The Hidden Costs of Containerization

How the unsustainable growth of the container ship industry led to the supply chain crisis

(Illustration by Peter and Maria Hoey)

LONG READ

BY AMIR KHAFAGY

FEBRUARY 2, 2022

This article appears in The American Prospect magazine’s February 2022 special issue, “How We Broke the Supply Chain.”

As the world celebrated the new year with family and friends, 23-year-old Filipino seafarer Vince Valeriano marked a dispiriting milestone. For over 15 months, the soft-spoken Valeriano and 22 of his fellow Filipino crewmates have been aboard Cyprus Sea Lines’ massive 54,000-ton MBSC Maria, without ever leaving the ship. This is their second consecutive holiday season without stepping ashore. Although Valeriano was well aware of the long stretches of time that he would be away from his family when he began seafaring two years ago, he could never have anticipated that he would not step on land for this long.

Valeriano says that he and his crewmates have been going stir-crazy. “We cannot go shopping. We’re very homesick here because the internet is limited and we can’t contact our family.”

To make matters worse, for two months Valeriano and the rest of the crew of the Maria have been in a seaman’s form of purgatory, indefinitely anchored off the Port of Long Beach, California, without any word when they will be able to unload their cargo and go back home. Originally, the crew of the Maria had an 11-month contract, but due to the traffic jam, their contract was involuntarily extended by four months. Valeriano makes a mere $530 a month aboard the ship. During the delays, the shipping companies have added very little in the way of hazard pay.

More from Amir Khafagy

The waiting can be excruciating. “It’s not so normal to be anchored this long,” he said via Messenger, his face visibly consumed by fatigue. “This is the first time I experienced this because with container ships you just go to the port but what can we do? They tell us the port is congested.”

Valeriano and the crew of the Maria are not alone. According to data from the Marine Exchange of Southern California, as of the first week of January, there were 105 container ships backed up outside the Ports of Los Angeles and Long Beach, by far the busiest ports in the United States. There was more cargo in the water offshore than the ports processed in all of November. Across the world, nearly 400 container vessels have piled up outside U.S. and Chinese ports, carrying 2.4 million containers.

On board with the cargo are people like Valeriano. At the start of the pandemic, 400,000 seafarers across the world were stranded at sea. As many store shelves lie bare and the cost of consumer goods continues to spike, seafarers are the unseen victims of the crisis, bearing some of the most painful costs.

By contrast, the crisis’s big winners are the nine ocean carrier companies controlling 80 percent of global shipping, which are raking in so much money that they have no reason to fix the problems and end Valeriano’s virtual imprisonment. The price of shipping a 40-foot container from China to the United States was once around $2,000. By August, it had soared to a record $20,000, a tenfold increase. By January, rates receded, but only to around $14,000, still enough to produce incredible profits for a concentrated industry. Shippers earned $25 billion in 2020; research consultant Drewry predicted $300 billion for 2021 and 2022.

This split between the fortunes of ocean shippers and their barely-hanging-on workers stems from industry-wide deregulation that supersized both container ships and the companies that pilot them. Governments handed over power to ocean shippers, and they took it, turning a global crisis into a historic jackpot, at the expense of seafarers and consumers.

The Rise of Containerization

It’s no exaggeration to say that the rise of the shipping container revolutionized the global economy. The abundance of plentiful and cheap goods we have become accustomed to finding at our local Walmart would not exist without the shipping container. Containerization drastically reduced the expense of international trade and increased the speed at which goods are delivered. Today, more than 60 percent of the world’s consumer goods, nearly $14 trillion worth of everything from iPhones to Chiquita bananas, are transported this way. Practically everything we own, will own, or ever want to own has been and will be shipped in a container.

Prior to the standardization of shipping containers between the 1960s and 1970s, most goods were stowed aboard cargo ships in individually counted units known as “break-bulk cargo.” Longshoremen, in crews of up to 25 men at a time, would manually load and unload cargo by hand in a time-consuming and laborious process that would take days. Ships would sit idle at port for far longer than they would be sailing at sea, making ocean shipping impractical, costly, and unreliable. Thus, most consumer goods were manufactured regionally and shipped by truck or rail; imports were rather limited and expensive.

