Sun, January 29, 2023

For years, small modular nuclear reactors (SMRs) have been teased as the next big thing in clean energy. They were promised to be the solution to safely and efficiently scaling nuclear energy and the catalyst that would bring the nuclear energy renaissance into full swing. But then they never arrived.

“Small modular reactors: What is taking so long?” asked an Energy Monitor report released last Fall. While these next-generation reactors have been right around the corner for years, the strict rules and regulations around nuclear energy, and especially new and unproven models of nuclear reactors, present a lengthy and costly process for SMRs to graduate from the research and development phase to deployment and commercialization. There’s a reason that the only two SMRs in the world that are already up and running are in Russia and China, where authoritarianism cuts through all kinds of regulatory red tape.

But it looks like the rest of the world could finally be getting ready to launch SMRs debut on the global stage. In the United States, the news broke just last week that the Nuclear Regulatory Commission has officially certified the design for what will be the nation’s very first SMR. The certification was published in the Federal Register on Thursday, meaning that companies interested in using the design can start applying now for a license to build. That license serves as “the final determination that the design is acceptable for use so it can't be legally challenged during the licensing process when someone applies to build and operate a nuclear power plant,” according to reporting from CBS News.

That’s the beauty of SMRs: the small models are designed to be manufactured off-site at a commercial scale, and assembled on site for more efficient nuclear energy deployment. This could fundamentally shift the role of nuclear power in the global energy mix. Contrary to popular belief, nuclear energy has been proven time and again to be safer than most other kinds of energy production. The real problem for the nuclear sector is that building new nuclear reactors is extremely expensive, thanks to all of those very necessary regulatory hurdles that ensure the safety of new builds. SMRs can avoid a lot of that expense through standardization.

This is a game changer. Not only would the wide-scale deployment of small modular nuclear reactors revitalize the United States’ declining nuclear industry, it would be a significant step forward in the global fight against catastrophic climate change. A statement from the U.S. Department of Energy this week said that the newly approved design "equips the nation with a new clean power source to help drive down" greenhouse gas emissions. The United States is the second-biggest greenhouse gas emitting country in the world, after China.

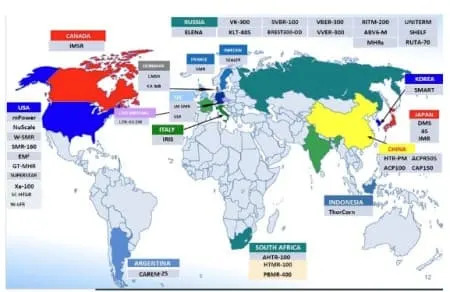

And the U.S. is just the latest nation to make a major breakthrough in SMR development and deployment. “Roughly 40 serious concepts are in development for the next generation of advanced nuclear reactors worldwide,” CBS reported last Friday. The vast majority of these reactors are still in development, in either the conceptual design phase or the basic and detailed design phases, according to figures from the International Energy Agency.

Development of small and medium-sized modular reactors around the world. (Source: Towards Safer and More Sustainable Ways for Exploiting Nuclear Power)

While SMRs present a major step forward for nuclear energy, they are just one part of what is potentially unfolding to be a worldwide reacceptance of nuclear energy. World leaders have been forced to reexamine the myriad benefits of nuclear power thanks to the energy crisis started by the Covid-29 pandemic and kicked into overdrive by Russia’s invasion of Ukraine and a resulting energy war between Brussels and the Kremlin. While nuclear power never died in some key economies, the West is beginning to ramp up production in a big way.The Biden administration’s Inflation Reduction Act is keeping the momentum building for nuclear power in the U.S. Overseas, Europe has also taken big steps to make nuclear power eligible for funding earmarked for renewable energy. When SMRs hit the stage in earnet, it could be the tipping point toward a new nuclear era.

By Haley Zaremba for Oilprice.com

Francois De Beaupuy

Sat, January 28, 2023

(Bloomberg) -- Behind layers of security and a thick concrete wall, a team of welders work in shifts to fix the crippled Penly nuclear plant in northern France. Sweating under protective gear, they’re replacing cracked pipes in the emergency cooling system which protects against a reactor meltdown.

Each weld takes at least three days to complete, with workers often on their knees or backs to reach for the correct angle. Even in radiation suits, health regulations limit work in that environment to a maximum 40 hours a year.

