Frik Els | August 1, 2022

Coal mining is back in the black. Stock Image.

New data from Industrial Info Resources show 4,790 metals and minerals capital projects (including mining, processing and refining) with a combined investment value of $443 billion are currently under construction around the world. A further 10,586 projects are under active planning and engineering – for a combined total of $1.11 trillion.

Joe Govreau, VP of Research at Industrial Info Resources, says that is an 8% increase from the preceding period as projects delayed by the pandemic are being restarted. Mining projects – from early exploration through to construction – make up half the global total.

The top seven miners have now upped capital outlays by more than 50% from the depths of the industry downturn in 2017. Govreau sees “no reason why expenditures won’t continue to be elevated for the next several years or more as companies look to increase production to meet expected demand growth from the energy transition.”

Red metal goes green

The decarbonisation revolution is not off to a great start though, not if you compare investments in the worst of the fossil fuels in terms of emissions – coal – with that of copper, without which there simply is no green energy transition.

Copper’s metal intensity – kilograms required per MW produced – of renewable energy sources like solar and wind is nowhere near that of coal or gas. To generate 1MW of offshore wind energy around 8.2 tonnes of copper have to be installed. The same figure for coal is 882kg.

According to one study, in order to reach net-zero by 2050, 19 million tonnes of additional copper need to be delivered. That implies a new La Escondida – the world’s largest copper operation by a wide margin – must be discovered and enter production every year for the next 20 years.

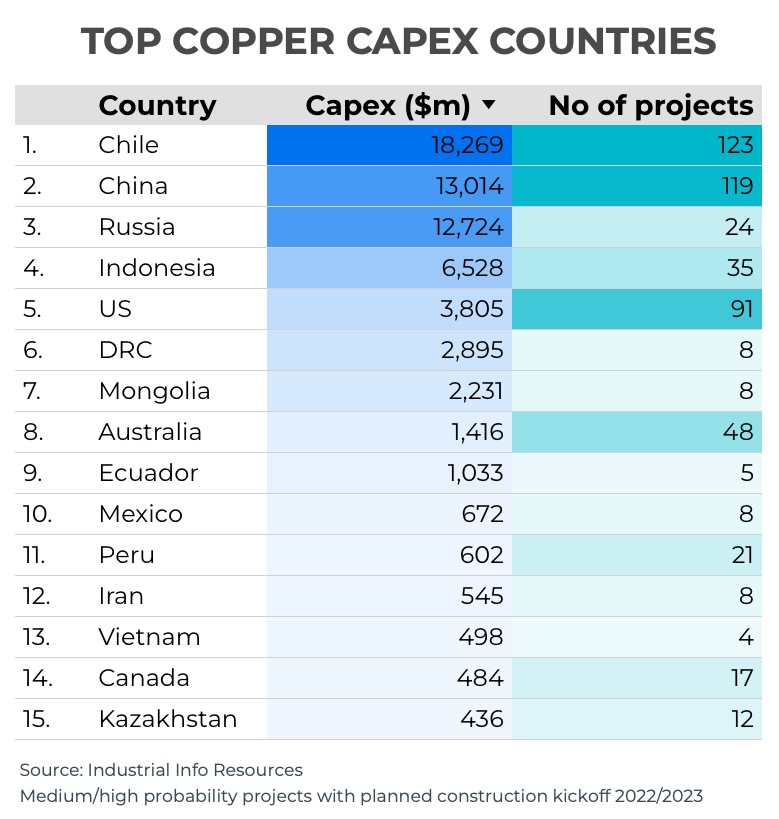

IIR tracks 708 active copper projects with construction kickoff in 2022/2023 around the globe. The combined value of these projects, which includes mining, processing and smelting, is $68.5 billion.

Unsurprisingly, Chile, the world’s largest copper producer and reserves holder, leads the way with 123 projects worth $18.3 billion followed by China boasting 119 projects with a combined value of $13 billion and Russia which is spending $12.7 billion on 24 new copper projects.

