Albemarle, union in Chile reach agreement, ending strike

Reuters | September 15, 2021

Brine pools from a Albemarle’s lithium mine.

Albemarle Corp, the world’s top lithium producer, said on Wednesday it had reached a labor contract deal with a union at its Atacama salt flat plant, ending a month-long strike that had inflamed tensions between workers and the company.

The 135-member “Albemarle Salar” union, which comprises about half the workers at its key Salar production plant, went on strike in August after failing to reach a deal with the US-based lithium miner.

The company said in a statement that it had inked a new 36-month contract with the union and that workers would return immediately to the job.

“The operations at the Salar plant today return to normality, with special emphasis on safety of workers while production returns to levels before the strike,” the company said.

Throughout the strike, Albemarle maintained the extended walk-off had not hit its output of lithium from Chile.

The company clarified on Wednesday that the strike had led to a reduction in the pumping of lithium-rich brine at its Salar Plant, where the walk-off took place, but that the labor action had not impacted overall output from its La Negra chemical plant, where brines are processed into battery grade lithium carbonate.

Union representatives did not immediately respond to a request for comment on the agreement.

Albemarle’s Atacama operations in Chile are a vital source of the ultralight white metal used in batteries that power electric vehicles. Competitor SQM operates nearby.

Albemarle, which struck labor deals with its three remaining Chilean guilds earlier this year, said the deal with its Salar union of workers brings closure to this year’s negotiations.

(By Dave Sherwood; Editing by Marguerita Choy)

Codelco reaches labor agreement with union at Salvador division

Reuters | September 15, 2021 | 2:32 pm Latin America Copper

Workers starting a shift at Codelco’s Andina mines. Image from Codelco.

Chile’s state-owned Codelco, the world’s largest copper producer, said on Wednesday it had reached agreement on a labor contract with a union representing workers at its small Salvador division in northern Chile.

The miner and the Benito Tapia Tapia union No. 6 signed a 36-month deal that includes a $5,200 signing bonus as well as production-linked benefits, the company said in a statement.

The company’s final contract offer was approved by 61% of the union workers who voted, Codelco said.

Soaring copper prices this year have handed unions in Chile more leverage than in the recent past, ratcheting up tensions in some labor negotiations, including a prolonged strike at Codelco’s Andina mine near Santiago.

Salvador, an aging deposit that has experienced declining ore grades and low productivity, has embarked on a $1.4 billion upgrade to extend its life.

The division produced 56,300 tonnes of copper in 2020.

(By Dave Sherwood; Editing by Peter Cooney)

Union at Albemarle Atacama plant rejects new contract offer, strike continues

Reuters | September 13, 2021 |

Image from Albemarle Corp.

A Chilean union at Albemarle Corp, the world’s top lithium producer, said on Monday it had rejected the company’s latest labor contract offer, leaving workers to continue a walk off that has extended for more than a month.

The 135-member “Albemarle Salar” union, which comprises about half the workers at its key Salar production plant, went on strike in August after failing to reach a deal with the U.S.-based lithium miner. The company maintains the extended walk-off has yet to hit its output of lithium.

ALBEMARLE SAID IT REGRETTED THE UNION’S DECISION BUT REJECTED ITS CLAIMS OF UNFAIRNESS

The union said in a statement issued Monday that the latest deal offered nothing beyond two prior proposals that were also rejected. The union called the contract offer “discriminatory” and said it would only foster salary inequality among its workers.

Albemarle told Reuters it regretted the union’s decision but rejected its claims of unfairness.

“The Salar aspires to a bonus for the termination of the conflict that is much higher than that of the other three unions with which we successfully concluded collective bargaining,” the company said in a statement.

Albemarle’s Atacama operations in Chile are a vital source of the ultralight white metal used in batteries that power electric vehicles. Competitor SQM operates nearby.

The company, which struck labor deals with its three remaining Chilean guilds earlier this year, said again on Monday it had a “solid” contingency plan that assured it could continue to meet its customers needs during the walk-off.