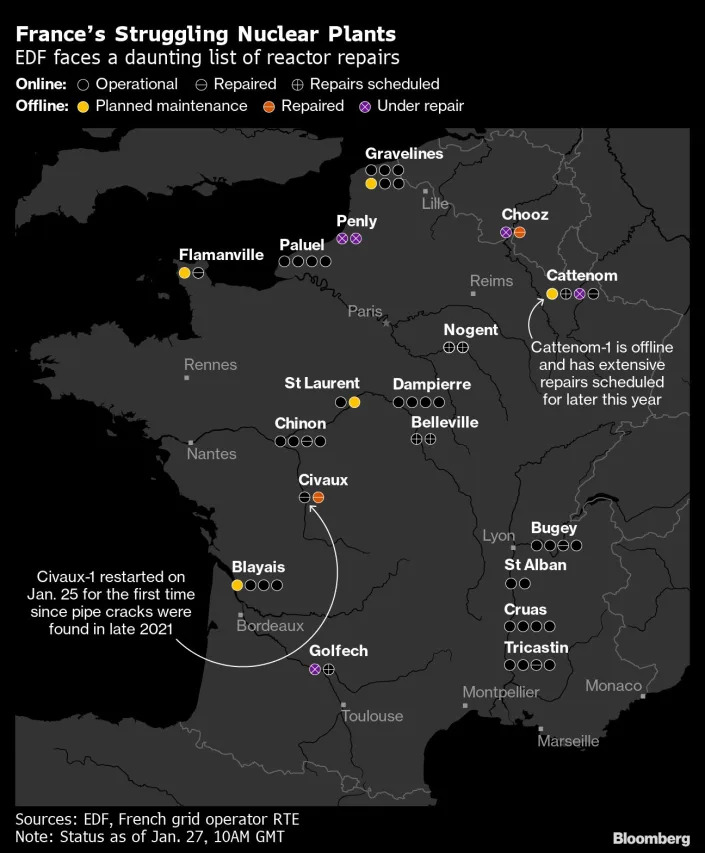

The complicated procedures, replicated across sites this winter, have hampered the ability of Electricite de France SA to get its reactors back online after lengthy shutdowns.

Deadlines have slipped. The two Penly reactors were scheduled to be back online this month and next. Instead, EDF has been forced to delay the restarts to May and June.

“These are complex situations, in a noisy and radioactive environment,” Laurent Marquis, a manager at Altrad Group-Endel which is coordinating the repairs for EDF at Penly, said last month, before the restarts were pushed back. “Workers can sometimes only hold their position for just a few minutes before they need to be replaced.”

The power station, below a cliff on France’s northern coast, normally provides electricity for about 3.6 million households. Its two reactors have been, in effect, grounded by faulty plumbing — the same cracked pipes first discovered by EDF at another plant in late 2021. That reactor, at Civaux in central France, only came back online on Wednesday after extensive repairs.

The discoveries plunged the operator into a crisis with repercussions for all of Europe. EDF called it an “annus horribilis,” and from early May to late October, about half of its 56 reactors sat idle due to the repair and maintenance backlog.

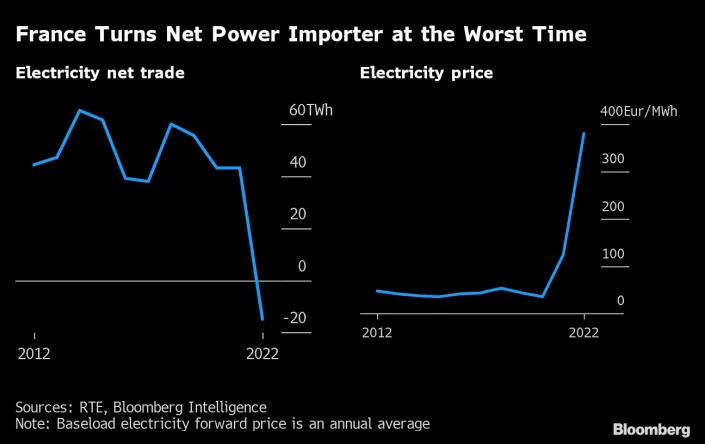

It flipped France from Europe’s biggest electricity exporter into a net importer last year, just as the continent needed it more than ever. After gas imports from Russia dried up, energy prices soared, governments spent billions helping consumers with their bills and Europe was threatened with shortages and blackouts.

So far, Europe has avoided the worst-case scenario, thanks to efforts to conserve energy and a relatively mild winter that reduced heating demand.

But the crisis is far from over, and EDF needs to find a way to avoid a repeat next winter. That challenge — finding problems, fixing them, doing checks — is already a mammoth task, and it’s being compounded by financial issues and staff shortages.

