Starbucks employees who support unionization protest ahead of Investor Day, in Seattle

Starbucks employees who support unionization protest ahead of Investor Day, in Seattle

Starbucks signage is pictured outside the company's headquarters in Seattle

Starbucks employees who support unionization protest ahead of Investor Day, in Seattle

Customers line up outside Starbucks' historic first location in Pike Place Market in Seattle

Tue, September 13, 2022 at 10:49 AM·3 min read

By Hilary Russ

SEATTLE (Reuters) -Starbucks Corp projects profits to grow between 15% to 20% per share over the next three years, a significant increase from previous guidance based on spending plans of $2.5 to $3 billion over the same period on technology, new stores and renovations, the coffee chain said on Tuesday.

The company is introducing technology to speed up production of its increasingly popular cold beverages and send digital orders away from busy locations as it seeks to prevent U.S. cafes from being overwhelmed by orders and improve working conditions for employees, it announced during its Investor Day event.

The Seattle-based company expects to return $20 billion to investors via share buybacks and dividends from fiscal 2023 to 2025. Wall Street analysts had largely expected earnings updates to be in line with previous guidance of 10 to 12% growth.

A surge in digital orders, which now make up nearly a quarter of all orders, has helped the coffee chain gain market share during the COVID-19 pandemic but has also led to barista burnout and strained the physical capacity at older stores.

The company is exploring "load balancing" technology that can send orders to stores that have capacity to actually fulfill them – instead of to stores already being slammed by drive-thru customers, for instance, Chief Technology Officer Deb Hall Lefevre said in an interview with Reuters.

"REINVENTION" OF STARBUCKS SINCE PANDEMIC

The pandemic changed customer behavior, leading to a deluge of mobile, delivery and drive-thru orders, as well as an increase in cold beverages and customized coffee drinks.

Calling it a "reinvention," the company laid out a sweeping plan spearheaded by interim Chief Executive Officer Howard Schultz, who will be replaced by Laxman Narasimhan in April.

The plan includes new equipment to heat food faster with less plastic waste, new store designs with larger shelves for orders and additional employee benefits.

A new system for iced coffee drinks shaves nearly a minute off the time it takes to make a Mocha Frappuccino, down to 35 seconds. Baristas would no longer need to haul a bucket of ice to the station every hour because the ice will be automatically fed into the new equipment.

Another machine, which brews hot coffee one cup at a time instead of in bulk batches and eliminates paper filters, is being tested in Minneapolis locations and could be rolled out next year.

Starbucks is on pace to reach 45,000 stores by the end of fiscal 2025 - or nearly eight new stores per day - it said. That includes a net new 2,000 new U.S. stores and some delivery-only locations.

In China, it plans to nearly double the number of stores to 9,000 - or one new store nearly every nine hours.

UNION BACKDROP

Employees at 236 stores voted to join a union over the past year, out of Starbucks' nearly 9,000 corporate-owned U.S. locations. Conversely, 52 stores voted against unionizing, according to National Labor Relations Board data.

Frank Britt, brought in by Schultz to lead the company's transformation strategy, said workers know how to solve the company's problems because they are on the front line.

"A lot of the concerns the partners have, whether they're affiliated with the union or not, are valid concerns. We agree, there's a trust deficit," he said in an interview.

Union members have been holding protests this week to bring attention to their demands. Billie Adeosun, a Starbucks employee since 2015 who works at a unionized location in Olympia, said on Monday higher wages were a top priority.

The company has lifted pay to an average of nearly $17 across non-unionized U.S. locations. Starbucks says the law prohibits it from offering increased benefits to unionized workers without bargaining over them.

"We know that these benefits or higher wages… wouldn't even exist without unions," said Adeosun, who makes $15 an hour. "We've been able to shine a spotlight on this company and show that they're not the liberal company they claim to be."

(Reporting by Hilary Russ; Editing by Josie Kao)

Starbucks Offers New Savings, Loan Perks for Non-Union Cafe

Leslie Patton

Mon, September 12, 2022

In this article:

(Bloomberg) -- Starbucks Corp. is introducing benefits related to financial savings and student-loan debt for its US baristas. The company says it isn’t allowed to give these new perks to staff at the roughly 300 stores where there’s been union activity.