The union has alleged the miner had been flying workers in by helicopter to replace those on strike, a practice it said violated union rights.

Albemarle extracts lithium-rich brine from beneath the salt flat at its Salar plant, then processes the distilled brines into battery grade lithium carbonate at its La Negra chemical plant near the city of Antofagasta in northern Chile.

(By Dave Sherwood; Editing by Chris Reese)

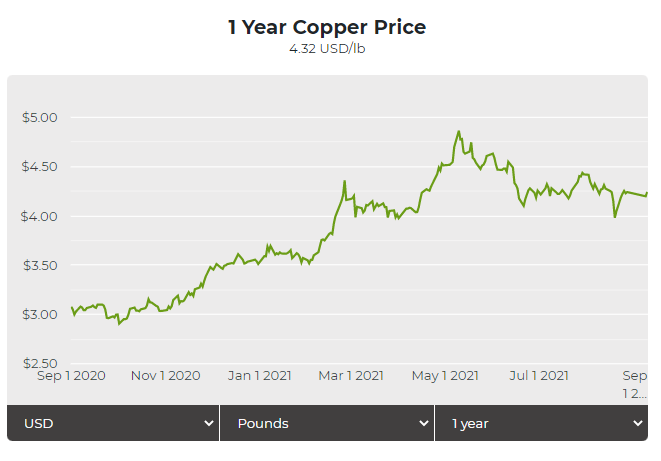

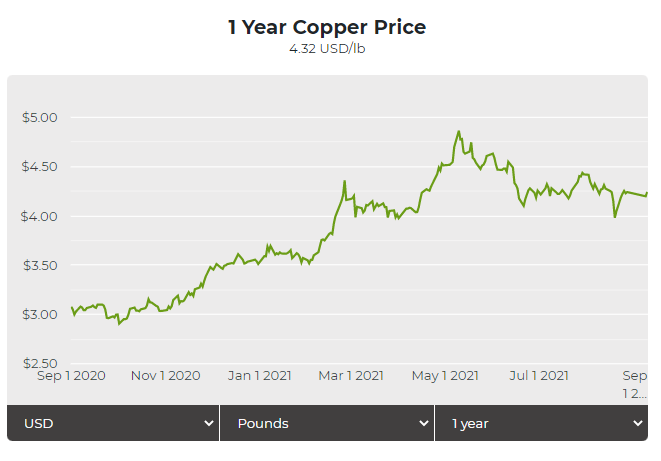

Copper price down as labour conflicts in Chile resolved, supply concerns fade

MINING.COM Staff Writer | September 13, 2021 |

Glencore Altonore copper casting wheel, Chile (Credit: Glencore)

The copper price fell again on Monday on signs that strike risks are all but over in Chile, the world’s biggest producer.

In quick succession, mining companies in Chile have resolved a series of labor conflicts.

On Friday, plant workers at Codelco’s Andina mine agreed to end a more than three-week stoppage. The next day, workers at BHP Group’s Cerro Colorado mine accepted an offer hammered out by the two negotiating teams in mediated talks, avoiding a strike.

The recent breakthroughs follow strike-ending agreements earlier this month with the two main unions at Andina and at a mine owned by JX Nippon Mining & Metals. The industry also managed to avoid stoppages at top-tier mines such as Escondida and El Teniente.

Copper for delivery in December fell 1.8% from Friday’s settlement price, touching $4.374 per pound ($9,622 per tonne) midday Monday on the Comex market in New York.

Click here for an interactive chart of copper prices

Massive global stimulus measures are keeping metals demand strong. Yet the economic bellwether has also been overshadowed lately as China’s move to curb metals production to reduce pollution and a coup in key bauxite supplier Guinea sent aluminum to a 13-year high of $3,000 a tonne.

China’s state reserves administration also released 150,000 tonnes of copper, aluminum, and zinc in the market that led to some cooling in copper prices.

(With files from Bloomberg and Reuters)