It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Monday, February 14, 2022

Inside the Bitcoin Laundering Case That Confounded the Internet

The arrests of Ilya Lichtenstein and Heather Morgan left the world of cryptocurrency incredulous: Could this goofy young couple have been Bitcoin’s Bonnie and Clyde?

Ilya Lichtenstein, left, and Heather Morgan were charged with conspiracy to launder billions of dollars worth of Bitcoin.Credit...District of Columbia U.S. Attorney's Office

Ilya Lichtenstein, left, and Heather Morgan were charged with conspiracy to launder billions of dollars worth of Bitcoin.Credit...District of Columbia U.S. Attorney's OfficeBy Ali Watkins and Benjamin Weiser

Feb. 13, 2022

When anonymous hackers infiltrated the cryptocurrency exchange Bitfinex in 2016, it shook the nascent world of digital currency and prompted speculation about who might have stolen what was then $71 million in Bitcoin.

But unlike traditional financial transactions, Bitcoin trades are publicly visible — moving the coins risked revealing who was behind the heist. And so for six years, as the value of Bitcoin soared, the loot sat in plain sight online as tiny fractions of the giant sum occasionally disappeared in a blizzard of complex transactions.

It was as if a robber’s getaway car was permanently parked outside the bank, locked tight, money still inside.

And then, this month, the car sped off.

In the strange and sometimes shadowy world of cryptocurrency, it was as if the earth shook. In the years since the Bitfinex hacking, crypto had exploded into the mainstream, and the theft had become notorious: a bounty worth over $4 billion. At last, it seemed, the hackers had emerged from hiding.

But it was not the hackers who had moved the stolen Bitcoin — it was the government, which had seized it as part of an investigation into two New York City entrepreneurs: one a little-known Russian émigré and tech investor; the other, his wife, an American businesswoman and would-be social media influencer with an alter ego as a satirical rapper named Razzlekhan.

Charged with conspiring to launder billions of dollars in Bitcoin, the couple, Ilya Lichtenstein, 34, and Heather Morgan, 31, were accused of siphoning off chunks of the purloined currency and trying to hide it in a complex network of digital wallets and internet personas. If convicted of that and a second conspiracy count, they could face up to 25 years in prison.

The arrests shocked some acquaintances of the couple, whose goofy online lives appeared at odds with prosecutors’ description of them as sophisticated criminals with stacks of foreign currency, multiple fake identities and dozens of encrypted devices stashed in their Manhattan apartment. As they awaited a Monday court hearing in Washington on whether they should be freed on bail, Mr. Lichtenstein and Ms. Morgan remained the subject of a confounding question: Could they really be at the center of one of cryptocurrency’s enduring mysteries?

The charges were a watershed in the evolving regulation of digital currency and, to some, a step forward in the government’s ability to trace its illegal laundering.

“The crypto space has always been seen as like a safe haven for criminals,” said Christopher Tarbell, a former F.B.I. special agent who helped lead the investigation into the Silk Road online marketplace for illegal drugs and other illicit goods.

“We’re now seeing that law enforcement has the knowledge, tools and skills to provide some accountability in what was the new wild, wild west of cybercrime,” Mr. Tarbell said.

Officials have not said whether they believe Mr. Lichtenstein and Ms. Morgan were directly involved in the Bitfinex breach. But their arrests laid bare the murky fringes of crypto culture, where the line between sophisticated virtual finance ventures and infantile online gags is razor thin and constantly shifting.

Sandra Ro, who leads the Global Blockchain Business Council, an industry association that advocates for the adoption of cryptocurrency markets, said the arrests “play into the narrative that the crypto community is populated by dubious and fringe characters, which is not the case.”.

“There are adults in the room,” Ms. Ro said, “who are building real products and services to grow a multitrillion-dollar industry responsibly.”

For many who follow the industry, Mr. Lichtenstein and Ms. Morgan came off as familiar characters in a realm where fortune favored the boldest investors, the flashiest personalities got rich fast and a single, obtuse tweet could rattle entire markets.

Almost immediately after the arrests, the hyperactive community that discusses cryptocurrency on social media and message boards began to pore over Ms. Morgan’s bizarre digital trail. Her videos — little-watched before she was charged — were suddenly being shared widely.

In one, apparently recorded at brunch, Ms. Morgan marvels at the size of her plate of pancakes, sneers, sticks out her tongue and wags her fingers before announcing that she is offering a commentary about consumerism and social media’s superficial nature.

The Bitfinex hacking was the stuff of legend, but Mr. Lichtenstein and Ms. Morgan hardly appeared to be suave, or subtle, digital cat burglars — or the tip of a grand conspiracy.

Sharing the pancake video, one typically irreverent Twitter account that comments on cutting-edge financial markets in an all-caps parody of the Incredible Hulk captured a widely expressed reaction to the revelation: “OK. THE HACKERS ARE NOT CIA. THEY ARE IDIOTS.”

Ms. Morgan was a regular contributor to Forbes and Inc., writing columns that advised her fellow entrepreneurs on how to protect their digital currency, and recommending rapping as a form of self-care, as she did through her alter-ego, Razzlekhan (Genghis Khan, but with more pizazz, her website says).

Those who know Ms. Morgan said her social media stunts were part of an elaborate act to confront social pressures.

Sign up for the New York Today Newsletter Each morning, get the latest on New York businesses, arts, sports, dining, style and more. Get it sent to your inbox.

“She works to free herself from a lot of the scripts that are embedded in our society,” said Morgan Brittni Sonnenfeld, who said she is Ms. Morgan’s cousin. “I admire her for that, she has a lot of strength.” Ms. Sonnenfeld acknowledged that news coverage of Ms. Morgan had made her “sound a bit crazy,” and she wondered whether Ms. Morgan’s persona may have drawn the authorities to her.

“I wonder, why do they want people looking at her? Who are we not looking at? Why are they choosing this specific person?” Ms. Sonnenfeld said.

The arrests also surprised Ms. Morgan’s friends, who described her as a disarmingly honest colleague in an industry defined by cutthroat competition.

“It is very jarring to think someone so open and vulnerable with people would have secrets,” one friend, Nora Poggi, said. “She is someone I care a lot about.”

In court records, the Justice Department describes the trail that it says led investigators to Mr. Lichtenstein and Ms. Morgan.

In January 2017, five months after hackers hit Bitfinex, a portion of what they stole was moved in small complex transactions into accounts that the couple controlled, according to a criminal complaint filed in federal court in Washington.

“This shuffling, which created a voluminous number of transactions, appeared to be designed to conceal the path of the stolen” Bitcoin, the complaint says.

Mr. Lichtenstein and Ms. Morgan were budding tech entrepreneurs at the time. Mr. Lichtenstein specialized in cryptocurrency and coding, according to his LinkedIn profile, and Ms. Morgan had returned from the Middle East, where she focused on currency markets.

Anirudh Bansal, the couple’s lawyer, declined a request for comment. But in court papers, he has made it clear that he believes the government’s case is weak and relies on “unsupported, conclusory leaps.”

