Dr. Amanda Clifford. Image credit: Surath Gomis.

It was a winter day in Toronto, at the height of the pandemic in February 2021, and Dr. Amanda Clifford was walking from the subway station to her apartment when she had the idea about how to formulate a copper coating that could kill covid faster.

Two months later, Clifford arrived at the University of British Columbia to speed up the efficacy of the process Teck Resources had been testing on public transit since 2020.

Clifford has a background in materials engineering, worked for Teck as an undergrad student on a co-op doing corrosion studies on base metals, and became an expert on functional coatings for biomaterials.

Copper alloy surfaces are naturally antimicrobial with self-sanitizing properties, and research showed these surfaces eliminate up to 99.9% of harmful bacteria and viruses — but there was a lag time in killing gram positive bacteria — and that was the challenge to overcome.

“My idea was for copper – it has one limitation that it kills gram positive more slowly, if we could change the surface chemistry, the topography or roughness, we can kill bacteria more quickly,” Clifford told MINING.com.

“One way we can do this, is copper is antimicrobial because it’s actually corroding very slowly, so it’s not copper in a zero state oxidation that’s antimicrobial, it’s positively charged copper ions that kill bacteria.”

The Coptek covid killing copper coating that has been deployed at most of the Applied Science buildings on the UBC campus and at the British Columbia Institute of Technology was funded by Teck’s Copper & Health program. The formula came from the surface engineering Dr. Clifford and her research team — Dr. Edouard Asselin, Dr. Elizabeth Bryce, and Dr. Marthe Charles developed — a collaboration between the Department of Materials Engineering and the Faculty of Medicine at the University of British Columbia.

The study was published in July in Advanced Materials Interfaces.

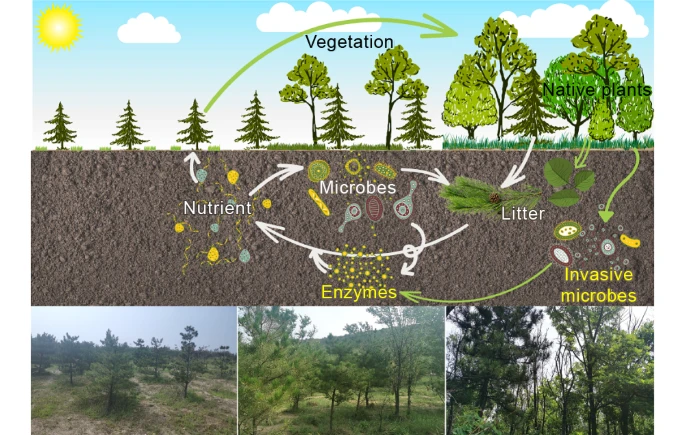

What the team did to mitigate the lag time in killing bacteria with pure copper while its corrodes or oxidizes, was couple two dissimilar metals, in this case zinc, which due to the different reduction potential corrodes first.

“That gets things going – its spontaneous, the zinc will just start corroding and then the copper will corrode. It got everything going and we got a lot better results. Another thing we did was add nano-scale roughness,” Clifford said.

That idea came from knowing that certain insects and reptiles skins have nanoscale roughness, which are naturally anti-bacterial.

“For our coating we took copper and zinc and added this nanoscale roughness, and now all of a sudden its overcoming the issue of killing gram positive bacteria slowly — and now its killing 99.7% within an hour, so half the time,” Clifford said.

The coating could significantly reduce the incidence of contracting bacterial infections from high-touch surfaces in healthcare facilities and other public spaces.

The next phase is to do a trial in hospitals — where the germ killing copper could have the most impact. Clifford said the strategy is to combat antibiotic resistance which can lead to ‘superbugs’ afflicting patients who are already sick.

“Part of that is decreasing the overall amount of pathogens and antibiotic resistant bugs that are already in public spaces, so this coating has that.”

The team is still studying how the coating works on other viruses in the hopes of making a bigger impact.

“Almost all the principles that were used to make this medical innovation were just pure metallurgical engineering applied to a medical application,” Clifford pointed out. “People who think that metallurgical mining engineering has a very niche application — the tools that you learn you can also apply to other applications such as medicine.”

Clifford didn’t realize the idea she had walking home from the subway that winter day would be developed to the point where it would be deployed on university campuses — and next in hospitals.

“As an academic you can make educated guesses,” she said.

“I thought it would work, and it did.”