It was not until 1956 that a trucking company owner named Malcolm McLean converted two old World War II oil tankers into the world’s first container ships. McLean, with the assistance of engineer Keith Tantlinger, designed a 33-foot steel intermodal container that could be easily lifted by cranes, placed snugly on the back of trucks and train cars, and locked to reduce theft. It would take only a few hours to unload a ship as opposed to days. Typically, the cost of hand-loading a ship would be about $5.86 per ton. With McLean’s new system, the price dropped to only 16 cents per ton.

Charmaine Chua, assistant professor of global studies at the University of California, Santa Barbara, has spent most of her career studying the growth and politics of the global logistics system. She explains that the move toward containerization did not take place overnight. Ports had to implement massive infrastructure upgrades, in turn radically reconfiguring the urban ecosystem. “It was a process not just about the box but about organizing the whole world transportation system in order to standardize the process in which containers would travel,” she said. “It requires ecological changes to port cities and massive expansions of trucking and shipping spaces that have huge consequences both for the lived environment for people who live in these cities as well as the ecological damage it has done to ports.”

Three ocean shipping alliances carry about 80 percent of seaborne cargo, up from 40 percent in 1998.

But the cost savings were hard to ignore. Mass containerization would allow goods to be produced in any and every low-wage country, radically reducing the biggest cost a company faces: labor. Still, the practice did not really take off until the U.S. deregulated the industries that would be newly boosted by this innovation: trucking, rail, and ocean shipping itself.

Prior to the 1980s, the Shipping Act of 1916 regulated the relatively modest ocean carrier industry like a public utility. Prices were transparent and there were no exclusive agreements for volume shippers; anyone wanting to ship cargo could access the same rates. The United States Shipping Board, later the Federal Maritime Commission (FMC), regulated prices and practices, and subsidies assisted domestic shipbuilding. The act enabled smaller companies to enter ocean shipping with stable prices to weather downturns.

But the Shipping Act of 1984, and later the Ocean Shipping Reform Act of 1998, took down this architecture. It allowed shipping companies to consolidate, and eliminated price transparency, facilitating secret deals with importers and exporters. The FMC was defanged as a regulator. Almost immediately, containerization took off. The number of goods carried by containers skyrocketed from 102 million metric tons in 1980 to about 1.83 billion metric tons as of 2017.

