Thawing permafrost poses environmental threat to thousands of sites with legacy industrial contamination

Nature Communications 14, Article number: 1721 (2023)

- Article

- Open Access

- Published:

Abstract

Industrial contaminants accumulated in Arctic permafrost regions have been largely neglected in existing climate impact analyses. Here we identify about 4500 industrial sites where potentially hazardous substances are actively handled or stored in the permafrost-dominated regions of the Arctic. Furthermore, we estimate that between 13,000 and 20,000 contaminated sites are related to these industrial sites. Ongoing climate warming will increase the risk of contamination and mobilization of toxic substances since about 1100 industrial sites and 3500 to 5200 contaminated sites located in regions of stable permafrost will start to thaw before the end of this century. This poses a serious environmental threat, which is exacerbated by climate change in the near future. To avoid future environmental hazards, reliable long-term planning strategies for industrial and contaminated sites are needed that take into account the impacts of cimate change.

Introduction

In the Arctic permafrost region, near-surface air temperatures are rising at rates at least two times faster than the rest of the globe1,2, with latest data analyses suggesting up to four-fold faster warming3, substantially changing the ground stability and hydrological conditions4,5. A recent review highlighted the potential of new biogeochemical risks that could be associated with permafrost thaw and the mobilization of hazardous substances from various sources6. At the same time, there is clear evidence of increased risk to the stability of infrastructure in permafrost regions7,8,9, which was built on the premise of permanently frozen ground. One prominent environmental disaster, attributed in part to the loss of soil stability10, was the spillage of 17,000 tons of diesel fuel from a destabilized tank facility near the industrial city of Norilsk in northern Siberia in May 2020, which entered the Arctic ecosystem and contaminated rivers, lakes, and tundra in a large permafrost watershed.

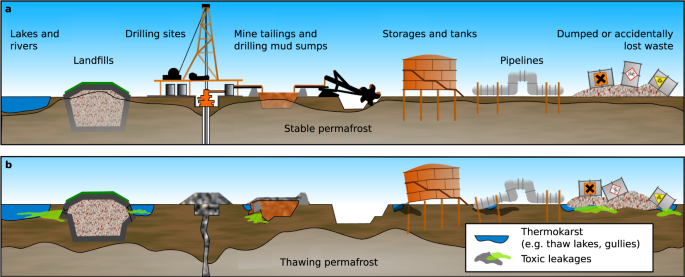

For decades, industrial and economic development of the Arctic was based on the assumption that permafrost would serve as a permanent and stable platform11. Past industrial practices also assumed that perennially frozen ground would function as long-term containment for solid and liquid industrial waste due to its properties as a hydrological barrier12,13,14. These widespread practices across the Arctic led to the accumulation of various toxic substances on or in permafrost. Known industrial waste types include drilling and mining wastes, toxic substances like drilling muds and fluids, mine waste heaps, heavy metals, spilled fuels, and radioactive waste (Fig. 1 Supplementary Table 1). Scientifically documented methods for dealing with such substances in remote Arctic regions during much of the 20th century include creating covered waste dumps in permafrost, covered drilling mud sumps, using hydrologically closed lakes and basins as natural dumps, and spreading substances across a large area for dilution in the belief that permafrost beneath and in the surrounding terrain would serve as a stable waste containment barrier of infinite duration15,16. A number of experiments were conducted in Alaska, Canada, and Russia in which toxic liquids and solids, including radioactive waste, were deliberately placed in permafrost for containment17,18,19. To date, there has been no assessment of the environmental impact of these activities on the Arctic as a whole. The thawing of permafrost makes such assessments all the more urgent as the potential risk of toxic release and mobilization continues to increase. In addition, it is foreseeable that thawing permafrost will substantially increase the cost of mitigation and adaptation measures, including maintenance, replacement, relocation of infrastructure, and remediation of contaminated sites7,8,20,21.

Past and present industrial activities in the Arctic result in various accumulations of hazardous substances in the Arctic a. The warming and thaw of near surface permafrost unlocks frozen disposal sites and destabilizes foundations and containment structures b. Furthermore, permafrost thaw intensifies thermo-hydrological erosion and increases the lateral flow of water, fostering the dispersion of contaminants.

In this study, we present a pan-Arctic compilation of the number of industrial sites in permafrost-dominated regions and estimate the number of contaminated sites associated with these sites. We use the Northern Hemisphere Permafrost Map22 to delineate the permafrost model domain, considering only areas with a permafrost occurrence probability of over 50%. Based on data from Alaska, we also assess the different types of toxic substances associated with industrial activities in these regions. We also use future climate scenarios to predict how many industrial and contaminated sites will begin to be affected by permafrost thaw. Our results suggest that industrial legacy sites in thawing permafrost and the release of toxic substances pose a significant environmental risk at the pan-Arctic scale, requiring management strategies.

.jpg?ext=.jpg)