Iraq Agrees To Hold 30% In TotalEnergies' $27 Billion Iraqi Project

The Iraqi government has agreed to have 30% in a major $27-billion project to be developed by supermajor TotalEnergies in Iraq, down from the 40% stake Baghdad had wanted previously, industry sources told Reuters on Tuesday.

In September 2021, TotalEnergies signed multi-energy agreements in Iraq for the construction of a new gas network and treatment units, the construction of a large-scale seawater treatment unit, and the construction of a 1 gigawatt (GW) photovoltaic power plant in the southern Iraqi region of Basra. TotalEnergies signed the agreements with the Iraqi Ministries for oil and electricity, and the country's National Investment Commission.

The French supermajor proposes to invest in installations to recover gas that is being flared on three oil fields and, as such, supply gas to 1.5 GW of power generation capacity in a first phase, growing to 3 GW in a second phase, and also develop 1 GWac of solar electricity generation capacity to supply the Basra regional grid.

The initial investment in the project is estimated at around $10 billion, TotalEnergies said back in 2021.

However, the project has seen setbacks due to the turbulent Iraqi domestic politics and Baghdad's initial insistence that Iraq holds 40% of the project.

The high stake Iraq wanted was one of the key sticking points toward structuring the deal.

Now it looks like a deal has been reached, with Iraq agreeing to take a 30% stake in the project after meetings in Baghdad in recent days, one industry source told Reuters.

A senior official with Iraq's oil ministry told Reuters, "The deal should be activated within days."

Three weeks ago, TotalEnergies CEO Patrick Pouyanné said at the firm's climate investor meeting, referring to the Iraqi project, "We have many discussions: we have expressed our views, we are waiting for the answer."

"So that's where we are, and I hope we'll find a common ground. I worked on it in the last month. But again, we need to have this political answer," Pouyanné added.

Commenting on the potential agreement, TotalEnergies' top executive also said, "Iraq is not the easiest place to invest."

By Charles Kennedy for Oilprice.com

The Iraqi government has agreed to have 30% in a major $27-billion project to be developed by supermajor TotalEnergies in Iraq, down from the 40% stake Baghdad had wanted previously, industry sources told Reuters on Tuesday.

In September 2021, TotalEnergies signed multi-energy agreements in Iraq for the construction of a new gas network and treatment units, the construction of a large-scale seawater treatment unit, and the construction of a 1 gigawatt (GW) photovoltaic power plant in the southern Iraqi region of Basra. TotalEnergies signed the agreements with the Iraqi Ministries for oil and electricity, and the country's National Investment Commission.

The French supermajor proposes to invest in installations to recover gas that is being flared on three oil fields and, as such, supply gas to 1.5 GW of power generation capacity in a first phase, growing to 3 GW in a second phase, and also develop 1 GWac of solar electricity generation capacity to supply the Basra regional grid.

The initial investment in the project is estimated at around $10 billion, TotalEnergies said back in 2021.

However, the project has seen setbacks due to the turbulent Iraqi domestic politics and Baghdad's initial insistence that Iraq holds 40% of the project.

The high stake Iraq wanted was one of the key sticking points toward structuring the deal.

Now it looks like a deal has been reached, with Iraq agreeing to take a 30% stake in the project after meetings in Baghdad in recent days, one industry source told Reuters.

A senior official with Iraq's oil ministry told Reuters, "The deal should be activated within days."

Three weeks ago, TotalEnergies CEO Patrick Pouyanné said at the firm's climate investor meeting, referring to the Iraqi project, "We have many discussions: we have expressed our views, we are waiting for the answer."

"So that's where we are, and I hope we'll find a common ground. I worked on it in the last month. But again, we need to have this political answer," Pouyanné added.

Commenting on the potential agreement, TotalEnergies' top executive also said, "Iraq is not the easiest place to invest."