Beyond Ms. Morgan’s highly public persona, little is known about the couple. They have been together for seven years and married for three, Mr. Bansal told a federal magistrate judge in Manhattan on Tuesday during arguments over whether the couple should be released on bail.

In saying that his clients were not a risk to flee, Mr. Bansal offered some personal details about them.

Also discovered in the search was over $40,000 in cash and substantial amounts of foreign currency.

Mr. Lichtenstein, Mr. Bansal said, came to the United States from Russia when he was 6. His father works for the housing authority of Cook County, Ill., and his mother is a biochemist at Northwestern University.

Ms. Morgan, who was born in Oregon, runs a consulting firm that employs up to 30 freelance writers at a time, Mr. Bansal said. Her father served in the U.S. military and is a retired biologist. Her mother is a high school librarian.

Mr. Lichtenstein’s family had immigrated to the United States to flee religious persecution and there was “no chance” he would return to Russia, Mr. Bansal said.

In a later letter, another of the couple’s lawyers wrote that Ms. Morgan had frozen several of her embryos at a hospital in New York in anticipation of starting a family.

“The couple would never flee from the country at the risk of losing access to their ability to have children,” the lawyer wrote.

At the hearing, a prosecutor, Margaret Lynaugh, said in opposing bail for Mr. Lichtenstein, a dual citizen of the U.S. and Russia, that he had an active Russian passport and the means and intent to flee.

The judge ordered that the couple be freed on multi-million-dollar bonds, but at the government’s request, a federal judge in Washington blocked their release and scheduled the hearing on Monday.

In court papers, the government has called Mr. Lichtenstein and Ms. Morgan “highly sophisticated criminals.” Prosecutors said they believed the couple had significant additional assets, including hundreds of millions of dollars in virtual currency stolen from the Bitfinex exchange that had not been recovered, as well as access to numerous fraudulent identities bought on the so-called darknet, a hidden portion of the internet used for illicit transactions.

The government says the couple had also established financial accounts in Russia and Ukraine, and appeared to have been setting up a contingency plan for a life in one of those countries before the pandemic.

As evidence of what they depicted as a complicated money-laundering scheme, prosecutors say in a court filing that they had traced stolen cryptocurrency to more than a dozen accounts held in the true names of the couple or their businesses.

The government says in the court filing that when agents executed a search warrant at the couple’s Lower Manhattan apartment on Jan. 5, they recovered more than 50 electronic devices, including a bag labeled “burner phone,” and more than $40,000 in cash. Many of the devices were partially or fully encrypted or otherwise password protected, the court filing says.

In Mr. Lichtenstein’s office, agents found two hollowed-out books whose pages appeared to have been cut out by hand to create secret compartments, the filing says. (The compartments were empty.)

And then there was the couple’s cat.

As agents were about to begin the search, Ms. Morgan and Mr. Lichtenstein said they would leave their apartment, but wanted to take their cat, the filing says. The agents allowed Ms. Morgan to retrieve the cat, which was hiding under the bed.

But as Ms. Morgan crouched by the bed and called to the cat, she positioned herself next to a night stand that held one of her cellphones, the filing says. She then reached up and grabbed the phone, and repeatedly hit the lock button in what prosecutors say was an apparent effort to make it harder for investigators to search the phone’s contents.

The agents had to wrest the phone from Ms. Morgan’s hands. Court records provided no further information about the cat.

Reporting was contributed by Chelsia Rose Marcius, Kate Conger, Sheelagh McNeill and Ed Shanahan.

Ali Watkins is a reporter on the Metro desk, covering crime and law enforcement in New York City. Previously, she covered national security in Washington for The Times, BuzzFeed and McClatchy Newspapers. @AliWatkins

Benjamin Weiser is a reporter covering the Manhattan federal courts. He has long covered criminal justice, both as a beat and investigative reporter. Before joining The Times in 1997, he worked at The Washington Post. @BenWeiserNYT

A version of this article appears in print on Feb. 13, 2022, Section A, Page 1 of the New York edition with the headline: Modern Crime, a Tech Couple And a Trail of Siphoned Crypto. Order Reprints | Today’s Paper | Subscribe