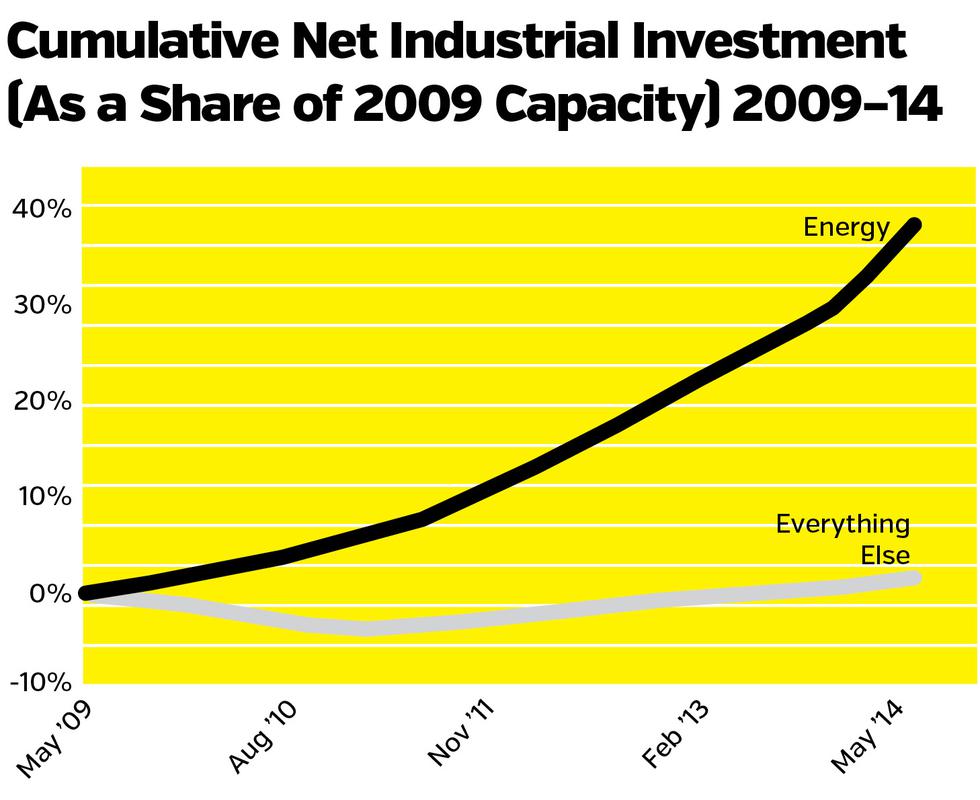

Ocean carriers quickly fell into three “alliances”: 2M, Ocean Alliance, and “THE Alliance.” These alliances carry about 80 percent of seaborne cargo, up from 40 percent in 1998, giving customers few options. Container ships also dramatically increased in size. Today, the average ship is capable of carrying over 20,000 containers at any given time. Many ships are absurdly gargantuan, with some as long as the length of the Empire State Building. Between 1980 and 2020, the deadweight tonnage of container ships has grown from about 11 million metric tons to around 275 million metric tons.

Infrastructure had to be altered to accommodate the increasingly large vessels. Between 2013 and 2019, the Port Authority of New York and New Jersey spent $1.7 billion to raise the 90-year-old Bayonne Bridge—which connects the New York City borough of Staten Island to New Jersey—clearance approximately 64 feet, from 151 to 215 feet, in an effort to accommodate larger ships. Several ports simply cannot handle mega-ships, narrowing the locations where they can be off-loaded.

The mega-ships reduced the per capita cost of shipping goods, which importers and exporters loved. But there were ulterior motives. No upstart carrier could possibly compete with the alliances; they couldn’t afford the massive startup costs to build or lease their own mega-ship. And ports that sunk money into accommodating the bigger ships were unlikely to alienate those mega-shippers through fees or other disfavored practices. The big bad ocean carriers had the rest of the supply chain over a barrel.

Expand

PAUL HENNESSY/SIPA USA VIA AP

The rise of the shipping container revolutionized the globalized economy.

Unintended Consequences

While offshoring made sense to some firms before containerization, its rise significantly cut down on shipping costs and made transporting finished goods over long distances economical. “The shipping container allowed us to take advantage of cheap labor overseas and move a lot of manufacturing offshore,” said Martin Danyluk, assistant professor in the School of Geography at the University of Nottingham. “And that comes at an incredible cost for workers domestically but also for communities.”

Factories no longer needed to be near suppliers and markets, paving the way for mass migration away from manufacturing hubs in Rust Belt cities such as Detroit, Flint, Cleveland, and Buffalo. In New York City, containerization was a major factor in the collapse of its industrial base between 1967 and 1975, pushing the city into a fiscal crisis. Organized labor was also severely wounded from outsourcing. In 2020, only 10.8 percent of wage and salary workers belonged to unions, down from 20 percent in 1983.

Containerization has also had a detrimental impact on the environment. Nearly all cargo ships use low-grade ship bunker diesel combustion engines to power themselves. Some of the biggest tankers can carry approximately 4.5 million gallons of fuel. Ships emit a plethora of toxic substances such as CO2, nitrous oxides, and sulfur oxides, which are known to cause acid rain. The pollution one ship emits produces the same amount of pollution as 50 million cars; emissions from just 15 ships would be the equivalent of all of the cars in the world. A study by the National Oceanic and Atmospheric Administration found that pollution from cargo ships has led to 60,000 deaths per year and costs up to $330 billion in annual health costs from lung and heart diseases.

Port-adjacent communities in Southern California are habitually covered in a blanket of smog emitted from ships and trucks idling in and around the ports. Yale researchers found that a 1 percent increase in vessel tonnage in port “increases pollution concentrations for major air pollutants by 0.3–0.4% within a 25-mile radius of the 27 largest ports in the United States.” Black communities are disproportionately located near ports, and Black people are more likely to be hospitalized for port-related illness.

“The communities that are being harmed by shipping activity are not evenly distributed,” said Danyluk. “It tends to be low-income communities of color … People who are already being marginalized and exploited for whatever the reason are disproportionately impacted by this activity.”

Increased shipping traffic is also playing a major role in disrupting fragile marine ecosystems. Thousands of cargo containers are lost at sea every year, with a possible 10,000 metric tons of plastic being released into the ocean. Vancouver’s famed Southern Resident killer whales are facing the possibility of extinction. The noise that container ships produce is loud enough to drown out up to 97 percent of the whale’s communication range, which impedes their ability to communicate and hunt cooperatively.

