Toronto's new wealth gap is driven by real estate, not income | The Star

Date: 2022-04-16

When Giulio and Antonia Cescato bought a brand-new, modestly sized condo-townhouse in downtown Toronto in January 2015 they paid just under $600,000.

They made $150,000 at the time, a combined salary that, along with equity from Giulio’s condo, allowed them to put down a 20 per cent deposit.

The two-bedroom home at Dundas and Sumach streets that they share with their six-year-old son, Gabriel, is near schools, transit, grocery stores, daycares, barbershops, banks and restaurants. Their payments right now leave enough room to splurge once in a while, and take the “occasional vacation,” without feeling stretched.

They had wanted to upsize eventually, but even with the increased value of their home, re-entering the housing market at the current sky-high prices would leave them “mortgage poor.”

“Even if the bank was to give us a mortgage, it doesn’t seem sustainable in our minds to take on that much debt,” Giulio, 42, said.

By today’s standards, the Cescatos are lucky. They were able to buy their house when the average cost of home was about $620,000. This year to date the average is $1.3 million.

The high cost of real estate has led to a widening wealth gap threatening individuals’ security and the long-term prosperity of the GTA — a divide not based on income, but on when and if you were able to buy into the real estate market.

That difference determines more than if a family scrapes by, scrounging for rent or mortgage payments, or whether it can comfortably cover its housing costs, and afford restaurants and vacations.

It also impacts the biggest life decisions, says University of British Columbia professor Paul Kershaw — whether to move out of your parents’ home; live with a partner; have children.

On Monday, federal Finance Minister Chrystia Freeland called Canada’s housing affordability challenge an “intergenerational injustice.”

“We cannot have a Canada where the rising generation is shut out of the dream of home ownership,” she said, referencing her government’s budget measures to increase housing supply and affordability.

It was an acknowledgment of how, in less than a generation, buying a home has gone from a financially challenging but relatively common milestone, to a pipe dream for many people, especially those without family wealth. The fevered housing market of the pandemic has only exacerbated those challenges.

Ontario home prices are 22.5 times the average disposable income, up from 12.1 in 2010, and 9.7 in 2005, according to a report from Oxford Economics released by Mortgage Professionals Canada in March.

“Maybe not 10 years ago, but 15 years ago, if you grew up in Toronto and you were fortunate to get a good education and get a good job, you could buy a house and you could live in a neighbourhood either where you grew up or in another neighbourhood of your choice,” says University of Toronto professor Matti Siemiatycki.

Now the tension between what people earn and the price of a home is pulling at the fabric of the city.

“People who grew up here can’t live in the neighbourhoods they grew up in anymore. They can’t afford to buy and often can’t afford to rent either,” he said.

The gentrifying of neighbourhoods risks “severing deep meaningful social ties as people hustle to make ends meet,” said Siemiatycki, citing soul-sapping commutes and “painful decisions to leave a place that they often love and call home.

“If young families and workers can no longer afford to live in Toronto or people feel precarious in their place here, the city risks losing the work and dynamism they contribute,” he said.

It also cements inequality within generational cohorts, says Kershaw, a founder of Generation Squeeze, a group that advocates for intergenerational equality, noting there is an entire swathe of people who don’t have access to wealth.

About a quarter of older Canadians are not homeowners, said Kershaw. That means their family members can’t rely on intergenerational wealth for housing assistance.

Canadians have one of the world’s highest rates of home ownership. In 2016, 67.8 per cent of Canadian households owned their dwelling. In Toronto it was 53 per cent.

New census data won’t be available until summer, but the most recent statistics suggest home ownership is down among younger people. The 2016 Census showed half of millennials owned a home at age 30, compared to 55 per cent of baby boomers who owned at that age.

And the trend seems to be more prominent in Toronto. The 2018 Housing Survey by Statistics Canada found while half of first-time homebuyers nationally were under the age of 35, only 41.2 per cent of first-time buyers in Toronto were under 35.

Toronto couple Karan Kumra, 33, and fiancée Erin Prisciak, 32, have given up vacations and live frugally in order to the make the mortgage payments on the upper Beach semi they bought late last year for just over $1 million.

The couple — who have a combined salary of $150,000 — say they wouldn’t have been able to enter the market if it weren’t for sizable help from family.

Prisciak, a radiation therapist, said for her, with $50,000 in student loan debt after graduating, buying a house in Toronto was “never an option.”

The couple were only able to purchase because of a gift of $250,000 from Kumra’s parents. That reduced their mortgage to around $805,000, which still means $3,000 a month in payments.

“We pretty much can’t plan trips outside the country, or we’ll fall behind on our mortgage. So, we do small trips in Ontario and maybe later we’ll get to other parts of Canada,” said Kumra, an entrepreneur who manages retail operations for a cannabis outlet in Toronto.

