So you want to be a climate-conscious investor. Here's how to avoid greenwashing

Experts recommend taking a closer look at sustainable investments

During a recent rally outside the University of Toronto, Saarthak Singh and Achint Singh joined the crowd urging the government to take action against climate change. But it's not the only way they advocate for a greener future. Both students also plan to make financial investments that will benefit the environment.

"Climate anxiety is at an all-time high," said Saarthak Singh. "How can I make sure that I'm also making a positive impact on the world?

Many Canadians are also letting their money do the talking. Assets in sustainable funds hit nearly $38 billion in Canada last year. But finding the right investments can be challenging: While a growing number of companies and funds claim climate-friendly credentials, many don't live up to their promises.

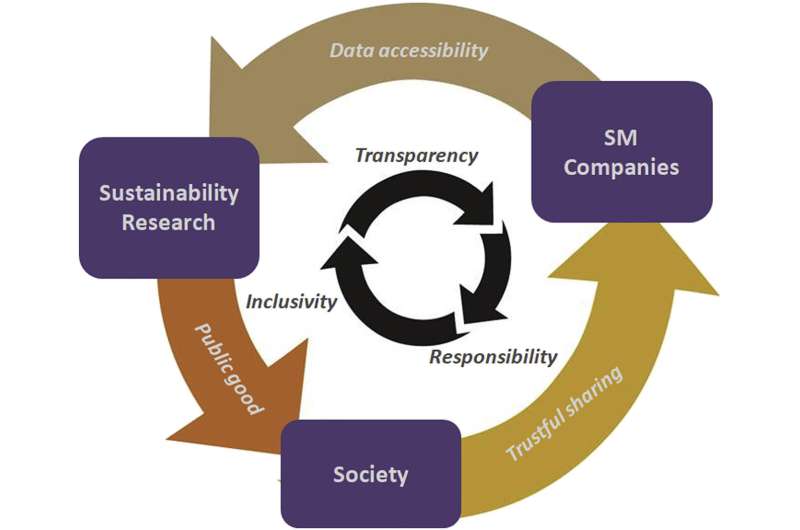

More transparency needed

Achint Singh decided to take matters into his own hands and founded a sustainable investment club on campus. They wade through pages and pages of documents to make their decisions about what to support.

"The information isn't easily available. It's opaque," he said. "It's not something that everyday people can just look up…. There needs to be more transparency and more clarity."

Making it easier for people to sustainably invest will have ripple effects, he added.

"It will snowball into a bigger movement … companies will have to begin to pay attention."

A number of companies and funds now receive environmental, social and governance (ESG) ratings. They are created by various commercial and nonprofit organizations, including MSCI, Morningstar, and the Global Reporting Initiative.

But Saarthak Singh does not think many of them are stringent enough, noting some oil companies are rated relatively well. He'd like to see ESG baskets separated so that companies and funds can be judged on environmental activities alone.

"Let's not give credit to companies which are selling their carbon, right?" he said.

Greenwashing concerns

Industry watchers have also sounded the alarm over greenwashing, a phrase which describes companies or funds that advertise themselves as more climate-friendly than they really are. InfluenceMap is a climate change think-tank that examined more than 700 funds that were marketed using ESG and climate-related keywords in 2021. It found that 71 per cent had companies within their portfolios that didn't align with global climate targets.

Daan Van Acker, who wrote the report, says that while there has been a crackdown on greenwashing, more action from government regulators around language and labels is necessary.

"Right now there's very little consistency or standardization of what it does or doesn't mean to be green," he said.

The federal government has proposed some green investing guidelines that define which investments can use the green label. But they carve out room for some high-polluting activities, recommending that oilsands activities can be labelled as "transition."

Environmental groups have criticized the labels, saying to describe oil and gas as sustainable at any level makes little sense.

Looking under the hood

"When it comes to marketing of green investments, it is a little bit of a Wild West," said Tim Nash, president of Good Investing, which provides research and coaching to green investors.

"It's really important that Canadian investors look under the hood of their investments to really understand what's inside the fund that they're about to purchase."

Nash points to a fund like the Franklin Clearbridge Sustainable Global Infrastructure Income Active ETF. He says an investor might assume it's a climate-friendly fund but would be "quite shocked" to learn it includes Enbridge.

"At the end of the day, they're a pipeline company," he said. "If we could get the whole industry on board to use the same terms and expressions, I think that would go a long way."

For now, experts have some simple advice for investors to avoid greenwashing:

- Know which companies are listed in green funds.

