URANIUM

UEC expands licensed capacity at Hobson plant; nears initial production in Texas

Staff Writer | November 17, 2022

Drilling in South Texas. Credit: UEC

Uranium Energy (NYSE American: UEC) announced Thursday that the Texas Commission on Environmental Quality (TCEQ) has approved its submission for a renewed and expanded radioactive material licence (RML) for the Hobson central processing plant.

The Hobson plant serves as the anchor of UEC’s hub-and-spoke in-situ recovery (ISR) production platform in South Texas, and will be used to process uranium loaded resin recovered from multiple satellite projects including Palangana and Burke Hollow.

The amended RML from the TCEQ would increase Hobson’s licensed production capacity by four-fold to 4 million pounds of U3O8 annually, distinguishing the plant as having the largest licensed capacity in Texas and the second largest in the US.

“We continue to execute on our strategy of growing UEC’s leadership as a pure-play, un-hedged uranium supplier in politically stable jurisdictions. Today’s achievement increases and advances our production capabilities in South Texas as we work towards the company’s return to production,” UEC CEO Amir Adnani said in a media statement.

South Texas is one of two production-ready ISR hub and spoke platforms held by UEC, the other being Wyoming. Together, the two platforms contain 12 satellite projects, seven of which are fully licensed, with over 71 million lb. of measured and indicated resources and 17 million lb. of inferred resources in place.

According to the August 2022 S-K 1300 technical report, the South Texas projects are estimated to contain a combined measured and indicated resource of 9.12 million lb. (4.74 million tonnes grading 0.10% U3O8) and 9.92 million lb. inferred (5.47 million tonnes grading 0.12% U3O8).

Of the three South Texas properties explored by UEC, the most recent drilling was done at Burke Hollow from 2019-2021, where the company has completed baseline sampling at the first production area and successfully conducted the production area pump test. This brings UEC one step closer to initiating production at Burke Hollow, which it describes as the newest and largest ISR wellfield being developed in the US.

In a separate announcement, UEC has also completed its acquisition of the Roughrider project in Saskatchewan from a subsidiary of Rio Tinto. In the press release, Adnani said that the Roughrider project “will anchor our Canadian high-grade conventional business and allow us to unlock value from the portfolio recently acquired from UEX.”

The development-stage Roughrider project has a non-current, historic resource of 58 million lb. at an average grade of 4.73% U3O8 in the eastern Athabasca Basin region, where 10% of global uranium production was sourced in 2021.

As previously announced in October, total consideration paid for the uranium development asset is C$150 million ($112.5m).

GREENWASHING

How the 2022 World Cup rebuilt a market for dodgy carbon credits

Bloomberg News | November 17, 2022

World Cup organizers have pledged to erase the event’s negative environmental impact. Credit: Adobe Stock

For almost a decade, the small, gas-rich country of Qatar has been one giant construction site. In preparation to host the FIFA World Cup this November, it’s built seven stadiums, new roads and dozens of hotels. Between the emissions generated by the new construction plus air travel to transport players and fans, the 2022 tournament is shaping up to be the most carbon-intensive on record.

World Cup organizers have pledged to erase the event’s negative environmental impact. They plan to make the event “carbon neutral” by buying offsets — paying, in theory, for carbon to be removed or reduced from the Earth’s atmosphere somewhere else.

In practice, the plan is deeply flawed. Qatar and FIFA not only aren’t mitigating the environmental impact of the event, they may be inadvertently magnifying it. Specifically, they’ve said they want to buy some 1.8 million offsets from the Doha-based Global Carbon Council, bolstering a new, local organization that signs off on the kinds of projects that fail to meet minimum standards anywhere else in the world.

GCC is certifying credits that “will make no difference whatsoever to global emissions,” said Gilles Dufrasne, a policy lead at the nonprofit Carbon Market Watch and an expert advisor to the Integrity Council for the Voluntary Carbon Market. “What GCC is offering here is at best ignorant, and at worst an obvious attempt to create more supply of low quality, low cost credits with an illusion of credibility.”

