Canada has short window to get ahead of U.S. hydrogen efforts, backer warns

, The Canadian Press

It is feasible to start exporting small shipments of Canadian-made hydrogen to Europe within three years but only if everyone moves quickly, the chairman of a company behind one of the biggest proposed green hydrogen projects in Atlantic Canada said Wednesday.

As the ink dried on the new Canada-Germany hydrogen alliance signed in Newfoundland and Labrador on Tuesday, World Energy G2 consortium director John Risley said time is of the essence.

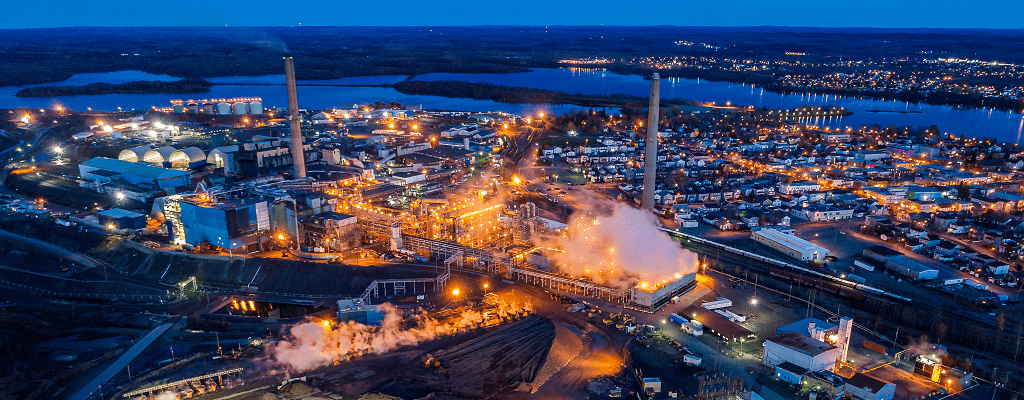

World Energy G2 has applied to the Newfoundland government to build a hydrogen plant powered by a three-gigawatt wind farm near the western port town of Stephenville. The product, known as "green" hydrogen because it is made by splitting water atoms using zero-emission renewable energy, is the type Germany wants.

Risley said the application to the provincial government to get the needed permits went in last spring, but things are moving slowly.

"We're encouraging them to understand that the opportunity for this industry is now," he said. "It's not something we can sit on our hands and sort of say, 'Oh, well, we're going to take our time and we're going to spend a couple of years sort of thinking this through,' because the opportunity will have been lost."

The issue isn't that others will swoop in and steal customers. There are plenty of those to go around. The issue is that the Canada-Germany agreement is aiming to get things flowing by 2025, and there are only so many companies and so many supplies available to build hydrogen plants from the ground up, Risley said.

The recently signed Inflation Reduction Act in the United States includes a lucrative hydrogen tax credit for projects that get going within the next year, which Risley said will be "an enormous stimulant" to a U.S. hydrogen industry.

"This is a very early-stage industry, there are not a lot of robust supply chain support industries to stand this industry up and it's going to become very quickly overwhelmed."

The industry is so young, a demonstration by one of the companies in the consortium fell flat during a trade show in Stephenville, hastily thrown together as a backdrop for the hydrogen agreement.

Prime Minister Justin Trudeau and German Chancellor Olaf Scholz toured booths at the show set up by various companies including one with toy cars powered by syringes of hydrogen. But when the leaders tried to race the cars, they failed. Scholz's moved only a few centimetres. Trudeau's didn't move at all.

Trudeau and Natural Resources Minister Jonathan Wilkinson are both quick to acknowledge that a year ago, Canada's discussions about hydrogen were looking into a much more distant future.

But when Russia invaded Ukraine and destabilized European energy supplies, the desire to move faster to replace oil and gas with renewables and clean energy exploded.

In the last six months, more than a dozen new Canadian hydrogen projects began moving faster, including Risley's.

The speed is worrisome to some in Newfoundland, who fear getting into the game quickly is coming at the cost of proper scrutiny.

As Trudeau and Scholz landed in Stephenville on Tuesday afternoon, hundreds of people from the town of about 6,000 lined the fences around the airport tarmac to watch with interest and excitement. But outside the building holding the trade show, several dozen protesters stood in the rain.

Some were of the anti-Trudeau "Freedom Convoy" ilk, but many were there to raise their opposition mainly to the installation of hundreds of wind turbines in their neck of the woods.

The G2 project is to be built in three phases with 164 turbines in each.

Paul Wylezol, chair of the International Appalachian Trail, told The Canadian Press last week he has concerns about the environmental risk those turbines pose.

Risley said the consortium is working with residents to allay fears and respond to concerns, intends to sign agreements with local First Nations, and do anything else required in a robust permit process.

"We will do all those things," he said. "We just need to be able to do them contemporaneously, we can't do them sequentially. Because we'll end up in a multi-year permitting process that will be not just incredibly expensive, but put us in the back of the line in respect of the supply chain issues I described."

He said if product is going to be produced by 2025, construction has to start next year.

The G2 project intends to really make ammonia — a combination of hydrogen and nitrogen — for which marine shipping options already exist. Once in Europe, the ammonia would either be used directly, or split back into hydrogen and nitrogen.

The end uses of hydrogen are varied. Hydrogen is already a key component in oil refining and steel production but most of the hydrogen used there is made from natural gas in a process that contributes carbon dioxide to the atmosphere.

Hydrogen also has developing uses as a source of electricity or heat and to power vehicles.