Era of Shocks Replaces Great Moderation, U.K. Budget Chief Says

, Bloomberg News

(Bloomberg) -- The era of easy growth and economic stability is over, with the war in Ukraine confirming that the world is caught in a period of successive shocks, the head of the U.K. government’s forecasting body said.

Richard Hughes, chairman of the Office for Budget Responsibility, said that policy makers have had to accept that uncertainty is the new normal.

The war is the fourth shock to the U.K. economy and the third globally in little more than a decade following the financial crisis in 2008, Britain’s vote to leave the European Union in 2016 and the coronavirus pandemic in 2020.

“The ‘Great Moderation’ is over,” Hughes said in an interview. “We seem to be living in world of global, novel, large, idiosyncratic shocks. It’s a huge challenge for forecasters, a huge challenge for policymakers. Ukraine has introduced a huge amount of volatility to the outlook.”

The global economy enjoyed an period of unusual stability from the 1980s to the financial crisis, a period dubbed the “Great Moderation” by economists James Stock and Mark Watson in 2002.

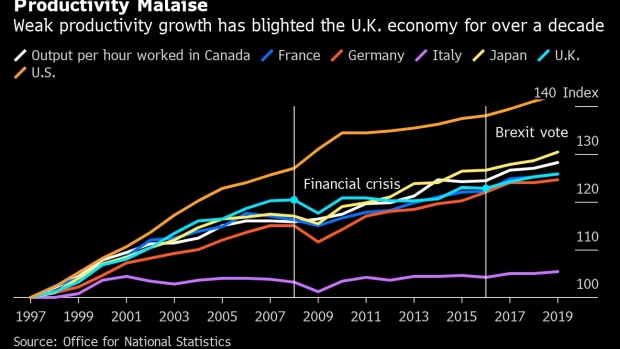

The financial crisis upended that era, leading to stagnant wages, lackluster growth and weak productivity. Bank of England policy maker Jonathan Haskel has termed it “The Great Economic Disappointment.”

The OBR has judged that the financial crisis, Brexit and Covid have all left permanent scars that reduced both the level of U.K. output and the pace of GDP growth.

Hughes, who oversaw the OBR’s latest forecasts for the Treasury’s Spring statement last week, said the war in Ukraine may be the next event to cause lasting economic damage in the U.K., due either to the conflict itself or through feedback from sanctions against Russia.

“We have not taken a view that this shock will be a supply hit to the U.K.,” he said. “That depends on the duration of the conflict and the duration of the international response. In the long run, what really matters is the outlook for supply.”

Hughes also downplayed the risk that rising inflation poses to the public finances, something Chancellor of the Exchequer Rishi Sunak has touted as a reason to keep a firm lid on spending.

“From an economic point of view, you want inflation low and stable. But from a fiscal point of view, some kinds of inflation are beneficial,” Hughes said. “Inflation that feeds into nominal wages helps the public finances because wages are taxed more than profits.”

“This bit of inflation has been particularly good for receipts for those two reasons. There’s been a nominal wage response and the frozen thresholds.”

Read more: Sunak Gets Budget Boost as Borrowing $34 Billion Below Forecast

That phenomenon is known as fiscal drag, where more people are drawn higher rates of tax as their wages rise above fixed income tax thresholds. At least 2 million Britons will be caught rates due to Sunak’s four-year freeze on thresholds, OBR documents show.

At the Spring statement last week, Sunak warned that debt servicing costs would increase four-fold to 83 billion pounds ($109 billion) next year due to higher inflation and interest rates. Hughes said the cost of higher inflation, on debnt servicing and welfare payments, was just two-thirds of the increase it delivers to government receipts.

He stressed that inflation remains a risk to the public finances, particularly as the amount of government debt linked to inflation is higher in the U.K. than other European countries. The upside would vanish, he said, if wages weren’t rising rapidly or if tax thresholds were eased.

Hughes was speaking after The Times newspaper reported that Sunak “viscerally hates” the OBR for making “policy judgments” that overshadowed his Spring statement.

Citing unnamed government sources, the newspaper reported that Sunak was unhappy the OBR said U.K. households faced the sharpest fall in living standards since records began in the 1950s and that personal tax cuts he announced unwound just one sixth of the rises since he took office.

The OBR’s figures dominated media coverage of Sunak’s Spring economic statement in which the chancellor cut taxes for 30 million working people. “The chancellor has not raised any of these issues with me,” Hughes said in response to the article in The Times.

The OBR documents show that the chancellor saw the forecasts eight days before the Spring statement. Its projections also handed the chancellor a 15 billion pound windfall, 10 billion pounds of which which Sunak used to cut taxes.

©2022 Bloomberg L.P.