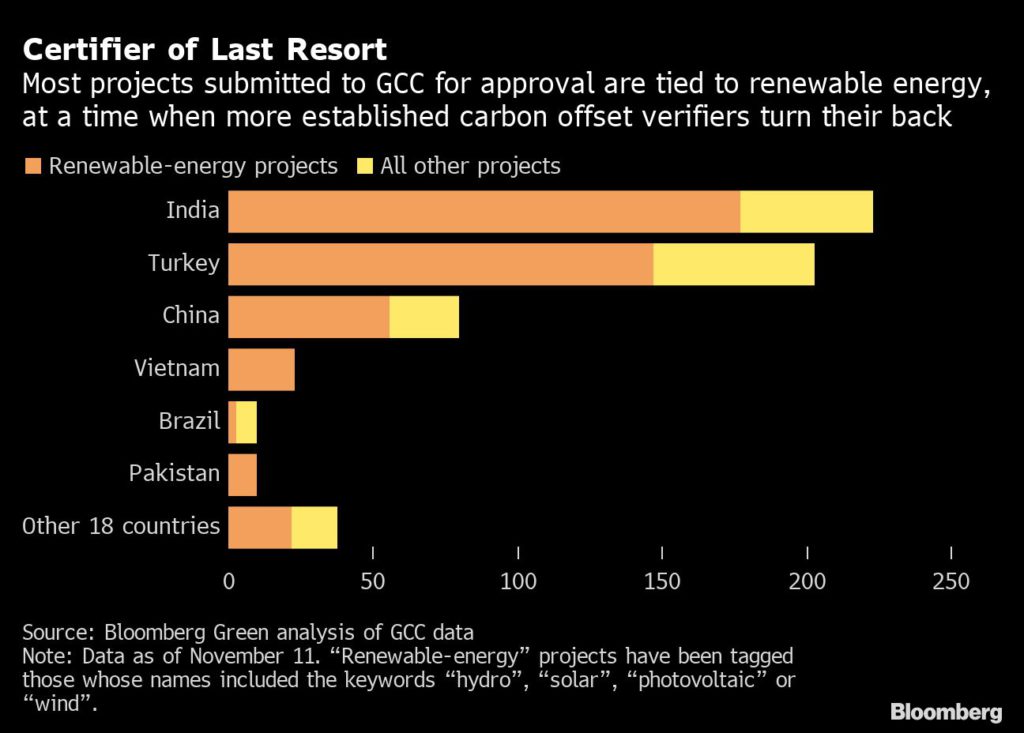

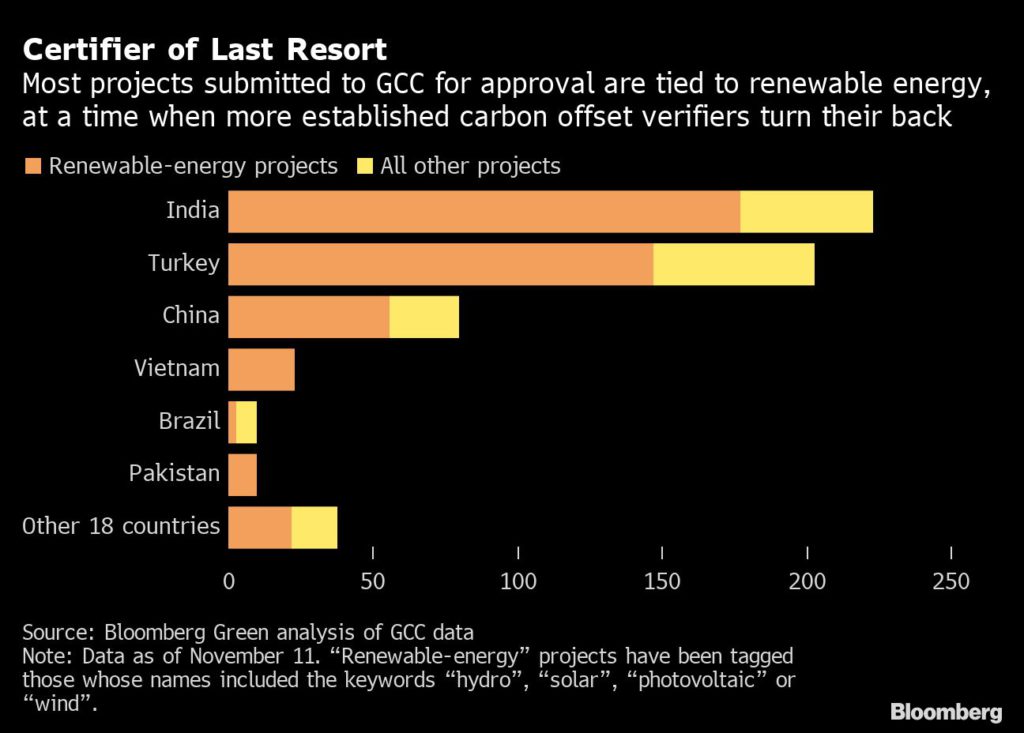

The problem, Dufrasne says, is that the projects that GCC approves can be tied to renewable energy developments in middle-income countries like India, Turkey and Serbia. In the past, a solar, wind or hydroelectric plant could generate carbon credits on the basis that the additional revenue motivated developers to take steps to replace fossil fuel energy. Without the credits, the renewable energy projects wouldn’t get built.

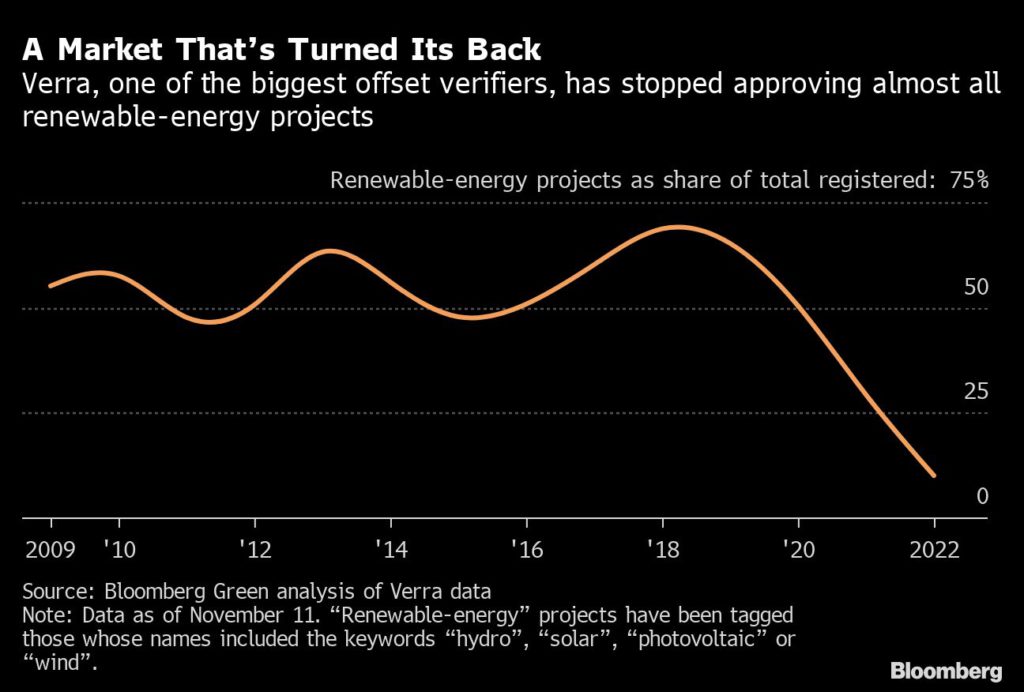

That’s no longer the case in most countries. From 2010 to 2021, the cost of renewable power fell by almost 90%. Solar and wind power are in high demand. Where developers don’t need an added incentive to build them, they shouldn’t generate credits that grant others license to pump new emissions into the atmosphere through, say, massive construction projects or air travel.

With a few, limited exceptions, Dufrasne says, “issuing carbon credits to large renewable energy projects in 2022 goes against fundamental integrity rules of carbon markets.”

