India iPhone Breakthrough Masks Struggle to Be Next China

Karthikeyan Sundaram, Eltaf Najafizada and Anup Roy

Thu, January 12, 2023

(Bloomberg) -- On paper, India’s chances of attracting global manufacturers look rosy.

Apple Inc. began assembling its latest iPhone models in the South Asian nation in a significant break from its practice of reserving much of that for giant Chinese factories run by its main Taiwanese assemblers, a key win for Prime Minister Narendra Modi’s “Make in India” campaign.

Among India’s advantages are rising geopolitical tensions between Western nations and China, and a growing friendship with the US, Australia and Japan, which form part of the Quad, a grouping of democracies to counter Beijing’s economic and military ambitions.

The country’s presidency of Group of 20 nations this year could also boost investor confidence. India is poised to hold the title of the world’s fastest-growing large economy in the next three years. Its gross domestic product is set to become the world’s third-largest before the end of the decade.

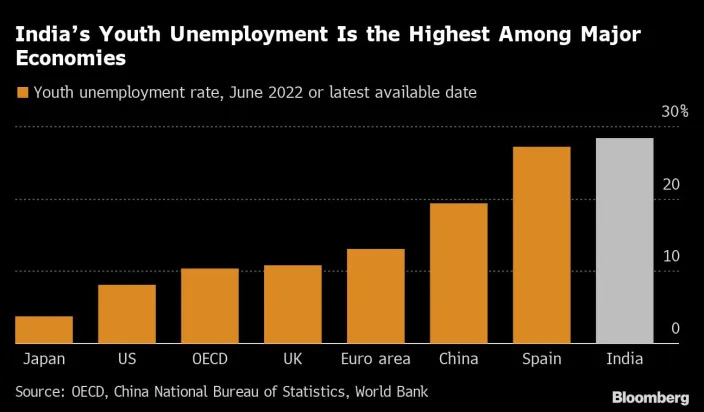

But experts warn that lasting gains to improve a sluggish manufacturing sector are still a ways off for India, soon to overtake China as the most-populous nation. Modi’s Make in India campaign, which aims to increase exports and create jobs, hasn’t quite panned out. Manufacturing accounts for 14% of the economy, a figure that’s barely budged in decades. And despite India’s massive demographic dividend, unemployment remains stubbornly high.

Since Make in India launched in 2014, the deadline for one of its key goals — to lift the share of manufacturing in GDP to 25% — has been pushed back three times, from 2020 to 2022 to 2025.

Amitendu Palit, an economist specializing in international trade and investment at the National University of Singapore, said decoupling from China has “not yet been pronounced.” In other words, for any meaningful relocation of supply chains, Palit said Modi’s government will need to prove that India is a cheaper and easier place to conduct business, rather than simply relying on political or security factors to lure companies.

While recent financial incentives under Modi offered Apple a cost-efficient path to set up shop in India, the California-based company is still making a fraction of its iPhones in the nation. And for every success, there are many companies that have quit India because of long-running challenges such as dealing with the country’s bureaucracy, including General Motors Co., Ford Motor Co. and Harley-Davidson Inc.

Tesla Inc., which had previously said it would consider setting up a factory in India provided the country first allows the company to sell imported cars by lowering duties, is now nearing a deal for a plant in Indonesia.

To meet expectations of a transformed India, Modi must continue to cut red tape and streamline labor laws. Ensuring businesses can obtain land is another hurdle.

Take the case of ArcelorMittal SA. The world’s largest steel producer attempted to build a steel plant in the eastern state of Odisha more than a decade ago, but ditched the plan in 2013 because executives couldn’t obtain land and permits needed to mine iron ore, a key raw material. The company has once again returned to Odisha, with plans to build a 24-million-ton a year plant through a joint venture with Nippon Steel Corp.

“It’s a difficult reform,” said Nada Choueiri, Mission Chief for India at the International Monetary Fund. “But needs to be advanced because when companies come and establish themselves, they need land.”

Employment is another headache. Delays in boosting manufacturing and a broader decline in agriculture mean that the 12 or so million Indians entering the workforce every year must rely largely on services for opportunities. But India is struggling to create enough jobs even in that sector, despite growing at a pace that few major economies can match. China solved the jobs problem by transitioning from farms to becoming the world’s factory.

Jobs are an important piece of the puzzle if India wants to increase its per capita income, which is currently below neighboring Bangladesh’s $2,723. Higher incomes will boost consumption, prompt businesses to invest even more and create new jobs, setting off a so-called virtuous economic cycle.

Though India continues to make headlines as the fastest-growing major economy, “it’s disappointing in terms of the progress on the ground,” said Shumita Deveshwar, chief India economist at consultancy TS Lombard.

Deveshwar listed problems that are mostly self-inflicted: weak infrastructure, a shortage of skilled labor and failure to implement policies that can attract enough investment. Even as India is inking major business deals — with Apple just one high-profile example — the consistency and type of investments worries some.

In recent years, a large portion of foreign capital has trickled into the services sector instead of production, according to Deloitte. Inflows slowed in 2021, and beginning in 2020 India has fallen off the top 25 rankings in Kearney’s FDI Confidence Index.

Kearney’s index measures the three-years-ahead confidence of companies investing in a certain market. China, the United Arab Emirates, Brazil and Qatar were the only emerging markets to make the 2022 list.

“Since the outbreak of the pandemic, our index has shown a strong preference from investors for developed over emerging markets,” said Terry Toland from Kearney. “This may suggest a perception of safety in developed over emerging markets.”

Modi is betting that the G-20 presidency will create the right opportunity to change that perception and beat back competition from other Asian economies such as Vietnam and Malaysia.

“2023 is going to be different, assuming no new unexpected shocks — global or domestic,” said Abhishek Gupta, senior India economist at Bloomberg Economics. “The country has pretty much put in place a structure already that should help kick-start an industrial recovery and boost manufacturing,” he added.

Friend-shoring, in which allies invest in each other, and a wider pivot away from China could benefit India — though the speed of change is far from clear.

“There is a lot of inertia,” said V. Anantha Nageswaran, India’s chief economic adviser. Leaving China is not a call that companies will take lightly, he said, since “they have invested so much in a big market.”

Still, East Asian countries will eventually run into capacity constraints at some point. “So I think we need to wait for these things to play out,” Nageswaran said.

--With assistance from Anurag Kotoky, Swansy Afonso, Sankalp Phartiyal and Zoe Schneeweiss.