CRIMINAL CAPITALI$M

Int'l operation takes down ChipMixer money laundering service

Deputy Attorney General Lisa Monaco announced Wednesday that an international operation had taken down ChipMixer, an international cryptocurrency platform accused of laundering more than $3 billion worth of bitcoin.

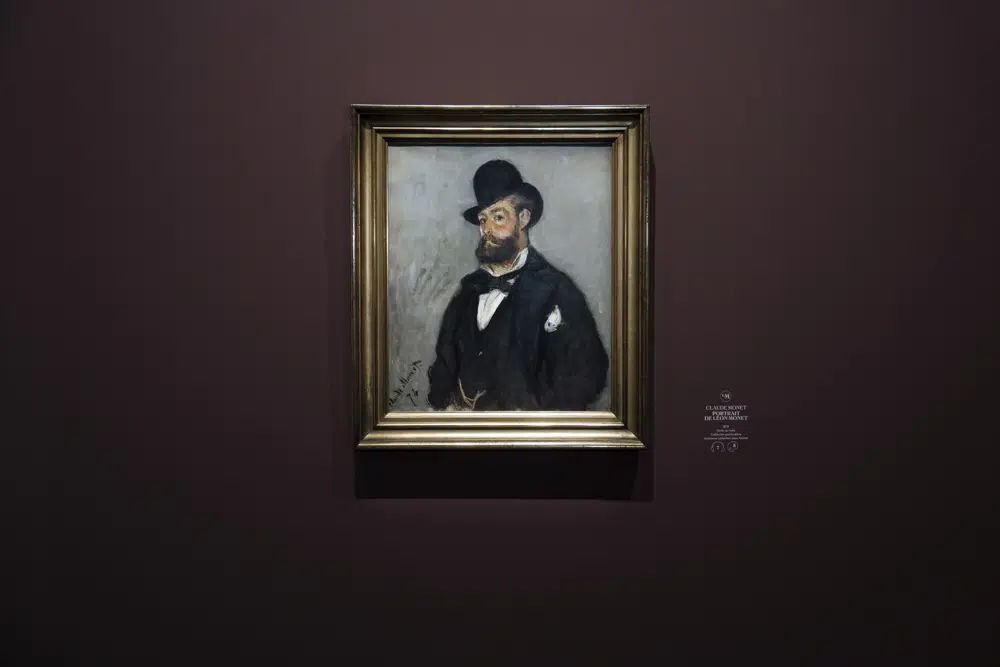

File Photo by Bonnie Cash/UPI | License Photo

March 16 (UPI) -- International authorities have conducted a takedown of ChipMixer, a darknet cryptocurrency mixing service that they accuse of laundering and hiding the origins of billions of dollars in bitcoin for criminal organizations, North Korean hackers and the Russian Intelligence Service.

The Justice Department announced the coordinated law enforcement action Wednesday, stating they seized of two domains that directed users to the ChipMixer service and a Github Internet hosting service account, while German police took down the ChipMixer back-end servers and more than $46 million in cryptocurrency.

"This morning, working with partners at home and abroad, the Department of Justice disabled a prolific cryptocurrency mixer, which has fueled ransomware attacks, state-sponsored crypto-heists and darknet purchases across the globe," Deputy Attorney General Lisa Monaco said in a statement.

A cryptocurrency mixing service obfuscates the origins of cryptocurrency by commingling the illicitly earned funds with other streams of cryptocurrency, and ChipMixer is one of the most widely used by bad actors to launder their funds, authorities said.

March 16 (UPI) -- International authorities have conducted a takedown of ChipMixer, a darknet cryptocurrency mixing service that they accuse of laundering and hiding the origins of billions of dollars in bitcoin for criminal organizations, North Korean hackers and the Russian Intelligence Service.

The Justice Department announced the coordinated law enforcement action Wednesday, stating they seized of two domains that directed users to the ChipMixer service and a Github Internet hosting service account, while German police took down the ChipMixer back-end servers and more than $46 million in cryptocurrency.

"This morning, working with partners at home and abroad, the Department of Justice disabled a prolific cryptocurrency mixer, which has fueled ransomware attacks, state-sponsored crypto-heists and darknet purchases across the globe," Deputy Attorney General Lisa Monaco said in a statement.

A cryptocurrency mixing service obfuscates the origins of cryptocurrency by commingling the illicitly earned funds with other streams of cryptocurrency, and ChipMixer is one of the most widely used by bad actors to launder their funds, authorities said.

Federal prosecutors said ChipMixer offered its clients numerous other services to conceal their bitcoin deposits from law enforcement and is responsible for laundering more than $3 billion worth of digital monies since 2017.

They also charged Minh Quoc Nguyen in a criminal complaint on Wednesday as the 49-year-old Vietnamese operator of ChipMixer with money laundering, operating an unlicensed money transmitting business and identity theft.

Prosecutors accuse the service of processing some $17 million in bitcoin connected to 37 ransomware strains and more than $700 million in bitcoin associated with stolen digital wallets, some which were thieved in heists by North Korean cyberactors from online video game network Axie Infinity last year and in 2020.

Russian General Staff Main Intelligence Directorate also used the service to purchase Drovorub malware, they said.