“We’re not out of the woods in terms of security of supply,” said Nicolas Goldberg, a senior manager in charge of energy at Colombus Consulting in Paris. “Don't expect miracles this year, some outages will sometimes be prolonged as unexpected things can be found during maintenance.”

The trouble started when EDF’s Civaux-1 reactor — which was only commissioned just over two decades ago — was undergoing a 10-year inspection. Ultrasound machines found signs of defects near the elbow or bend on pipes in the cooling system that didn't fit the classic profile of thermal fatigue. The utility had no choice but to cut the 3-centimeter thick steel tubes to examine them, and was then confronted with a disturbing discovery.

A section of the pipe was damaged by so-called stress corrosion, a phenomenon that's well known in the oil and gas and other industries but extremely rare in the atomic sector. Suddenly, EDF was scrambling to find the cause of the unexpected faults.

From December 2021, EDF extended its checks and progressively halted more than a dozen units for lengthy inspections, only to find more signs of stress corrosion.

Reactors are regularly taken offline without any major impact; EDF typically shuts down about 40 of its reactors every year for anything from short-term refueling to a partial inspection or long-term maintenance. But the additional halts caused chaos.

Output from France’s nuclear plants — which typically represent about 70% of the country's electricity production — dropped to 279 terawatt-hours last year from about 361 TWh in 2021. The utility estimates it will recover to 300-330 TWh in 2023, but that still means France may keep importing power for a significant part of the year.

The lower output is expected to deliver a €32 billion ($35 billion) hit to its 2022 results, compounding the utility's financial problems. The French government, which already owns 90% of EDF, is trying to fully nationalize the company to help put it on a more secure footing.

In France, the controversy surrounding EDF led to a war of words between President Emmanuel Macron and Jean-Bernard Levy, who was EDF chief executive until late last year. Levy said government talk about closing reactors made it harder to hire, leaving the company short of key workers, something that Macron has called that an “unacceptable” excuse.

The president and many of EDF’s critics see the issues as proof the operator had been resting on its laurels, with its aging plants plagued by longer shutdowns and its new builds facing cost overruns and delays.

But for the French consumers and companies that rely on EDF’s power, the pressing problem right now is getting the country’s nuclear engine back up to speed.

Inside the 40-meter high Penly reactor buildings, that means cutting tens of meters of pipe, preparing spare parts ordered from Italy and checking their length. Fittings are tested to make sure they can support the installed tubes. And when the welding begins, ultrasound images are taken every night to ensure the next layer of metal in the repair can be added. Since finding corroded pipes at Civaux-1, EDF has been analyzing parts in a special laboratory.

“It’s a phenomenon that was unexpected, which means we didn’t entirely understand it,” said Julien Collet, deputy director general of France’s nuclear safety agency. “Immediately, you wondered about its magnitude, and whether other reactors are affected.”

By May, the utility had concluded that 16 of its reactors had pipes more prone to stress corrosion. Significantly, they were actually the group’s newest reactors, where the French nuclear plant builder Framatome — a unit of EDF — had modified the original Westinghouse Electric Co. design used for the 40 older units.

Among other changes, the new layout made four safety water injection lines more sinuous — more twists and bends — making them vulnerable. With winter and the threat of blackouts looming, firms working on repairs had to fly in extra workers to try to meet deadlines.

Framatome and Westinghouse brought in about 100 specialist welders from North America, on top of the 500 metal workers and engineers available locally. That was a “no-brainer, given the stakes,” Framatome CEO Bernard Fontana said at a parliamentary hearing in December.

At Civaux, EDF set up a designated workshop for welders to practise, according to Sebastien Le Jan, a team leader at Onet Technologies who oversaw repairs on the No. 1 reactor.

Onet had to poach teams from other sites and find volunteers willing to postpone holidays.

“Everyone knew that we had to succeed as soon as possible,” Le Jan said in an interview.

It wasn’t just a manpower issue. Tools had to be adapted to operate in tight spaces, with welders using mirrors to work on piping too close to walls, while scores of dossiers were compiled to secure regulatory approval to replace tubing in record time.

Similar scenes played out elsewhere including at Chooz and Cattenom in northeast France.

Of the dozen reactors where pipes were cut for checks, EDF found no sign of cracking in three of them, while two had cracks caused by welding defects where tiny portions of metal had been insufficiently melted.