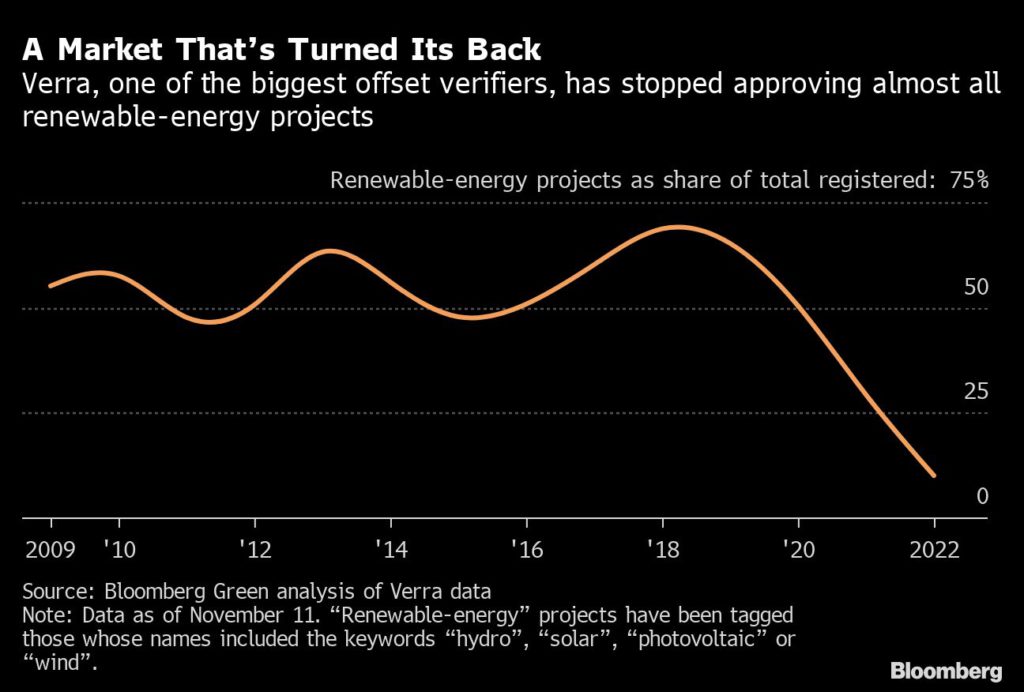

That’s why Verra and Gold Standard, the world’s two biggest certifiers of carbon offset projects, have refused grid-connected renewable energy projects in all but the poorest countries since 2019. “ We came to the conclusion that only those in least-developed countries were still additional,” said David Antonioli, chief executive at Verra. The verification body introduced the ban to “make sure carbon finance was driven to where it is needed most,” he said.

The Science Based Targets initiative goes further, saying that companies should only buy offsets from projects that actively remove carbon from the atmosphere — a definition that excludes renewable energy projects.

GCC, though, strongly disagrees. Chief Operating Officer Kishor Rajhansa says it assesses each project individually, and renewable energy can be a legitimate source of offsets. “Renewable energy is the single biggest climate mitigation activity to reach a net-zero world,” he said.

“We disagree on principle with the decision taken by Verra and Gold Standard to make a blanket decision on all the projects from the developed world,” Rajhansa said. “We want to give every project owner a chance to demonstrate additionality.”

Operational since 2019, GCC had until recently certified just a few projects. But the publicity from the World Cup — along with a tightening of standards elsewhere — has lifted its business prospects significantly. The commitment from FIFA and the Supreme Committee to host a carbon neutral tournament and their ambition to source credits from the region gave the GCC plan impetus, Rajhansa said.

Now there are almost 600 projects waiting for GCC approval, submitted by project developers or middlemen with nowhere else to turn. Indian energy company Emergent Ventures has submitted a handful of grid-connected solar projects to GCC for certification. “It’s the only working standard allowing registration of renewable energy power projects,” Emergent Ventures director Atul Sanghal said. “This is the main reason to go for GCC registration.”

GCC may generate up to 400 million credits over the next decade, said Rajhansa. At today’s prices, that would be worth around $1 billion. Almost all are renewable energy projects and rely either on GCC’s own methodology or that produced by the United Nations Clean Development Mechanism, a scheme established in 1997 by the Kyoto Protocol that’s now considered outdated and is “de facto dead,” according to Dufrasne.

Carbon offsets can be bought and sold with little oversight. The United Nations and other global bodies are working on universal standards, and regulators are increasingly interested in the exchanges that have cropped up to connect buyers and sellers.

So far, the World Cup organizers have been the sole purchasers of credits verified by GCC, which charges to verify offset projects and is owned by the Qatari government. However, all approved and submitted projects are marked by GCC as “CORSIA eligible,” meaning they could be used by airlines to meet their offsetting obligations under the scheme going by the same name.

In response to questions this month, FIFA said all of the event organizers — FIFA, the Supreme Committee and its Qatar 2022 committee — will decide independently whether and where to buy offsets. FIFA now says it will not be purchasing offsets verified by GCC.

The Supreme Committee said it supported the formation of the GCC in 2016 to contribute to regional climate action, but GCC is now operating as an independent organization. “Sustainability has defined all our planning and operations,” the Committee added, which include a new solar power plant, tree nursery, green spaces and electric buses.

The emergence of GCC has spurred new calls for global regulation of the voluntary carbon market, establishing a common, high standard for the credits that can be credibly claimed to offset emissions. Even if GCC tightened its standards in line with other bodies, there’s nothing to stop another organization from popping up to verify renewable energy credits, and as long as the offsets are “verified,” companies will buy them and apply them to net zero goals.

“Without much stricter rules and oversight, the [market] will not play a significant role in reaching the Paris Agreement goals; on the contrary, it could end up facilitating more emissions,” said Juerg Fuessler, managing partner at INFRAS, a sustainability consultancy, and former member of a UN expert panel on carbon crediting methodologies.

Buyers of poor quality credits “divert resources and attention from necessary real and additional mitigation activities,” Fuessler said, and fail to move the needle on meaningful emissions reductions.

(By Natasha White and Verity Ratcliffe, with assistance from Demetrios Pogkas)

