Canada's Tech Start Ups Face Financing Hurdles With SVB Collapse

Customers wait in line outside a branch of the Silicon Valley Bank in Wellesley,

Massachusetts, U.S., March 13, 2023.

By Maiya Keidan and Divya Rajagopal

TORONTO (Reuters) -Last week's sudden collapse of Silicon Valley Bank (SVB) could choke funding for Canada's technology start-ups and place them in the hands of domestic lenders who may be more selective in financing new ventures, financiers told Reuters.

That would be bad news for a sector that took a beating in 2022, which has made investors more risky averse in early stage investments.

"I would say this is probably the worst possible time (for this to happen) in the last decade because of the tech pullback we've had," said Neil Selfe, CEO at advisory INFOR Financial.

SVB's Canadian division, which received a license to operate in 2019, competed against other banks and private lenders to help finance the growth of the Canadian technology sector, before it collapsed on Friday. It had doubled its secured loans to C$435 million ($314 million) in 2022 from previous year.

Canada had come to be known as the world's second-biggest global tech hub in the world after Silicon Valley, Kim Furlong, CEO of Canadian Venture Capital and Private Equity Association told CBC News on Monday.

Companies including Shopify Inc were examples of Canada's tech success story, which helped pull more investments into the sector.

U.S. regulators stepped in on Sunday after the collapse of SVB, which had a run after a big bond portfolio hit.

CIBC, Royal Bank of Canada and Bank of Montreal were the most likely to pick up both SVB's current book, and future clients in Canada, John Ruffolo, Managing Partner Maverix Private Equity, a Toronto-based PE firm said.

All three banks have dedicated technology lending groups.

A spokesperson for RBC declined to comment while CIBC and BMO did not respond to requests for comment

Selfe at INFOR Financial said while SVB Canada was a smaller player "it was an important competitor in that market."

"I think Canadian banks will continue to lend to earlier stage technology companies but without Silicon Valley Bank as a lender, I think they can afford to be much more selective in who they lend to and potentially increase the price at which they lend."

Canada's top six banks already control more than 80% of the banking assets and the industry has come has attack from consumers advocates and politicians for its dominance.

Benjamin Bergen, president at Council of Canadian Innovators, a lobby group for Canadian technology companies, agreed.

"Before SVB went down, accessing capital was increasingly becoming tighter and tighter for Canadians for startups for scale ups," he said.

"And with this, really what we're hearing from the ecosystem is, you know, it is going to make it even more difficult, so that's really what we're monitoring."

Canadian companies saw overall venture capital investment of C$1.3 billion ($947.38 million) so far this year, compared to C$4.5 billion over the first three months of 2022 and C$3.5 billion over the same period in 2021, according to Refinitiv data.

Funding environment for start-ups was already getting difficult due to rising interest rates. Investors were also turning selective due to the threat of a recession. Aside from the banks, the federal government also has a Venture Capital Catalyst Initiative program that invests in promising Canadian technology companies.

($1 = 1.3722 Canadian dollars)

(Additional reporting by David Ljunggren in OttawaReporting by Maiya Keidan and Divya RajagopalEditing by Edward Tobin)

Etsy, other e-commerce companies feel squeeze of SVB collapse

NEW YORK, March 13 (Reuters) -Etsy ETSY.O on Monday resumed payments to merchants with Silicon Valley Bank accounts after the e-commerce platform paused their payouts over the weekend following the U.S. government shutdown of the bank last week.

Approximately 0.5% of Etsy's active sellers -or around 2,700 merchants- had their payments delayed on Friday related to SVB's collapse, according to Etsy.

"We are working to pay these sellers today, and we’ve already started processing payments via another payment partner this morning," an Etsy spokesperson told Reuters on Monday.

The payments Etsy sellers received is unrelated to the Federal Reserve's Sunday announcement, which ensured that SVB's customers would have access to their funds on Monday.

Shopify SHOP.TO, which provides websites and apps to stores, also halted payments to online sellers with Silicon Valley Bank accounts, telling merchants they must switch accounts to receive funds, according to the company's website.

Etsy and Shopify each work with 5.4 million and 1.75 million online merchants respectively worldwide, mostly small-to-medium size businesses.

Some Etsy sellers decided to put their stores on vacation mode, pausing customer purchases in an effort to minimize their financial losses while others say they have received their payments on schedule.

Moshe Steinberg, 31, said that he received a payment from Etsy on Monday morning, but is still waiting for it to clear with his bank.

"It was a nail biting situation until I checked my bank account this morning," the 3D-printed seller from Central Ohio said, adding that Etsy is currently his only source of income.

Etsy merchant Elizabeth Thompson, 57, said she has received little guidance from the company on what transpired.

"I just don’t understand why they can’t be a little more transparent about what’s going on. It’s not like it’s their fault," she added.

Etsy said it communicated with any seller who was impacted on Friday directly via email and posted an update in their forums on Saturday.

E-COMMERCE RESPONSE

Shopify Chief Executive Tobi Lutke said in a tweet on Saturday that the company was seeing "very minor impact" from the SVB collapse.

"We use SVB as one of 12 or so banks spread over mostly Canada and US," Lutke said, adding "a small portion of our US operational fund flows is tied up in SVB but we are working around it and it should be business as usual."

Shopify has temporarily paused payments to its merchants who receive payments to SVB accounts. These online sellers must update their bank accounts that have no connections with SVB to resume getting payments.

Shopify Capital, an arm of Shopify that provides loans and cash advances to its merchants, has been impacted by SVB's closure, according to the company's website. Merchants are not able to view their loan offers or see their loan repayments as of now.

