Charles V: French scientists decode 500-year-old letter

BIBLIOTHÈQUE STANISLAS DE NANCY

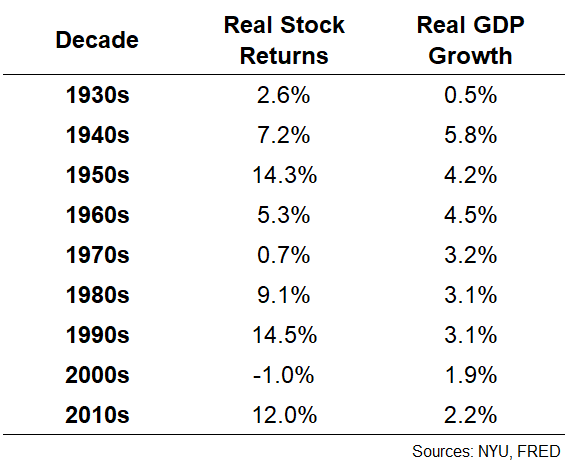

BIBLIOTHÈQUE STANISLAS DE NANCYA coded letter signed in 1547 by the most powerful ruler in Europe has been cracked by French scientists, revealing that he lived in fear of an assassination attempt by an Italian mercenary.

Sent by the Holy Roman Emperor Charles V to his ambassador at the French royal court - a man called Jean de Saint-Mauris - the letter gives an insight into the preoccupations of Europe's rulers at a time of dangerous instability caused by wars of religion and rival strategic interests.

For historians, it is also a rare glimpse at the darks arts of diplomacy in action: secrecy, smiling insincerity and disinformation were evidently as current then as they are today.

Cryptographer Cecile Pierrot first heard a rumour of the letter's existence at a dinner party in Nancy three years ago. After lengthy research she tracked it down to the basement of the city's historic library.

Setting herself a challenge to decode the document within a few days, she was disconcerted to find the task rather harder than she had thought.

The three-page letter - consisting of about 70 lines - is mainly written using about 120 encrypted symbols, but there are also three sections in plain contemporary French.

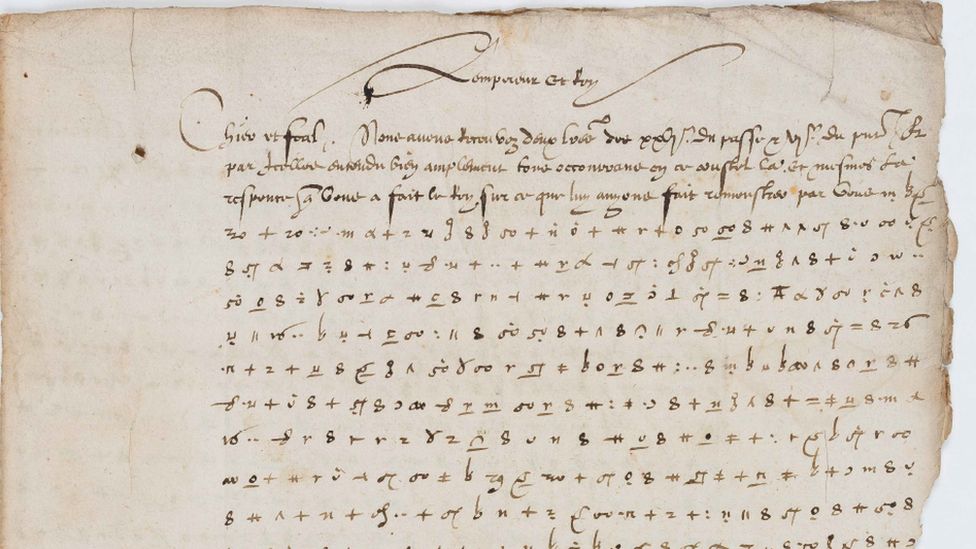

"The first thing was to categorise the symbols, and to look for patterns. But it wasn't simply a case of one symbol representing one letter - it was much more complex," says Pierrot.

"Simply putting it into a computer and telling the computer to work it out would literally have taken longer than the history of the universe!"

GETTY IMAGES

GETTY IMAGESLittle by little she and her team began to make progress. There were, she found, two types of symbol: simple and complex. Vowels were in the main not written as letters, but added as diacritical marks as in Arabic. The 'e' vowel though had no diacritical mark, so was largely absent.

They also found that while most symbols represented letters or combinations of letters, others represented whole words - like a needle for English King Henry VIII. And there were symbols that had apparently no function at all.

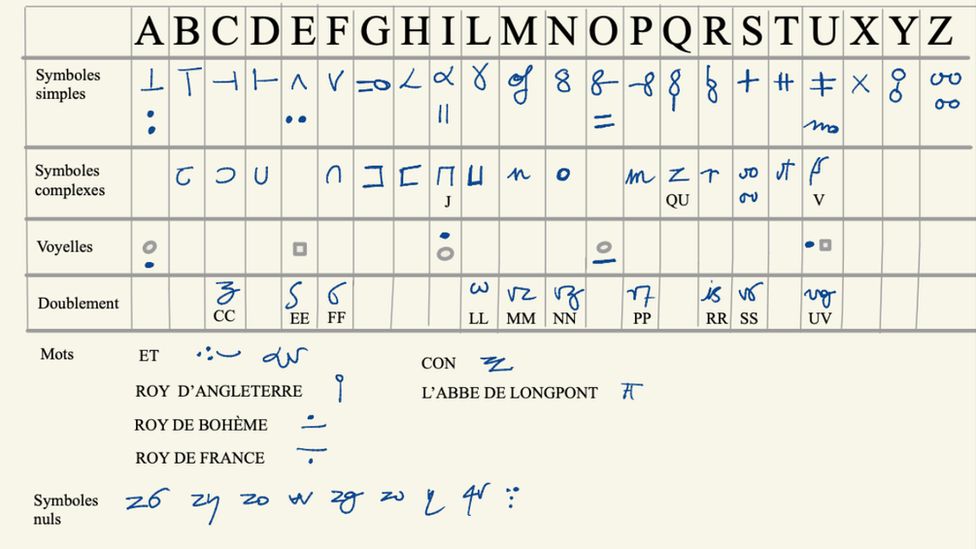

Finally the breakthrough came when historian Camille Desenclos pointed the team to other coded letters to and from the emperor. On one of these, kept at Besançon, the recipient had made an informal translation.

