EIA expects nine new Gulf of Mexico natural gas and crude oil fields to start in 2022

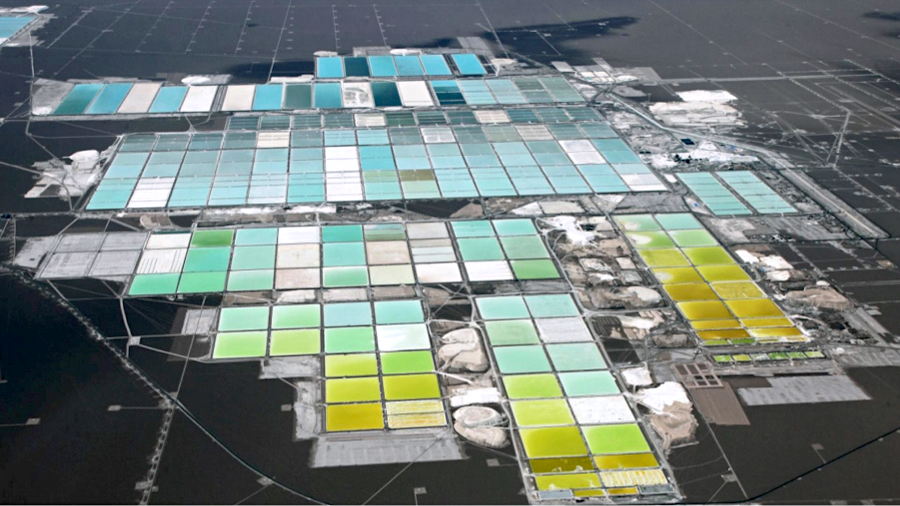

In our June 2022 Short-Term Energy Outlook (STEO), we forecast that new fields coming online in 2022 will account for 5% of natural gas production and 14% of crude oil production in the U.S. Federal Offshore Gulf of Mexico (GOM) by the end of 2023. We expect that GOM natural gas production will average 2.1 billion cubic feet per day (Bcf/d) in 2023, down 0.1 Bcf/d from 2022. We expect that GOM crude oil production will average 1.8 million barrels per day (MMb/d) in 2023, about the same as in 2022. Currently, no GOM fields are scheduled to start up in 2023.

During 2021, 15% of all U.S. crude oil production was produced in the GOM, and 2% of U.S. natural gas production was produced there. In our STEO, we forecast that eight new fields in the GOM will produce both oil and natural gas by year-end, based partly on data from Rystad Energy. We expect a ninth field, which will produce only crude oil, to start in 2022.

We expect that the additional capacity will not quite sustain crude oil production at levels similar to the end of 2021. The additional capacity from these new fields will not increase natural gas or crude oil production in the GOM. We expect GOM natural gas production to continue its three-year decline; annual GOM production last rose in 2019. Declining production from existing GOM fields is greater than the increase in production from new fields for natural gas and is equal for crude oil.

Since the late 1990s, new development in the GOM has been targeting oil-bearing reservoirs. Today, most of the natural gas produced in the GOM comes from associated-dissolved natural gas production in oil fields instead of natural gas fields. In 2020, gross withdrawals of natural gas in the GOM that came from natural gas wells accounted for less than 30% of total GOM natural gas production, compared with 76% in 1999.

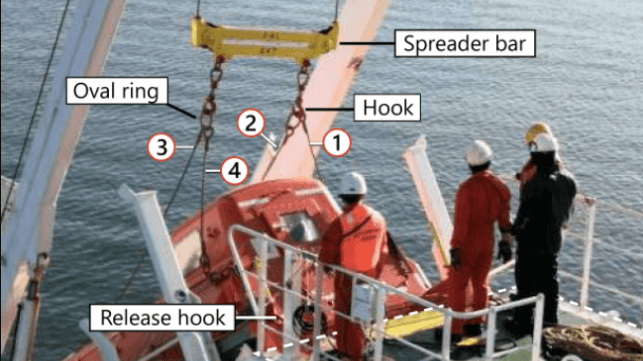

We expect the large development fields of Argos, King’s Quay, and Vito to begin production in 2022. Each has a peak production capacity of 100,000 barrels of oil equivalent per day (MBOE/d) or more, and each is the result of a focused effort to lower the costs of field developments. Offshore producers have made significant progress simplifying and standardizing floating production systems and collaborating with various partners, including overseas construction services companies, to reduce total costs and remain competitive with onshore producers.

However, fields expected to start in 2022 may shift into our 2023 forecast if their start-up dates are pushed back. In addition, fields expected to start in 2024 could begin earlier, resulting in changes to our initial production forecasts.

Principal contributors: James Easton, Kirby Lawrence, Jim O’Sullivan

JUNE 21, 2022