UNDER THE BUS

Defense blames Trump Organization employee’s ‘greed’ in tax fraud trial

Lawyer argues chief financial officer Allen Weisselberg committed crimes to enrich himself and company’s benefit a byproduct

Lawyer argues chief financial officer Allen Weisselberg committed crimes to enrich himself and company’s benefit a byproduct

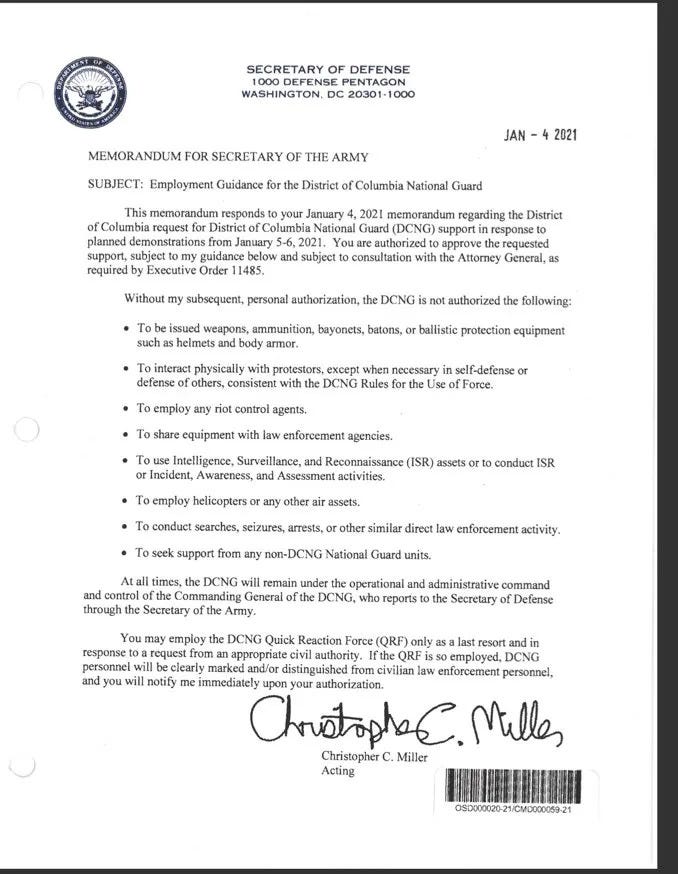

Allen Weisselberg enters the courtroom in New York City in August 2022.

Photograph: Getty Images

Reuters in New YorkThu 1 Dec 2022 20.40 GMT

As the end of a criminal tax fraud trial of Donald Trump’s real estate company neared on Thursday, a defense lawyer argued that the former president knew nothing about a former senior executive’s years-long scheme.

Democrats get Trump tax returns as Republican House takeover looms

Susan Necheles, representing one unit of the Trump Organization, pointed the finger at Allen Weisselberg, the longtime chief financial officer, in her closing argument to the 12-member jury in New York state court in Manhattan.

“We are here today because of one reason and one reason only – the greed of Allen Weisselberg,” Necheles said. “The purpose of Mr Weisselberg’s crimes was to benefit Mr Weisselberg.”

Necheles also pinned blame on Donald Bender, an accountant with Mazars USA, for turning a blind eye to Weisselberg’s wrongdoing.

“President Trump relied on Mazars, he relied on Donald Bender to be the watchdog,” Necheles said. “Bender failed.”

Prosecutors were expected to deliver their closing argument on Thursday afternoon and Friday, with jury deliberations beginning on Monday.

The Trump Organization was charged in July 2021 with paying personal expenses for executives without reporting the income, and compensating them as if they were independent contractors, in a 15-year scheme to cheat tax authorities.

If convicted on all nine counts, the company faces up to $1.6m in fines. Trump, who is seeking the presidency in 2024, is not charged.

Weisselberg pleaded guilty to tax fraud and other charges under an agreement with prosecutors and is expected to serve five months in jail.

The trial began on 24 October, before Justice Juan Merchan. To prove guilt, prosecutors must show Weisselberg and other executives acted as “high managerial agents” when they carried out tax fraud and that they intended to benefit the company in some way.

Weisselberg has worked for the Trump family for about five decades and is now on paid leave. He testified that he improperly received bonus payments as non-employee compensation and hid from tax authorities payments for rent, car leases and other personal expenses.