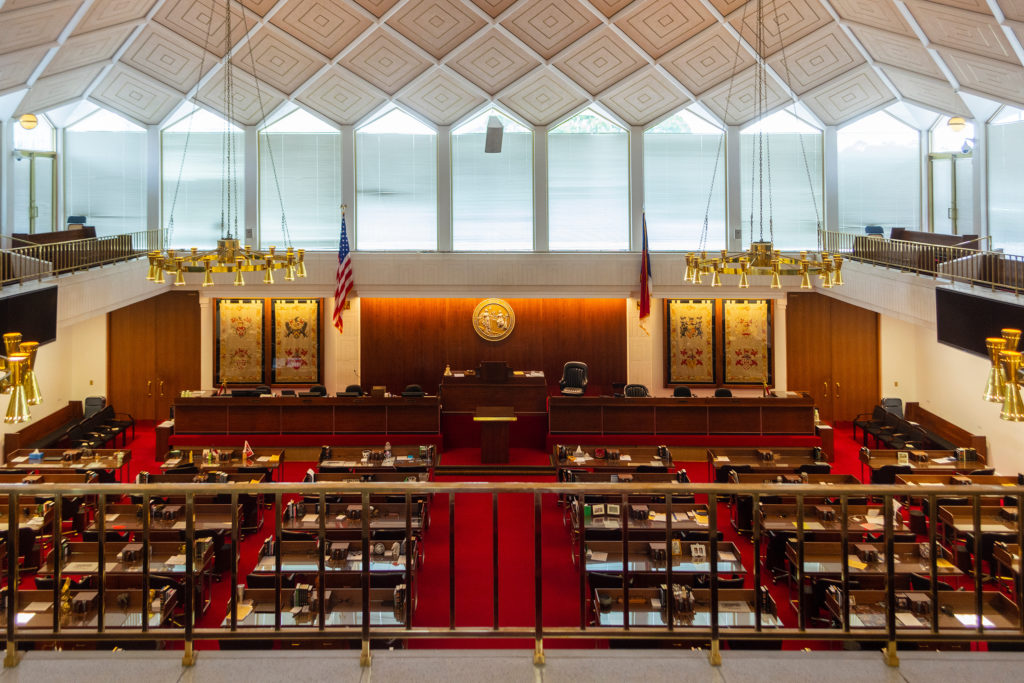

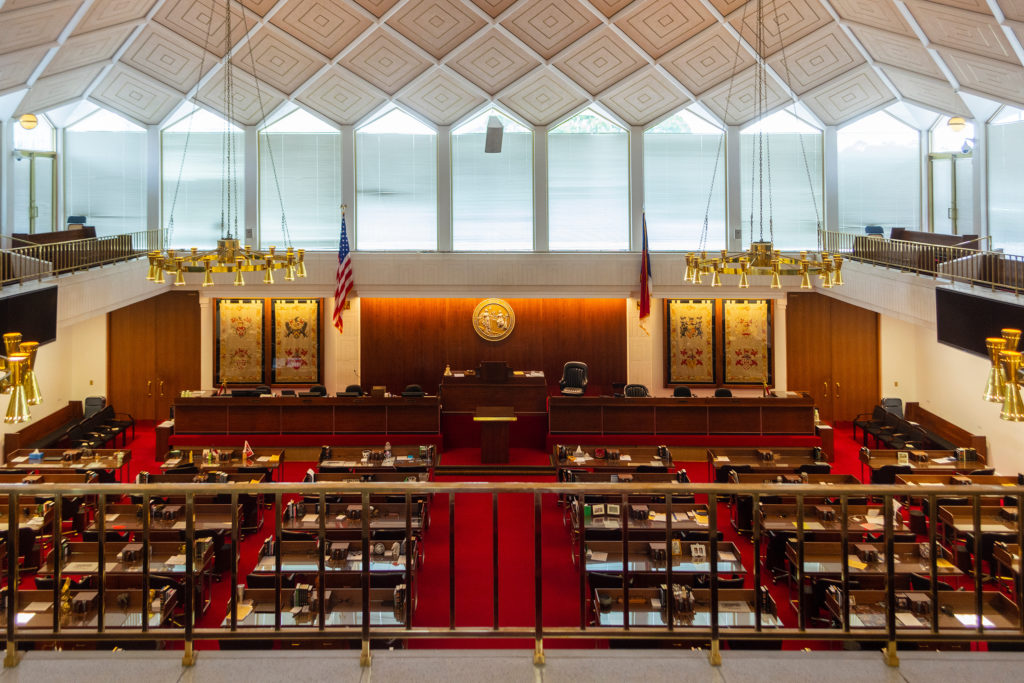

MINING IS NOT SUSTAINABLEUS Republicans aim to shorten EV mine permitting after House winReuters | November 17, 2022 |  Stock image.Republicans will seek to boost American production of lithium, copper and other electric-vehicle metals after the US midterm elections gave them narrow control of the House of Representatives and the power to influence how regulators approve or deny mining projects.

Stock image.Republicans will seek to boost American production of lithium, copper and other electric-vehicle metals after the US midterm elections gave them narrow control of the House of Representatives and the power to influence how regulators approve or deny mining projects. The party on Wednesday was projected to have won at least 218 seats needed to control the House when the new Congress begins on Jan. 3, a narrow victory after more than a week of vote counting.Republican leaders had promised voters during the election they would cut the mining permit review timeline in half and boost domestic EV mining, rather than seek more supply overseas. They also want federal agencies to coordinate better when reviewing mine permit applications and to place time limits on when lawsuits against mines may be filed.“We need to step up our mining activities if we’re going to have an electrified economy,” said Representative Bruce Westerman, an Arkansas Republican who is poised to become chair of the powerful House Natural Resources Committee.Westerman and other Republicans will be partially stymied by Republicans’ failure to wrest control of the US Senate from Democrats.“We’re not talking about gutting environmental laws,” Westerman told reporters on Thursday. “We’re talking about making environmental laws work so we can protect the environment and have a strong and vibrant economy at the same time.”Westerman said he has spoken with Senator Joe Manchin, a West Virginia Democrat and the chair of the Senate energy committee, about permitting reform and is “hopeful that it’s an area where we can work together.”With their newfound control, Republicans could threaten to withhold funding from agencies perceived as taking too long to approve mines. President Joe Biden, though, will still oversee the permitting process.Miners and their Republican supporters, who have long complained that the US mine permitting process is capricious, say they are hopeful for some changes in the new Congress.“We’re optimistic that the oversight function will be robust and that the (Biden) administration will comply with legal statutes already laid out,” said Rich Nolan, head of the National Mining Association, an industry trade group.Conservationists, who are typically aligned with Democrats, have argued that regulatory review should not be unduly rushed despite the rising popularity of EVs.Republicans plan to investigate Biden’s decisions to halt development of Antofagasta Plc’s Twin Metals copper project in Minnesota and Rio Tinto Plc’s Resolution Copper project in Arizona. The Resolution project is opposed by Representative Raúl Grijalva, an Arizona Democrat who will relinquish his chairmanship of the House Natural Resources Committee to Westerman.“We want the politics to be out of the permit review process and let the facts, the science and the truth be the determinant as to whether a mine moves forward,” said Representative Pete Stauber, a Minnesota Republican set to become chair of the House’s Subcommittee on Energy and Mineral Resources, which oversees mining on federal land.Biden’s regulators are also scrutinizing a Nevada lithium project from ioneer Ltd. Proposed mines from Lithium Americas Corp and Polymet Mining Corp face stiff court challenges.Other parts of the energy industry are hoping for permitting reform, too. Alan Armstrong, chief executive of Williams Companies Inc, said he expects a tough but successful fight to streamline the permitting process for hydrogen pipelines.Legislation signed by Biden earlier this year extends EV tax credits to minerals produced in countries with US free trade deals. Republicans say that expanding such deals to other countries is not a priority for the new Congress.“My first goal would be to develop the resources we have here at home,” said Westerman.(By Ernest Scheyder and David Gaffen; Editing by Matthew Lewis)