But in the majority, EDF did find stress corrosion causing cracks as deep as 6 millimeters on pipes.

Under fire for the 2022 chaos, EDF is trying to get ahead of further potential problems.

It plans to replace emergency cooling system piping in seven reactors as a preventative measure during planned halts of 160 days, starting this spring. The aim is to avoid doing weeks of checks only to find the pipes need replacing anyway.

Having initially fallen behind schedule, EDF is confident it has the labor, spare parts and supply chains in place to complete the repairs in time for next winter. The company says it’s also improved its inspection equipment so that it won't need to cut more pipes to determine the size of new cracks.

Not everyone is convinced. EDF has a history of missed maintenance deadlines, which an external audit published in June blamed on inadequate management of data, staff shortfalls and inexperienced teams in charge of turnarounds.

The company is still trying to figure out the speed at which cracks progress through pipes once they appear, meaning it faces tighter, more frequent monitoring of its reactors. Future setbacks can’t be ruled out.

The plan to fix seven safety cooling systems in 2023 is “not the end of the story,” Cedric Lewandowski, EDF’s senior executive vice-president for nuclear and thermal production, said at a parliamentary hearing this month. “It’s possible that we have to carry long and complex works. I think that 2023, ’24 and ’25 will continue to entail issues related to the stress corrosion.”

If that caps nuclear output, that means less power for France, and less to export to Europe.

Compounding the pipe issues is the broader maintenance work needed on what’s an aging fleet. Most of EDF’s reactors were built from the late 70s to the mid-90s, and now require longer down time. The utility wants to coincide the corrosion repairs with the other halts to maintain production, Lewandowski said.

On top of that, the utility is still repairing 122 faulty welds at a new flagship reactor in Flamanville in Normandy, which it wants to commission in the first half of 2024. The project is already over a decade behind schedule, and about €10 billion over budget.

All of which raises significant questions for EDF and the French government. Macron, despite his initial reservation about the nuclear industry's future, decided last year to boost atomic output alongside swathes of renewable energy to curb reliance on fossil fuels. He’s also planning to pay €10 billion to fully nationalize the utility.

France is not alone; 12 years on from the Fukushima disaster in Japan, the world is shifting back toward atomic power as governments try to improve energy security after Russia’s invasion of Ukraine.

Macron’s government wants to help EDF build six new large reactors and begin preparatory studies on another eight units by 2050.

But building 14 new reactors is “absolutely not within EDF’s reach with its current balance sheet,” said Celine Cherubin, a senior credit officer at Moody’s Investors Service. Beyond the full nationalization, a more favorable regulation for EDF may still be needed to help it meet its investment needs, she said.

EDF is also trying to restore its technical credibility, coming up with a new version of the reactors it is building in the UK and France that have been dogged with cost overruns.

The bigger question is whether EDF and the government can now reverse the sense of decline in France’s nuclear industry.

“This nuclear fleet is a strength, it’s our independence,” Sophie Mourlon, head of the energy directorate at the Energy Transition Ministry, said at a nuclear conference in Paris in October. But when it’s not working properly, “it’s also our Achilles’ heel.”

--With assistance from Samuel Dodge and Patricia Suzara.

Mackenzie Shuman

Wed, January 25, 2023

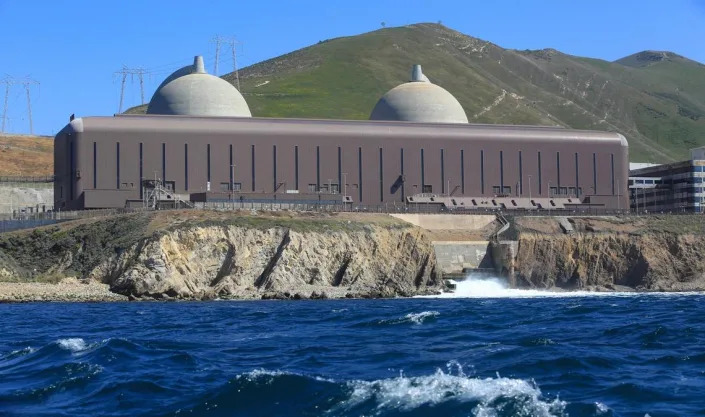

Federal regulators on Tuesday rejected a request from PG&E that would have eased the utility company’s efforts to keep operating California’s last nuclear power plant longer.

The Nuclear Regulatory Commission (NRC) sent the utility company a letter on Tuesday spelling out the steps it must take to keep operating Diablo Canyon Power Plant past 2025, when it’s scheduled to close.