"This was our Rosetta Stone," says Pierrot, referring to the inscriptions which help decode Egyptian hieroglyphics. "It was the key. We would have got there in the end without it, but it saved an awful amount of time."

BIBLIOTHÈQUE STANISLAS DE NANCY

BIBLIOTHÈQUE STANISLAS DE NANCYThe rarity of the letter 'e' is a sign that the codemakers knew their stuff. Because 'e' is the most common letter (in old as in modern French), it is what codebreakers would be looking for first. And the fake symbols were simply put in to sow more confusion.

"Of course by today's standards it is pretty basic," says Pierrot, who spends her normal time thinking about quantum physics and massive prime numbers. "But given the tools they had, they certainly put us to work!"

So what is in the letter?

The team has not yet issued a full translation, which they are saving for an academic paper. But this week they set out the themes.

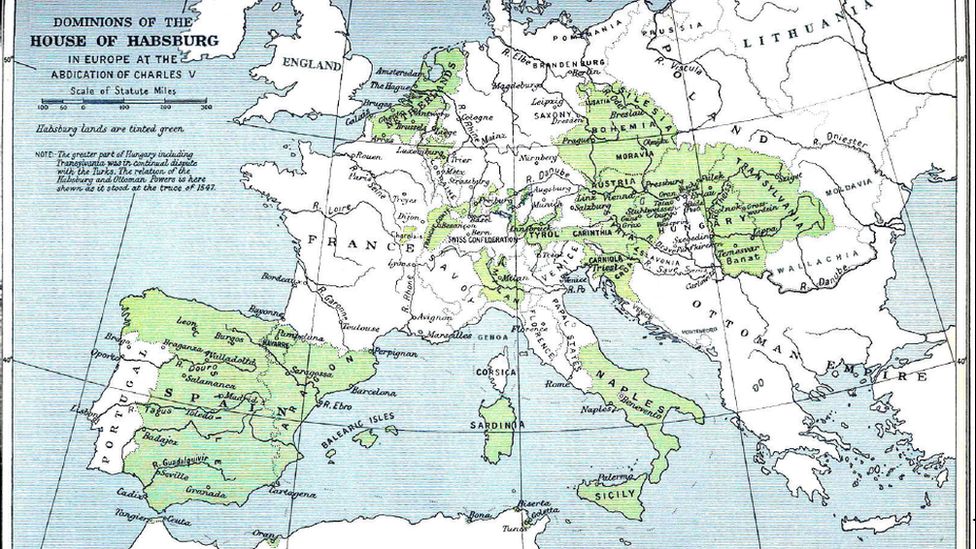

February 1547 was a time of rare relative peace between the rival powers of France and the Holy Roman Empire. Emperor Charles V - ruler of vast areas including Spain, the Netherlands, Austro-Hungary and southern Italy - was no longer actually at war with King Francois I. But mistrust still prevailed.

Two recent events were in both rulers' minds. The first was the death of the Henry VIII just a few weeks before. And the second was the rebellion in Germany by a Protestant alliance called the Schmalkaldic League.

In the letter, Charles V reveals his concern to maintain the peace with France so that he can focus his forces against the League. He tells the ambassador to keep himself abreast of thinking in the French court, in particular any reaction to the death of King Henry.

What he wants to avoid above all is the French and English combining to lend more assistance to the Protestant rebels.

THE CAMBRIDGE MODERN HISTORY ATLAS

THE CAMBRIDGE MODERN HISTORY ATLASCharles V then speaks of a rumour which is circulating - that he, the emperor, is to be the target of an assassination attempt by the Italian condottiere (mercenary leader) Pierre Strozzi. Saint-Mauris is to find out as much as he can about this story. Is it just gossip, or a genuine threat?

And finally in the longest part of the letter Charles V sets out for his ambassador the current state of play in his campaign against the League. There has been a new outbreak of rebellion in Prague, and the emperor's nephew Ferdinand of Tyrol has been forced to flee.

But Charles V gives instructions on how Saint-Mauris is to "spin" the news at the French court. The Prague rebellion is a minor affair, he is told to say, and Ferdinand has left the city because he wants to join his father - the emperor's brother - on campaign.

For the historian Camille Desenclos, the fact that some parts of the letter are encrypted and others not is significant.

"They all knew there was one chance in two that the letter would be intercepted. In which case there were messages that were worth passing to the French," she says - like the fact that the emperor was co-operating on confidence-building measures in northern Italy.

"These were left in plain language. But there were other matters that had to stay secret - like the true state of affairs with the Protestant rebellion, and they were put into code."

What followed? Only a few weeks later the French king François I died, to be replaced by his son Henri II. Charles V defeated the League the next year, but Protestantism was in Germany to stay. In 1552 Henri II formed a new alliance against the emperor with the Protestant princes.

And there was no assassination attempt. Charles V died in a Spanish monastery in 1558.