The party on Wednesday was projected to have won at least 218 seats needed to control the House when the new Congress begins on Jan. 3, a narrow victory after more than a week of vote counting.Republican leaders had promised voters during the election they would cut the mining permit review timeline in half and boost domestic EV mining, rather than seek more supply overseas. They also want federal agencies to coordinate better when reviewing mine permit applications and to place time limits on when lawsuits against mines may be filed.“We need to step up our mining activities if we’re going to have an electrified economy,” said Representative Bruce Westerman, an Arkansas Republican who is poised to become chair of the powerful House Natural Resources Committee.Westerman and other Republicans will be partially stymied by Republicans’ failure to wrest control of the US Senate from Democrats.“We’re not talking about gutting environmental laws,” Westerman told reporters on Thursday. “We’re talking about making environmental laws work so we can protect the environment and have a strong and vibrant economy at the same time.”Westerman said he has spoken with Senator Joe Manchin, a West Virginia Democrat and the chair of the Senate energy committee, about permitting reform and is “hopeful that it’s an area where we can work together.”With their newfound control, Republicans could threaten to withhold funding from agencies perceived as taking too long to approve mines. President Joe Biden, though, will still oversee the permitting process.Miners and their Republican supporters, who have long complained that the US mine permitting process is capricious, say they are hopeful for some changes in the new Congress.“We’re optimistic that the oversight function will be robust and that the (Biden) administration will comply with legal statutes already laid out,” said Rich Nolan, head of the National Mining Association, an industry trade group.Conservationists, who are typically aligned with Democrats, have argued that regulatory review should not be unduly rushed despite the rising popularity of EVs.Republicans plan to investigate Biden’s decisions to halt development of Antofagasta Plc’s Twin Metals copper project in Minnesota and Rio Tinto Plc’s Resolution Copper project in Arizona. The Resolution project is opposed by Representative Raúl Grijalva, an Arizona Democrat who will relinquish his chairmanship of the House Natural Resources Committee to Westerman.“We want the politics to be out of the permit review process and let the facts, the science and the truth be the determinant as to whether a mine moves forward,” said Representative Pete Stauber, a Minnesota Republican set to become chair of the House’s Subcommittee on Energy and Mineral Resources, which oversees mining on federal land.Biden’s regulators are also scrutinizing a Nevada lithium project from ioneer Ltd. Proposed mines from Lithium Americas Corp and Polymet Mining Corp face stiff court challenges.Other parts of the energy industry are hoping for permitting reform, too. Alan Armstrong, chief executive of Williams Companies Inc, said he expects a tough but successful fight to streamline the permitting process for hydrogen pipelines.Legislation signed by Biden earlier this year extends EV tax credits to minerals produced in countries with US free trade deals. Republicans say that expanding such deals to other countries is not a priority for the new Congress.“My first goal would be to develop the resources we have here at home,” said Westerman.(By Ernest Scheyder and David Gaffen; Editing by Matthew Lewis)

Nativ Carbon completes largest reforestation project ever in Australia

Staff Writer | November 18, 2022 |

Nativ Carbon personnel planting seeds. (Image courtesy of Nativ Carbon).

Nativ Carbon, a Perth-based company that delivers vegetation farming for carbon offsets to the mining and oil and gas sectors, announced the recent completion of the largest reforestation project ever in Australia.

Located near Moora in Western Australia, the project consisted of the reforestation of unviable farmland owned by oil company Woodside.

The Moora project included the use of more than 40 biodiverse species and over 1.2 million seedlings.

“The goal of the project was to achieve Australian Carbon Credit Units (ACCUs) objectives as well as create a diverse habitat for native fauna,” Nativ Carbon director David Lullfitz said in a media statement. “We are working with industry to reforest vast tracts of degraded, cleared land and that will not only put back the trees, and shrubs, it will stimulate regional and Indigenous employment. Furthermore, it will result in fauna returning to land that was cleared historically.”

In Lullfitz’s view, Woodside’s initiative in the Western Australian Wheatbelt is a good example of what other industries in the region can do to offset their carbon emissions.

The executive noted that laws governing ACCUs are fostering a range of new restoration and environmental industries which is creating significant regional employment opportunities.

The Moora development, for example, employed a substantial number of Aboriginal people who assisted with seed collecting, fence removal, weed control and plant installation. Overall, about 30 people worked on plant installation and surface preparation.

“Our statistics for our first project were 51% Indigenous employment for the planting crew. Twenty-one people were employed in the planting crew in total. A further 24% of those 21 employees, were recruited from the local Moora area,” the release reads.

“Nativ Carbon aims to consistently provide regional and Indigenous employment opportunities, where possible, and we are pleased to have achieved that goal in this project.”

APACHE LAND CLAIM

Full 9th US Circuit to tackle complex Resolution Copper mining case

Reuters | November 17, 2022 |

Town of Superior Apache Leap. (Image source: Resolution Copper)

The full 9th US Circuit Court of Appeals said on Thursday it will weigh whether the federal government improperly gave Rio Tinto Plc thousands of acres in Arizona for its Resolution Copper mining project in a case that pits religious rights against the green energy revolution.

The San Francisco-based court said it will decide the case en banc, meaning all of its 11 members will participate in the decision. Three members of the court had previously ruled for Rio and the land swap in June. No date has been set for the new hearing.

The dispute centers on the federally owned Oak Flat Campground, which some Apache consider home to deities and which sits atop a reserve of more than 40 billion pounds of copper, a crucial component of electric vehicles. If a mine is built, it would create a crater 2 miles (3 km) wide and 1,000 feet (304 m) deep that would destroy that worship site.

In 2014, Congress and then-President Barack Obama approved a complex deal to give Rio the land. A bill under consideration now would undo that deal, though it is expected to fail.

Rio said it respects the en banc decision. The project is a top priority for the company’s leadership.

“There is significant local support for the Resolution Copper project, and we will continue our efforts to understand, address and mitigate the concerns raised by others,” Rio spokesman Simon Letendre said.

BHP Group Plc, a minority partner in the project, deferred comment to Rio.

Apache Stronghold, a nonprofit group comprised of members of Arizona’s San Carlos Apache tribe and others, cheered the ruling.

“The government protects historical churches and other important religious landmarks, and our site deserves no less protection,” said Wendsler Nosie of the Apache Stronghold.

(By Ernest Scheyder; Editing by Lincoln Feast)

Ecuador indigenous community rejects mining on their land after court ruling

Reuters | November 18, 2022 |

Ecuadorian Amazon rain forest, looking toward the Andes. Credit: Wikimedia Commons

Ecuador’s Shuar Arutam indigenous people said on Friday they will not allow mining on their territory, threatening a large copper mining operation in the Andean country, after a court ruled their rights to prior consultation were violated.

Ecuador’s Constitutional Court in September ruled the environmental permit granted in 2011 for the major San Carlos Panantza copper project required a consultation with the Shuar Arutam community, but this was not carried out.

Indigenous community leaders gathered in Puyo argued that the court ruling annulled the environmental license held by ExplorCobres SA, a unit of China’s CRCC-Tongguan Investment.

“Companies do not have to continue granting concessions on our lands, we will not accept more entries into our territories,” said community president Josefina Tunki. “We will always be ready to defend our autonomous lands.”

Ecuador’s conservative president, Guillermo Lasso, is betting on the mining sector to boost the economy, with exports projected at $3 billion this year. However, court rulings and referendums favoring local communities have hampered the plans.

The September ruling ordered the government to carry out a consultation with the Shuar people within six months, and that the country’s environment ministry make a public apology for granting the environmental permit.

Nathaly Yepez, an Amazon Watch lawyer representing the communities who have waged legal battles for years, said subsequent consultations “cannot be equivalent to correcting company mistakes.”

Ecuador’s energy and environment ministries did not immediately respond to a request for comment. The company ExplorCobres could not be reached.