PG&E originally applied for license renewal for Diablo Canyon in 2009 — only to withdraw and terminate that application in 2018 after announcing plans to close the San Luis Obispo County nuclear power plant and replace it with other forms of carbon-free energy.

In an October letter to the NRC, the utility company asked the agency to simply resume its review of its 2009 license renewal application.

The NRC denied that request in its letter on Tuesday, instead instructing PG&E to submit a new license renewal application for the power plant.

“This decision does not prohibit you from resubmitting your license renewal application under oath and affirmation, referencing information previously submitted, and providing any updated or new information to support the staff’s review,” the NRC said in its letter.

Diablo Canyon nuclear power plant owned by PG&E is scheduled to close in 2024 and 2025, but an effort is underway to extend the life of the plant.

U.S. Rep. Salud Carbajal, D-Santa Barbara, indicated in a statement Wednesday that he was pleased with the NRC’s decision.

“The Nuclear Regulatory Commission’s decision this week reflects the need for thorough review before approving additional years of operation beyond its current license,” the Central Coast congressman said. “This ruling affirms that corners cannot be cut when it comes to nuclear safety.”

PG&E has told The Tribune it plans to submit a new application by the end of 2023 — just one year before one of Diablo Canyon’s twin reactors are slated to shut down.

Pictured here is the Unit 2 containment dome, a transmission line and the turbine building of Diablo Canyon nuclear power plant owned by PG&E. The shutdown of the two units owned by PG&E is scheduled for 2024 and 2025.

According to PG&E, the 2,200-megawatt Diablo Canyon Power Plant provides about 9% of the state’s total electricity supply.

Diablo Canyon’s unit 1 reactor license is set to expire on Nov. 2, 2024, while the license for the second unit would expire on Aug. 26, 2025. Without valid licenses, the reactors must shut down.

That means the NRC would have less than a year to review the new license renewal application before unit 1 must shut down. The application review process typically takes up to five years.

To keep the reactors operating past their expiration dates, PG&E has requested the NRC grant it an exemption from a federal law that states it must file license renewal applications more than five years before the license expires.

The law allows for a nuclear power plant to continue operating past its originally scheduled closure date if the NRC is still reviewing its license renewal application — as long as that application was filed more than five years before the expiration date.

Because PG&E is set to file its license renewal application for Diablo Canyon less than five years before its originally scheduled closure date, the law requires that the reactors must shut down as planned.

PG&E wants the NRC to grant it an exemption to that law so it can keep Diablo Canyon open and delivering electricity to the grid.

The utility company requested that exemption in the same October letter in which it asked the NRC to resume review of its 2009 application.

“The (NRC) staff is evaluating that exemption request and expects to provide a response in March 2023,” Tuesday’s letter read.

Steam is released from reactor No. 1 at Diablo Canyon nuclear power plant at Avila Beach in a May 2000 file image.

Nuclear power plant must shut down as planned, groups argue

Whether Diablo Canyon Power Plant should stay open has long been a subject of debate among lawmakers and environmental groups.

A push by Gov. Gavin Newsom and the California State Legislature led to the passage of Senate Bill 846 in September, allocating up to $1.4 billion to PG&E so it can keep the plant running through 2030.

That law was passed after the state failed to procure enough clean energy to meet rising demand.

Nonprofit groups San Luis Obispo Mothers for Peace, Environmental Working Group and Friends of the Earth filed a petition with the NRC on Jan. 10, arguing that it would be unlawful for federal regulators to allow PG&E to keep Diablo Canyon operating while the agency reviews its license renewal application.

The National Environmental Protection Act “prohibits the (commission) from extending the Diablo Canyon license terms by any means, unless it first addresses the significant environmental impacts of operation during the extended term, including earthquake risks, impacts to marine life of Diablo Canyon’s outdated once-through cooling system,” the groups said in the petition, as well as “impacts of delaying or deferring license renewal-related maintenance and inspection measures in anticipation of shutdown.”

The NRC had not responded to the groups’ petition as of Wednesday.

In his statement Wednesday, Carbajal said that “public engagement is key as we embark on this next phase” of Diablo Canyon’s operation..

“When it comes to extending the lifespan of Diablo Canyon Power Plant, nothing is more important to me than ensuring that our community’s safety is not compromised in pursuit of this extension,” Carbajal continued, adding that he’s “urged our federal experts to keep the Central Coast directly in the loop when it comes to the next steps for renewing Diablo Canyon’s license.”