By Korea Herald

Published : Feb 12, 2022

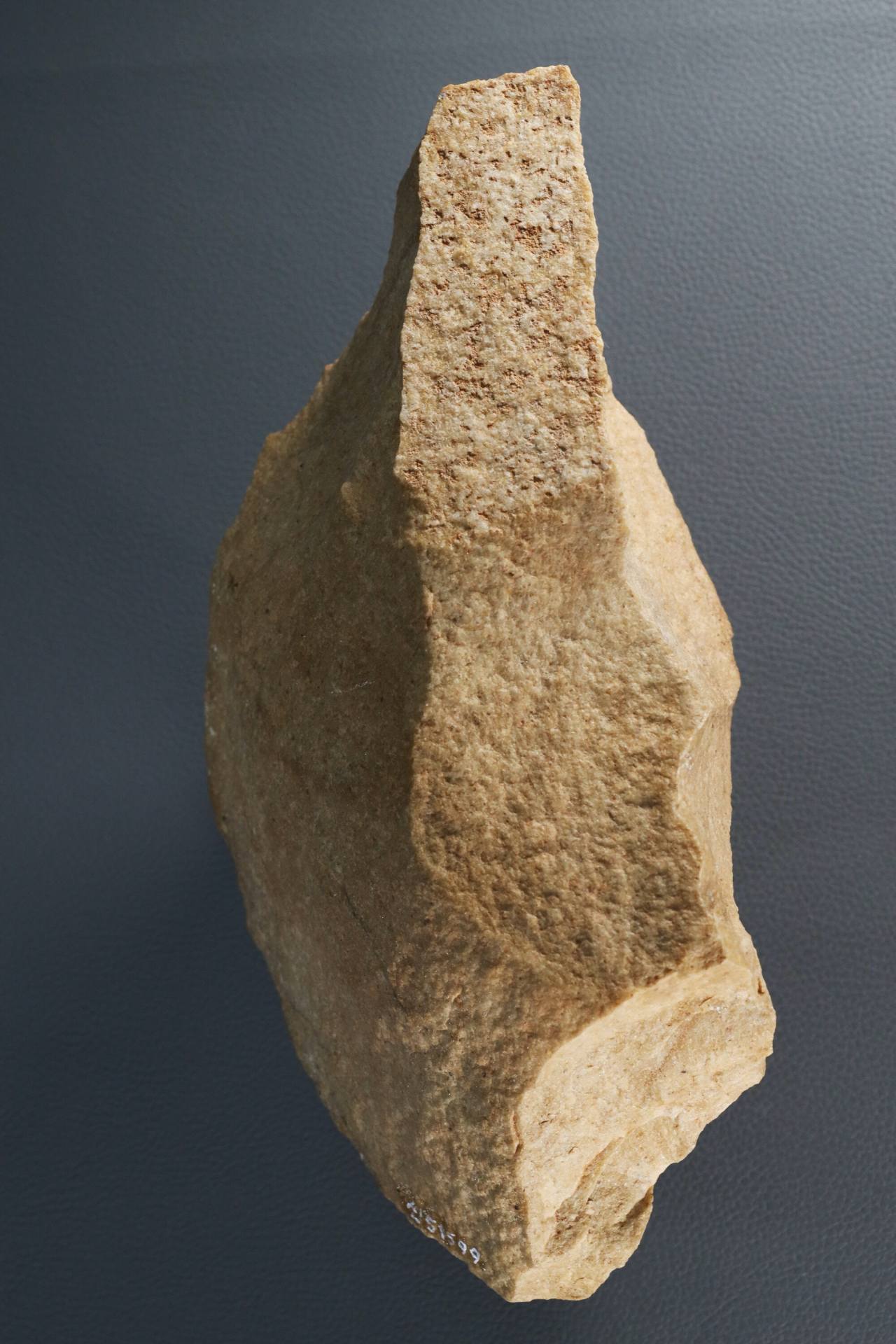

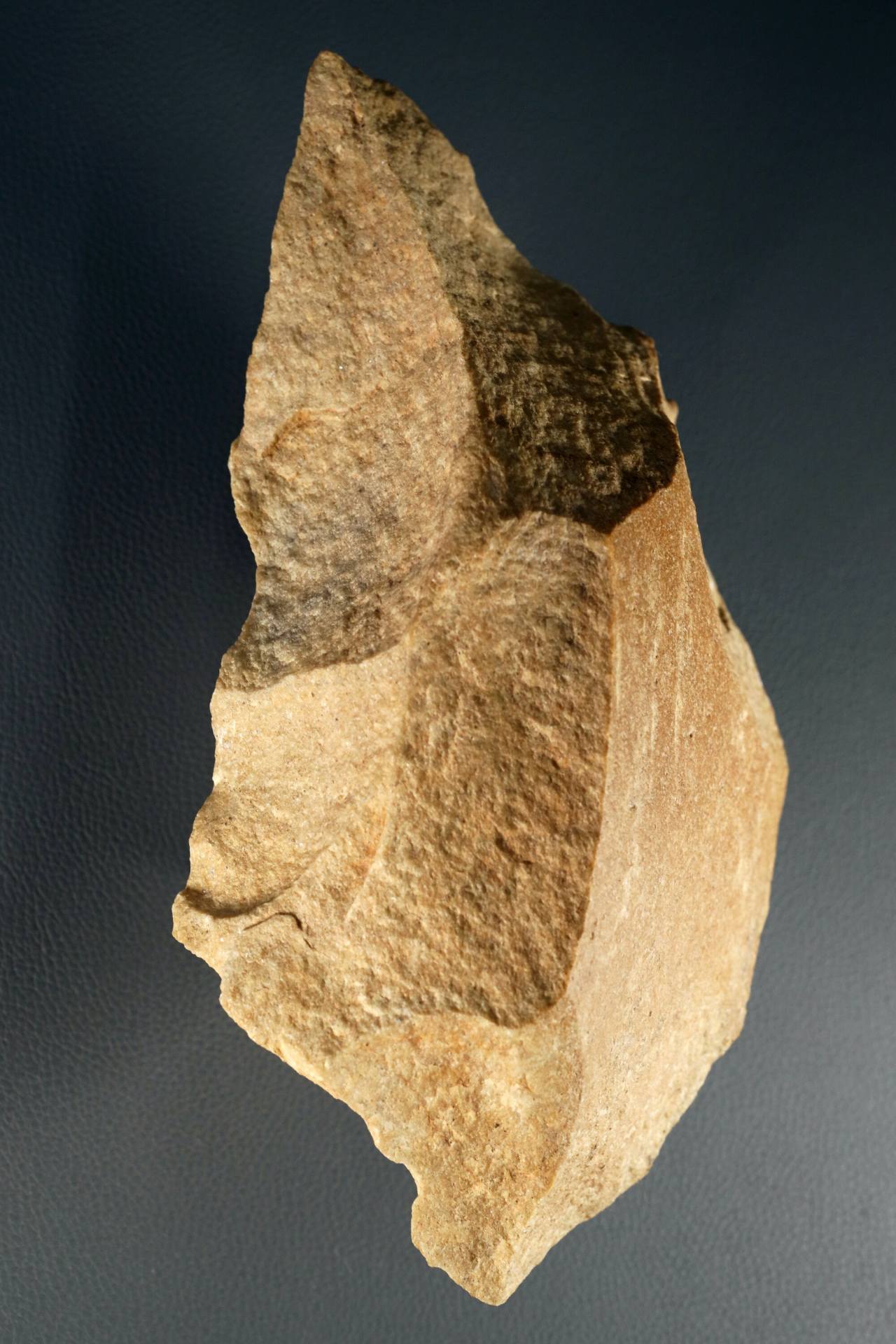

Discovered in 1978 near Hantan River in Jeongok-eup, Yeoncheon-gun, Gyeonggi Province, by US Airman Greg Bowen, Jeongok-ri handaxe is pictured with special permission at the National Museum of Korea in Seoul.Photo © HyungwonKang

Long before the Upper Paleolithic Period, the late Stone Age, during which our immediate ancestors the Homo sapiens inhabited the Korean Peninsula, there were ancient Hominin, a group consisting of extinct human species and all our immediate ancestors who lived in Korea.

The Stone Age all over the world was characterized by the use of rudimentary chipped stone tools, of which an abundant variety are found in Korea.

When an Acheulean-like handaxe, a Paleolithic period tool, which was the cutting-edge tool of Hominins back in the Stone Age, was found in Korea by Greg Bowen, a young US airman who in 1978 was stationed in Korea, the discovery placed Korea on the paleo-archeology map of the world.

Bowen was out on a date with his future wife Yi Sang-mi when he found a biface handaxe, the stone handaxe which was chipped on both sides of the blades (four sides), in Jeongok-ri located about two hours’ drive north of the capital city Seoul, along Hantan River in Gyeonggi Province.

According to Yongwook Yoo, a professor of archaeology at Chungnam National University, diverse types of stone tools such as hand axes, cleavers, hunting stones, fist-sized picks, scrapers, notched tools and others were unearthed from the sedimentary layer in the Imjin-Hantan River Area near Jeongok-ri between 1979 and 2010.

Korean researchers have been busy digging for ancient clues in the area since Bowen‘s discovery of the Jeongok-ri handaxe and more than 100 Acheulian-like handaxes have been discovered.

Jeongokri handaxe, an Acheulean-like handaxe from Korea estimated to have been used 70,000 to 40,000 years ago by ancient Hominin, the group of extinct human species of immediate human ancestors. Photo © Hyungwon Kang

Jeongok-ri handaxe was a tool for Hominins on the Korean Peninsula, which was local technology, differentiated from the Acheulean handaxe, according to Yoo.