The government and indigenous leaders are now working on a draft community consultation law, as part of agreements reached after indigenous-led protests shook the country last June.

The agreements include the suspension of mining concessions in territories considered of historic and generational value.

(By Alexandra Valencia and Carolina Pulice; Editing by Matthew Lewis)

Plans for OPEC of nickel finds doubters in Australia, Canada

Bloomberg News | November 17, 2022 |

South Sulawesi, Indonesia. Credit: Wikimedia Commons

An Indonesian proposal to create an OPEC-like group of nickel suppliers has raised eyebrows among Australian miners.

Indonesian Investment Minister Bahlil Lahadalia floated the idea of an alliance that he said would help to unite government policies on the in-demand battery metal — and push the development of the downstream industry — at the Group of 20 Summit in Bali this week. The plan has been discussed with both Canada and Australia.

The Minerals Council of Australia, the country’s major mining association, wouldn’t support the formation of supply-constricting cartels, according to Chief Executive Officer Tania Constable.

It’s “very useful that countries work together to solve the problems that we have around the supply of critical minerals,” she said. However, “we’ll always be mindful we are meeting all our international trade obligations, and you don’t see cartels forming,” Constable said.

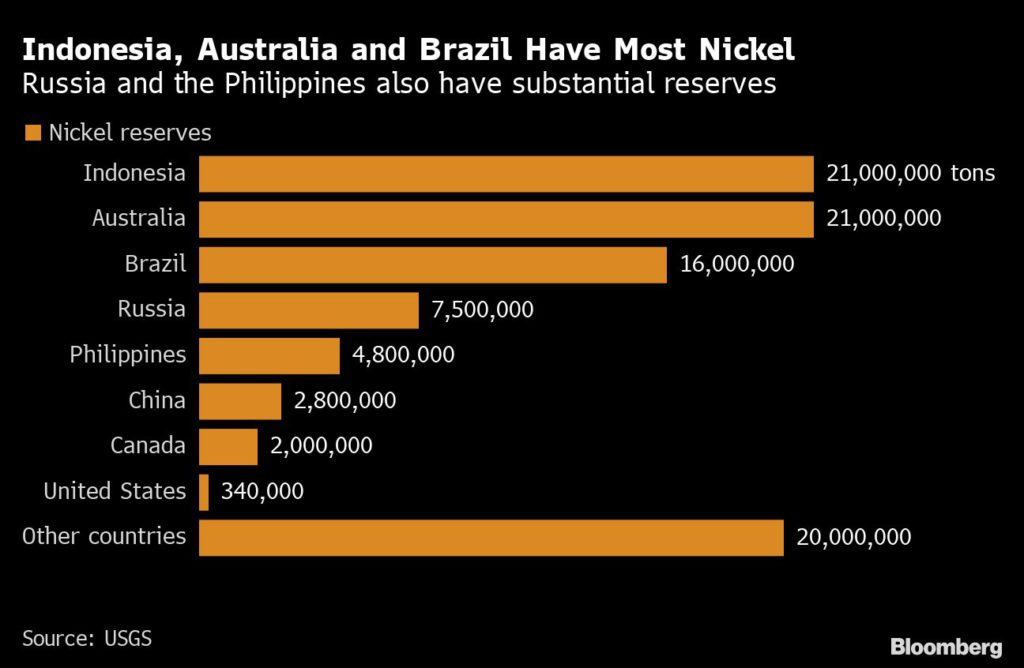

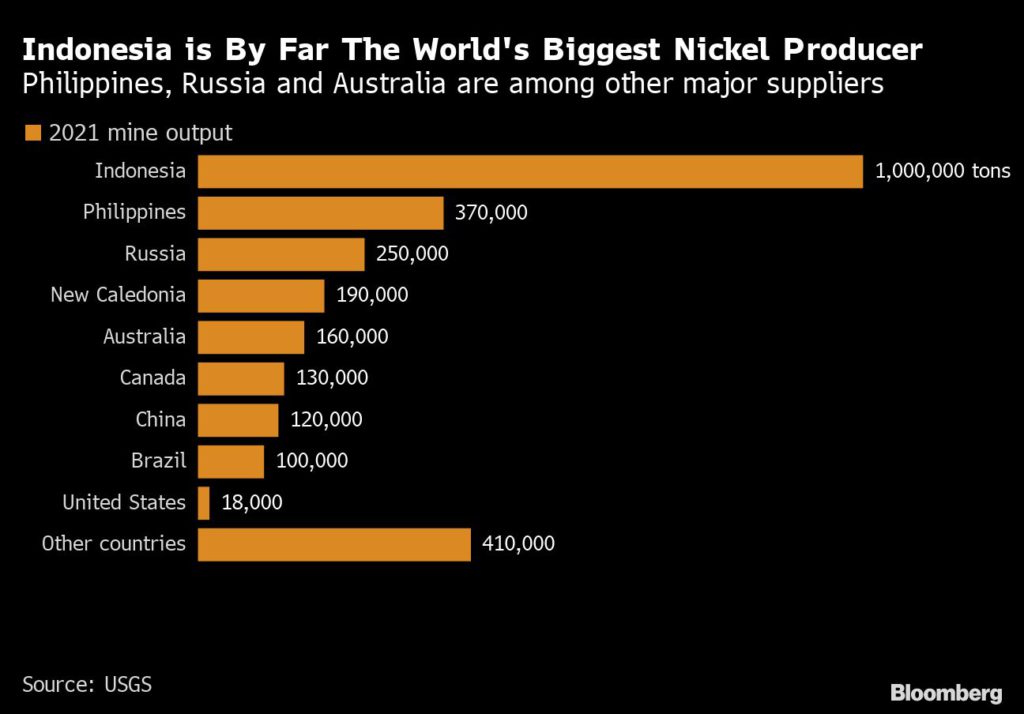

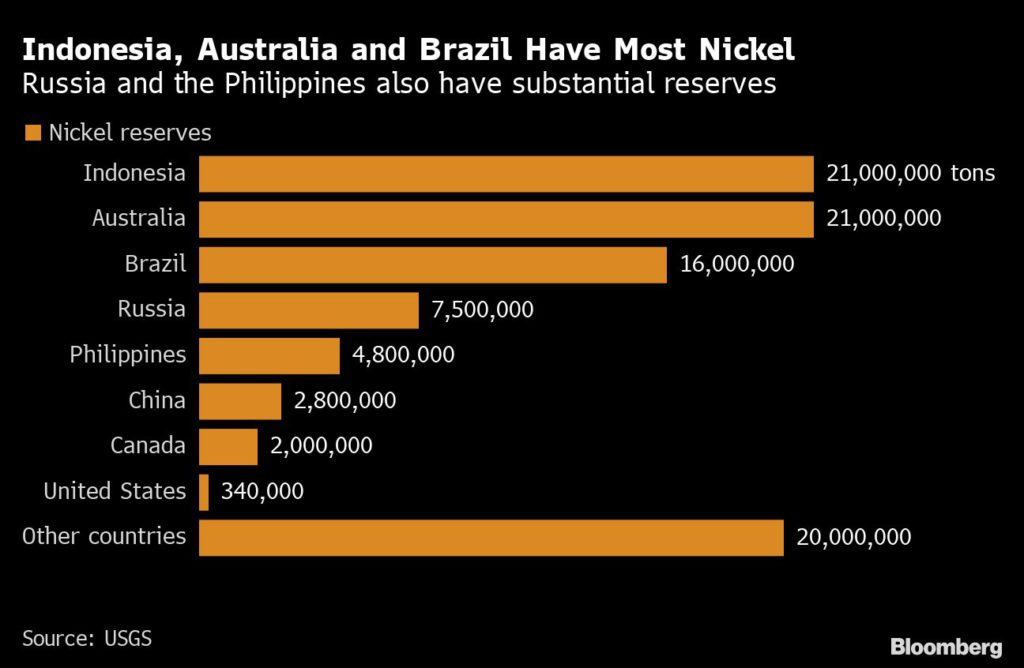

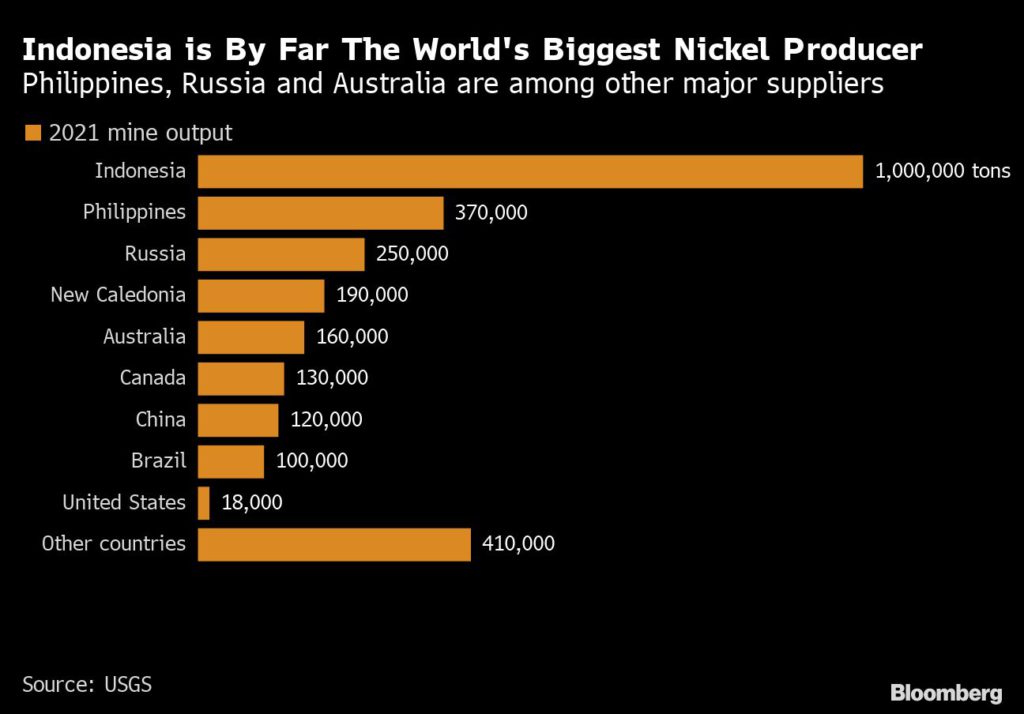

Indonesia is the biggest producer of nickel by a wide margin and is home to around 20% of the world’s deposits of the metal, US Geological Survey data show. Australia has a similar level of reserves but less than a fifth of the output of its neighbor.

Jakarta’s proposal on nickel — used for electric vehicle batteries — fits with Indonesian President Joko Widodo’s strategy of the nation becoming a hub for more refining of metals and even production of electric vehicles. The country hopes to leverage its mineral deposits to move up the supply chain as the world de-carbonizes.

Indonesia is approaching Canada, which also has significant nickel deposits, on the plan, and discussed speeding a potential trade agreement between the two countries this week, Lahadalia said.

However, Canada is unlikely to sign on to the proposal for a nickel alliance, according to a Canadian government official familiar with the matter. Trade Minister Mary Ng wouldn’t agree to collaborate on the idea when she met with her Indonesian counterpart, according to the official, speaking anonymously to discuss a private meeting.

