NFL megastar quarterback Tua Tagovailoa has been told to retire despite being just 24 years old, after the Miami Dolphins star suffered a concussion just days after a scary injury in a separate game

Tua Tagovailoa suffered a severe concussion on Thursday

By Charlie Wilson

Miami Dolphins quarterback Tua Tagovailoa has been told that he should retire from the NFL with immediate effect after potentially suffering two concussions in just four days.

Tagovailoa shockingly suffered what looked to be a severe concussion on Thursday night's loss to the Cincinnati Bengals, just days after many believed him to have suffered one in the win over Buffalo Bills. The Dolphins have been highly-criticised for their handling of the situation, with a number of world-renowned neuroscientists warning of the dangers of having two concussions in a short space of time.

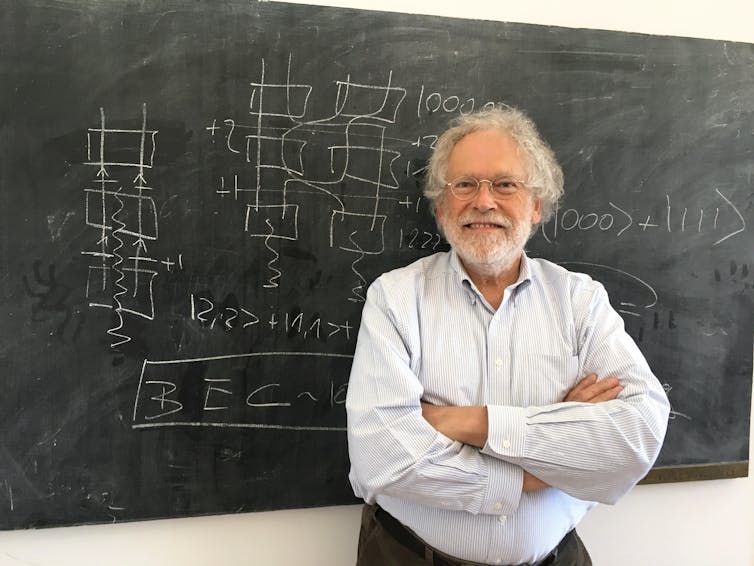

And now, Dr Bennet Omalu, the first doctor to discover and publish findings on chronic traumatic encephalopathy (CTE) in American Football players has stated that Tagovailoa should retire from the NFL for the good of his health.

Dr Omalu's work was portrayed by Will Smith in the Hollywood film Concussion in 2015, with CTE now being heavily studied worldwide after his findings were published in 2005. He has since continued his work in the field at the University of California.

Speaking to TMZ Sports, Dr Omalu said his message to Tagovailoa would be: "If you love your life, if you love your family, you love your kids -- if you have kids -- it's time to gallantly walk away. Go find something else to do."

In the first incident against the Bills, Tua looked like he suffered a hit to the head, before getting up and running gingerly as he then fell to the ground. Many had stated that this was symptoms of a concussion, and if so, he should be taken out of the game. However, he was allowed to remain.

As the NFL and NFLPA discuss new concussion protocol, Chiefs coach Andy Reid says open communication is key

The doctor who cleared the quarterback to re-enter the game has now been fired by the NFL, with investigations into the incident continuing.

Just days later, Tagovailoa was slammed to the ground, as he would look like he would go into the 'fencing position'. This is defined as when a person experiences an impact that's strong enough to cause traumatic brain injury, such as a concussion, their arms often go into an unnatural position.

Fellow neuroscientist, Chris Nowinski, had tweeted before the game: "If he has a second concussion that destroys his season or career, everyone involved will be sued & should lose their jobs, coaches included. We all saw it, even they must know this isn't right."

And after the concussion sadly happened, he added: "This is a disaster. Pray for Tua. Fire the medical staffs and coaches. I predicted this and I hate that I am right. Two concussions in 5 days can kill someone. This can end careers. How are we so stupid in 2022."

Tua Tagovailoa issued with harrowing warning after scary hit in Miami Dolphins loss

Dolphins star Tua Tagovailoa discharged from hospital after horror head and neck injuries

Tua Tagovailoa to play against Cincinnati Bengals despite concussion fears

Fan sneaks into Miami Dolphins practice and leaks plays including Tua and Tyreek Hill

NFL star Tyreek Hill had brutal reason for turning down New York Jets for Miami Dolphins

Miami Dolphins QB Tua Tagovailoa looked like 'Mike Tyson KO'd him' in concussion verdict

Coronavirus cases increased by 14% last week, with more than 1.1 million people testing positive (Picture: Getty Images)

Coronavirus cases increased by 14% last week, with more than 1.1 million people testing positive (Picture: Getty Images)