The Federal Reserve hiked interest rates by 0.25 percentage points on Wednesday after numerous failures in the banking sector had prompted some analysts on Wall Street to call for a pause.

The quarter-point hike is the ninth consecutive rate increase by the Fed since March of last year as part of the U.S. central bank’s program of quantitative tightening undertaken in response to high inflation. The Fed’s baseline interest rate range is now set to 4.75 to 5 percent.

The move shows that the Fed’s first priority remains bringing down elevated price levels, even as the bank’s rate increases have strained portfolios in the banking sector, triggering some poorly managed banks to collapse.

Inflation has been falling but is still high

Price growth as measured in the consumer price index (CPI) and personal consumption expenditures (PCE) price index have been coming down since the middle of last year but are still well above the Fed’s target rate of 2 percent.

The PCE ticked up to 5.4 percent annually from 5.3 percent for the first time in several months in January, leading some analysts to call for a larger 0.5 percentage point increase this month by the Fed.

Concerns about the banking industry took the larger hike off the table earlier this month.

Inflation in the economy hasn’t occurred across the board in the aftermath of the coronavirus pandemic but has been concentrated in different sectors at different times.

An initial inflation in durable goods and autos has since dissipated, along with commodity inflation following the escalation of the war in Ukraine, while inflation in the housing sector remains a primary driver of the elevated headline numbers.

“These things have really had their own separate timing and their own separate dynamics. It’s very hard to argue that any of these are just your standard demand-driven inflation,” economist J.W. Mason of the City University of New York said during an event earlier in March

Some Fed policy prediction algorithms put the chances of a 0.25 percentage point rate hike as high as 86 percent on Tuesday, but many analysts had still been calling for a break in the hikes ahead of the Fed’s decision this week.

“Bank stress calls for a pause,” analysts for Goldman Sachs wrote in a Monday research letter to investors, arguing that banking is more important than other sectors of the economy.

“Banking is not just another sector of the economy because financial intermediation is vital to every sector. As a result, addressing stress in the banking system is the most immediate concern and must take priority over other less urgent goals for the moment. We expect that policymakers and staff economists at the Fed will have the same view,” they wrote.

Other influential commentators agreed.

“The banking mess is, as far as I can tell, sufficient reason for the Fed to pause until we know more,” economist Paul Krugman wrote online.

Backdrop of failed banks

The Fed decision comes after a series of bank failures over the past week-and-a-half prompted government intervention to prop up the banking sector and placate volatile markets.

The spark was lit by the collapse of Silicon Valley Bank (SVB), where a run by rich depositors largely from the venture capital sector led to insolvency. The bank couldn’t pay depositors because their money was tied up in longer-term bonds that hadn’t yet come to maturity and are sensitive to interest rate hikes.

The Federal Deposit Insurance Corporation (FDIC), Fed and Treasury responded by insuring all deposits at the bank above the standard $250,000 limit, using money from the FDIC’s deposit insurance fund as well as a new line of credit from the Fed backed up by $25 billion of taxpayer money.

Markets responded positively to the move last Monday but were falling fast by the middle of the week on fears of yet more failures.

Another California-based bank, First Republic, was poised to collapse before Treasury Secretary Janet Yellen reportedly leaned on JPMorgan Chase chief Jamie Dimon to organize a private-sector bailout, corralling a consortium of 11 banks to pony up $30 billion.

“The [systemically important banks] would never have made this low return investment in deposits unless they were pressured to do so and without assurances that [First Republic Bank] deposits would be backstopped if it failed,” billionaire investor Bill Ackman wrote online last Thursday. It isn’t known if Ackman held a commercial position with regard to First Republic.

Meanwhile, European giant Credit Suisse failed after Saudi investors declined to increase their investment in bank, leading to an appeal to the Swiss National Bank and eventually a shotgun sale to rival UBS

Fed’s balance sheet has spiked

Independent of the move on rate hikes, the Fed’s balance sheet has rocketed up over the past week, already potentially stalling the Fed’s tightening program.

The balance added more than $300 billion in assets over the course of last week, jumping up from $8.34 trillion to $8.64 trillion.

