Residents in the Leeds suburb of Roundhay, where Liz Truss went to school, express their views

Robyn Vinter

@robynvinter

On the high street in the leafy suburb of Roundhay, where Liz Truss went to school and her parents still live, there is a sense of frustration, and even anger, at the measures announced in Friday’s mini-budget.

Catherine Brittain, a childminder, was forced to negotiate with her energy provider, which upped her bills from £109 a month to £350. She was able to agree to pay £200 until after Christmas.

She said: “I can’t afford to pay more. I’m worried about the cost of living and at the moment I haven’t passed that on to parents but I’m not sure how much longer I can keep it up.”

She needs to provide a warm home for the children she cares for, as well as meals, and it comes at a cost.

“I’m not a charity. I could charge more but I charge what I think is fair.”

Brittain is worried about the ability of Truss – “a vile human being” – and her cabinet to prevent a huge economic crisis and is sceptical of the chancellor Kwasi Kwarteng’s tax reforms.

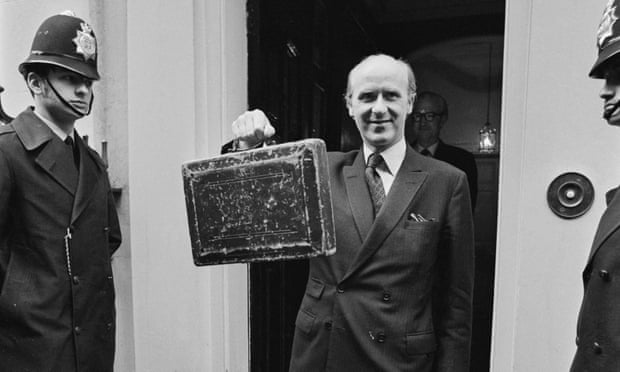

Kwarteng revealed a surprise cut to income tax, scrapping the additional rate, which saw high earners paying 45% on any income over £150,000. He also brought forward a planned 1% cut in the basic rate of income tax from 2024 to next year.

“They’re just helping the rich and maybe a few crumbs eventually dribble down to us.

“We need a windfall tax, otherwise we’re just going to pass on these debts to our children.”

Last month, Sade Scales’s monthly direct debit for her gas and electricity rose from £65 to £89 overnight. It might not seem like much compared to what some people are paying but working as a part-time carer in Leeds while looking after a disabled child, any further rises will hit her hard.

“I’ve got some credit on my energy account but I’ve had to cut back,” she said. “I think I’m going to need extra money this winter since it’s just going to get worse.”

She was frustrated that other countries, such as France, had been largely insulated from energy price rises by government policies. In January, the French government capped price rises from the state-owned energy company EDF at 4%. It also made a one-off payment of €100 (£84) last year to the poorest 5.8m households.

Scales added: “It’s not our fault. It’s like, why are you taking it out on us? There has to be a cut-off point.”

Her friend Sandra Smith, a parent and carer, agreed.

“A lot of my single friends are not doing well. It’s a struggle, they’re living month to month. I haven’t got much faith that anything is going to get better,” she said.

Smith was also frustrated to hear about plans to force universal credit claimants into working more hours, as a former recipient who knows how difficult it is to survive on what is offered.

Kwarteng announced claimants working less than 15 hours a week would be penalised if they were not seen to be trying to get more work, in an effort to “get Britain working again”.

Smith said: “Universal credit is the worst thing ever. All your money is conjoined together instead of being allocated for different things. When I was on it, I’d only have £300 left over after paying rent and that didn’t include bills. It puts people at risk.”

It is a particularly strange announcement, she said, given that unemployment rates are at historic lows and most universal credit recipients are in work. In addition, she said, pushing claimants to take on more work is already happening.

“I did 15 hours and they were pushing me to do 25. I actually wanted to work more but it was so hard to get childcare. They don’t help you. The whole system is discouraging,” she said.

“You might need an advance to pay for something up front and they can just refuse you if they don’t feel like the reason is satisfactory.”

Scales added: “You can see why people turn to crime. It’s quick money.”

Nearby at the well-loved Leeds attraction Tropical World, an indoor wildlife park and aquarium, Kwarteng’s measures were equally unpopular.

Katie Fenton-Green, a PE teacher on maternity leave, echoed the sentiments on the high street. “It hasn’t hit us yet but we are more worried than normal. I’ve been looking into merino wool blankets for the baby.”

Her wife works full time for ITV, which recently gave staff a cost of living bonus. But she is annoyed at the lack of measures in the budget to address energy company profits while people struggle.

“I just don’t feel that the cost is justified while companies are declaring a profit. It would be understandable if the companies were struggling but they’re not, and the government just seems to be helping those who are well off.”

Even those who expect to benefit from the mini-budget cannot make sense of it.

Sam Smith, an accountant, and his partner Tia McKeon, who works in digital marketing, would be better off under the chancellor’s plans to scrap a rise in national insurance payments.

“It sort of feels unnecessary,” Smith said. “Most people wouldn’t mind helping out more where they can and we’re not people who are struggling. It’s always the worst-off who are most affected, though I don’t know what the other option is.”

This article was amended on 23 September 2022. An earlier version said that the energy price cap announced by Liz Truss earlier this month “only benefits those spending over £2,500 a year”. The price cap is a limit on the unit cost of electricity and gas, not on overall bills; and the £2,500 a year figure relates to the average amount that a typical household in Great Britain will pay under the new cap.