Before the discovery of the Jeongok-ri handaxe, Eurocentric archeology did not believe there were Acheulean-like handaxes in Asia. The biface cutting tool, the stone tool chipped symmetrically on both sides from all four angles, was believed to be an exclusive technology of the Homo erectus period, when ancient human ancestors first started walking on two feet.

In earth’s history, the large chipped-stone handaxe, commonly known now as Acheulean bifaces, were one of the oldest, most common and longest-used tools for ancient Hominins.

Researchers have debated about the age of the Jeongok-ri handaxe for decades.

Based on the most recent scientific tests and findings, Yoo of CNU says, “There’s some attraction to dating archeological relics blindly old, but I believe the Jeongok-ri handaxe falls somewhere between 70,000 to 40,000 years old.“

The Korean Peninsula is defined by numerous mountains and rocks have always been a great resource for people who live here.

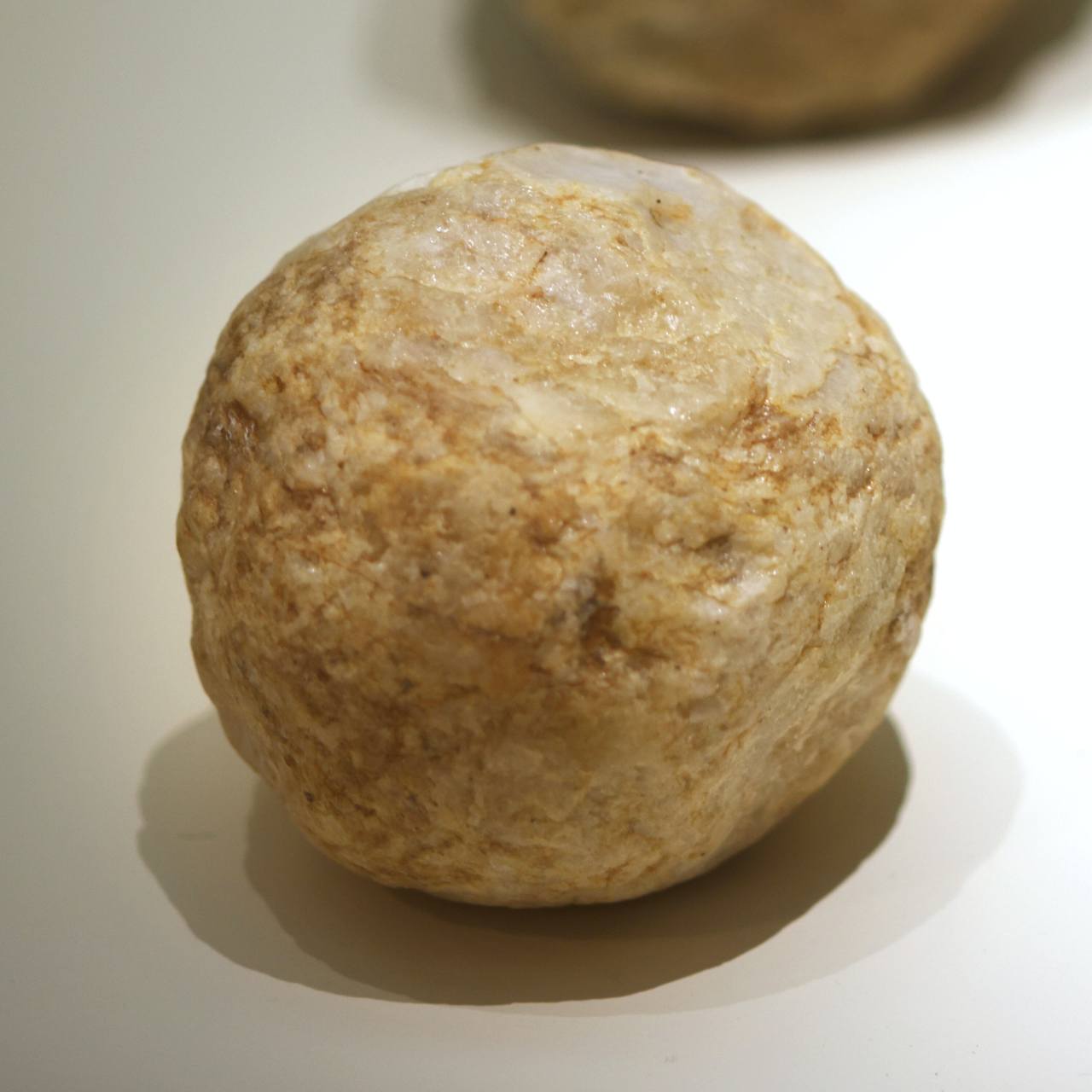

A baseball-sized highly weathered and used hammer stone, used to make handaxe by chipping the stone, also called a spherical polyhedron-bola, from the Stone Age is on display at the National Museum of Jeonju in Korea. It was discovered in Samgil-ri in Imsil-gun, North Jeolla province. Photo © Hyungwon Kang

“Homo sapiens were excellent problem solvers. We have found pieces of Obsidian, a dark volcanic glass formation rock, used to make weapons and tools and which are only available near Baekdu Mountain in the Korean Peninsula, in the Imjin-Hantan River area,” said Yoo. The Imjin-Hantan River area is several hundred kilometers away from Baekdu Mountain, the source of the Obsidian rocks. “It’s evidence that they traveled hundreds of kilometers to find high-quality raw material,” said Yoo.

The main difference between the Korean Acheulean-like handaxe and the Acheulean handaxe of Europe and Africa is the raw material. “The way in which the stone chips off makes the Korean handaxe look more rough,” said Yoo.

Lots of baseball-sized, highly weathered and used hammer stone, also called a spherical polyhedron-bola from the Stone age were also found in the Imjin-Hatan River area.

“The spherical rock was probably made when it was used to strike a handaxe or other stone tool and its edges were worn down,” said Yoo. The hammer stone is also found in other areas in Korea, reflecting the widespread knowledge of stone tool-making at the time.

“I can definitely say that Jeongok-ri is a very important site that shows the early Hominin activities” said Sang-Hee Lee, a professor of anthropology at University of California at Riverside.

Bowen, who made the remarkable discovery during his time in Korea, studied anthropology at the University of Arizona upon returning to the US with his wife Sang-mi Bowen, and worked for the Navajo Nation Historic Preservation Department until his retirement. He died in Arizona in 2009.

By Hyungwon Kang (hyungwonkang@gmail.com)

---

Korean American photojournalist and columnist Hyungwon Kang is currently documenting Korean history and culture in images and words for future generations. -- Ed.

By Korea Herald (khnews@heraldcorp.com)

That wasn't all they found

The artifacts recently unearthed are comparable to the Folkton Drums, pictured here.

