FTX founder Sam Bankman-Fried has launched an attack on regulators for failing to protect consumers today, even as he admitted he “basically forgot” about an account holding $8bn of customer’s cash.

In Twitter messages with a reporter at the Vox news website, the 30-year-old former billionaire, who had publicly courted regulators and lawmakers in the past, said “f*ck regulators” and claimed his previous overtures towards them were “just PR”.

“They make everything worse. They don’t protect consumers at all,” he wrote.

When told he was previously “really good at talking about ethics” in the industry, he responded: “Ya. Hehe. I had to be. It’s what reputations are made of to some extent.”

Bankman-Fried’s comments come as he continues to scramble to fill an $8bn hole in the exchange’s finances and pay back customers and up to one million creditors.

FTX’s sister firm Alameda has reportedly lost over $8bn in customer funds on speculative bets in the sector, including suffering heavy losses from the collapse of the Terra Luna ecosystem earlier in the year.

Bankman-Fried said the blackhole in its balance book was down to “messy accounting” and the fact FTX forgot that customers had been wiring cash to Alameda.

“Like ‘oh, FTX doesn’t have a bank account, I guess people can wire money to Alameda’s to get money on FTX’”, he said.

“3 years later….’ph god it looks like people wired $8bn to Alameda and oh god we basically forgot about the stub account that corresponded to that and so it was never delivered to FTX’”.

The founders and FTX’s few remaining employees are scrambling to raise money to pay back customers, with the pleas reportedly falling on deaf ears so far.

The founder added that filing for bankruptcy was his “biggest mistake” yet as it restricted the flow of funds back to the exchange, and people were now trying to “burn it all to the ground out of shame”.

It came as the Singaporean venture capital giant Temasek wrote down its mammoth $275m investment in the exchange, following suit with FTX’s other big name backers like Sequoia Capital and Softbanks’ Vision Fund.

Nov 17, 2022

—by Protos Staff

FTX chief exec, John J. Ray III, has filed his first declaration in the bankruptcy of FTX, FTX US, Alameda Research, and related entities. Ray, who had served as Chairman of Enron during its bankruptcy, stated that he’d never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

Preston J. Byrne, a cryptocurrency lawyer and partner at Brown Rudnick LLP, described it to Protos as “one of the most scathing court filings I’ve ever read.”

What’s contained in the filing?

For the purpose of this bankruptcy, more than 130 companies have been divided into the following four silos.The WRS Silo is made up primarily of the US entities including FTX US, LedgerX, and the FTX US Derivatives business.

The Alameda Silo contains the corporations that made up Alameda Research.

The Ventures Silo includes FTX Ventures and other structures used for venture investing.

The Dotcom Silo comprises the remaining companies which made up the non-US FTX exchanges.

Read more: Panic and resignations reign over FTX’s final days

The filing makes it very clear that “Each of the Silos was controlled by Mr. Bankman-Fried,” contradicting Sam’s repeated claims that Alameda Research was independent and that he didn’t control it.

The WRS Silo

This filing reveals that several parts of the US-focused business do still appear to be solvent. These include LedgerX, the securities clearing and broker-dealer firms, and the custody offering.

FTX US had received a loan from BlockFi for $250 million against FTX Token (FTT).

The filing also makes clear that the consolidated balance sheet for this silo is unaudited, and that, “because this balance sheet was produced while the debtors were controlled by Mr. Bankman-Fried, I do not have confidence in it.” This is echoed for the other silos.

The Alameda Silo

The Alameda Research portion of the business was almost entirely controlled by Sam Bankman-Fried (SBF), with him owning 90% and the remaining 10% being owned by co-founder Gary Wang.

Alameda Research was loaning to a variety of related parties including:$2.3 billion to Paper Bird Inc., an entity controlled entirely by SBF.

$1 billion to SBF specifically.

$1 billion to Nishad Singh, former director of engineering, first for Alameda Research and then FTX.

$55 million to Ryan Salame, former co-CEO of FTX Digital Markets.