They’re thankful for being able to buy their home, which they view as a retirement asset.

“We’re very privileged, very lucky … to have that kind of assistance from family. We’re absolutely thrilled that we got in when we did because (the market) is getting (more expensive),” Kumra said.

That kind of gift isn’t the reality for most first-time home buyers. Ipsos research for the Toronto Regional Real Estate Board found only 17 per cent of buyers were counting on gifts from family or friends. And while the proportion of buyers expecting family support has been consistent since 2015, the value of those gifts has grown along with “the meteoric rise of housing,” said Ipsos senior vice-president Sean Simpson.

“There’s no amount of hard work or pulling yourself up by your bootstraps that is going to help most people (get into the market),” added Prisciak. “If you don’t have some kind of wealth from family, I don’t think buying a house in Toronto is an option.”

Kershaw agrees.

“We’ve created an economy where full-time work in a reasonable period of time cannot secure housing. I don’t even mean home ownership — even access to a rental with enough bedrooms to have a family,” he said.

Kershaw calls himself a prime example. During his 17 years as a professor, he figures he’s paid about $500,000 into his defined contribution pension plan.

“Last year, while I was sleeping, my home went up by $500,000,” he said.

The impact is personal and public. In the hot real estate markets of Toronto and Vancouver, Kershaw said the high cost of housing will make it increasingly difficult to attract the best and brightest workers.

“Why would you want to come where your wage is going to buy you a fraction of the property? You’re pushing that 30- or early 40-year-old away from cities because they’re looking for space, they’re looking for the access to the ground to send their kids out to play,” he said.

While families moving further out of the city to smaller communities rejuvenates more affordable places, it also spreads the contagion of unaffordable housing and wealth inequality by driving up the prices there.

/https://www.thestar.com/content/dam/thestar/news/gta/2022/04/16/torontos-new-wealth-gap-is-driven-by-real-estate-not-income-where-those-who-got-in-early-can-live-a-very-different-life/B881669971Z.1_20220414173350_000+GR01GFPGO.4-0.jpg)

For economist DT Cochrane, the Toronto region’s housing crisis isn’t a sudden, isolated problem — it is a symptom of an issue that has been brewing for years.

It is “maddening,” he said, that people have been talking about the wealth gap since long before the pandemic.

In the GTA, there are few social issues that better illustrate the growing divide between rich and poor than the lack of affordable housing.

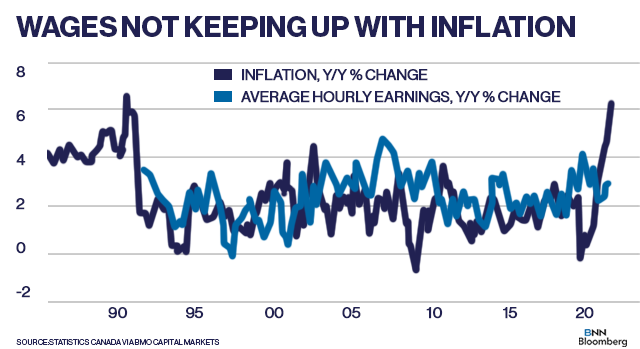

And while governments and the housing industry mainly focus on a supply shortage, analysts and economists, including Cochrane, who works with Canadians for Tax Fairness, say the high cost of housing has to be viewed in the context of other factors including wages, pensions, interest rates and the commodification of homes.

If we ignore those issues, the wealth gap will only widen as people increasingly view housing as their retirement nest egg or an asset for a corporation.

“What’s happening in the housing market is going to turbocharge the process,” he said.

“Owning a house becomes an important source of leverage to then buy another house and another house. To go from owning one house to two houses is much easier than to go from owning zero houses to even one house.”

A 2020 report from the Toronto Region Board of Trade and WoodGreen Community Services found people earning $40,000 to $60,000 a year have been priced out of Toronto. Among them: personal support workers, grocery clerks, social workers, nurses and teachers.

Anyone who works in the city should be able to afford to live in the city, said Cochrane. “Otherwise, they’re just fly-in slaves.

“The fact that a teacher can’t afford to buy a house in Toronto should be really worrisome to the people of Toronto,” he said.