Victoria Jones/PA Images via Getty Images

BY TOBIAS CARROLL

In 1893, archaeologists working near Scarborough, England unearthed a series of drums that were thousands of years old. Known as the Folkton Drums, they are now in the collection of the British Museum — and offer an invaluable look back into England’s history. Recently, archaeologists in the same general location uncovered another drum (technically, a chalk sculpture) that’s even older — making it a rough contemporary of Stonehenge.

If that had been the only thing of note found in the dig in question, it would still be a landmark discovery. But, as a new article in The Washington Post demonstrates, the discovery has another dimension — one that’s sure to puzzle historians for years to come.

The drum was found next to a gravesite containing the remains of three children, their bodies in a position that the archaeologist who discovered them described as “cuddling.” Unsurprisingly, this adds more than a little mystery to the site. The Post‘s article offers a host of possibilities, from the effects of a pandemic to a ritual sacrifice.

According to the article, the drum itself will be on display as part of a larger exhibit at the British Museum. As for where, specifically, the drum and the bodies were found — well, that’s still shrouded in secrecy. Consider it one more mystery to add to a host more that were recently unearthed.

The former first lady allegedly sold tickets for a meet and greet for a non-existent charity

By TOM BOGGIONI

PUBLISHED FEBRUARY 13, 2022 5:00AM (ES

This article originally appeared on Raw Story

In a deep dive into how Donald Trump has turned his four years as president into a money-making machine cashing in on his renewed celebrity, the New York Times notes that Melania Trump is being scrutinized for selling tickets to a meet and greet with a portion of the proceeds going to a charity that doesn't appear to exist.

While noting that former first lady has already been attempting to make money by auctioning off some apparel, the Times' Shane Goldmacher and Eric Lipton reported that Melania has a "high tea" event scheduled in April in Florida that is raising eyebrows.

According to the report, "Mrs. Trump is now selling tickets to the April 'high tea,' with organizers saying that some of the profits will benefit an initiative of her 'Be Best' endeavor called 'Fostering the Future,' meant to provide computer-science scholarships to young people who have been in foster care."

With details vague as to what portion of the ticket sales will go to the former president's wife, questions are being raised about her "Fostering the Future" charity.

"Florida requires any organization that raises charitable contributions in the state to register. No charity with the name 'Fostering the Future' or 'Be Best' is registered in Florida," the Times reported with an official in the state admitting they are taking a look at the situation.

"Asked about the solicitation, officials at the Florida agency that oversees charitable fund-raising said they also could not find evidence of the required state registration and had opened an inquiry as a result," the Times report states with Erin M. Moffet, an agency spokeswoman, pointing out "the state law requiring charities to register before soliciting money."

According to Moffet, "Consumer Services Division is currently investigating whether this event involves an entity operating in violation of Chapter 496, Florida Statutes."

The Times' report also notes that Whip Fundraising is organizing the event and that a spokesperson for Melania Trump did not respond to questions about the investigation.

By Vaughan Jones

Published: Sunday, February 13, 2022

Storyblocks

Just in time for Valentine’s Day, the Federal Trade Commission released its yearly report on online romance scams.

The report shows a record $547 million was lost in 2021, after more than $300 million was lost in 2020.

Dana Kennedy is the state director of AARP Arizona. She says the removal of stigmas around online dating have contributed to an increase in fraud, especially for the elderly.

“So, it could be that they're not tech savvy. It also could be that they're more people actually trying these online apps to find romance. And we know that during COVID, more and more people were turning to online platforms,” said Kennedy.

She says research from 2020 found that elderly people lose the most money in scams like these.

“People aged 40-69 have been the most likely to report losing money on a romance scam. And people 70 and over report the highest median losses, just a little under $10,000,” Kennedy said.

Kennedy recommends looking for red flags when talking to someone online, such as someone repeatedly planning and canceling in-person meetings. She also suggests not sending money via mail, wire or electronic transfer to someone you’ve met online before you meet them in person.

If you do fall victim to a scammer, she says AARP has a national fraud helpline at (877) 908-3360, and those in Arizona looking to report local fraud can contact the Arizona Attorney General’s Office.

Unless officials crack down on the flood of advertising, a national crisis of gambling addiction is coming.

New Hampshire Governor Chris Sununu shows a receipt after placing the state's first legal sports wagering bet on his mobile phone in December 2019. | Charles Krupa/AP Photo

Opinion by JACK O’DONNELL

02/13/2022

Jack O’Donnell is author of the memoir Trumped! The Inside Story of the Real Donald Trump His Cunning Rise and Spectacular Fall.

This Sunday, Americans are expected to wager nearly $8 billion on the Super Bowl matchup between the Los Angeles Rams and the Cincinnati Bengals. This number is nearly twice the amount bet on last year’s big game.

What explains this staggering increase? It’s not just the popularity of the teams. This is the first Super Bowl of the online gambling era.

Sports betting has been legalized in 30 states, plus Washington, D.C., thanks to a 2018 U.S. Supreme Court ruling that overturned the ban on sports betting. Now, more than 100 million Americans live in places where they can legally wager. In 2020, the industry hit $1.5 billion in revenue, a 69 percent increase year to year. And in the first quarter of 2021, it is estimated that revenue rose another 270 percent. But it wasn’t until the NFL agreed to allow ads for sports gambling on its telecasts at the beginning of this season that the betting floodgates truly opened.

Companies like FanDuel, MGM and Caesars have spent hundreds of millions of dollars over the past year hawking their wares on TV and social media with celebrity-filled advertisements. Anyone who uses a computer, watches television, carries a smart phone or listens to the radio, likely has been exposed to Jerry Rice dumping Gatorade on a winning DraftKings bettor or some other celebrity-filled come-on. The barrage has been relentless, consistent and so widespread that it is safe to say anyone older than 12 understands where and how to make a bet on everything from the final score of Sunday’s game to whether Bengals quarterback Joe Burrow’s first pass will be a completion or not.

This has not happened by chance. It is a strategic and methodical effort to make sports betting seem no different than going to the grocery store to pick up a loaf of bread. The difference, however, is that gambling addiction can and will cause suffering to individuals, families and businesses. The evidence is abundant. According to the Wall Street Journal, the National Problem Gambling helpline (1-800-522-4700) received an average of more than 22,500 calls a month in 2021, up from a monthly average of 14,800 the year before. Problem gamblers carry an average of $55,000 in debt and more than 20 percent end up filing for bankruptcy.

I know the gambling industry intimately. I know how the C-suite thinks. I know what investors demand from the companies. I know how the marketing people develop strategies and promotions to get the consumer to play the games. I know because I developed those strategies. I have held positions as Senior VP of Marketing for Steve Wynn, president and COO for Donald Trump, and COO for Merv Griffin. I also owned or operated gambling operations in five U.S. States and Greece. I know the language of “hooking” a small-time gambler and how to land a “whale,” someone willing to risk tens of thousands of dollars on a single bet. But for the past 20 years, I have worked in the addiction and behavioral health field. Currently, I am the CEO of C4 Recovery Foundation, an organization that, among other things, is an advocate for individuals suffering from addiction.

