an aired interview with China Media Group.

The company debuted four upgraded vaccines targeting the now widespread COVID-19 Delta and Beta variants during the 2021 China International Fair for Trade in Services (CIFTIS) held in Beijing from September 2 to 7.

The four second-generation COVID-19 vaccines belong to three types: inactivated, recombinant protein and mRNA.

Among them, the broad-spectrum recombinant protein vaccine has completed phase-I and phase-II clinical trials, Zhu Jingjin, Party chief of CNBG, said during the CIFTIS.

The two new inactivated vaccines are the upgraded versions of the two vaccines developed by CNBG's subsidiary Beijing Institute of Biological Products(BIBP) and the Wuhan Institute of Biological Products(WIBP) respectively, which have been on the market since the beginning of this year.

CNBG is seeking approval from China's drug regulator for the clinical trials of the upgraded BIBP and WIBP inactivated vaccines, Zhang said. Since China has controlled the COVID-19 epidemic, and there are not many cases in the country, large-scale clinical trials of the vaccines will be conducted in overseas countries, he said.

The company will speed up the clinical trials of the vaccines in other countries to test their effectiveness against COVID-19 variants once they get approval, he said, adding that the company hopes to obtain the results of the trials by mid-2022 and promote the availability of the vaccines on the market afterward.

The existing inactivated vaccines developed by Sinopharm and Sinovac Biotech are still effective against the Delta and Beta variants, he said, citing lab experiment results and real-world data in south China's Guangdong Province and a dozen of countries, including Sri Lanka and Mongolia.

For the time being, those who need a boost dose will still get existing vaccines, he said.

But the development of upgraded vaccines targeting COVID-19 variants is to get people better prepared in the future, he said.

By Gao Yun

Daishan No.4 Wind Farm in in Zhoushan City, east China's Zhejiang Province.

Among China's arduous efforts to honor its commitment to peaking carbon dioxide (CO2) emissions by 2030 and achieving carbon neutrality by 2060, developing offshore wind power, one of the key technologies to meet the goals, is of great significance.

According to a report released by the Global Wind Energy Council on Thursday, China led the world in new offshore wind installations in 2020, for the third year in a row.

The global offshore wind industry installed 6.1 gigawatts (GW) of capacity last year, while China added over 3 GW last year, accounting for half of the global tally, said the council's flagship report titled "Global Offshore Wind Report 2021." The Netherlands with nearly 1.5 GW and Belgium with 706 megawatts (MW) were the next two countries to follow.

By the end of 2020, eight coastal provinces in China had offshore wind power projects connected to the grid, contributing to an installed capacity of about 9 GW, making China the world's second for offshore wind power installations after the UK.

Hailing offshore wind with "the biggest growth potential of any renewable energy technology," the report said a total of 35 GW capacity has been installed worldwide currently, saving 62.5 million tonnes of CO2 emissions.

Guodian Zhoushan Putuo No. 6 Offshore Wind Farm in Zhoushan City, east China's Zhejiang Province, June 5, 2018. /CFP

China, with continuous breakthroughs in relevant equipment and technologies as well as decreasing costs, has stepped on a rapid development track for the sector.

In east China's Zhejiang Province, an offshore wind farm in the Zhoushan City initiated the province's offshore wind power deployment.

The construction of the wind farm, named Guodian Zhoushan Putuo No. 6 Offshore Wind Farm, started in 2017.

After over two years' of construction, all the 63 wind turbines went into operation, with a capability of generating over 7 million kilowatt-hours of electricity per year for nearly 350,000 households, equivalent to the power created by burning 240,000 tonnes of standard coal, cutting about 700,000 tonnes of carbon emissions annually.

With abundant wind power resources, Zhoushan has also harbored several other offshore wind power farms.

Located near the Zhoushan Islands is one called Daishan No. 4 Wind Farm, which was commissioned and connected to the grid in May this year.

It will form the province's largest group of offshore wind farms with another two wind farms namely Shengsi No. 5 and No. 6, bringing the total wind power generation in the area to 1.44 billion kilowatt-hours once fully operational.

Owned by the China General Nuclear Power Corporation, the Daishan No. 4 Wind Farm comprises 54 wind turbines, with a total installed capacity of 234 MW. It is able to supply 618 million kilowatt-hours of electricity to the power grid a year.

"Compared with a coal-powered plant of the same size, the wind farm helps cut 170,000 tonnes of coal and reduce 470,000 tonnes of harmful gas and dust," Zhao Wen, director of the Daishan wind farm, told CGTN in an interview.

The clean energy will be used to support the development of the oil and gas businesses in Zhoushan, which will play a significant role in optimizing local energy structure, saving energy and reducing emissions, said the Zhoushan Municipal Development and Reform Commission.

The offshore wind power sector has been one of the focuses in Zhejiang Province's 14th Five-Year Plan (2021-2025 (FYP)), which plans to add 4.5 GW of offshore wind power during the period with more projects completed.

Zhang Jianhua, director of China's National Energy Administration, said the 14th FYP is the first five-year period and a critical period for the transition to low-carbon energy before hitting peak emissions by 2030.

"By 2030, the share of non-fossil energy in primary energy consumption should reach around 25 percent, and the total installed capacity of wind power and solar energy should reach over 1,200 GW," said Zhang. "These two goals are daunting but we must achieve them."

Stay tuned with CGTN for more in the Tides of Change II series.