Europol said in a statement that it supported the German and U.S. law enforcement effort that also included investigative support from Belgium, Poland and Switzerland.

"Today's coordinated operation reinforces our consistent message: we will use all our authorities to protect victims and take the fight to our adversaries," Monaco said. "Cybercrime seeks to exploit boundaries, but the Department of Justice's network of alliances transcends borders and enables disruption of the criminal activity that jeopardizes our global cybersecurity."

Michigan bank holding company pleads guilty in $69M securities fraud case

Financial services firm Sterling Bancorp agreed Wednesday to plead guilty to security fraud, including a $27.2 million fine, which will go toward paying restitution.

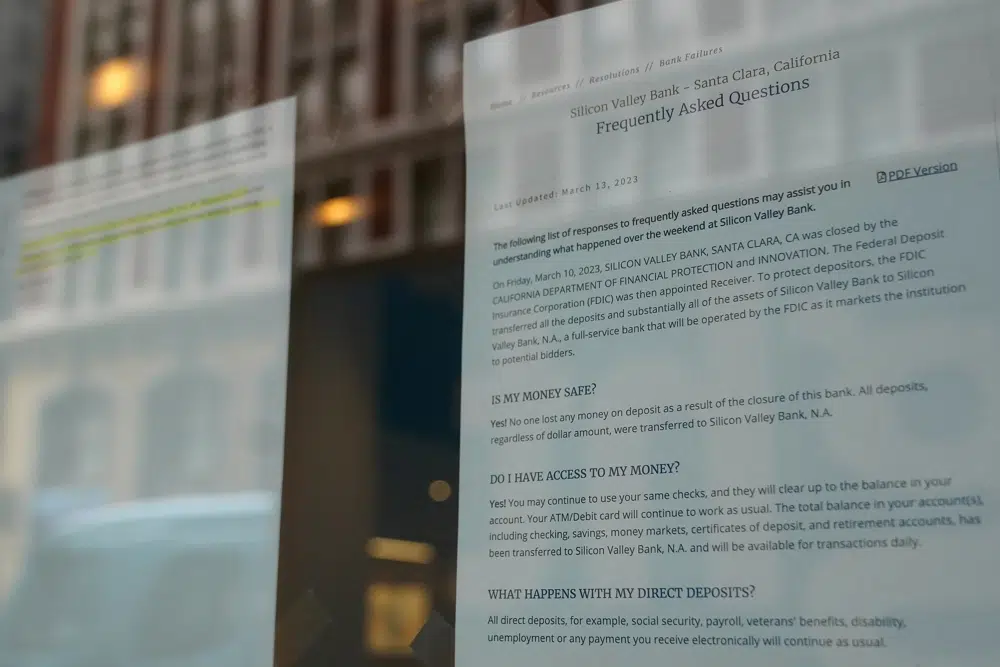

File Photo by John Angelillo/UPI | License Photo

March 15 (UPI) -- Financial services firm Sterling Bancorp agreed Wednesday to plead guilty to securities fraud, including a $27.2 million fine, which will go toward paying restitution.

The Michigan-based bank holding company pleaded guilty to one count of securities fraud, under terms of the plea agreement, according to the Justice Department.

The company also will serve a probation term through 2026. Officials are not seeking a criminal fine in the case.

Sterling committed $69 million worth of securities fraud. Prosecutors contend it filed false statements related to its initial public offering in 2017, as well as its subsequent financial statements in 2018 and 2019.

March 15 (UPI) -- Financial services firm Sterling Bancorp agreed Wednesday to plead guilty to securities fraud, including a $27.2 million fine, which will go toward paying restitution.

The Michigan-based bank holding company pleaded guilty to one count of securities fraud, under terms of the plea agreement, according to the Justice Department.

The company also will serve a probation term through 2026. Officials are not seeking a criminal fine in the case.

Sterling committed $69 million worth of securities fraud. Prosecutors contend it filed false statements related to its initial public offering in 2017, as well as its subsequent financial statements in 2018 and 2019.

The bank allegedly encouraged its employees to push its Advantage Loan Program to customers in the lead-up to the IPO. The program provided loans with a 35% interest rate, "but it did not require submission of typical loan documentation, such as an applicant's tax returns or payroll records."

"For years, Sterling originated residential mortgages that were rife with fraud to pad its bottom line and then lied about these loans in its IPO and subsequent public filings, defrauding unwitting investors," Justice Department Assistant Attorney General Kenneth Polite Jr. said in a statement.

"This proposed guilty plea reflects the nature and seriousness of the wrongdoing and demonstrates the Department of Justice's commitment to protecting the integrity of our public markets, holding corporations accountable for their criminal misconduct, and compensating victims for their losses," he said.

Sterling Bancorp merged into Webster Financial Corp. last year.

Total losses to non-insider-victim shareholders amounted to just under $70 million.

Negotiated as part of the plea deal, the fine will go toward paying restitution to non-insider victims. The lack of criminal charge is to ensure the company pays all it is able to the victims.

"This proposed guilty plea holds Sterling accountable for its role in defrauding non-insider victim-shareholders of millions of dollars by originating fraudulent loans through its Advantage Loan Program and filing false securities statements about the Program in its IPO and subsequent annual filings," said Tyler Smith, acting inspector general of the Federal Deposit Insurance Corporation, in a statement.