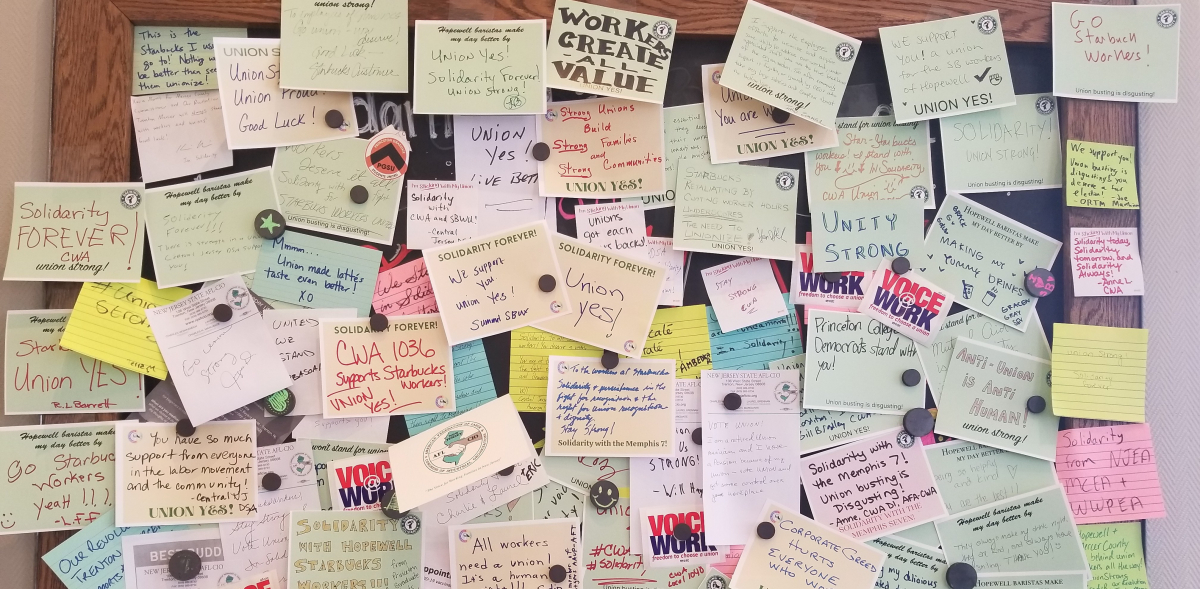

If more workers had union protection, stronger pensions and higher wages, people would be less reliant on rising home values for their financial futures, added Cochrane.

“We don’t think about corporations having obligations to their workers at all, whereas in the immediate postwar era there absolutely was that perspective.”

U of T professor Siemiatycki says it’s also important to put rising housing costs through the lens of inclusivity and diversity — who is able to buy into the market and who is excluded.

“We are running the risk of gentrification in some neighbourhoods that have really historic ties to racialized communities and continue to be hubs of those communities,” he said.

“If the market is just left to run wild, those communities have often had a very hard time buying in.”

Mike Moffatt, senior director of policy and innovation at the Smart Prosperity Institute, who also teaches at the Ivey Business School at Western University, adds that households could face another kind of crisis. He is among those who say it is possible home prices will eventually fall, although he won’t speculate on when that might happen.

If they do, he says, “There is a good chance we end up with the worst of both worlds where we have a significant enough correction to put people underwater (having a mortgage that’s higher than the value of your property), but prices are still so high that first-time homebuyers can’t get into the market.”

Moffatt fears it could take five to 15 years to sort out the region’s housing supply issue — which he believes is the main driver of unaffordability. Asked if that means an entire generation has been sacrificed, he says, many people have already been priced out for years.

“I do think there’s a problem,” he said.

“Most of my research associates are in their mid- to late 20s. They all feel like they’ll never be able to get a home. They’re not happy about it and I get where they’re coming from. I share the concerns.”

Meantime, says Kershaw, Canada’s aging population, which had better pensions, has the lowest rate of poverty and low income of any age group in the country.

“It’s not like today’s retirees are depending on housing but they do get accustomed to the extra wealth,” he said.

Kershaw says Canada has to think about how we build back better in terms of housing because we’re not as productive when it comes to output of work compared to other countries. Instead, our economy relies on real estate, rental and leasing which produces relatively few jobs.

“With low interest rates, Canadians have borrowed more money and bid it into the price of housing,” he said.

Watching the struggles in the market, the Cescatos, who bought their townhome in 2015, are staying put — choosing not to stretch their finances in order to move up.

The couple say they’re fortunate they had the money for a decent down payment — “Which was all our free capital,” said Giulio, a planner with a firm in the city — and that their home had room for when their child came along.

They had hoped to parlay their unit into something larger, but that plan is “kind of laughable right now,” Giulio said. Even though the Cescatos earn larger salaries now and their unit has nearly doubled in value in the last five years, a move into a larger home isn’t in the cards because everything else on the market has soared too.

“Even a modestly priced house close to where we live now, we’d be looking into the couple million dollars range, if not more and tripling our mortgage,” Giulio said.

“The accountant in me says ‘absolutely not,’” added Antonia, 43.

So at this point they are looking at making improvements to their unit to make it their “forever home.”

“We have a European-style fridge, it’s small for a family. I had a friend who choked when she saw my refrigerator,” said Antonia. “So we might want to think about doing some kitchen renos down the road, to actually fit a full-sized refrigerator.”