An Unsustainable Model

On the ground, the exuberant and gregarious Stefan Mueller, a tugboat captain with a passion for the sea who also serves as an inspector with the International Transport Workers’ Federation (ITF), the union that represents transport workers globally, has combed the shores of Long Beach on his boat, meeting with the crews of the ships anchored offshore. Throughout his many decades of organizing seafarers, he has never seen such a bottleneck, nor has he seen crews this exhausted. As he sees it, the entire shipping industry has grown unstable; in essence, the ships have become too big to fail.

“People say why don’t the ships just go to other ports, well it’s because other ports don’t have deep enough harbors,” he says. “In this big rush for shipping, and monopolizing of the industry, they also said bigger ships mean more cargo. So the ships are really big and that’s the problem, so it became not practical.”

Supply chain experts such as Martin Danyluk agree with Mueller that the entire model on which containerization was built was unsustainable. The pandemic has only exposed the vulnerable underbelly of the supply chain system. As manufacturers, retailers, and consumers have grown to depend on constant flow on cheap container ships, any delay could lead to a domino effect. Case in point: Last March, when the massive, 1,300-foot-long Ever Given clogged the Suez Canal, one of the world’s most significant routes for global trade, it nearly brought the world to its knees. Nearly 400 ships were lined up behind it and are estimated to have prevented $9.6 billion worth of trade.

“Over the decades, we have seen manufacturing companies embrace a kind of riskier supply chain model, where they have tried to trim the fat and embrace what is called lean production systems at every point along the chain,” said Danyluk. “They are minimizing inventory, they are working to minimize labor cost, by counting out workers and automating as much of the transport system as possible. They are tightening the timeline so that goods are sitting for as little time as possible.”

Expand

Meanwhile, the ocean carrier alliances were able to take advantage of the bottlenecks that arose in the pandemic because of their prodigious pricing power. They could raise shipping rates tenfold without fearing any loss of business because customers had next to no alternatives. And they could charge importers for use of their containers (known as detention fees) even if their cargo was buried under several stacked containers and couldn’t be reached. It’s like Uber running all the taxi companies out of town and then being able to jack up prices without limit.

Even as many businesses struggle to keep afloat during the pandemic and consumers struggle to afford consumer goods that have seen prices surge to 31-year highs, the pandemic has been generous to the container shipping industry, with profits at record highs. Mega-ship companies see the increased risk of their business model not as a problem to solve but as an opportunity to exploit. They have no reason to fix the backlog; they’re too busy making money off it.

The Hidden Cost of Labor on the High Seas

Crew members aboard ships, meanwhile, are not reaping any of the industry’s rewards. In fact, with many shipping delays, instead of switching crews at the port after the end of their contracts, companies are forcing their crews to work well beyond the end of their contracts with very little, if any, additional compensation.

“I’m blown away that they aren’t offering these crews double their wages,” said ITF inspector Mueller. “Some of the companies have been pumping up extra $100 or $200 a month. They add a little money to their basic pay, but after you have been on a ship for over a year even that is not enough.”

In 2018, the International Labour Organization (ILO) set the recommended minimum wage for an able-bodied seafarer on a global vessel at $641 a month. A well-paid worker makes a little less than twice that, Mueller explained. “That’s their basic 40-hour week, all their overtime, they live on the ship and a good-paying job is $1,200 a month total,” he said. “So basically it’s so cheap to get these guys.”

But the minimum wage set by the ILO is only a recommendation that ship owners are not bound to. Valeriano, who is just starting out, makes much less than the minimum wage set by the ILO. Although he wouldn’t mind earning extra money, what he really wants is for the company to send him home, rather than wait indefinitely to switch crews. The ITF union, which has agreements with several shipping companies, including Valeriano’s employer, has been advocating for long-delayed crews like his to be replaced and flown home, with little success.

“I should be able to relax with my family with no stress. It’s very stressful here,” Valeriano says.

One way that container shipping companies cut labor costs and avoid regulatory oversight is by adopting the flag of another nation. These are known as flags of convenience (FOC), and shipping companies around the world will often register their ships with a nation that offers less regulatory scrutiny. As of 2009, Panama, Liberia, and the Marshall Islands were the most frequent flags flown by container ships. Workers aboard FOC ships operate under the labor laws of that country, enduring much lower standards in working conditions and receiving far lower wages. Valeriano’s ship, the Maria, flies the flag of the Marshall Islands but is in fact owned by a Greek firm.