By Charles Kennedy for Oilprice.com

Western Oil Companies Are Not Welcome In Iraq But Russian And Chinese Ones Are

Last week’s banning by the Baghdad-based Federal Government of Iraq (FGI) of oil sales made independently by the government of the semi-autonomous region of Kurdistan (KRG) in northern Iraq should be seen in the context of the Saudi Arabia-Iran relationship resumption deal done on 10 March. And that context is more easily explained if the deal is written not as the Saudi Arabia-Iran deal, but rather as the Saudi Arabia/OPEC-China/Russia/Shia Crescent of Power deal. The Shia Crescent of Power comprises most notably Iran, Iraq, Syria, Lebanon and Yemen. Turkey (25 percent Shia and still furious at not being accepted fully into the European Union) is on the periphery of this group. The last part of the jigsaw was revealed exclusively by OilPrice.com just after the Saudi Arabia-Iran deal in a comment made by a very high-ranking official from the Kremlin that: “By keeping the West out of energy deals in Iraq – and closer to the new Iran-Saudi axis - the end of Western hegemony in the Middle East will become the decisive chapter in the West’s final demise.” Before the Saudi Arabia-Iran deal, everything the China-Russia axis had been doing in the Middle East had been to manoeuvre itself into a better position to usurp the influence of the U.S. and its allies in the oil and natural gas centre of the world, the Middle East. After the Saudi Arabia-Iran deal, China and Russia are where they want to be, and it is gloves off time. In terms of building up to this moment – that will see all powers of the northern region of Kurdistan gradually subsumed into those of the south to create one unified country again, governed out of Baghdad – Russia was the one who laid down the operational strategy in northern Iraq that was then replicated by China in southern Iraq a little later. More specifically, as analysed in depth in my latest book on the global oil markets, after the overwhelming vote in Iraqi Kurdistan in September 2017 for an independent Kurdish state there were huge protests when the vote was ignored by Baghdad. These were violently subdued by forces from Iran and Turkey (both of which have their own sizeable Kurdish populations) and southern Iraq, at which point of chaos Russia moved in to take over Iraqi Kurdistan’s oil sector. It achieved this by three methods. First, it provided the KRG with US$1.5 billion in financing through forward oil sales payable in the next three to five years. Second, it took an 80 percent working interest in five potentially major oil blocks in the region. And third, it established a 60 percent ownership of the vital KRG oil pipeline running into Turkey through a US$1.8 billion investment to increase its capacity to one million barrels per day (bpd).

It was then Russia that fomented discord between the KRG in the north and the FGI government in the south, principally by exploiting existing discontent on both sides with the budget payments-for-oil deal that had been agreed between north and south Iraq in 2014. This deal – which forms the basis for last week’s banning of independent oil sales from Iraqi Kurdistan - was that the KRG would export up to 550,000 barrels per day (bpd) of oil from the Kurdistan oilfields and Kirkuk via the FGI’s Baghdad-based State Organization for Marketing of Oil (SOMO) in the south. In return, Baghdad would send 17 percent of the federal budget (after sovereign expenses) - around US$500 million at that time - per month in budget payments to the Kurds. This deal never worked properly, and Russia from 2017 sought to exacerbate this to create much greater discord between north and south Iraq through several methods also analysed in depth in my latest book on the global oil markets.

At the end of 2020/beginning of 2021, China decided to use the same strategy in southern Iraq that Russia had used in the northern Kurdistan region. The Russians had used a massive flow of financing, through a huge prepayment deal for oil, as the first step in effectively taking control of the Iraqi Kurdistan oil industry. Mirroring this, China’s Zhenhua Oil signed a US$2 billion five–year prepayment oil supply deal with the FGI in Baghdad. This development was extremely troubling for Washington for three key reasons. First, the deal was obviously straight out of the playbook that Russia had used to gain control over the Iraqi Kurdistan oil industry in 2017, as analysed above. Second, it was clear Russia and China were working closely together in Iraq in a manner not seen before there. Specifically, a key reason why Baghdad had so welcomed China into its southern oil and gas fields was because China had said that it might be able to ease tensions over the budget payments-for-oil deal by liaising with Russia. But it had been Russia since 2017 that had been firing up the Kurds to inflame these tensions. The third reason was that it was that in addition to the military elements that Russia had brought to its activities in the Iraq Kurdistan region, the huge new Chinese deal in the south was being done by Zhenhua Oil, an arm of China’s huge defence contractor Norinco.

For a long time, it suited China’s and Russia’s purposes to keep the north and the south of Iraq in a constant state of economic conflict centred on the 2014 budget payments-for-oil deal, as it was unwinnable from a legal perspective and could therefore be dragged out forever. According to the KRG, it has authority under Articles 112 and 115 of the Iraq Constitution to manage oil and gas in the Kurdistan Region extracted from fields that were not in production in 2005 – the year that the Constitution was adopted by referendum. The KRG also maintains that Article 115 states: “All powers not stipulated in the exclusive powers of the federal government belong to the authorities of the regions and governorates that are not organised in a region.” As such, the KRG argues that as relevant powers are not otherwise stipulated in the Constitution, it has the authority to sell and receive revenue from its oil and gas exports. However, the FGI in Baghdad and SOMO argue that under Article 111 of the Constitution oil and gas are under the ownership of all the people of Iraq in all the regions and governorates. Consequently, they believe that all oil and gas developed across all of Iraq should be sold through official channels of the central Federal Government of Iraq in Baghdad.

Now, though, with Saudi Arabia now firmly added to its sphere of influence after years of building up the relationship with Riyadh, as also analysed in depth in my latest book on the global oil markets, the China-Russia axis feels sufficiently emboldened to signal its true purpose: it is taking full control of the Middle East. Any choice cuts it wants from the best oil and gas reserves from anywhere in the region – across all countries with an allegiance to Sunni Islam leader Saudi Arabia or to Shia Islam leader Iran, which together is every country – are to be offered to Chinese and Russian companies in the first instance. There is no problem shipping or selling any of the oil and gas that China itself does not want, as sanctions currently are only on Iran, not Iraq, and these can easily be circumvented anyway, through methods also analysed in depth in my latest book on the global oil markets.