To the uninitiated, this might look like the free market at work. If the activity is legal, one might ask, why shouldn’t companies be allowed to attract customers by any means necessary? For the same reason, we don’t let cigarette companies make smoking look fun by using “cool” cartoon camels. Smoking might be legal, but we know it’s dangerous. The same logic should apply to sports gambling.

For elected officials concerned with protecting their constituents, runaway gambling ads should be their worst nightmare. But unfortunately they are sleeping on the job. Despite studies that show a direct correlation between increased exposure to gambling advertising and problem gambling, the last time a local or state government cared about the social impact of gambling on its residents was back in 1976 when New Jersey first legalized casino gambling.

As a result of the citizens of New Jersey voting to approve casino style gambling in Atlantic City as a tool for urban development, a strict set of regulations was enacted. In 1977 the New Jersey Casino Control Act was signed into law. At the time, the state referred to legalized gambling as an “experiment.” Regulators and state officials were skeptical that the benefits of legal casinos would outweigh the negative. The most pressing concern was that of increased crime and the social impact gambling would have on the state’s residents. They were particularly concerned about increases in gambling addiction.

One of the thousands of regulations and controls the state deemed necessary was to limit advertising of the gaming products. A casino property could advertise its hotel, food offerings and entertainment, but it was forbidden to advertise the casino games themselves, including slot machines and the size of the jackpots or odds offered. That, the regulators deemed, was too dangerous to leave in the hands of the operators. Regulators were convinced that if allowed, the industry would prey on the young and those who could least afford to be spending money in a casino. Regulators knew the industry would make false and unrealistic claims about betting and would glorify the ease of winning.

The example that regulators gave was the only other legal location to gamble at the time: Nevada. In Nevada, every street in almost every town had billboards with enticements to gamble. Advertisements screaming “Loosest Slots, 99% payback” created a can’t-lose impression. One could even play slot machines at the local grocery store. New Jersey was determined not to let the operators do to Atlantic City what they had done to Nevada. Problem gambling afflicts 6 percent of Nevada residents, according to the International Problem Gambling Center, well above the national average of just over 1 percent.

The story of New Jersey is actually a great case study comparison for what is happening with sports betting currently. New Jersey eventually relaxed many of its restrictions on advertising, as gaming expanded, and competition increased. But the state didn’t surrender total control. There were still limitations and approvals needed for certain types of promotions and offerings to entice people to play the games. There was a time when every promotion required advance approval, to assure it was not misleading or unfair to the potential customer. There have been no such restrictions for sports betting.

So, what should regulators be concerned about today? Brain chemistry. The neuroscience of gambling is exactly the same as other addictive behaviors, such as drugs, alcohol, sex and eating. Like other addictive behaviors, when one gambles, the brain releases dopamine, which is a feel-good neurotransmitter that makes you feel excited. It would be logical to think this feeling only occurs when one wins, but the brain releases dopamine no matter the outcome. An individual who gets a “positive” response from an activity is not capable of logically deciding when he should stop betting.

The problem lies with advertising “hooks.” The operators of sports betting sites are not just making betting available, they are offering incentives to begin betting and to keep on betting. A good example is one site that offers a new customer $200 in free bets for making just one $5 bet.

Why does this make good business sense? The answer goes right back to brain chemistry. The operators know the more bets an individual places, the more dopamine is being released in the brain. So instead of feeling good for one single bet, they are assuring that the player is going to get several more feel-good jolts, making it very likely that the player will crave more after they have exhausted the $200 of free play.

Back in the early days of Atlantic City, every casino gave free cash to people who rode buses on day trips to the city. You could get $50 for simply showing up. The casino operators knew that most of the $50 would be deposited in the slot machines in the first hour after they arrived. With five more hours before the bus left for home, the customer would reach into his own pocket to keep the rush going. The only difference between the tactic the casinos used back then and what the online companies are doing now is that bettors are using their phones while sitting on their couch at home.

And like most products, the sports betting companies know that familiar pitch men and humor can appeal to various demographics, creating a sense of trust. Older bettors are bound to feel good seeing Brent Musburger encourage one to place a bet, and every 30- to 40-year-old will undoubtedly believe Drew Brees, having watched him play for the past 25 years, encouraging you to live your “Bet life.” And the even more troubling creation of fictional characters dressed in costumes having fun in a fantasy world, reminiscent of Camel Joe cigarette ads and his appeal to younger demographics, including underage individuals.

I am not suggesting that everyone who watches an ad for sports betting is going to become addicted to the activity. The reality is, like other forms of gambling, it is a very small percentage of individuals who become addicted. It is estimated that at least 2.5 million Americans have a severe addiction to gambling. But most experts agree the number is likely much larger.

There are no physical side effects as with alcohol or drug addiction. The first sign to an outsider that a person is suffering from a gambling addiction might be the loss of a home, divorce or even suicide.

But the easy accessibility of gambling products, accelerated by ubiquitous advertising, means that the pool of individuals susceptible to addiction has grown enormously, without adding some type of guardrail for the industry. DraftKings, currently the largest company providing sports betting services, believes there are in excess of 50 million bettors in the U.S. — roughly one in seven Americans. And they admit their goal is not only to target existing bettors, but also to “expand the aperture,” meaning create new bettors.

At a recent conference of the American Gaming Association in New Jersey, when discussing the overwhelming frequency of betting ads, industry leaders asked their membership, “How much is too much”? They expressed a fear of backlash from legislators and gaming regulators. The last thing they want is anything that will make it harder to create new bettors. They also admitted that the current spending pace on advertising is so over top that it is not sustainable for the industry. It will undoubtedly drag some sports betting companies into bankruptcy.

But the industry cannot self-regulate. I know how the industry thinks: They will say that illegal betting has been around forever and it’s enough for them to include some warnings and toll-free numbers in their ads. Beyond that, they’ll say, they have no obligation to protect the public from itself. But the gambling companies are not the ones who have to cover the social costs of an epidemic of gambling debt. This alone is reason enough for legislators to step in and provide the kind of national guardrails that New Jersey once applied.

In the business of gambling, the house always wins. They are going to make their money; it is just a matter of how many lives will be ruined in the process before they are mandated to change the way they prey on their victims. This Sunday, there will be one loser on the field but as you watch the blitz of gambling ads, think about the millions of losers off the field.

Legalized Sports Betting Could Be A Step Toward Reducing Homelessness

LOS ANGELES – California will host Super Bowl LVI in Inglewood this weekend, but sports betting isn’t legal in the state. Experts say that doesn’t mean no one in California is wagering on the big game, it’s just happening illegally and in secret – something legalization advocates are vying to change.

“When you take stuff out of the darkness … it’s going to be better,” said Steve Bornstein, president of North America Genius Sports, speaking at a panel Wednesday during the run-up to Sunday’s matchup between the Cincinnati Bengals and L.A. Rams.

“Ultimately, that’s how you’re going to connect with more fans, gamifying the content.”