The Ventures Silo

The bankruptcy team has not been able to locate any financial statements for one of the entities, Island Bay Ventures. The Ventures Silo also owes several related parties:$1.4 billion to Alameda Research.

$68.6 million to a different Alameda Research entity.

$38.5 million to Alameda Ventures.

$2.25 million to West Realm Shires.

The Dotcom Silo

The total value for non-customer cryptocurrency remaining at FTX is about $659,000.

Notably, the books shared in this filing don’t seem to include among the FTX receivables the funds that were supposedly lent to Alameda Research, suggesting they’re deeply inadequate.

What was going on?

FTX had no serious accounting system and these entities didn’t have their own accounts department and were doing a very poor job of tracking their cash. They lacked “an accurate list of bank accounts and signatories” and paid “insufficient attention to the creditworthiness of banking partners.” The result of this is that they don’t currently know how much cash is remaining at FTX.

Furthermore, this filing also claims that they have “substantial concerns as to the information presented in these audited financial statements.” The WRS Silo, comprised of the US side of the business was audited by Armanino LLP, and the Dotcom Silo was audited by Prager Metis, the first metaverse auditing firm. The filing continues that they “do not believe it appropriate for stakeholders of the court to rely on audited financial statements as a reliable indication of the financial circumstances.”

The employment situation at FTX is similarly chaotic, with the debtors being unable to compile a complete list of employees or detail on what terms they worked. People seemed to have responsibilities across different entities.

FTX lacked many internal and financial controls, including for its disbursement of assets, with requests being approved in a chat channel with supervisors responding with emojis.

Corporate funds belonging to FTX Group were used to purchase homes and other items for employees, and many of these transactions lack documentation and were recorded in the personal names of FTX employees and advisors.

FTX’s digital assets were not appropriately secured, with SBF and Wang both having access to assets across all businesses with the exception of LedgerX.

Furthermore, an “unsecured group email account” was used as the “root user to access confidential private keys and critically sensitive data,” potentially contributing to the ‘hack’ that has resulted in lost FTX assets.

Nor was there daily reconciliation of blockchain positions and FTX used the previously reported backdoor to hide “misuse of customer funds.” Alameda Research was also secretly exempted from FTX’s automatic-liquidation protocol.

Ray also cites the “failure of the co-founders… to identify additional wallets” as one of the major impediments to locating all of the digital assets for FTX. This suggests the company isn’t cooperating with the bankruptcy.

Furthermore, “FTX Group had billions in investments other than cryptocurrency… however, the main companies in the Alameda Silo and the Ventures Silo did not keep complete books and records.” The lack of financial recordkeeping for these firms will further lengthen and complicate recovery for FTX creditors.

It continues with additional failures of FTX corporate governance including: “One of the most pervasive failures of the FTX.com business, in particular, is the absence of lasting records of decision-making. Mr. Bankman-Fried often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same.”

It also seems that the new CEO is still unable to access certain information from FTX, and because of that the firm is currently “unable to create a list of its top 50 creditors.”

Read more: Bahamian rhapsody: FTX users exploit loophole to withdraw crypto

The final point, which FTX official Twitter accounts also felt the need to make exceptionally clear, is that SBF is no longer employed and does not speak for the combined entities. This is increasingly important as he’s taken to messaging journalists “f**k regulators” and to describing his ethics statement as “mostly PR.”

An emergency motion filing related to this bankruptcy claims that there’s “credible evidence that the Bahamian government is responsible for directing unauthorized access to Debtor’s systems for the purpose of obtaining digital assets of the Debtors.”

Previously, FTX had announced that withdrawals were staying open for Bahamas-based users at the request of regulators, to which the Bahamas Securities Commission responded that it had not “authorized or suggested… the prioritization of withdrawals for Bahamian clients.”

The filing also references SBF’s previous direct message in which he talked about winning a jurisdictional battle with Delaware as an important step to restoring FTX. This, it said, was evidence that the Bahamian bankruptcy proceedings would be far more favorable.

What led to the collapse?