The ultimate aim of China is as it has been since it began its economic growth spurt in the 1990s – to overtake the U.S. as the world’s largest economy by nominal GDP by 2030 at the latest – despite already being the world’s largest economy by purchasing power parity, the largest manufacturing economy and the largest trading nation. At around the same time, China needs to ensure that it has all the energy resources it needs to withstand any sanctions that may be imposed should it make good on President Xi’s instructions to the Chinese military to be ready to invade Taiwan by 2027. Helpfully as well from its perspective, having watched Russia’s invasion of Ukraine, China knows what not to do. Whether this particular ban of independent sales by Iraqi Kurdistan remains in place or not, China and Russia have laid down the marker that whatever happens now across all of Iraq will only happen with their blessing.

By Simon Watkins for Oilprice.com

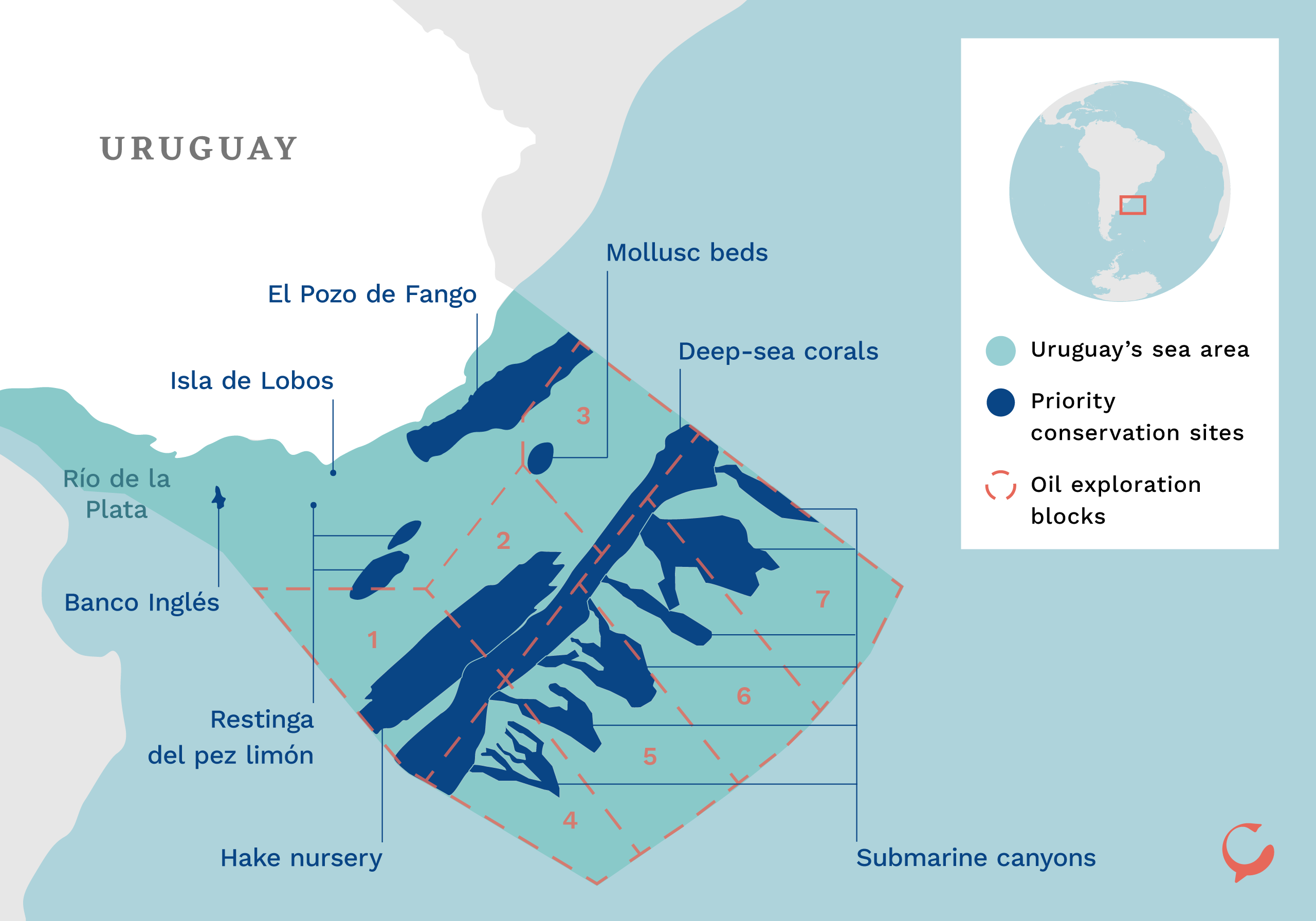

Uruguay’s priority areas for marine conservation overlap with offshore oil concessions. Data source: Uruguay Ministry of Environment / ANCAP

Uruguay’s priority areas for marine conservation overlap with offshore oil concessions. Data source: Uruguay Ministry of Environment / ANCAP