"Shopify expects to resume all operations for Shopify Capital in the United States within the next few days," the company said on its website.

Shopify is also opening interest-free balance accounts for merchants with the funds equal to the amount of payroll so that merchants can pay their employees, according to a Shopify spokesperson.

Block Inc's SQ.N Square, which processes credit-card payments for online and brick-and-mortar businesses, on Friday began pausing payments to their merchants SVB accounts and required them to update their banking information, according to a person familiar with the matter.

Switching bank accounts can pose a problem for sellers whose sole business account was with SVB. The payment holds have forced thousands of marketplace sellers and mom-and-pop shops to scramble to switch bank accounts and scurry to get access to funds for new product inventory.

Reporting by Doyinsola Oladipo and Arriana McLymore in New York City; Editing by Aurora Ellis

Especially those with operations in the U.S.

Author of the article: Stephanie Hughes

Published Mar 13, 2023

The collapse of Silicon Valley Bank is unlikely to have a significant direct impact on Canada’s Big Six banks, but fallout from the U.S. tech lender’s demise could nevertheless complicate life for those with operations south of the border, analysts said on March 13.

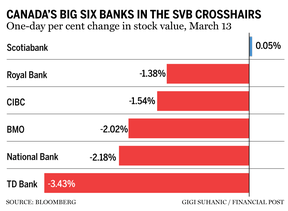

Canadian bank stocks tumbled last week, losing nearly $20 billion in market capitalization, after Santa Clara, Calif.-based SVB suffered a run on deposits and was taken over by U.S. regulators. Bank shares were down again on Monday, with Toronto-Dominion Bank falling the furthest, off nearly three per cent in afternoon trading in Toronto. It closed down 3.43 per cent on the day.

Despite investor jitters, concerns for the Big Six were limited. Unlike SVB, which catered to a niche market funding tech start-up companies, Canada’s big banks dominate their home market and are diversified across industries and business lines.

“From a Canadian perspective, not only should the failure of SVB not have significant negative implications for our banks, but this crisis should actually be viewed as further vindication of the Canadian banking model, which is dominated by a few large and diversified players,” Bank of Nova Scotia analyst Meny Grauman said in a March 13 note.

While the risk of direct contagion to the Canadian banking system appeared minimal, National Bank of Canada analyst Gabriel Dechaine flagged some potential sore spots Canadian banks, especially those with major recent acquisitions in the U.S., could face in the wake of SVB’s collapse.

BMO, for example, has just established a foothold in California, where SVB did most of its business, through its US$16.3 billion Bank of the West acquisition.

“Though (Bank of the West) has different lending exposures within the state (i.e., not uber-concentrated in tech), if there is a ripple effect of SVB’s failure on the broader economy in California, BMO’s growth outlook could dampen,” Dechaine said in a March 13 note.

He added that further declines in the loan and deposit balances at Bank of the West, which were already below BMO’s initial expectations at the time the deal closed earlier this month, could prompt the bank to revise its forecasts again.

Dechaine said the SVB fallout also makes TD’s US$13.4 billion acquisition of First Horizon Corp. more interesting. TD has indicated that it does not expect to achieve regulatory approval by the proposed May 27 closing date and is trying to negotiate another extension. There has been speculation it might try to reduce its offer.

“Setting aside the issue of obtaining regulatory approvals, recent events have prompted even more questions about TD’s ability and willingness to negotiate a lower acquisition price,” Dechaine said, noting U.S. regional bank stocks plunged 12 per cent last week.

RBC, meanwhile, has had a growing stake in the California market since its acquisition of City National Bank in 2015. Dechaine’s concerns with RBC’s California footprint were somewhat assuaged by the fact that the state represents only seven to eight per cent of RBC’s total lending.

RBC was reportedly one of the potential suitors looking under the hood of SVB after regulators took control, according to Reuters. Sources told reporters that RBC had been exploring options to pursue SVB but was ultimately not comfortable with the risks involved. RBC declined to comment on the Reuters report and the SVB collapse.

Exposure to the U.S. regional banking market in general was another risk flagged by Dechaine. San Francisco-based First Republic Bank saw its shares fell by over 75 per cent in early Monday morning market trading amid fears that some smaller banks could be vulnerable if depositors became nervous and started to withdraw funds.

Increased regulatory risk also appeared to be on the table after U.S. President Joe Biden on March 13 said he wanted to prevent a repeat of the collapse.

“I’m going to ask Congress and the banking regulators to strengthen the rules for banks to make it less likely this kind of bank failure will happen again, and to protect American jobs as a small business,” he said.

RECOMMENDED FROM EDITORIAL

Silicon Valley Bank fallout: What you need to know

OSFI seizes control of Silicon Valley Bank's Canadian assets

Canada's banks beat the street, but can they outrun the downturn?

Despite the uncertainties, authorities on both sides of the border offered assurances that the financial and banking systems were safe.

The Office of the Superintendent of Financial Institutions, Canada’s top banking regulator, seized SVB’s Canadian operations on March 12 and made it clear that SVB did not take deposits in Canada and that its collapse was due to its specific predicament.

Deputy Prime Minister Chrystia Freeland said she spoke with financial sector leaders on the evening of March 12.

“We are in close contact with OSFI, which took action earlier this evening,” Freeland said in a March 12 statement on Twitter. “Canada’s well-regulated banking system is sound and resilient.”

Scotiabank’s Grauman suggested the episode might prompt the U.S. banking sector to take pointers from its Canadian counterpart, which is more concentrated. He said even without formally making such a move, U.S. deposit balances might shift from smaller financial players toward bigger banks with larger capital pools to reduce risk.

• Email: shughes@postmedia.com