Bornstein’s comments come as various groups are trying to get ballot initiatives approved to legalize sports betting in California.

Arizona legalized sports betting in 2021 and saw $1.2 billion through its first three months of operations, according to the Arizona Department of Gaming, and industry experts predict Super Bowl bets will top $100 million in the state.

Thirty states have legalized sports betting, and the competition to legalize sports betting in California is heated. In the United States alone, sports betting is estimated to be a $150 billion dollar industry, according to Legal Sports Betting.

Proponents of one new sports betting initiative in California say allowing gambling here is about more than winning – it’s about improving the lives of people experiencing homelessness across the state.

The California Solutions to Homelessness and Mental Health Support Act, an initiative that’s still in the early stages of getting signatures to land on the November 2022 ballot, is backed by seven U.S. sportsbooks, including major players FanDuel, DraftKings and BetMGM.

RELATED STORY

The initiative would place a 10% tax on online betting profits, which would be put into an online sports betting trust fund. Eighty-five percent of those funds would go toward helping cities and counties address homelessness and support mental health programs, according to the initiative filed with the California Department of Justice office.

According to the state’s Legislative Analyst’s Office, this could generate “mid-hundreds of millions of dollars” annually in the trust fund alone. Big numbers like that could have a profound effect on homelessness in California, where 161,548 people were living on the street in January 2020, according to the latest federal estimates.

“It’s a great way to legalize it (sports betting) and try to get some tax base out of it for an absolutely important issue,” said Jennifer Friedenbach, executive director of Coalition on Homelessness, which works to create permanent solutions to homelessness while working to protect the human rights of those forced to remain on the streets.

To make it to the ballot, the initiative will need 997,139 signatures before June 30. As of now, supporters are 25% of the way there, according to PlayCA, a national site that provides readers with news and resources related to legal, regulated online gambling options in the United States.

Four mayors have publicly backed the initiative, including Sacramento’s Darrell Steinberg, Fresno’s Jerry Dyer, Oakland’s Libby Schaaf and Long Beach’s Robert Garcia, who all released statements in support.

Three other initiatives are vying to get on the ballot as well, with two backed by tribal groups and the other backed by cardrooms (commercial gaming establishment) in California. All of them could be on the ballot this November if they meet the signature quota, leaving voters with the ultimate choice.

With a population of 39 million, California long has been coveted when it comes to legalizing sports betting.

“California is the holy grail, it’s the biggest piece out there,” said Peter Schoenke, board member of the Fantasy Sports and Gaming Association.

Although sports betting could be a step toward alleviating homelessness in California, it’s a money machine for all states.

“We think that California could generate roughly $40 billion a year in wagers – and as much as $50 billion a year on the most optimistic side,” said Zack Hall, media relations lead for PlayUSA, a sports betting site.

Numbers in almost all the other states would likely pale in comparison. To give some context, New York, which recently legalized sports betting, had a first month of $1.6 billion in bets placed – which is the record for most wagers placed in a month.

By Susan Brink

Published February 13, 2022

Prakash Singh/AFP Via Getty Images

Until the emergence of COVID-19, tuberculosis was the deadliest infectious disease in the world. How did it evolve from a terrible disease to a largely controlled one to the horrific plague it is now?

That's the question that science journalist Vidya Krishnan explores in her new book, Phantom Plague: How Tuberculosis Shaped History, released this month. It traces the spread of TB from the U.S. and Europe in the 19th century to lower-income countries — including Krishnan's country of India — where it continues to flourish today.

The answer, she finds, has a lot to do with lack of treatment, overtreatment or the wrong treatment. When antibiotics became widely available in the 20th century, the West had the resources to pay for them and cure and control TB. Poorer countries didn't. And when antibiotics did become available in lower-income nations, they were often overused. With antibiotic overuse came antibiotic resistance as pathogens learned to fight off the cures. The result is what Krishnan calls a "monster" version of the disease known as multidrug-resistant TB.

Newer therapies are available in wealthy countries to control this strain of TB, but they are still greatly limited in poorer countries. And that has allowed multidrug-resistant TB to thrive.

Arvind Krishnan author of Phantom Plague: How Tuberculosis Shaped History.

Nowhere on the planet is that reality felt more than in India. It has the world's highest incidence of TB — its 2.8 million cases annually account for more than a quarter of cases globally, according to the U.S. Agency for International Development. Within India, the city of Mumbai — a focus of Krishnan's book — is one of the hot spots for both TB and multidrug-resistant TB.

Krishnan, an award-winning writer based in India who has written critically of India's health-care system for The Atlantic and other media outlets, talks to NPR about TB's outsize impact on her country. This interview has been edited for length and clarity.

Ullstein Bild/Getty Images

A village drummer announces the arrival of the tuberculosis vaccine during an immunization campaign in India in the 1950s.

Why did you begin this book in New York in the 19th century?

I wanted to show how we repeat the same disease-spreading mistakes over and over.

Spitting is as rampant in Mumbai as it was in New York in the 19th and early 20th centuries, when men were determined to spit despite fines. [TB germs are in saliva, and spitting can propel droplets into the air and spread the disease.] Anti-spitting laws were hard to enforce because the habit was so ubiquitous. The struggles to pass laws to curb spitting are the same 100 years later in Mumbai and across India.

And like New York City in the 19th century, India is densely populated with poor people living in overcrowded, often unsanitary conditions.

Describe the housing projects for the poor in Mumbai and their result on TB.

They have become incubators for TB. Mumbai urban planning has focused on making cheap labor available in urban centers. So they built high-rises with barely 3 meters [just over 3 yards] between buildings. Some neighborhoods are so densely packed with people that, despite being by the shoreline of the Arabian Sea, people living there get no sunlight, no fresh air. One architect who I spoke to calls it "skylight robbery" because the lower floors get no natural light. The disease thrives in places with poor ventilation. And people live in tiny, crammed spaces.

And these crowded quarters are dangerous because TB spreads through the air — traveling on a cough, sneeze, spittle or even a laugh. Is TB in India then confined to the poor, who spend much of their lives trapped in unhealthy neighborhoods?

No. People living in [these] conditions go out. They take cabs. They take the bus. They work in the homes of the rich. So it spreads.

Why has TB been so difficult to control in India?

In India, there is corruption and lack of accountability in the health care system. And we have a system of highly privatized health care. Patients who can afford the private system often get overtreated, because the incentive for private doctors is to retain patients until every last rupee is taken.

I wrote about a patient named Shreya. She was misdiagnosed for years. Her body was carpet-bombed with antibiotics. If a doctor can't treat TB, they're supposed to send the patient to a tertiary center where the government provides free medicines.

Instead, you write that doctors kept treating her with drugs that didn't work.

By the time Shreya's family ran out of money [to pay for treatment] and took her to a government hospital, she was resistant to many antibiotics. The drugs that could treat her were locked in patents and severely rationed in India.

And for this reason, as you write in your book, Shreya's family sued the government to release a rationed drug that is in short supply in India.