In contrast, the US is spending $3.8 billion while Canadian spending on new copper ventures is a paltry $484 million, behind Iran and Vietnam. Govreau also points to Peru, the world’s number two producer, which is spending only $602 million after pandemic lockdowns and social unrest brought development to a standstill.

Back in black

In contrast to copper, coal has a pipeline of 1,863 projects around the globe with a value of $80.8 billion.

Govreau says coal consumption and production jumped over the past year on the back of increased demand for power generation and steelmaking. Consumption of metallurgical coal is expected to be strong again this year.

The Chinese ban on Australian coal is a boost for swing suppliers – US coal exports were up 26% last year, says Govreau. Asian nations are also upping investment in coal mining, and in contrast to Europe and the US, more coal-fired plants are being built than are being retired.

China derives 65% of its electricity from coal, has vast amounts of reserves and is heavily investing in consolidating and automating its coal mines to supply its massive power generation fleet. Coal mining is also attracting investment in the near term because soaring gas prices makes it a cheaper alternative for electricity generation.

Bloomberg News | August 2, 2022

Mount Owen thermal and coking coal mine in Australia. Image: Glencore

The world’s biggest miners have spent the past two weeks reporting lower profits, shrinking dividends and a worsening outlook as the year rolls on. Next up: Glencore Plc looks set to buck the trend.

While commodities like iron ore and copper have retreated as gloom settles over the global economy, Glencore is enjoying two key advantages over its mining rivals — a powerful trading business that thrives in volatile markets, and a suite of coal mines now churning out previously unimaginable earnings thanks to the global energy crunch.

As a result, analysts are forecasting record profits and returns when Glencore reports on Thursday, with first-half earnings seen more than doubling from a year ago.

It’s a sharp reversal from previous years. The company had lagged its biggest rivals, largely because it doesn’t mine any iron ore, a commodity that helped supercharge earnings for mega miners BHP Group and Rio Tinto Group. But China’s Covid controls have sapped demand for the steelmaking ingredient as investor worries about a global recession weigh on commodity prices more broadly.

Rio Tinto last week reported a sharp decline in first-half profit and cut its dividend in half, while Anglo American Plc announced lower earnings and shareholder returns. Other miners from Vale SA to Lundin Mining Corp. also disappointed.

For now, the companies are still making good money, if not at last year’s record levels. It was Anglo’s second-best first half on record, while Rio paid its second-biggest interim dividend. But the increasingly uncertain outlook and weakening prices have cast a shadow over the underlying numbers, particularly as relentlessly rising costs across the industry add to profit-margin pressures.

“Prices have sharply declined from first-half averages, so these reported results do not reflect the reality of the markets today,” said Christopher LaFemina, an analyst at Jefferies Group LLC. “We are in a stage of the cycle during which prices are falling and costs are still rising. Not a good combination.”

Against this backdrop, Glencore is expected to deliver its best-ever results. The company has already said that its trading profit will exceed the top end of its guidance range, after it cashed in on volatile markets.

But it’s coal — the dirtiest fuel — that is seen as the really big earner.

Prices have soared to records this year as a global energy crisis boosts demand for fossil fuels around the world. Utilities are curbing imports from Russia due to the war in Ukraine, tightening the amount of available supply, while surging natural gas prices are also increasing demand for coal.

That’s put Glencore in a position to return cash to shareholders on a scale that was previously the reserve of the iron-ore majors, with some analysts forecasting payouts could exceed $10 billion in total this year.

The current dividend policy is to pay $1 billion from its trading unit, plus 25% of free cash flows from the sprawling mining business.

Still, some of those expectations — at least for the half year — have been tempered after Glencore flagged that its profitable bets on volatile commodity markets have tied up more working capital than normal.

“The underlying result will be very strong, and when markets return to lower volatility this working capital will be released making it a temporary impact,” said Tyler Broda, an analyst at RBC Capital Markets. “For now, however, this could temper the cash returns expected at the half-year results.”

(By Thomas Biesheuvel)