What are EU's options in palm oil row with Malaysia and Indonesia?

Indonesia and Malaysia say the EU's palm oil restrictions are unfair and "discriminatory" and are hoping for the WTO to resolve the dispute. Meanwhile, the EU has been introducing new limits on using palm oil as fuel.

Palm oil can be used to produce fuel, but emissions are very high

The World Trade Organization could soon rule on two cases brought against the European Union over its decision to phase out the import of unsustainable palm oil by 2030.

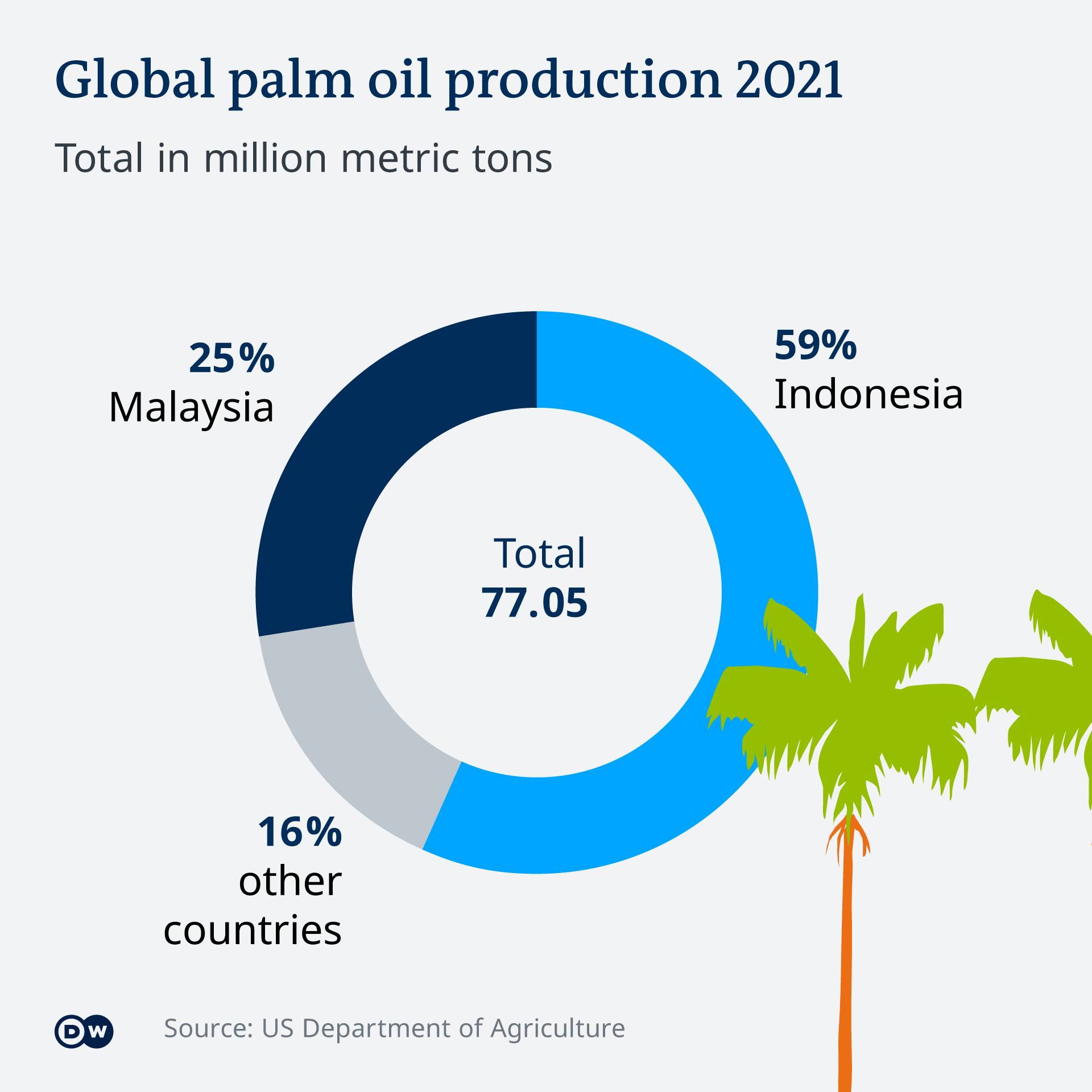

The complaints were filed by Indonesia and Malaysia, the world's two largest palm oil producers, who slammed Brussels' Renewable Energy Directive II as unfair and "discriminatory."

The EU has been sending mixed signals on the controversial issue.