Weisselberg’s testimony may have helped the defense. He told jurors his greed motivated him to cheat on taxes, and described the company’s modest payroll tax savings as a “byproduct”. At one point, he choked up while describing his embarrassment at violating the Trump family’s trust.

Necheles told jurors: “The issue here is not whether as a byproduct the company saved some money … You see what he said. His intent was to benefit himself, not the company.”

Bender, who was granted immunity, was the main defense witness. He testified that he trusted Weisselberg to give him accurate information for company tax returns and had no obligation to investigate further. Mazars cut ties with the Trump Organization in February.

Trump has called the charges politically motivated. The Manhattan district attorney, Alvin Bragg, is Democratic, as is his predecessor, Cyrus Vance, who brought the charges last year.

The criminal case is separate from a $250m civil lawsuit filed by the New York attorney general against Trump, three of his adult children and his company in September, accusing them of overstating asset values and his net worth to get favorable bank loans and insurance.

Trump faces federal investigations into his removal of government documents from the White House after leaving office and efforts to overturn his 2020 election loss, and a Georgia state investigation over attempts to undo his election defeat there.

Reuters in New YorkThu 1 Dec 2022 20.40 GMT

As the end of a criminal tax fraud trial of Donald Trump’s real estate company neared on Thursday, a defense lawyer argued that the former president knew nothing about a former senior executive’s years-long scheme.

Democrats get Trump tax returns as Republican House takeover looms

Susan Necheles, representing one unit of the Trump Organization, pointed the finger at Allen Weisselberg, the longtime chief financial officer, in her closing argument to the 12-member jury in New York state court in Manhattan.

“We are here today because of one reason and one reason only – the greed of Allen Weisselberg,” Necheles said. “The purpose of Mr Weisselberg’s crimes was to benefit Mr Weisselberg.”

Necheles also pinned blame on Donald Bender, an accountant with Mazars USA, for turning a blind eye to Weisselberg’s wrongdoing.

“President Trump relied on Mazars, he relied on Donald Bender to be the watchdog,” Necheles said. “Bender failed.”

Prosecutors were expected to deliver their closing argument on Thursday afternoon and Friday, with jury deliberations beginning on Monday.

The Trump Organization was charged in July 2021 with paying personal expenses for executives without reporting the income, and compensating them as if they were independent contractors, in a 15-year scheme to cheat tax authorities.

If convicted on all nine counts, the company faces up to $1.6m in fines. Trump, who is seeking the presidency in 2024, is not charged.

Weisselberg pleaded guilty to tax fraud and other charges under an agreement with prosecutors and is expected to serve five months in jail.

The trial began on 24 October, before Justice Juan Merchan. To prove guilt, prosecutors must show Weisselberg and other executives acted as “high managerial agents” when they carried out tax fraud and that they intended to benefit the company in some way.

Weisselberg has worked for the Trump family for about five decades and is now on paid leave. He testified that he improperly received bonus payments as non-employee compensation and hid from tax authorities payments for rent, car leases and other personal expenses.

Weisselberg’s testimony may have helped the defense. He told jurors his greed motivated him to cheat on taxes, and described the company’s modest payroll tax savings as a “byproduct”. At one point, he choked up while describing his embarrassment at violating the Trump family’s trust.

Necheles told jurors: “The issue here is not whether as a byproduct the company saved some money … You see what he said. His intent was to benefit himself, not the company.”

Bender, who was granted immunity, was the main defense witness. He testified that he trusted Weisselberg to give him accurate information for company tax returns and had no obligation to investigate further. Mazars cut ties with the Trump Organization in February.

Trump has called the charges politically motivated. The Manhattan district attorney, Alvin Bragg, is Democratic, as is his predecessor, Cyrus Vance, who brought the charges last year.

The criminal case is separate from a $250m civil lawsuit filed by the New York attorney general against Trump, three of his adult children and his company in September, accusing them of overstating asset values and his net worth to get favorable bank loans and insurance.

Trump faces federal investigations into his removal of government documents from the White House after leaving office and efforts to overturn his 2020 election loss, and a Georgia state investigation over attempts to undo his election defeat there.

Pedro Portal/El Nuevo Herald/TNS

Pedro Portal/El Nuevo Herald/TNS