The Australian government didn’t immediately respond to a request for comment on the investment minister’s idea.

The world’s major nickel producers and holders of reserves are a diverse group, both geographically and politically, which may make forming a cartel difficult. After Indonesia and Australia, Brazil has the largest deposits, followed by Russia, the Philippines, China and Canada. In terms of output, Indonesia is the biggest by far, ahead of the Philippines, Russia and New Caledonia.

Indonesia’s proposal would add to increasing complexities in battery-material supply chains that are still in relative infancy. The bid to bring producer nations into a closer relationship comes as major economies including the US try to develop more secure sources of supply.

President Joe Biden’s Inflation Reduction Act requires carmakers to process the majority of their battery materials onshore or in a country with a free-trade agreement with Washington if they want to receive tax credits, said Conrad Mulherin, director, energy transition, at PWC Australia.

The US and Indonesia don’t have an FTA.

Nevertheless, Indonesia’s huge reserves give it bargaining power, Mulherin said. “The reality is there is not enough nickel within the FTA countries to supply to the US car industry.”

(By James Fernyhough, with assistance from Sing Yee Ong, Eko Listiyorini, Martin Ritchie, Ben Westcott and Brian Platt)

Canada ‘very unlikely’ to join OPEC-like group for nickel – gov’t source

Reuters | November 17, 2022 |

Indonesia’s Investment Minister Bahlil Lahadalia and Canadian Trade Minister Mary Ng discussed the potential for a critical minerals partnership earlier this week. Credit: Mary Ng’s official Twitter page

Canada has not committed to establishing an OPEC-like organization for nickel-producing countries with Indonesia and is “very unlikely” to participate in any such group, a Canadian government source familiar with the discussions said on Thursday.

Indonesia proposed talks with Canada to establish the organization in a meeting between Investment Minister Bahlil Lahadalia and Canadian Trade Minister Mary Ng on the sidelines of the G20 summit in Bali earlier this week.

A statement from Bahlil’s office said Ng “welcomed the proposal and the next step for both countries to explore such collaboration opportunity.”

“Minister Ng did not commit to exploring this collaboration at this time,” said the source who was not authorized to speak on the record. “It is very unlikely we will be doing this (joining an OPEC-like nickel group). Officials expressed high levels of reservation about the Indonesian proposal.”

A spokeswoman for the Indonesian investment ministry did not respond to a request for comment made outside of office hours.