Related party transactions led directly to the collapse of his empire: SBF-controlled FTX sent customer deposits to SBF-owned Alameda Research to fund its continued cryptocurrency speculation. This was in addition to sending billions of dollars in loans to himself and entities he controls. SBF led to the collapse and bankruptcy of FTX, FTX US, Alameda Research, FTX Ventures, and 130 related entities.

—by Protos Staff

Over the years, Jump Crypto, the crypto-specific arm of Chicago-headquartered trading firm Jump Trading, has worked alongside some of the most prominent firms and individuals in the crypto space. However, it’s also been embroiled in its fair share number of high-profile controversies.

Jump’s ties to FTX

Jump and FTX go way back and the relationship is a deep one. However, the links haven’t always been viewed favorably. Indeed, Jump was accused of colluding with Sam Bankman-Fried’s Alameda Research on seed funding rounds and yield farming investments.

It’s also been alleged that Jump withdrew $300 million in assets from FTX the day before the exchange paused withdrawals. That wallet spent a few days routing USDT and USDC to two other Ethereum addresses. It also routed thousands of ETH to at least two other wallets.

To be fair, Jump has acknowledged its exposure to FTX but maintains that its finances were “managed within accordance with our risk framework.”

Jump previously had to bail out its own company

In February 2022, Jump Crypto paid $320 million to bail out token bridge Wormhole after hackers stole $325 million in Wormhole-wrapped ether on Solana. How had it acquired those funds? According to Jump Trading president Dave Olsen, it bought 120,000 ETH, which was then worth $3,000 per ETH. This eventually led to rumors that it could have dipped into digital assets belonging to Menlo Park-based exchange Robinhood to cover Wormhole’s losses.

Wormhole acts as an intermediary for crypto asset swaps between Ethereum (ETH) and Solana (SOL) blockchains, allowing users to transform Ethereum tokens into Solana-bound ones and vice versa.

But smart contract hackers exploited a bug to mint hundreds of millions of dollars worth of Solana-based Wrapped ether (WETH) without posting the required ether collateral.

Its president has close links to now-defunct Terra

Kanav Kariya became Jump Crypto’s president in September 2021 after a stint as an intern at Jump Trading Group’s digital asset division.

Under Kariya’s watch, Jump began developing tools like Pyth, which provides real-time asset pricing data for DeFi applications. Jump has also continued its support for Solana, agreeing to develop upgrades for Solana’s software and build a new validator client.

As well as heading up Jump Crypto, Kariya is also a member of Luna Foundation Guard’s (LFG) governing council. This is significant because, as previously reported by Protos, LFG transferred more than 52,000 bitcoin (BTC) from its reserves to Jump Trading in an effort to defend the price of terraUSD (UST).

According to a recent independent report, however, Jump provided no details about the transactions it made.

The company has made some interesting decisions

In the wake of the FTX meltdown, Kariya published a number of tweets that led to people calling for greater transparency. However, he seems to be ignoring them beyond acknowledging that they were “down bad.”

Read more: Jump Crypto ties to FTX and Solana put Robinhood users at risk

In addition, Jump Crypto reportedly sued a Carl Sagan fan for the Wormhole.com domain and, alongside FTX, co-led Coral’s $20 million funding round. Coral is building developer tools for Solana, including the smart contract developer framework Anchor and what it calls “web3’s iPhone.”

For more informed news listen to our investigative podcast Innovated: Blockchain City.

Zhao also said he told Bankman-Fried to “put on a suit, go to D.C. and start answering questions.”

Nov 17, 2022

Speaking at an event with economic think tank the Milken Institute in the UAE, Binance CEO Changpeng Zhao called former FTX CEO Samuel Bankman-Fried a “psychopath” for alluding in a tweet that Zhao was his “sparring partner” amid FTX’s catastrophic collapse.

The FTX liquidity crisis began to come to light on November 6, when Zhao tweeted that he was going to liquidate all of Binance’s FTT holdings (FTT is FTX’s native token) due to “recent revelations” that FTX was lobbying “against other industry players behind their backs.”

