Reuters | June 30, 2022 |

Ferromagnetic fluid magnetized by a neodymium magnet (Stock Image)

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

A metallic NATO is starting to take shape, though no-one is calling it that just yet.

The Minerals Security Partnership (MSP) is in theory open to all countries that are committed to “responsible critical mineral supply chains to support economic prosperity and climate objectives”.

But the coalition assembled by the United States is one of like-minded countries such as Australia, Canada, the United Kingdom, France and Germany with an Asian axis in the form of Japan and South Korea.

It is defined as much as anything by who is not on the invite list – China and Russia.

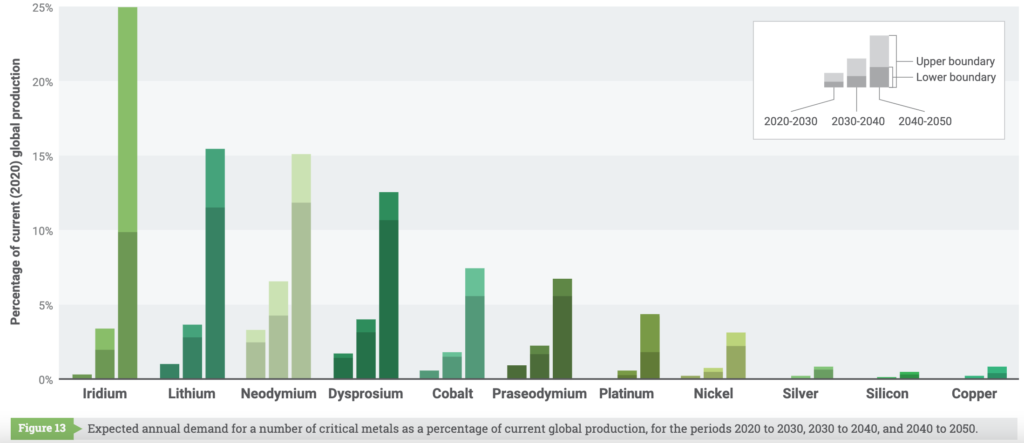

China’s dominance of key enabling minerals such as lithium and rare earths is the single biggest reason why Western countries are looking to build their own supply chains.

Russia, a major producer of nickel, aluminium and platinum group metals, is now also a highly problematic trading partner as its war in Ukraine that the Kremlin calls a “special military operation” grinds on.

A previously highly globalised minerals supply network looks set to split into politically polarised spheres of influence, a tectonic realignment with far-reaching implications.

‘Friend-shoring’

The United States and Europe have realised that they can’t build out purely domestic supply chains quickly enough to meet demand from the electric vehicle transition.

The answer is “friend-shoring”. If you can’t produce it yourself, find a friendly country that can.

“Friend-shoring is the idea that countries that espouse a common set of values (…) get the benefits of trade so we have multiple sources of supply and are not reliant excessively on sourcing critical goods from countries where we have geopolitical concerns,” US Treasury Secretary Janet Yellen said in “a fireside chat” with Canada’s Deputy Prime Minister and Minister of Finance Chrystia Freeland.

The process was already well underway before the US State Department announced the formation of the MSP on June 14.

US and Canadian officials have been working closely as Canada fleshes out a promised C$3.8 billion ($3.02 billion) package to boost production of lithium, copper and other strategic minerals.

European Commission Vice-President Maroš Šefčovič has just been in Norway to seal “a strategic partnership” on battery technologies and critical raw materials.

The Pentagon is getting in on the friend-shoring trend too.

It has asked Congress to amend the Cold War-era Defense Production Act (DPA) to allow it to invest directly in Australia and the United Kingdom.

The Defense Department (DoD) says it is “unnecessarily” constrained by the existing requirement to invest only on home soil or in Canada. Leveraging the resources of two “closest allies” would “increase the nation’s advantage in an environment of great competition”.

Rare earths breakthrough

The first tangible rewards of all this heightened mineral diplomacy are starting to be seen.

Rare earths have posed a particular headache for Western countries because of China’s dominance of the supply chain, particularly the processing stage of production.

The only operating rare earths mine in the United States, for example, has been shipping its concentrate to China for refining.

The DoD is investing $120m in a new plant for heavy rare earths separation. It has chosen an Australian company as its partner.

Lynas Rare Earths will supply the plant in Texas with mixed rare earths carbonate from its mine in Western Australia as well as working with third-party suppliers “as they become available,” it said.

The plant is due to become operational in 2025 and Lynas and the DoD are already working on a complementary light rare earths separation facility.

Expect many more such “friendly” tie-ups in the coming months as the United States and Europe attempt to pivot away from “unfriendly” nations.

Hostilities

As for China and Russia, “we’re still going to have a relationship with countries outside this closest circle but it’s going to be a (…) relationship that has less trust at its heart,” according to Chrystia Freeland.

The days of unlimited Chinese mining investment in countries such as Canada and Australia are probably over.

Canada waved through Zijin Mining Group’s 601899.SS acquisition of Toronto-listed Neo Lithium Corp last year, saying it saw no risks to national security.

But speaking to the Globe and Mail earlier this month, Jonathan Wilkinson, Natural Resources Minister, signalled a change in stance. “I do think that it is appropriate for us to pause and reflect on whether we will allow those kinds of transactions going forward,” he said.

This is not just a question of ownership but also of off-take deals if material is being shipped to China for refining. “Canada needs to ensure that it is protecting itself in an area that is clearly strategic and ensuring that those supply chains will be robust for our allies,” Wilkinson said.

The investment climate has just got a lot chillier for Chinese operators and there has already been a hostile reaction.

The DoD said on Tuesday it was “aware of the recent disinformation campaign” against Lynas and other rare earth mining companies operating in the United States.

This follows claims by US-based cybersecurity firm Mandiant that a pro-China propaganda campaign used fake social media accounts to try to stir up opposition to proposed new mines and plants.

China’s Computer Emergency Response Team (CERT) and embassy in Washington did not respond to a Reuters request for comment.

It’s a warning sign of what may come if the geopolitical polarisation of critical minerals supply turns ugly.

A ‘big deal’

The MSP marks a new chapter in the critical minerals story. The pressure to decouple from China has been growing for several years but Russia’s invasion of Ukraine has concentrated minds.

While the immediate focus is on Russia’s role in the energy sector, there is a recognition that critical minerals could be next.

“Being dependent on countries that do not always share our perspectives on global affairs, and that have shown the ability at times to use their control of some of these resources as a weapon, is not a very good strategy,” warned Canada’s Wilkinson.

The era of globalised trade patterns in strategic commodities is over, according to Chrystia Freeman.

Friend-shoring is going to be “the big economic and geopolitical issue” going forwards and “the world has not yet really started to properly grapple with how big a deal this is”.

(Editing by Emelia Sithole-Matarise)