After her parents went to court, she received bedaquiline, a drug that could have saved her early in her disease. But it was too late and she died. Her doctor said she had a "miserable end."

What's happening is mass medical negligence. If you are poor, you may be undertreated without compassion because the system is overwhelmed. If you are rich [or like Shreya's parents, able to provide some private care until the money runs out], you are overtreated and often not correctly.

What needs to happen for India to control the spread of TB?

For starters, global health cannot be funded by charity. Philanthropists are often invested in pharmaceutical companies, and that's a clash of interests. Philanthropy can provide some drugs and vaccines, but it doesn't address structural issues: The poor get undertreated and the rich get overtreated. Neither is good. We need to reform the system.

Two equally important things need to happen simultaneously. People need access to free medicines, counseling and care; and India needs public health awareness campaigns so people can learn how to protect themselves. Most residents are unaware of the scale of the TB outbreak.

What does TB's long history teach us about the current pandemic?

Basically, no one is safe until we're all safe.

Susan Brink is a freelance writer who covers health and medicine. She is the author of The Fourth Trimester and co-author of A Change of Heart.

Copyright 2022 NPR. To see more, visit https://www.npr.org.

ROME—The Italian government appointed a special commissioner on Friday to coordinate measures aimed at eliminating an outbreak of African swine fever, the prime minister’s office said in a statement on Friday.

“The plan aims at eradicating African swine fever in wild boars on national territory and to prevent its spread among farmed pigs, in order to ensure the protection of animal health, the national production system and exports,” the statement said.

The government gave regions 30 days to draw up their own schemes to tackle the deadly hog disease, which was discovered in northeast Italy at the start of the year.

African swine fever is harmless to humans but often fatal to pigs, leading to financial losses for farmers. It originated in Africa before spreading to Europe and Asia, and has killed hundreds of millions of pigs worldwide.

China’s agriculture ministry announced last month that it was suspending pork imports from Italy because of the outbreak.

The Canadian truck protests started over vaccine mandates. But the trucking industry in the U.S. is more concerned about things like where to park their rigs.

A trucker fuels up his truck at the Loves Truck stop on Nov. 5 in Springville, Utah.

| George Frey/Getty Images

By TANYA SNYDER and ALEX DAUGHERTY

02/11/2022

The vehicle blockades that have snarled North American supply chains, paralyzed Canada’s capital and inspired threats of a copycat convoy to Washington, D.C., may have started with truck drivers irate about mask and vaccine mandates. But the grievances of the protests’ biggest champions bear little similarity to the demands that U.S. truck drivers’ union reps and trade groups typically bring to Washington.

Start with this fact: Truck drivers in the U.S. already don’t have to wear masks, and the vast majority are not required to be vaccinated against Covid, unless they plan to cross an international border.

Instead, the typical top gripes for trucking advocates with the Biden administration and Congress include Washington’s failure to help drivers find a safe place to park and sleep for the night.

In fact, the top U.S. trucking advocates have taken pains to disavow the trucker blockades, including one that has stalled traffic for days at a key trade chokepoint between Detroit and Windsor, Ont.

Protestors block traffic at the Ambassador Bridge, linking Windsor, Ontario and Detroit on Wednesday. | Nicole Osborne/The Canadian Press via AP

The U.S. Teamsters union issued a statement Thursday saying it “denounces” the blockade, adding: “Our members are some of the hardest workers in the country and are being prevented from doing their jobs.”

A leader of the Owner-Operator Independent Drivers Association, a coalition representing more than 150,000 independent truck drivers in the U.S., echoed that sentiment in an interview on Wednesday.

“I do not support any disturbance or destruction,” said Lewie Pugh, executive vice president of OOIDA and a long-time truck driver. While the group opposes the cross-border vaccine mandate that has inspired the Canadian protests, Pugh said the demonstrations are beginning to cost truckers the public’s support and goodwill.

And the industry’s biggest trade group, the American Trucking Associations, said Thursday that it “strongly opposes any protest activities that disrupt public safety and compromise the economic and national security of the United States.”

Six things to know about Canada’s trucker protest

Many of the nation’s approximately 3.5 million truck drivers are free to disagree, of course. But for all the talk on Facebook and elsewhere about truck convoy protests impeding the Super Bowl or other facets of life in the U.S., its supporters’ rhetoric for the most part doesn’t focus on issues specific to truckers. The largest of those groups, “The People’s Convoy,” exhorts citizens to join it to “bring back our freedoms, our civil liberties, and bring an end to all unconstitutional mandates.”

U.S. truckers have been largely free of such mandates — constitutional or not — since November, when Labor Secretary Marty Walsh said the Biden administration’s vaccine-or-test requirement for many private-sector employees would not affect truck drivers whose workplace is in “a cab driving by yourself.” The Supreme Court drove the final nail by staying the entire mandate last month.

The trucking group ATA, which fought against those mandates, is taking a victory lap during a virtual event on Friday, billed as “How ATA Stopped the Vaccine Mandate.”

Not that truckers still don’t have a long list of gripes about Washington. Pugh said they have long complained about costly and burdensome regulations. Meanwhile, they have had limited success pushing Congress to help expand the supply of overnight parking spots for truck drivers, a chronic burden for truckers’ quality of life. Advocates for large and small trucking companies have also been embroiled in an intra-industry dispute over a federal mandate requiring the use of electronic devices to keep track of how long truckers drive.

“Every administration promises you this and promises you that,” Pugh said, adding: “Parking is in a crisis in this industry. Truckers should at least be able to have a safe place to park and sleep at night. And once again they don’t get it.”

Pugh said he understands some truck drivers’ anger over the Canadian vaccine mandates, calling it just “the straw that broke the camel’s back” after years of governments ignoring their needs.

The industry also spends significant effort on issues related to the use of electronic logging devices to track driving hours and safety and environmental regulations, and currently has its hands full with supply chain snarls and not enough drivers to meet demand.

“Parking is in a crisis in this industry. Truckers should at least be able to have a safe place to park and sleep at night.”Lewie Pugh, executive vice president of OOIDA

But if a trucker protest convoy does roll into Washington, it wouldn’t be a new phenomenon.

In May 2020, near the onset of the pandemic, dozens of truck drivers blasted their horns around the White House to object to low shipping rates, certain safety regulations and the threat of self-driving vehicles taking away some truckers’ jobs.

Seven years earlier, right-wing activists’ threats to jam the Beltway with as many a million big trucks fizzled, drawing about 30 participants and little noticeable effect on traffic.

Even Brian Brase, one of the leaders of the movement for a copycat convoy in the U.S., also organizes a yearly nonpolitical convoy to Washington to promote trucking, the website for which claims they oppose “protests, shutdowns, or strikes.” Those trucks park legally on the National Mall, and drivers have conferred with federal officials during past events.

Past videos of the annual trucking convoy include interviews with drivers seeking better rates, fewer regulations on driving times and more parking spaces for big rigs.