Oil companies in many OPEC countries such as Saudi Arabia are owned by the government while in countries such as Nigeria contracts stipulate that government can compel private companies to cut or raise production.

A suggestion for a nickel OPEC had been met coolly by Canadian producers, who said a global cartel would not benefit them.

“Canadian companies are integrated into the North American supply chain and the Canadian resource base is a little bit different,” said Canada Nickel Chief Executive Mark Selby. “This proposal is more of a way for Indonesia to capture more value in their own country.”

Bahlil said on Wednesday that a group of nickel-producing countries could make sure they get an optimal return from the electric vehicle (EV) industry.

The two ministers did discuss working with “allies such as Indonesia to develop sustainable and resilient global supply chains,” said the source.

Indonesia and Canada are the world No. 1 and No. 6 nickel producers, respectively.

(By Steve Scherer, Bernadette Christina and Divya Rajagopal; Editing by Matthew Lewis)

GEMOLOGY

Lucara extends sales deal with HB by 10 years

Cecilia Jamasmie | November 17, 2022 |

A 393.5 carat top white Type IIa gem quality diamond dug up at Karowe. (Image courtesy of Lucara Diamond.)

Canada’s Lucara Diamond (TSX: LUC) has extended its sales agreement with HB Trading covering high-value diamonds from the Karowe mine, in Botswana, for another ten years.

The contract will see Lucara’s +10.8 carat production sold at prices based on the estimated polished outcome of each diamond. This is determined through state-of-the-art scanning and planning technology, with a true up paid on actual achieved polished sales thereafter, less a fee and the cost of manufacturing.

The company first partnered with HB in 2020 to sell Karowe’s large, high value diamonds. These kinds of gems have historically accounted for about 60% to 70% of Lucara’s annual revenues.

The fresh agreement extends this arrangement for ten years, Lucara said.

“For the first time in our ten-year history, we have insight on what becomes of each and every +10.8 ct rough diamond produced from our mine, participating in each step of the planning and manufacturing process right through to the final polished sale,” Lucara CEO Eira Thomas said in the statement.

The Vancouver-based miner is in the midst of expanding Karowe underground, with first production expected in mid-2026. The project will extend the mine’s life until 2040.

Karowe remains one of the highest-margin diamond mines in the world, producing an average of 300,000 carats each year.

Since beginning commercial operations in 2012, it has become the only mine in recorded history to have yielded two 1,000+ carat diamonds — the 1,758 carat Sewelô in 2019 and the 1,109 carat Lesedi La Rona in 2015, which sold for $53 million.

Massive emerald cluster sets new record at Gemfields auction

Cecilia Jamasmie | November 18, 2022 |

The Kafubu Cluster was found at the Kagem emerald mine in Zambia in March 2020. (Image courtesy of Gemfields.)

Africa-focused Gemfields (LON: GEM) (JSE: GML) racked up $30.8 million in revenue from its latest emerald action, which included a massive cluster of emeralds weighing 187,775 carats (37,555 grams).

The Kafubu Cluster, discovered at its Kagem mine in Zambia in March 2020, set a new record as the most expensive single emerald item ever sold by Gemfields, the miner said without providing specifics.

“Our end-of-year emerald auction has delivered a pleasing and solid result despite a clear softening of both prices and sentiment when compared with the remarkable highs we enjoyed in May 2022,” Adrian Banks, managing director of product and sales, said. “This has been a record-shattering year for Kagem with an amazing $149 million in auction sales.”

The coloured gems producer said proceeds will be reinvested in Zambia, including royalties due to the country’s government, which has a 25% stake in Kagem.

Zambian emeralds tend to have a higher iron content than emeralds from other origins, which means they are less fragile. High iron content also means fewer surface-reaching fractures and less need for treatments and enhancements.

The 37.5 kg cluster set a record as the most expensive single emerald item ever sold by Gemfields. (Image courtesy of Gemfields.)

Batteries’ ‘guts’ reveal details on why they fail

Staff Writer | November 17, 2022 |

Advanced Li-Ion battery. (Reference image by the Argonne National Laboratory, Flickr.)

Engineers and chemists at the University of Illinois Urbana-Champaign are working together to combine a powerful new electron microscopy technique and data mining to visually pinpoint areas of chemical and physical alteration within rechargeable ion batteries.

In a paper published in the journal Nature Materials, the scientists explain that their efforts are the first to map out altered domains inside rechargeable ion batteries at the nanoscale – a 10-fold or more increase in resolution over current X-ray and optical methods.

According to the group, previous efforts to understand the working and failure mechanisms of battery materials have primarily focused on the chemical effect of recharging cycles, namely, the changes in the chemical composition of the battery electrodes.

But the new electron microscopy technique, called four-dimensional scanning transmission electron microscopy, allows the team to use a highly focused probe to collect images of the inner workings of batteries.

“During the operation of rechargeable ion batteries, ions diffuse in and out of the electrodes, causing mechanical strain and sometimes cracking failures,” Wenxiang Chen, first author of the study, said in a media statement. “Using the new electron microscopy method, we can capture the strain-caused nanoscale domains inside battery materials for the first time.”

Chen pointed out that these types of microstructural heterogeneity transformations have been widely studied in ceramics and metallurgy but have not been used in energy storage materials until this study.

He and his colleagues also believe that the 4D-STEM method is critical to map otherwise inaccessible variations of crystallinity and domain orientations inside the materials.

“The combined data mining and 4D-STEM data show a pattern of nucleation, growth and coalescence process inside the batteries as the strained nanoscale domains develop,” co-author Qian Chen said. “These patterns were further verified using X-ray diffraction data collected by materials science and engineering professor and study co-author Daniel Shoemaker.”

Qian Chen plans to further this research by creating movies of this process – something for which her lab is well known.

“The impact of this research can go beyond the multivalent ion battery system studied here,” said Paul Braun, a materials science and engineering professor, also co-author of the study.

“The concept, principles and the enabling characterization framework apply to electrodes in a variety of Li-ion and post-Li-ion batteries and other electrochemical systems including fuel cells, synaptic transistors and electrochromics.”

BAD CHINESE MINER

Mining operations at MMG’s Las Bambas mine in Peru down to 30% due to blockade

Reuters | November 17, 2022 |

Las Bambas open pit. (Image courtesy of MMG).

Mining activities at MMG Ltd’s Las Bambas copper mine are operating at just 30% of capacity, a source close to the company said on Thursday, due to blockades from nearby communities.

The blockades started in late October, the source said, and have slowly reduced mining activities due to lack to of supplies. The company had previously announced the reduction of operations but had not detailed its extent.

Chinese-owned Las Bambas ranks among the world’s biggest copper mines but has been repeatedly disrupted by social conflicts with nearby indigenous communities since it opened in 2016.

Peru is the world’s No. 2 copper producer.