The new benefits begin Sept. 19, Seattle-based Starbucks said in a statement Monday. The savings program lets staff contribute a part of their after-tax pay to a personal savings account, with the company contributing $25 and $50 credits at milestones up to $250 per person. Starbucks workers will also have access to a new student-loan benefit with coaching on debt about repayment options and refinancing.

Starbucks, which has more than 9,000 US locations that are company owned, legally can’t unilaterally give these benefits to stores that have union activity, according to spokesperson Reggie Borges. Instead, the new benefits can be discussed in collective bargaining, he said.

However, Workers United, the group attempting to organize Starbucks cafes, has argued that the union waived its right to negotiate over extending benefits being provided to other stores, so there’s no legal obstacle to doing so. In August, National Labor Relations Board prosecutors issued a complaint alleging Starbucks violated labor law by withholding new benefits from unionized stores.

“Starbucks is blatantly disregarding the law to continue their scorched-earth union-busting campaign,” Workers United said in a statement. “Starbucks is not only damaging their brand and their business, but irrevocably damaging their credibility as a company.”

Starbucks first announced broader benefits improvements for its baristas on May 3 -- saying they would include opportunities to increase sick-time accrual, a new financial-stability program and tools to help those with student loans. The latter two items are what the company addressed in the Monday announcement.

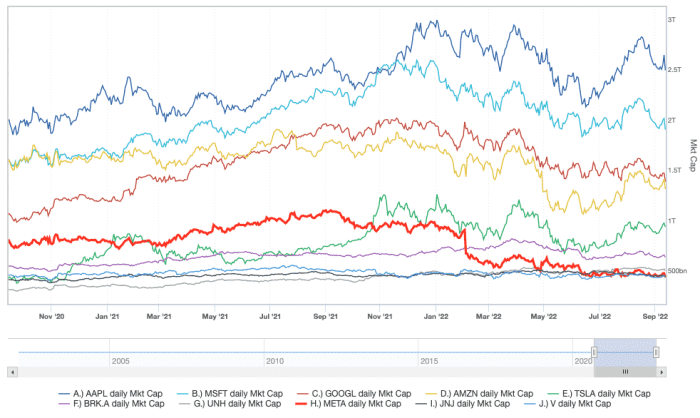

Starbucks shares were up 0.4% to $89.04 at 3:27 p.m. in New York. The stock was down 24% this year through Sept. 9, compared with the 15% decline of the S&P 500 Index.

Colin Lodewick

Tue, September 13, 2022

Andrew Lichtenstein—Corbis/Getty Images

Starbucks employees across the country have long enjoyed more benefits than the average service worker.

The company offers retirement planning options and mental health resources. A decade ago, it expanded its health plan to cover gender reassignment surgery for trans employees.

On Monday, the coffee giant announced a slate of new benefits focused on improving the financial well-being of its workers. And while the vast majority of employees will be eligible, a notable portion won’t: those who work at stores that have unionized. The first Starbucks location voted to unionize in December of last year. Since then, other notable unionization movements have emerged at other major American companies, including REI, Amazon, and Trader Joe’s.

Since last December, Starbucks has been grappling with a unionization movement at stores across the country. Now, over 200 locations have unionized, with others continuing to file petitions to vote. Several thousand workers are now union members.

The company has remained steadfast in its opposition to unionization throughout the process, arguing that the unions will get in the way of the company’s direct relationship with its workers.

The new benefits include a new savings plan option along with a student loan management program that comes with tools like individual coaching on loan repayment.

“We’ve heard from our partners and know that pressures of inflation, in addition to debt and savings, are weighing heavily on them,” said Ron Crawford, senior vice president of total rewards for Starbucks, in a press release on Monday. “Providing industry-leading benefits for our partners is a cornerstone of who we are as a company.”

Starbucks’ current interim CEO Howard Schultz first hinted at plans to expand benefits earlier this year during an online forum with store leaders. During the meeting, he said that new benefits couldn’t be extended to unionized employees per U.S. labor law requirements that employers negotiate pay and benefits separately with unionized workers.