The tweet caused a bank run as FTX customers piled in to pull funds off the exchange. A whopping $6 billion exited FTX over 72 hours, compared to the “tens of millions” in withdrawals ordinarily handled on an average day. It also exposed FTX’s shortfall in meeting the requests.

In less than a week, one of the largest and most trusted crypto exchanges went up in flames, along with its crypto celebrity founder and CEO Sam Bankman-Fried. Dan Roberts, Stacy Elliott, and Kate Irwin walk you through exactly how it happened, what it means for you, their own takes on the most interesting subplots, and what we can learn from it all. Plus: We review some comments SBF and CZ made on this podcast that look remarkable in hindsight. Watch Episode 23 of the gm podcast and make sure to subscribe on Apple or Spotify.Go to video page

“When [Bankman-Fried] reached out to me, I thought he was going to ask for an OTC deal to buy the FTT tokens, and in this way, we sort of silence the noise in the market,” said Zhao. “But when he called me, he very quickly alluded [to the fact that] they’re in big trouble. They’re looking for a buyout.”

When asked to respond to Bankman-Fried’s tweet that they were sparring partners, Zhao replied, “I think only a psychopath can write that tweet.”

Former Enron Liquidator Finds 'Complete Absence of Trustworthy Financial Information' at FTX

He continued: “He never told me I was his sparring partner. I’m actually not sure if that’s even tweeted at me.” When asked who else it could be, Zhao replied “we can guess,” but did not go further.

Zhao claimed neither he nor Binance sees other exchanges as competitors, arguing that takeovers are not as effective as trying to grow the industry, which he said is still nascent. "We haven’t even reached 1% adoption. We can grow the industry 100x,” he said.

He then reiterated his sentiment that FTX should have tried to “grow the industry and not lobby against other players.”

Zhao told the audience that on the day of Bankman-Fried’s offending tweet, “he should have been working on other things, not writing tweets.” He claimed to have said as much in an industry group chat, recommending the disgraced FTX CEO “put on a suit, go to D.C. and start answering questions.”

A checkered crypto bromance.

The tension between Bankman-Fried and Changpeng Zhao has been brewing intermittently for the last three years.

Back in 2019, Binance invested $100 million in FTX, effectively owning 20% of it, but Zhao and Bankman-Fried’s relationship faltered as they became competitors. Two years later, Bankman-Fried bought back Zhao’s stake for $2.1 billion, paying partly in FTT tokens.

FTX Used Client Funds, FTT Tokens, and Robinhood Shares to Prop Up Alameda: Report

Since Binance’s FTT holdings were not inconsiderable, Zhao’s tweet that he was going to liquidate all FTT on his exchange’s balance sheet, coupled with an unfavorable rumor mill surrounding FTX, was enough to cause widespread panic selling.

Binance offered to bail out FTX on Tuesday, November 8—two days into the crisis, but u-turned 24 hours later, citing the “latest news reports regarding mishandled customer funds and alleged U.0.S agency investigations.”

