Bloomberg News | August 2, 2022 |

Electric vehicle. (Image by bixusas, Pixabay).

This week, everyone working on energy and climate issues in the US is intensely focused on the Inflation Reduction Act, looking for smoke signals as to whether it will pass and if any modifications will be made.

The bill is a potential boon to many sectors of the green economy, including electric vehicles. Here are my team’s takeaways on some of the important EV-related aspects of the bill:

Tax credit extension

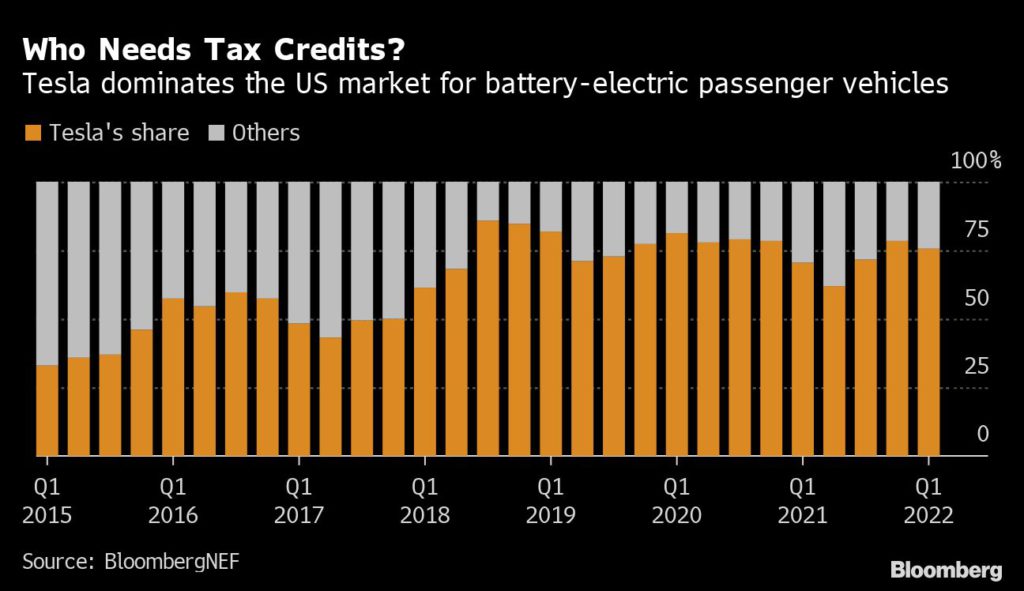

The revival of the $7,500 tax credit is a big deal, especially for Tesla, General Motors and Toyota. All three have sold at least 200,000 vehicles that were eligible for the incentive as the system is set up now. Once manufacturers cross that threshold, buyers of their cars start to receive reduced credits, and eventually none at all. Ford and Nissan are nearing this point, as well.

The bill would make the full incentive available again starting next year, and importantly, would allow consumers to access the perk at the point of sale instead of during tax season.

Automakers that have had sold fewer EVs might, in theory, be upset to see the 200,000-vehicle cap lifted, since it was bound to give them an advantage in the near term. But in practice, most should be happy to see the additional purchase support, since fuel economy regulations are set to tighten in the years ahead. This change will make it much easier to sell EVs and hit their targets.

While tax credits are important, it’s worth noting that Tesla buyers haven’t been eligible for federal tax credits for well over two years, and that hasn’t stopped the company from dominating the EV segment by accounting for more than 70% of battery-electric models sold in the US last year. Making products that consumers actually want is still more important than making products that qualify for tax credits.