While it’s true that Starbucks cannot change benefits without approval from unionized employees, experts previously told Fortune that there are few obstacles in the way from giving unionized employees the expanded benefits.

Workers United, the union seeking to represent Starbucks workers, told Fortune on Tuesday that the company’s decision to not extend the new benefits unilaterally stands on tenuous legal ground, especially after the National Labor Relations Board issued a statement recently that Starbucks’ presentation of expanded benefits only available to non-union employees infringes on the National Labor Relations Act, America’s cornerstone of labor legislation.

“The NLRB recently issued an official complaint against Starbucks alleging that withholding new benefits from unionized workers is illegal,” said a spokesperson from Workers United in a statement to Fortune. “For Starbucks to claim otherwise is simply a lie and blatantly disregarding federal labor law.”

Starbucks did not immediately respond to Fortune’s request for comment.

Starbucks adds employee benefits to help with student debt, build savings accounts

Starbucks (SBUX) is adding two new employee benefits ahead of its Investor Day on Tuesday — a savings account with Fidelity and student loan management tools.

In letter to U.S. "partners," what Starbucks calls employees, Chief Partner Officer Sara Kelly said the inspiration for the benefits, which begin September 19th, came from its collaborative sessions with partners at stores across the country.

"One of the top ideas we have heard is support for partners who want to better manage their finances – from navigating student loans to getting better at saving," Kelly said.

Ron Crawford, SVP of benefits at Starbucks, told Yahoo Finance "a large portion" of partners are in college.

The Student Loan Management Benefit is intended to help partners manage their student loans through a partnership with the online tool benefit platform Tuition.io. This is in addition to the company's existing Starbucks College Achievement Plan, which allows eligible partners to receive total upfront tuition coverage for a first-time Bachelor’s degree through Arizona State University’s online program. Crawford hopes the benefits provide partners with the proper online tools and resources to help them get "reorganized" ahead of student loan payments going back into effect on Dec. 31, 2022, as well as the opportunity to cancel $10,000 in debt.

"We estimate that we've got about a third of our partners who have student loan debt. It's probably somewhere in the neighborhood of $20,000 to $25,000, which usually means a monthly payment of a couple of hundred dollars," Crawford said

My Starbucks Savings, the second new benefit offering, is intended to help partners save for the "unexpected," according to a company press release. In partnership with Fidelity, partners can contribute a portion of after-tax pay on a recurring basis directly from their paycheck to an individual savings account. As an incentive, Starbucks will contribute $25 and $50 credits at certain milestones.

"Any of our partners who open up one of these savings accounts and just start off with a $5 per paycheck contribution, when we see that we will drop $50," Crawford explained. "Every quarter thereafter, we see that they're still doing at least the $5 and they've got a balance of $50, then we will drop in $25 per quarter going forward."

Starbucks plans to contribute up $250 per eligible partner.

"We're really trying to do here is build a behavior, build a savings muscle, because that's what our partners are asking for, that they're wanting to save, but they struggle with how to get it done," Crawford added.

The new benefits, however, will not be offered to partners who work in unionized stores or in have been in the process of petitioning or voting to unionize after the date of May 3rd, when Starbucks announced a $1 billion dollar investment plan in its employees.

"The law doesn't allow us to unilaterally give them [to these locations], but ... as part of collective bargaining, we will obviously have this as one of the options through the process of the bargaining with those unionized stores," he explains.

According to National Labor Relations Board (NLRB) records, 233 Starbucks stores have voted in favor of unionization as of Wednesday, August 31, and 214 of those stores have been certified by the agency while 48 stores have voted against a union and 11 are currently being challenged.

The new benefits are the first to be announced since the Seattle-based chain named Laxman Narasimhan as incoming CEO, effective October 1st. The company noted that the benefits are an extension of nearly 30 the coffee giant has offered throughout the years.

Crawford said the benefits will ultimately lead to better customer service. "All of these programs that we've added through the years, what we have found is that when we make an investment in our partners, they in turn, provide an excellent customer experience to our customers."