“What it has essentially allowed is a massive shifting of the burden of costs and the depressing of wages onto seafarers, who are often paid below what the ship would pay if they were beholden to regulatory standards in their home country,” says Charmaine Chua of UC Santa Barbara.

Crew members aboard ships are not reaping any of the industry’s rewards.

In 2015, Chua saw firsthand how FOC served to lower the wages of workers when she embarked on a grueling journey from Los Angeles to China on an Evergreen Marine Corp. container ship. The crew was mostly Filipinos who were subcontracted by a hiring agency, and the officers were all German.

“The differences in wages were about $3,000 per crew member at the same rate depending on if you were German or Filipino,” she said. “This turned out to be too costly for the company, so they started to move to a flag-of-convenience model and fired all of the German crew on the ship, which means that everybody worked at a lower wage.”

With companies increasingly turning to an FOC business model, it has led to a race to the bottom. To save on labor costs, shipping companies outsource much of their staffing to third-party companies in the developing world. Of the 1.6 million seafarers currently working on 50,000 commercial ships, about 230,000 of them are from the Philippines, making them the single-largest group of seafarers in the world. India represents a close second.

“Most people when they talk about races to the bottom, they are really talking about labor markets between the U.S., Europe, and the rest of the world when it comes to factories and industrial production, but this is happening on the ocean too,” Chua says.

The Loneliness of the Seafarer

On land, 72-year-old Pat Pettit and her sister Mary have been running the International Seafarers Center (ISC), a workers center supporting seafarers in Long Beach, pretty much single-handedly throughout the pandemic. Pettit first volunteered with ISC in the 1980s and eventually became the organization’s manager. Her grandfather was a seafarer and so was her stepfather. “I lived the seafarer’s life, so I know how hard it is,” she says.

For long stretches of time, seafarers are alone with their thoughts and out of contact with the outside world. In the open ocean, seafarers have no access to Wi-Fi or the telephone. This can take a toll on one’s mental health. Over 25 percent of seafarers suffer from severe depression, and nearly 6 percent of deaths at sea are caused by suicide. The pandemic has only worsened the alienation, and suicide rates have been increasing.

Since the outbreak of the pandemic, Pettit has been driving back and forth to the port nonstop, purchasing and dropping off supplies for the seafarers anchored offshore. Even if seafarers are docked at port, their companies are not allowing them to come onshore out of fear of triggering a COVID outbreak on the ship. Together with the Long Beach health department, Pettit has been working to vaccinate as many of the crews as they can, and they have already vaccinated 10,000 workers.

Although the past two years have been exhausting, the pandemic has only strengthened Pettit’s resolve in alleviating the plight of seafarers in the modest way that she can. “Work on the ship has gotten way more difficult, especially with this pandemic,” she says. “It’s just crazy and I just feel sorry for them.”

For workers like Valeriano, the nearly two years at sea have taken a toll on his body and mind. “It’s like a prison,” he said. “I can’t sleep because I want to go home and miss my family. I’m dealing with anxiety and depression. It’s not easy.”

During his wellness checks aboard anchored ships, Stefan Mueller has been working with seafarers as they try to push for the companies to send them home. However, many are reluctant to rock the boat, so to speak, out of fear their company could retaliate against them.

“There’s a blacklist,” said Mueller. “If there were 24 guys out of 200,000 seafarers that made a really big stink, those guys’ names would be faxed to all the crewing agencies and make sure never to hire them. So they don’t want to risk losing their entire careers.”

Normally clean-shaven, Valeriano has allowed his beard to grow wild as a testament to his mental state. He aches for the comforts of his mother’s home cooking and craves Jollibee, a Filipino fast-food restaurant, and guilty pleasure. Onboard the ship, mechado, a Filipino beef stew, is routinely served for dinner. He says it’s hard to swallow.

With internet access sporadic, Valeriano finds it hard to pass the time. Regardless, he fights off the depression with the hope that one day soon he will be back in the warm sun of Manila with his family and friends. As a frontline worker, he feels that has earned his right to some rest.

“I want to go home. I deserve to go home actually.”

AMIR KHAFAGY is an award-winning New York City–based journalist. He has contributed to such publications as The New Republic, Vice, The Appeal, The Guardian, Curbed, Bloomberg, and In These Times. Follow him on Twitter @AmirKhafagy91.