Staff Writer | July 5, 2022 |

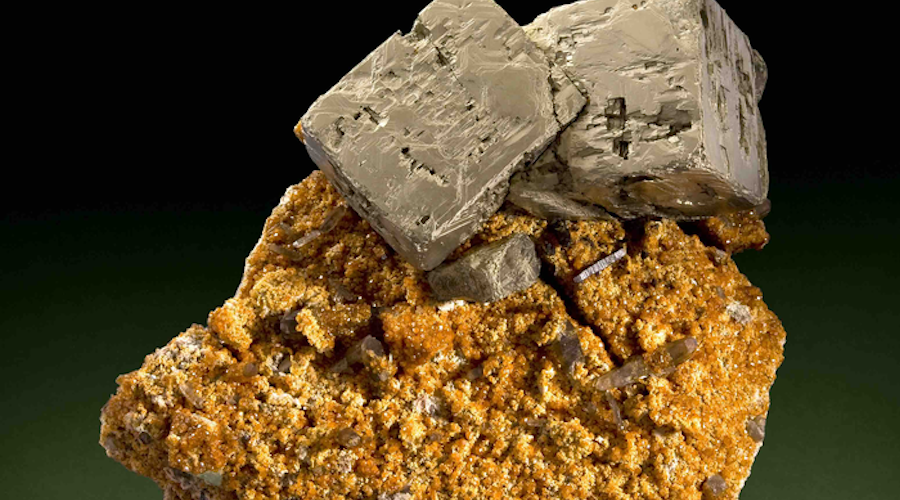

Nature has used 21 different ways over the last 4.5 billion years to create pyrite. (Image by ARKENSTONE/Rob Lavinsky, courtesy of the Carnegie Institution for Science).

Researchers at the Carnegie Institution for Science developed a method for clustering (lumping) kindred species of minerals together or splitting off new species based on when and how they originated, a novel approach that explains the origins and diversity of every known mineral on earth.

In two papers published in American Mineralogist and sponsored in part by NASA, the scientists point out that their findings help reconstruct the history of life on earth, guide the search for new minerals and ore deposits, predict possible characteristics of future life, and aid the search for habitable planets and extraterrestrial life.

The International Mineralogical Association recognizes more than 30 “species” of tourmaline, but the new papers acknowledge only a handful of “mineral kinds.” (Image by ARKENSTONE/Rob Lavinsky, courtesy of the Carnegie Institution for Science).

The International Mineralogical Association recognizes more than 30 “species” of tourmaline, but the new papers acknowledge only a handful of “mineral kinds.” (Image by ARKENSTONE/Rob Lavinsky, courtesy of the Carnegie Institution for Science).According to co-authors Robert Hazen and Shaunna Morrison, once mineral genesis is factored in, the number of “mineral kinds” — a newly-coined term — totals more than 10,500, a number about 75% greater than the roughly 6,000 mineral species recognized by the International Mineralogical Association on the basis of crystal structure and chemical composition alone.

Another key finding of the 15-year scientific effort is that more than 80% of the earth’s minerals were mediated by water, which is, therefore, fundamentally important to mineral diversity.

By extension, this explains one of the key reasons why the Moon and Mercury and even Mars have far fewer mineral species than earth.

“The work also tells us something very profound about the role of biology,” Hazen said in a media statement. “One-third of earth’s minerals could not have formed without biology – shells and bones and teeth, or microbes, for example, or the vital indirect role of biology, such as by creating an oxygen-rich atmosphere that led to 2,000 minerals that wouldn’t have formed otherwise.”

Many roads lead to…fool’s gold

The paper also notes that nature created 40% of earth’s mineral species in more than one way – for example, both abiotically and with a helping hand from cells – and in several cases used more than 15 different recipes to produce the same crystal structure and chemical composition. Those recipes ranged from near-instantaneous formation by lightning or meteor strikes, to changes caused by water-rock interactions or transformations at high pressures and temperatures spanning hundreds of millions of years.

Among those minerals with a number of different recipes is pyrite, aka fool’s gold, for whose creation nature came up with 21 different methods over the last 4.5 billion years. Pyrite forms at high and low temperatures, with and without water, with the help of microbes and in harsh environments where life plays no role whatsoever.

Composed of one part iron to two parts sulphide (FeS2), pyrite is derived and delivered via meteorites, volcanos, hydrothermal deposits, by pressure between layers of rock, near-surface rock weathering, microbially-precipitated deposits, several mining-associated processes and many other means.

Rare elements

The studies also found that rare elements play a disproportionate role in the planet’s mineral diversity. Just 41 elements — together constituting less than 5 parts per million of earth’s crust — are essential constituents in some 2,400, or over 42%, of earth’s minerals. The 41 elements include arsenic, cadmium, gold, mercury, silver, titanium, tin, uranium, and tungsten.

In addition, much of the planet’s mineral diversity was established within its first 250 million years, with the oldest known minerals being tiny, durable zircon crystals, almost 4.4 billion years old.

There are also almost 300 minerals that are thought to pre-date earth itself. Of these, 97 are known only from meteorites, with the age of some individual mineral grains estimated at 7 billion years, which is billions of years before the origin of our solar system.

Mining, on the other hand, has also played a role in the creation of minerals — over 500 species of them. Of these, almost half were formed by coal mine fires.

How they did it

To reach their conclusions, Hazen and Morrison built a database of every known process of formation of every known mineral. Relying on large, open-access mineral databases, amplified by thousands of primary research articles on the geology of mineral localities around the world, they identified 10,556 different combinations of minerals and modes of formation.

In all, minerals have come into being in one or more of 57 different ways.

The goal behind all this work was to understand how the diversity and distribution of minerals have changed through deep time and to propose a system of mineral classification that reflects mineral origins in the context of evolving terrestrial worlds.

.jpg)