“Amid the failures, banks borrowed $153 billion from the primary credit discount window … and another $12 billion via the new Bank Term Funding Program,” analysts for Deutsche Bank wrote in an analysis last week.

They pointed out the Fed also provided $143 billion of liquidity to the 2 FDIC-owned bridge banks set up after the closures of SVB and Signature Bank.

“By district breakdown, San Francisco (+$233 billion ) and New York ($55 billion) had the biggest increases in securities and loans portfolios. Despite record activity at the discount window, total Fed liquidity borrowed was still a fraction of peak liquidity provided during the [global financial crisis] and Covid,” they wrote.

While the Fed’s actions over the past week may prove enough to save the banking industry from a wider collapse, Americans overwhelmingly agree that taxpayers should not have to bail out banks that can’t properly manage themselves.

A new public opinion poll by Ipsos found that 84 percent of Americans agree – and 56 percent agree strongly – “that taxpayers should not have to foot the bill for irresponsible bank management.” The frustration is bipartisan, with 85 percent of Democrats and 86 percent of Republicans in agreement.

Less than half of Americans are in favor of government bailouts of U.S. financial institutions at 49 percent, the poll found.

.jpg?ext=.jpg) The steam generator being extracted from the containment building (Image: Eskom)

The steam generator being extracted from the containment building (Image: Eskom).jpg)

.jpg?ext=.jpg) Vogtle 4 pictured in February (Image: Georgia Power)

Vogtle 4 pictured in February (Image: Georgia Power).jpg?ext=.jpg) Deep Isolation's concept for the disposal of nuclear fuel and high-level waste (Image: Deep Isolation)

Deep Isolation's concept for the disposal of nuclear fuel and high-level waste (Image: Deep Isolation).jpg?ext=.jpg) Energoatom President Petro Kotin and Rolls-Royce SMR's Sophie Macfarlane-Smith signing the MoU (Image: Energoatom)

Energoatom President Petro Kotin and Rolls-Royce SMR's Sophie Macfarlane-Smith signing the MoU (Image: Energoatom).jpg) From left to right: Fortum Technical Director Olli Kymäläinen, Rolls -Royce SMR Head of Business Development, Nordics Tuomo Huttunen, Fortum Head of New Build Feasibility Study Laurent Leveugle, and Rolls-Royce SMR Head of Customer Engagement Sophie Macfarlane-Smith (Image: Rolls-Royce SMR)

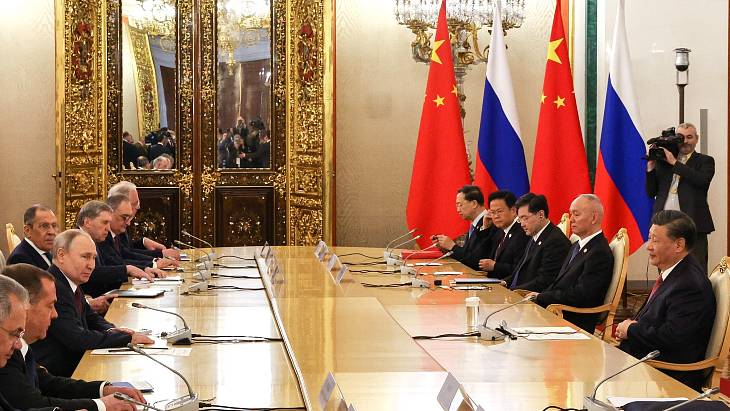

From left to right: Fortum Technical Director Olli Kymäläinen, Rolls -Royce SMR Head of Business Development, Nordics Tuomo Huttunen, Fortum Head of New Build Feasibility Study Laurent Leveugle, and Rolls-Royce SMR Head of Customer Engagement Sophie Macfarlane-Smith (Image: Rolls-Royce SMR) The two countries agreed to deepen cooperation in a wide range of areas (Image: www.kremlin.ru)

The two countries agreed to deepen cooperation in a wide range of areas (Image: www.kremlin.ru).jpg?ext=.jpg) A cutaway of a plant based on the BWRX-300 (Image: GEH)

A cutaway of a plant based on the BWRX-300 (Image: GEH)