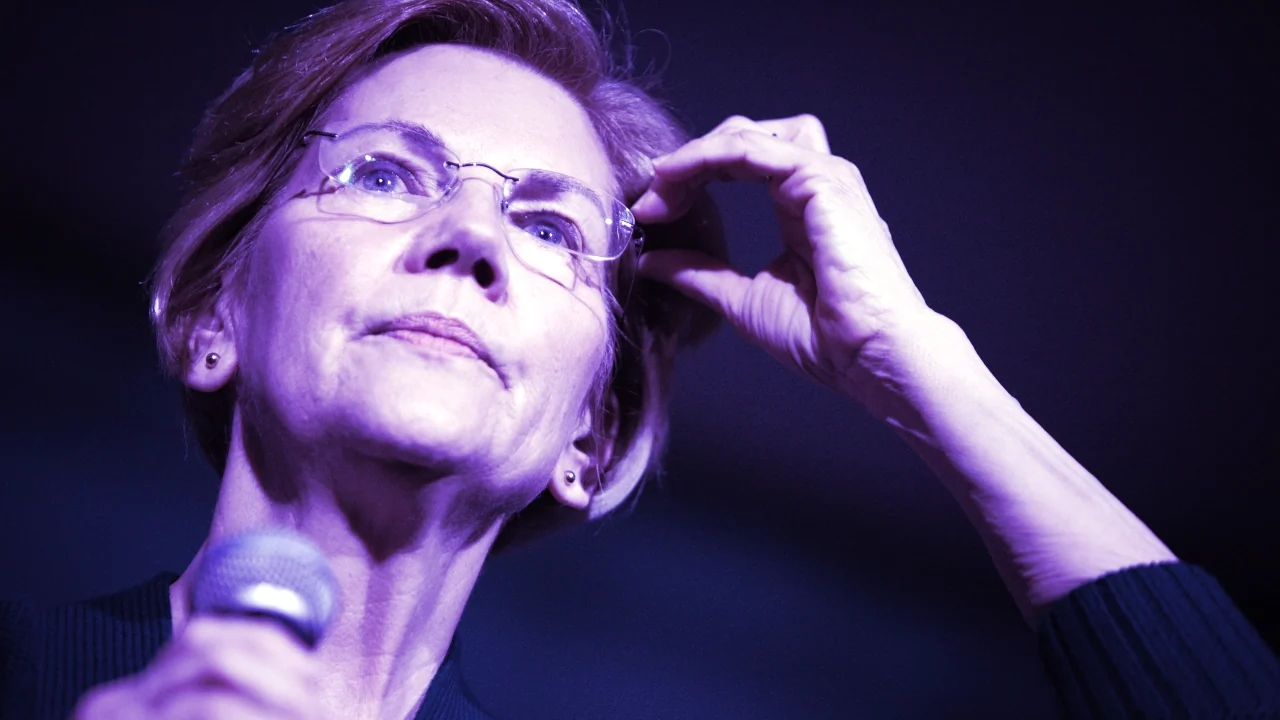

Warren, in a letter to FTX founder Sam Bankman-Fried, requested internal company documents to help explain the crypto exchange’s eyebrow-raising practices.

By Sander Lutz

Nov 17, 2022

Warren, along with Senator Dick Durbin (D-IL), demanded that the company produce full balance sheets for FTX and its 130 subsidiaries dating back to 2019, along with other documentation, in a letter sent Wednesday to both FTX founder and former CEO Sam Bankman-Fried and the exchange’s appointed liquidator, John Jay Ray III.

“New revelations continue to shed light on what now appears to be an appalling case of greed and deception,” the letter stated. “The public is owed a complete and transparent accounting of the business practices and financial activities leading up to and following FTX’s collapse and the loss of billions of dollars of customer funds.”

Want to be a crypto expert? Get the best of Decrypt straight to your inbox.Your EmailGet it!

The letter also copied the chairs of the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC).

In addition to balance sheets, the Senators requested detailed clarification of the “poor internal labeling” system that Bankman-Fried tweeted last week was responsible for an alleged multi-billion dollar discrepancy in his understanding of the exchange’s finances and liquidity. The letter also asked for confirmation of the existence of an alleged “back door” between FTX and its sister trading firm Alameda Research, which was maintained by Bankman-Fried to be an entirely separate entity from FTX.

In a court filing issued today, newly appointed FTX CEO John Ray alleged that Alameda possessed a “secret exemption” on FTX that would protect it from “certain aspects of FTX.com’s auto-liquidation protocol.” In other words, Alameda played by its own rules on FTX grounds.

Warren’s letter today also asks for clarity on the $1.7 billion in customer funds that have apparently gone missing; in that matter, and numerous others, the Senators have asked Bankman-Fried to clarify which other FTX employees, besides himself, were responsible for these decisions.

“Billions of dollars-worth of investor funds seem to have disappeared into the ether,” the letter reads. “[...] These developments justify our long-standing concerns that the crypto industry ‘is built to favor scammers.’”