- Look beyond buzzwords, such as "sustainable," for specific phrases, such as "fossil-fuel free."

- Use screening tools like Morningstar that rate these funds on how green they are.

- READ THIS BLOG

Are Oil Stocks Too Good For ESG

InvestorsTo Pass Up?

- Energy stocks gained a total of 135 percent over 2021 and 2022 and are on track to add another 22 percent this year, according to analysts cited by Bloomberg.

- With such a gap between energy stock performance and the broader market, it's not surprising that ESG-minded investors are tempted by energy stocks.

- Not everyone appears to even be sure what ESG actually is amid the heated debate about ESG investing in the U.S.

“We know that the transition will not be a straight line. Different countries and industries will move at different speeds, and oil and gas will play a vital role in meeting global energy demands through that journey.”

This is what BlackRock’s chief executive, Larry Fink, wrote in this year’s annual letter to shareholders. For such a fervent supporter of the energy transition, Fink’s admission of the vital role that oil and gas would continue to play in the world’s functioning may have been surprising at any other time.

Yet it came amid a wave of changing sentiment in the investment world. And this change is seeing investors rush back from ESG stocks to oil and gas.

Last year, BlackRock’s peer Vanguard quit a net-zero banking alliance—the Net Zero Asset Managers initiative—claiming it needed more clarity and independence concerning its environmental, social, and governance commitments to clients.

Also last year, global lenders including JP Morgan, Bank of America, and Morgan Stanley warned they would leave a UN-backed net-zero initiative for the financial sector—the Glasgow Financial Alliance for Net Zero—because their membership in it could end up violating U.S. antitrust legislation.

In fairness, the latter warning came as a result of a political pushback against ESG investing in the US. Conservative states targeted asset managers and banks that were making loud proclamations about their ESG plans that, by definition, would include reducing their exposure to oil and gas. Since for many of these states oil and gas are vital revenue contributors, the idea of such reduced exposure did not sit well.

Yet it’s not just a political pushback. Investors themselves are beginning to be in two minds about their dedication to ESG investments. Because while Larry Fink and his peers continue to reiterate their commitment to net zero and the transition, they are seeing very well where oil and gas stocks have moved over the past two years.

Energy stocks gained a total of 135 percent over 2021 and 2022 and are on track to add another 22 percent this year, according to analysts cited by Bloomberg. This surge compares with a not-so-impressive 5-percent gain for the S&P 500 over the two-year period.

With such a gap between energy stock performance and the broader market, it is not really surprising that investors previously committed exclusively to what is being advertised pretty much as the only ethical, responsible form of investment are now changing their attitudes.

Rockefeller Capital Management, Bloomberg reported this week, has a 6-percent energy weighting despite its dedication to ESG investing. The firm’s energy weighting is larger than the S&P 500’s, where energy stocks represent 4.8 percent of the total, the report notes.

Clients at Rockefeller’s wealth management unit, meanwhile, have boosted their combined holdings in the oil and gas industry, buying stocks in Exxon, Chevron, Petrobras, Diamond Energy, and all other public oil and gas companies regardless of size.

It’s self-evident that the excellent performance of oil and gas stocks during the last two years was one big reason why investors are once again paying attention to them. Another reason is the emergence of doubts and misgivings about the profitability of ESG investments.

Returns have been called into question, as have the green credentials of companies advertising as ESG-friendly. Not everyone is convinced that ESG investing is the only true path to the future world of profits. Not everyone appears to even be sure what ESG actually is amid the heated debate about ESG investing in the U.S. And this may lead to lawsuits.

According to this report in Responsible Investor, the debate could unleash a wave of litigation as investors seek clarity about the nature of ESG or seek to get compensation for unprofitable decisions made by their financial advisers on ESG grounds.

Such a development would likely compromise ESG as a concept further—financial advisers are not fans of litigation and might begin to think twice before advertising this or that investment as both ESG and profitable when it isn’t, as pointed out by critics.

“I think that our industry is going through a time where the consumers of these products could benefit from additional clarification,” the chief marketing officer of Parnassus Investments told Bloomberg. The firm has no oil and gas holdings, but pressure on the industry to reconsider has been growing.

“ESG funds pay a higher expense ratio. If you start showing a negative tracking error because you don’t hold energy, you’re going to close down the fund at some point,” accounting and auditing professor Shivaram Rajgopal from the Columbia Business School told Bloomberg.