Leslie Patton

Mon, September 12, 2022

(Bloomberg) -- Howard Schultz took the helm of Starbucks Corp. more than five months ago pledging a massive reinvention of one of the world’s largest restaurant companies. Until now, the details have been vague -- but that’s expected to change at Tuesday’s presentation to investors.

Starbucks is expected to explain plans to redesign cafes -- with analysts saying the company will likely home in on delivery and carryout-friendly formats. The company is also under pressure to deliver more financial details on what those makeovers will cost in the long term, and what impact kitchen upgrades and higher salaries will have on the bottom line.

“It’s a pretty long list of things that need to be sorted out,” said Ben Wong, an analyst at Motley Fool Asset Management, which owns about 136,000 shares. “How much are the continued investments in the employees and stores, and how much is that going to impact margins?”

On Monday, Starbucks shares rose 1.1% at 10:22 a.m. in New York. The stock has lost about 23% this year, more than the 14% decline of the S&P 500 Index.

Since becoming interim chief executive officer in April, Schultz has said the company is overhauling the Starbucks experience along five broad points, but there’s still uncertainty about what they mean in practical terms over a longer horizon. The company, which has said it’s spending about $1 billion in fiscal 2022 on higher wages and improved stores, suspended its financial guidance for the year amid uncertainty in the key growth market of China.

Incoming CEO

Starbucks removed one key question mark earlier this month when it announced Laxman Narasimhan will succeed Schultz as CEO. The 55-year-old, who’s coming from UK consumer-goods maker Reckitt Benckiser Group Plc, will join the Seattle-based company in October and embark on an extended tour of its operations before becoming CEO in April.

The period will be crucial for realizing Schultz’s vision for the company. Starbucks in the past has closed and relocated less-profitable locations, and is now closing some stores due to security problems while adding more drive-thrus and delivery-focused stores. Remodeled cafes also are supposed to make baristas’ jobs easier and less stressful.

Key hurdles include a unionization drive which has grown to more than 200 US locations, and uneven performance in China amid ongoing pandemic restrictions. Wong flagged both China and the labor push as adding layers of uncertainty for investors.

Starbucks’s move to raise US barista wages to an average of $17 an hour and give additional bumps to more tenured staff hasn’t stopped the union drive that’s become increasingly contentious. The company is trying to convince employees that they’ll be better off if they don’t unionize.

The pay increases, along with supply-chain and commodity inflation, have weighed on Starbucks profitability despite menu price hikes.

Equipment Details

Meanwhile, the lack of specifics around additional equipment and technology expenses is keeping a lid on the share price, according to BTIG LLC analyst Peter Saleh, who expects the company to “provide a lot more detail” at the investor event, including information on capital investment and what that means for long-term profitability.

“They have more cash on the balance sheet than they need,” he said in an interview. “And I don’t know where they’re going to spend it, or how they’re going to spend it.”

Starbucks had more than $3.2 billion in cash and short-term investments as of July 3. After returning as interim leader, Schultz’s first move was to suspend the company’s buyback program, saying the money could better be spent on stores and employees. Thus far, the chain has been deploying new coffee brewers and warming ovens, improving training and experimenting with new types of stores.

Any changes to the store format are of crucial importance for Starbucks, which came up with its concept of the “third place,” where customers spend time between work and home. While Starbucks has always said the third place won’t go away, it has been building smaller locations geared to pickup and delivery. And about 90% of its new stores include car lanes -- taking a page from fast-food chains rather than relaxed coffeehouses.

Starbucks, which has more than 15,000 stores in the US, is poised to accelerate store growth under the new CEO, Credit Suisse analyst Lauren Silberman said. She predicts cafe layouts will be adapted to better accommodate to-go orders. For example, Starbucks could add pick-up shelves, such as those used by Chipotle Mexican Grill Inc., to get customers in and out faster.

“I don’t see it as much as complete remodels as reconfiguration,” she said of the plan to update locations. Silberman also sees a more personalized Starbucks app coming, with features such as text messages and games to engage diners.

Starbucks is betting its presentation can win over skeptical investors who have sold off the stock in recent months amid economic uncertainty and profitability concerns.

“In order for the stock to perform, then a lot of those issues probably have to be resolved,” Wong said. “Everyone is looking forward to the upcoming investor day.”