Senator Warren has long been a vocal critic of the crypto industry, tweeting last week that FTX’s collapse validated both her skepticism of the industry as a whole, and the need for the federal government to regulate the space with a much firmer grip.

Senator Warren: Crypto Puts Financial System in the Hands of 'Shadowy Super-Coders

At a hearing of the Senate Banking Committee this morning, Senator Elizabeth Warren (D-MA), now one of Congress’s most prominent crypto skeptics, continued to sound the alarm about Will Gottsegen Jul 27, 2021

“Too much of the industry is smoke and mirrors,” Warren wrote. “It’s time for stronger rules and stronger enforcement to protect ordinary people.”

FTX is currently in the midst of bankruptcy proceedings; the company’s liquidator, John Ray III, who previously oversaw Enron’s collapse, stated in a Delaware bankruptcy court on Wednesday that FTX represented the most troubling case of corporate malpractice he’d ever seen.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray wrote. “From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

“This situation is unprecedented,” said John J. Ray III, who helped manage Enron after its collapse in an accounting fraud scandal in 2001.

Sam Bankman-Fried, the former chief executive of the cryptocurrency exchange FTX, which collapsed into bankruptcy.Credit...Erika P. Rodriguez for The New York Times

Sam Bankman-Fried, the former chief executive of the cryptocurrency exchange FTX, which collapsed into bankruptcy.Credit...Erika P. Rodriguez for The New York TimesBy David Yaffe-Bellany

David Yaffe-Bellany writes about the crypto markets and financial technology.

Nov. 17, 2022

John Jay Ray III helped manage the aftermath of some of the largest corporate failures in history, including the implosion of the energy trading firm Enron after an accounting fraud scandal in 2001.

But the corporate dysfunction at FTX, the collapsed cryptocurrency exchange that he took over last week, is the worst he has ever seen.

In a blistering court filing on Thursday, Mr. Ray described an astonishing level of disarray and said he had never seen “such a complete failure of corporate control.” He listed a series of “unacceptable management practices,” including the use of an unsecured group email for access to sensitive data, and said the financial information maintained by FTX was deeply untrustworthy.

“From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented,” he wrote in the filing in the U.S. Bankruptcy Court for the District of Delaware.

FTX collapsed last week after a run on deposits exposed a deep financial hole in the business. Last Friday, the company filed for bankruptcy, and its chief executive, Sam Bankman-Fried, resigned. The collapse has kicked off investigations by the Justice Department and the Securities and Exchange Commission focused on whether FTX improperly used customer funds to prop up Alameda Research, a trading firm that Mr. Bankman-Fried also founded.

The Aftermath of FTX’s Downfall

The sudden collapse of the crypto exchange has left the industry stunned.A Company in Disarray: The new chief executive of FTX, who helped manage Enron after its collapse, said that he had never seen “such a complete failure of corporate control.”

The Scope of the Meltdown: FTX could owe money to more than one million creditors, according to the first substantial court filing since the company’s bankruptcy.

Investors Under Scrutiny: Venture capital firms and investment funds showered nearly $2 billion on FTX with few strings attached. Now, they are facing questions, too.

A Pall on a Philanthropy Movement: The fall of FTX dealt a significant blow to the “effective altruism” movement that is deeply tied to the company’s founder, Sam Bankman-Fried.

The collapse has jeopardized the savings of hundreds of thousands of customers who deposited their crypto holdings on the FTX platform. FTX had a wide reach across cryptocurrency companies, and its collapse has sent shock waves through the industry. Last week, the crypto lender BlockFi — a firm that was closely linked to Mr. Bankman-Fried’s crypto empire — said that it was suspending operations. On Wednesday, the crypto firm Genesis announced that its own lending arm was halting withdrawals.

Mr. Bankman-Fried did not respond to a request for comment.

The bankruptcy filing on Thursday offered the first detailed look at FTX’s business. And it describes a level of dysfunction that goes beyond even some of the most pessimistic assessments offered over the last week and a half.