In other words, if you’re only delivering on half of the promise—sustainable investment—but not on the other half—profits—the most natural thing for investors would be to insist on changes that rectify the situation. Because investing is not charity. It is an activity seeking a profit.

By Irina Slav for Oilprice.com

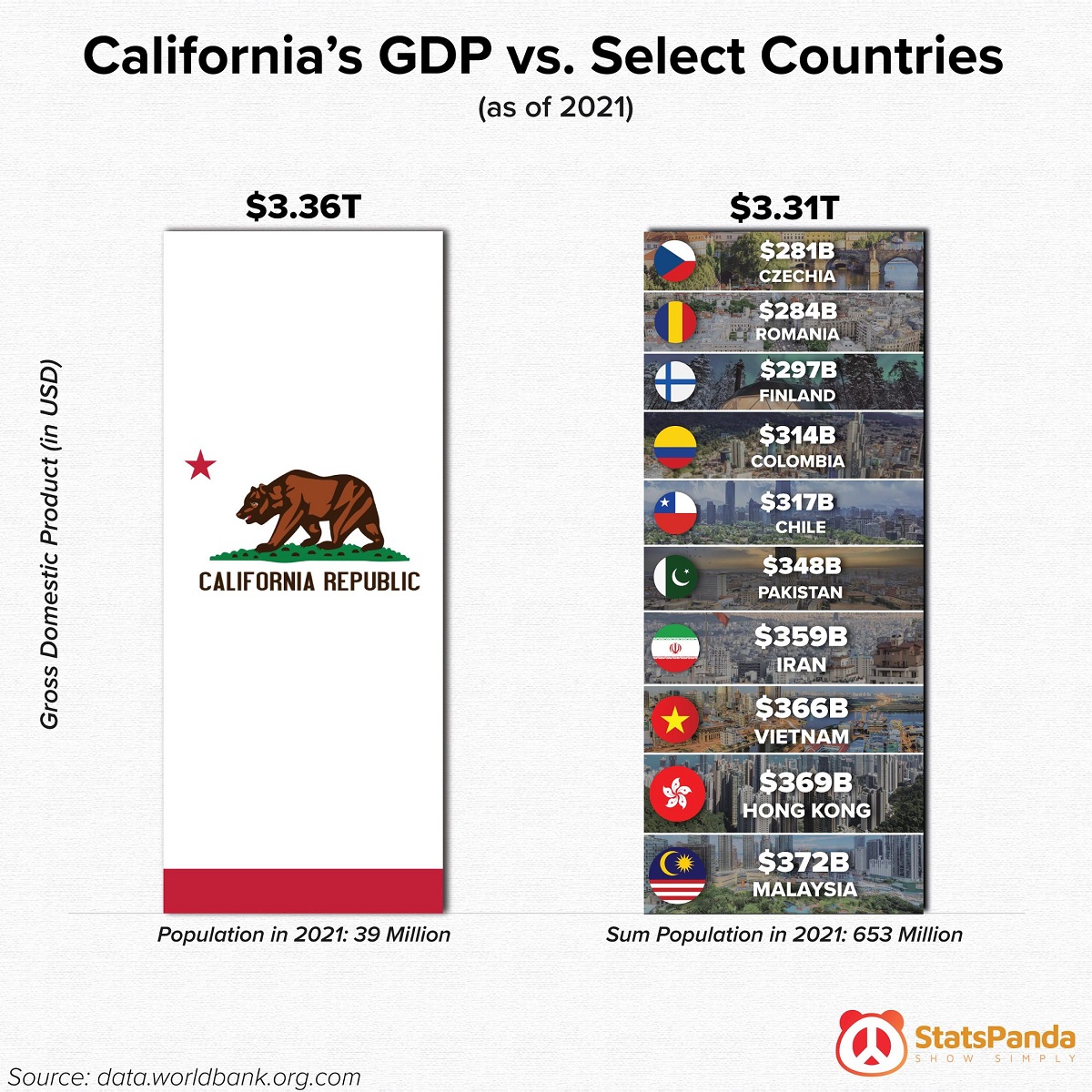

Malaysia $372B

Malaysia $372B Hong Kong $369B

Hong Kong $369B Vietnam $366B

Vietnam $366B Iran $359B

Iran $359B Pakistan $348B

Pakistan $348B Chile $317B

Chile $317B Colombia $314B

Colombia $314B Finland $297B

Finland $297B Romania $284B

Romania $284B Czechia $281B

Czechia $281B