Big Oil Gets a Second Chance for Giant Offshore Fields in Brazil

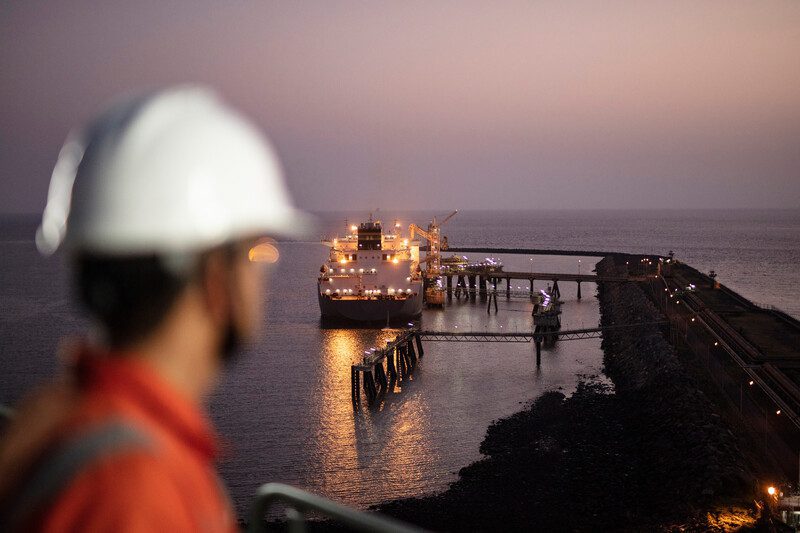

Photo: renatopmeireles/Shutterstock

By Mariana Durao and Peter Millard (Bloomberg) —

Brazil is giving Big Oil a second chance to join two massive offshore oil prospects in a test of the industry’s appetite for expansion as the world transitions to cleaner energy.

In an auction on Friday, Exxon Mobil Corp., Royal Dutch Shell Plc and eight other applicants will be looking at a 70% cheaper signing bonus than two years ago to bid for partnerships with Petroleo Brasileiro SA in the Sepia and Atapu fields in ultra-deep waters of the South Atlantic.

Sweeter terms and higher oil prices make the prospects an attractive opportunity to tap some of the largest oil discoveries this century, known as pre-salt deposits. But the timing is tricky: U.S. producers have been focused on boosting investor returns with dividends and stock buybacks, while European oil titans have ambitious goals to reduce their carbon emissions and invest heavily in cleaner energy in the coming decades.

“Without placing a bet on higher future oil prices, it will be hard for bidders to justify going much beyond the minimum,” Luiz Hayum, senior research analyst at Wood Mackenzie Ltd., wrote in a report.

In November 2019, the two fields failed to attract bidders in what was possibly the world’s priciest oil auction, with signing bonuses alone totaling $9 billion at the exchange rate of the time. Now Brazil is asking for roughly $2 billion, a 70% discount in local currency terms.

This time around it’s also clearer how much winning bidders will need to pay Petrobras for previous investments, at about $3.2 billion per area. Bidders win by offering the biggest percentage of the oil they produce to the government.

Petrobras, as the state-controlled producer is known, has already exercised its rights to secure operating control and a 30% minimum stake, no matter who wins.

The lower signing bonuses send a clear signal that Brazil understands how much it needs to improve the terms of the auction in the current environment, said Schreiner Parker, the head of Latin America at Rystad Energy, said

“With traditional exploration becoming ever harder to justify in boardrooms across the world, inorganic growth is one way to sustain a healthy reserves replacement,” he said.

The original contracts for the two fields put a limit on how many total barrels Petrobras can extract. The winners of this auction will get the right to produce volumes that exceed the original terms.

The prospects are part of an area estimated to hold as much as 15 billion barrels of recoverable crude, according to a study by Houston-based consultancy Gaffney, Cline & Associates in 2019. That also includes Petrobras’s Buzios and Itapu fields.

Petrobras already produces oil in the area, eliminating most exploration risks. The company’s partner in a block that borders on Sepia is Portugal’s Galp Energia SGPS. Galp, France’s TotalEnergies SE, and Shell are its partners in a block that borders on Atapu.

Sepia and Atapu are the last two big fields with ongoing production and proven reserves that Brazil is scheduled to offer.

“This is the last big auction we’ll see, the last bottle of Coke in the desert,” said Adriano Pires, director of infrastructure consultancy CBIE.

© 2021 Bloomberg L.P.

Total, Shell Emerge As Top Bidders in Brazil’s $2 Billion Offshore Auction

Photo: Shutterstock / marchello74

Petrobras, Total and Shell secured the nearby Atapu field.

The auction was widely seen as a test of Brazil’s investment climate and of large oil producers’ willingness to keep spending big on traditional assets. Officials, who had been keen to attract major foreign players, deemed it a success, and analysts said the offers agreed to were relatively rich.

The results suggested that some production assets can still fetch strong interest, even as traditional E&P budgets at the world’s top oil firms are increasingly constrained amid a broad shift toward green energy.

While the signing bonuses were fixed at 7.138 billion reais for Sepia and 4.002 billion reais for Atapu, the percentage of oil produced that will be handed over to the state, known as ‘oil profit,’ varied depending on the bidder. Oil profit for the winning Atapu consortium came to 31.68%, while oil profit for the winning Sepia bid came to 37.43%.

Bids “were high, which reduces returns,” said Marcelo de Assis, head of Latin America upstream research at Wood McKenzie. “They were more aggressive than we expected.”

Brazil-listed preferred shares in Petrobras were off 2.1% in afternoon trade, underperforming the nation’s benchmark Bovespa equities index, which had fallen 0.7%. London-listed shares in Shell fell 1.8% on Friday.

Brazil attempted to sell both fields in 2019, but neither received offers, even from Petrobras. At the time, complex legal issues and rich signing bonuses kept oil majors away.

This time, bidding terms were considered more attractive, several industry sources told Reuters, largely due to big cuts in both signing bonuses and minimum profit oil.

The fields are considered attractive as Petrobras has already discovered commercially recoverable oil in both blocks, eliminating exploration risk.

Eleven companies signed up for the chance to bid on Friday: Petrobras, Exxon Mobil Corp, Shell, Galp Energia SGPS SA , Chevron Corp, Ecopetrol SA, Equinor ASA, Enauta Participacoes SA, Petronas, TotalEnergies and Qatar Energy.

Petrobras holds a 30% stake in the winning Sepia consortium, TotalEnergies holds 28%, and Petronas and Qatar Energy hold 21% each. At Atapu, Petrobras holds a 52.5% stake, Shell has a 25% stake and TotalEnergies a 22.5% stake.

A second production unit is expected to be approved in the near future to increase Sepia’s overall capacity from 180,000 barrels per day (bpd) to more than 350,000 bpd, Qatar Energy CEO Saad Sherida Al-Kaabi said in a statement.

Production at Sepia has plateaud at 160,000 barrels per day, although a second production unit yet to be approved will raise this to 350,000 bpd, TotalEnergies said in its own statement.

The two fields could boost Brazil’s oil production by 12% over the next decade and bring in almost $40 billion in investment, its Energy Ministry said on Monday. Petrobras is set to receive $6.2 billion for past investments in the two fields. ($1 = 5.68 reais) (Reporting by Gram Slattery and Marta Nogueira in Rio de Janeiro and Sabrina Valle in Houston; Editing by David Gregorio, Diane Craft and Alexander Smith)

(c) Copyright Thomson Reuters 2021.