In rich detail, Mr. Ray walked through the company’s many corporate missteps and suspicious management, including the use of software to “conceal the misuse of customer funds.” He said there was “an absence of independent governance” between FTX and Alameda, which was owned almost entirely by Mr. Bankman-Fried.

He also said he could not trust that financial statements assembled under Mr. Bankman-Fried’s leadership were accurate. “The FTX Group did not keep appropriate books and records, or security controls, with respect to its digital assets,” he wrote.

Alameda’s quarterly financial statements were never audited, he said. But according to financial information in the filing, Alameda made loans totaling about $3.3 billion to Mr. Bankman-Fried and an entity he controls, and about $600 million to two other FTX executives, Nishad Singh and Ryan Salame.

Since he took over last week, Mr. Ray said, his team has secured about $740 million worth of cryptocurrency belonging to various parts of FTX’s business. But he called that sum “only a fraction” of what he hopes to recover, saying the company has hired forensic analysts and blockchain experts to assist in locating any remaining funds. The run on FTX left the company owing an estimated $8 billion, according to people familiar with the matter.

In Mr. Ray’s telling, the mismanagement permeated the entire company.

Mr. Ray said FTX’s human resources department was so disorganized that his team had been unable to prepare a complete list of who worked at FTX. And he said corporate funds had been used to buy homes and other personal items for employees and advisers, without proper documentation. Employees would make payment requests through a chat portal, where supervisors approved disbursements using “personalized emojis,” the filing said.

According to the filing, FTX lacked lasting records of corporate decisions, partly because Mr. Bankman-Fried relied on communications platforms that were set to automatically delete messages after a short time and encouraged employees to use the same applications.

Mr. Ray, 63, took over FTX last Friday. A veteran of several famous corporate implosions, he has a reputation as something of a turnaround artist — an executive who specializes in making the most of distressed situations. He’s best known for serving as Enron’s chief executive during its bankruptcy and has been involved in a number of other prominent corporate restructurings, earning praise for his dogged efforts to recover funds for creditors.

The collapse of FTX was a shocking fall for Mr. Bankman-Fried, who was widely considered one of the most reliable figures in the freewheeling, loosely regulated crypto industry.

Once worth as much as $24 billion, Mr. Bankman-Fried became a frequent presence in the halls of Congress, where he testified about the future of the crypto industry and tried to shape legislation governing the industry. He rubbed shoulders with famous actors and athletes, and once appearing onstage at a conference in the Bahamas with former President Bill Clinton and Tony Blair, the former British prime minister. He was also a prolific and much-sought-after political donor, contributing more than $5 million to President Biden’s 2020 election effort.

But after the collapse, a series of damaging revelations about his leadership of FTX have come to light. He relied on a close circle of fellow executives, and sometimes did not share information with key figures at the company. At times, he was in a romantic relationship with Caroline Ellison, the chief executive of Alameda. And he is firmly in the cross hairs of law enforcement and government regulators, raising the prospect of criminal charges and possible prison time.

Since resigning, Mr. Bankman-Fried has started to speak more publicly about the collapse of his company. In an interview with The New York Times on Sunday, he claimed that he had been unaware of how much money Alameda had borrowed from FTX. He expressed deep regrets over his management of the firm. But at other moments, he seemed almost flippant, describing the video game he had been playing during the crisis and outlining a bizarre plan to post a series of cryptic tweets.

Later, in a series of Twitter messages to a reporter at Vox, he said he regretted allowing the company to file for bankruptcy, and added that regulators “make everything worse.”

The filing on Thursday went to great lengths to distance Mr. Ray and the rest of FTX’s current leadership from the former chief executive, who is in the Bahamas. “Mr. Bankman-Fried is not employed by the debtors and does not speak for them,” the filing said, calling his public statements “erratic and misleading.”

David Yaffe-Bellany covers cryptocurrencies and fintech. He graduated from Yale University and previously reported in Texas, Ohio, Connecticut and Washington, D.C. @yaffebellany