Mining Industry Warns Energy Transition Isn’t Sustainable

- There is a glaring problem in the energy transition that not many people are acknowledging.

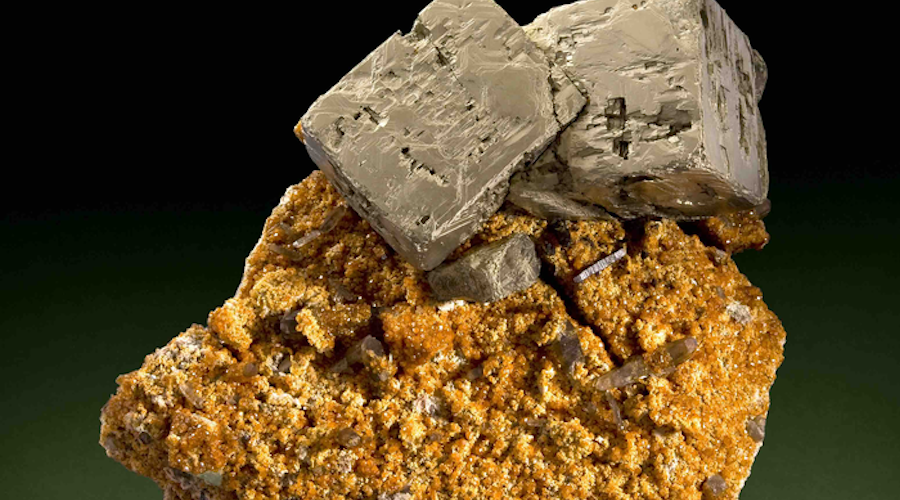

- It is being built on the back of finite resources, and the mining industry is already warning that there aren’t enough metals for all the batteries the transition will require.

- Because of the short supply, prices are on the rise, as are prices across commodity sectors.

The energy transition has been set by politicians as the only way forward for human civilization. Not every country on the planet is on board with it, but those that are have the loudest voices. And even amid the fossil fuel crunch that is beginning to cripple economies, the transition remains a goal. It is no secret that the transition—at the scale its architects and most fervent proponents envisage it—would require massive amounts of metals and minerals. What does not get talked about so much is that most of these metals and minerals are already in short supply. And this is only the start of the transition problems.

Mining industry executives have been warning that there is not enough copper, lithium, cobalt, or nickel for all the EV batteries that the transition would require. And they have not been the only ones, either. Even so, the European Union just this month went ahead and effectively banned the sales of cars with internal combustion engines from 2035.

“Rare earth materials are fundamental building blocks and their applications are very wide across modern life,” a senior VP at MP Minerals, a rare-earth miner, told Fortune this month. He added that “one third of the demand in 2035 is not projected to be satisfied based on investments that are happening now.”

Because of the short supply, prices are on the rise, as are prices across commodity sectors. According to a calculation by Barron’s, the price of a basket of EV battery metals that the service tracks has jumped by 50 percent over the past year as a result of various factors, including Western sanctions against Russia, which is a major supplier of such metals to Europe.

The combination of short supply and rising prices is, of course, making the energy transition even costlier than it has been projected to be. It has also reminded us all that because of these metals and minerals, which are exactly as finite as crude oil and natural gas, the transition is not towards a renewable-energy future. It is towards a lower-carbon future. And this future may perpetuate some of the worst models of the past we want so much to leave behind.

A lot of the battery metals that the energy transition needs are sourced from Africa, a continent fraught with poverty, corruption, and political uncertainty. It is also a continent that is currently threatened by a new sort of colonialism because of the energy transition.

In a recent analysis for Foreign Policy, Cobus van Staden, a China-Africa researcher from the South African Institute of International Affairs, wrote that the dirty secret of the green revolution is its insatiable hunger for resources from Africa and elsewhere that are produced using some of the world’s dirtiest technologies.

More importantly, van Staden added, “What’s more, the accelerated shift to batteries now threatens to replicate one of the most destructive dynamics in global economic history: the systematic extraction of raw commodities from the global south in a way that made developed countries unimaginably rich while leaving a trail of environmental degradation, human rights violations, and semipermanent underdevelopment all across the developing world.”

It is difficult to argue with this forecast if you know the history of resource exploitation in Africa. Sometimes called “the resource curse” and commonly used for oil, it has been in fact, a notable feature of the colonial and post-colonial period. Van Staden notes human rights violations, corruption, and the perpetuation of low labor and environmental standards, and he also notes that pretty much all foreign businesses in Africa’s mining sector are doing all this.

Based on this evidence, it appears that besides non-renewable, the energy transition appears to not be very socially conscious. In other words, the ESG investment movement, which focuses on transition companies, might, in fact, be a movement that rewards companies that are neither very environmentally nor socially friendly. At least not in Africa. And there are no white hats because, as Van Staden says, “The entire logic of the battery metals race is to secure national prosperity at home—not in Africa.”

It could perhaps be argued that unlike the last time—the Industrial Revolution—this time, we have a lot more mechanisms to protect human rights. As true as that may be, there hasn’t been a lot of progress on that in the Democratic Republic of the Congo, for example, a huge country that is key for the transition because of its cobalt wealth.

Even with these mechanisms, there is no way to eliminate corruption unless all involved don’t want to eliminate it, which appears not to be the case with mining companies and resource-rich African governments. That’s the problem with corruption; it is hard to uproot. Corruption, in turn, affects environmental standards and fair compensation for workers, and the resource curse keeps its stranglehold on the continent.

The good news is that all these problems with the transition were more or less taboo until recently. Now they are being talked about more and more, and this would hopefully lead to a readjustment of goals or at least timelines to make them more realistic. Maybe, just maybe, the just transition idea will gather speed as well.

.png)