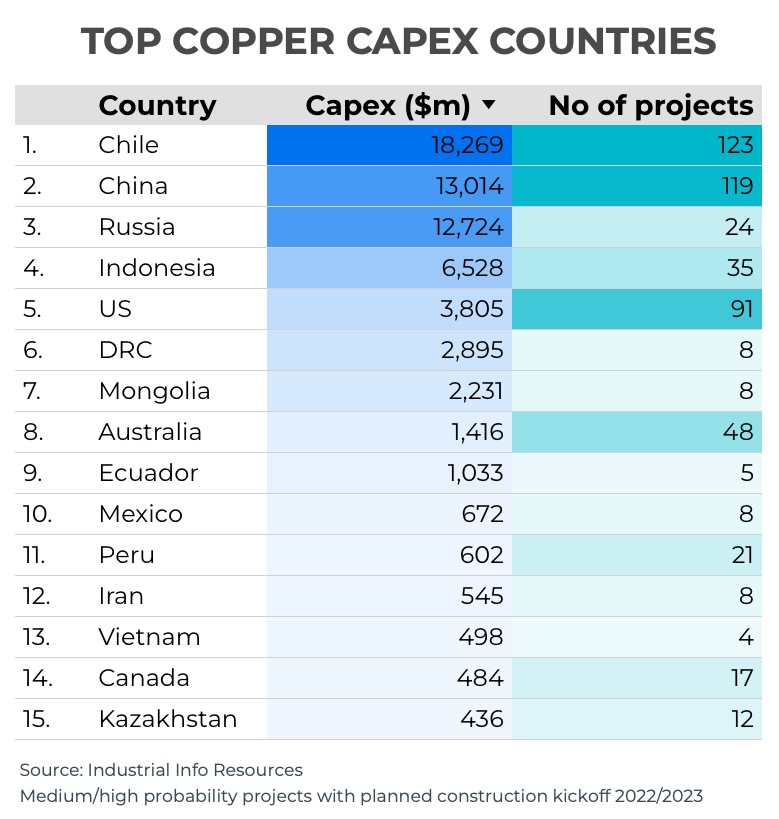

As my Bloomberg News colleagues have pointed out, the requirement that battery materials are sourced locally could be challenging for carmakers to navigate. There’s also a requirement that a share of other components are manufactured in North America.

In auto board rooms across the country this week, there are likely requests flowing down the organization and out to suppliers to determine which models will qualify and how quickly sourcing can be localized. BNEF’s analysis indicates mid-stream refining capacity for battery metals is more likely to be an issue than raw material supply.

A boost for commercial EVs

New commercial EV provisions allow vehicles weighing less than 14,000 pounds to claim the $7,500 clean car tax credit. Heavier vehicles can have the lesser of two amounts: 30% of the differential between the clean vehicle and a comparable internal combustion engine vehicle, or a $40,000 incentive.

This would fully cover the cost of a 150 to 250 kilowatt-hour battery pack today, and will do more in the future as prices come down. It would be an immediate and significant boost to the nascent commercial EV market in the US, which lags Europe and China in most segments.

The bill also includes $3 billion to help the US Postal Service decarbonize its fleet and shift to EVs. The Postal Service recently announced it was increasing the portion of its initial 50,000 mail-truck purchase from Wisconsin-based Oshkosh that will be electric to 50%, a major win for activists who fought against the initial decision to go almost exclusively with combustion vehicles.

Loan programs

The package also includes $2 billion to help automakers retool and convert existing facilities to manufacture clean vehicles, and allows for as much as $20 billion in loans to help auto companies build new clean-vehicle facilities across the country. Ford, GM and Stellantis are likely to benefit from the conversion portion going into a contract-bargaining year with the United Auto Workers union. EV manufacturing in the US is already ramping up quickly, and this provision — which has largely flown under the radar — will further accelerate progress.

Importantly, many plants being built or retooled for EVs are in Republican states. For example, VW invested $800 million in its plant in Chattanooga, Tennessee, and just announced last week it has started producing the first ID.4 electric sport utility vehicles there. Having a strong EV manufacturing base in red states should help prevent EVs from being a political football as the next federal election cycle rolls around.

Outlook

A sense of scale is important here. The bill would extend EV tax credit availability out to 2032. Over that period, BNEF expects around 175 million light-duty vehicles will be sold in the US. As it stands now, a sizable and growing portion of those will be eligible for a tax credit.

There’s lots more to process — BNEF clients can access our full initial take here — but my initial feeling is that the bill, coupled with the stricter fuel-economy regulations the Biden administration is putting in place, should put the US right back in the race for EV leadership. China is off to a very strong head start, but these are still early days. Don’t count the US out.

(By Colin McKerracher, with assistance from Corey Cantor and Ethan Zindler)