On one hand, its officials have made clear that oil production is a leading cause of deforestation and so cannot comply with renewable energy targets. There is also an issue of pollution — palm oil diesel releases up to three times as many emissions compared to traditional petroleum-based fuel.

In early July, EU lawmakers adopted draft rules for the ReFuelEU initiative, which would mean 85% of all aviation fuel would have to be "sustainable" by 2050. Palm oil byproducts would not be acceptable. And there is now talk in the European Parliament of bringing forward the final phaseout date for palm oil imports, currently set at 2030.

At the same time, Brussels has attempted dialogue with palm oil exporters in recent months, including through the ASEAN-EU Joint Cooperation Committee meeting in Jakarta in late June.

And since the introduction of a renewable energy directive in 2018, the EU's imports of palm oil have actually increased. In 2021, the EU imported €6.3 billion ($6.4 billion) worth of palm oil and palm oil products, most used for biofuels.

Indonesia and Malaysia accounted for 44.6% and 25.2% of those imports, respectively. EU imports from Indonesia were up 9% last year, compared to 2020, according to Indonesian government data. Russia's war in Ukraine, which started in late February, has put additional pressure on Brussels to secure its fuel supply.

Indonesia and Malaysia together dominate the world's palm oil supply

Malaysia decries 'crop apartheid'

The Malaysian and Indonesian governments have also tried to keep their options open in the EU row.

"Malaysia has often employed both a cordial and confrontational approach over palm oil with the EU, not exclusively one or the other," explained Helena Varkkey, associate professor at the Department of International and Strategic Studies at the University of Malaya.

Earlier this year, Malaysian Plantation Industries and Commodities Minister Zuraida Kamaruddin slammed what she called "crop apartheid."

"We will show them that Malaysia is not a nation to be fooled around with," she said.

Last month, however, she said Kuala Lumpur wants a cordial, "win-win" solution to this problem, referencing the World Trade Organization.

"WTO cases take a long time to resolve, so it would still be necessary for countries to engage outside of the WTO during this process, and Malaysia probably sees the benefit of doing so amicably," said Varkkey.

And with the dispute ongoing, the Malaysian government is busy finding new markets. During his visit to Kuala Lumpur this month, China's Foreign Minister Wang Yi vowed that Beijing would increase imports of palm oil from the country. China is currently the world's second-largest importer of the product, after India.

What if the WTO rules against the EU?

The WTO decision seems to be drawing near. The panel to decide Indonesia's case was formed in November 2020. A panel of the same members was formed for Malaysia's case in July 2021. Both are chaired by Manzoor Ahmad, Pakistan's former permanent representative to the WTO. Members are Sarah Paterson, of New Zealand, and Arie Reich, of Israel.

A senior EU official, who requested anonymity, said they expect a decision before the end of the year.

If the WTO panels were to rule in favor of Indonesia and Malaysia, Brussels has three options, explained Stefan Mayr, a senior scientist at the Institute for Law and Governance at Vienna University of Economics and Business.

First, the EU could appeal the panel report. But that could set back a final ruling by years, as any decision would have to come after new members are appointed to the WTO's Appellate Body. The body is currently not functioning due to the US blocking new appointees.

The second option, Mayr noted, would be for the EU to comply with the WTO ruling and adapt the environmental policies established by the Renewable Energy Directive II. Whether the EU could make cosmetic changes to its palm oil phaseout, while keeping the essence of the policy, is unclear.

Lastly, the EU could simply carry on regardless and accept any retaliatory measures imposed by Indonesia and Malaysia.

This last option, however, doesn't seem too likely. A senior EU source with knowledge of this issue, who requested anonymity, said: "we will, of course, abide by whatever the WTO decides."

Geopolitics and palm oil

If the EU was to ignore the ruling, Indonesia and Malaysia would struggle to retaliate economically, analysts reckon. According to European Commission data, Malaysia is only the EU's 20th largest trading partner in goods; Indonesia is 31st.

But another EU official, also not authorized to speak publicly on the issue, speculated that Brussels would not want to unnecessarily frustrate two key actors in Southeast Asia, where the EU is keen on boosting its reputation and signing new free trade deals. Because of the energy crisis caused by the Ukraine war, the official also expects EU imports of palm oil to continue growing in the coming years.

Moreover, Jakarta has one more card to play — it could limit the export of raw materials necessary for the production of stainless steel. The EU brought a case against Indonesia to the WTO on this issue in November 2019.

"Which option the EU would choose is obviously not a purely legal question," said Mayr.

"There are conflicting interests at play and in light of the current geopolitical situation, it seems even more difficult to gauge how the EU would react to an unfavorable outcome in the WTO disputes."

Edited by: Darko Janjevic